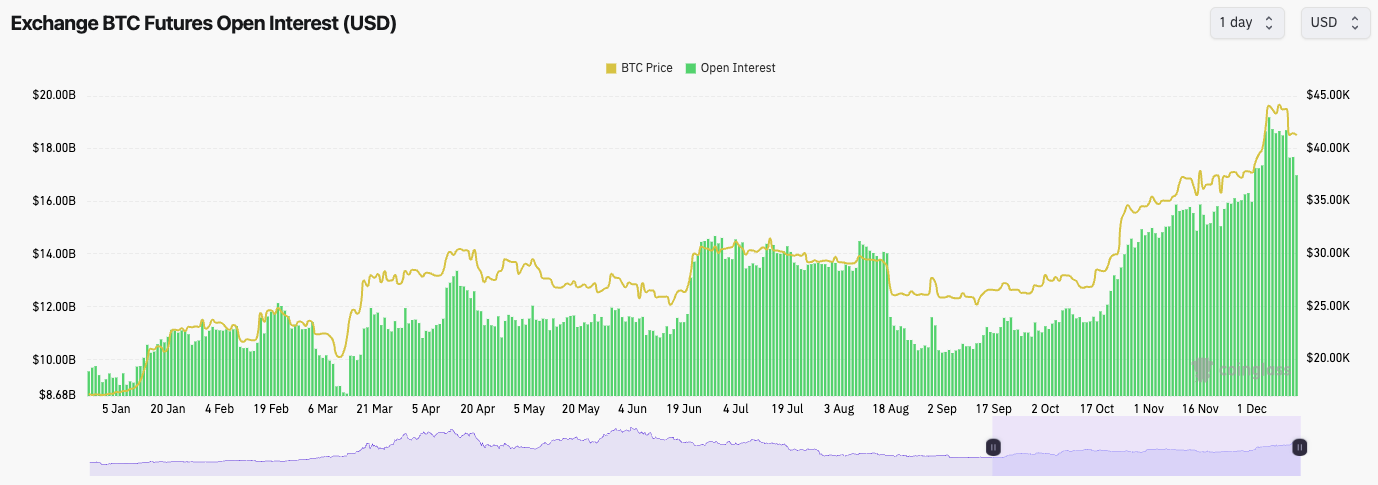

On the mechanics side, this move down has been positive in that it has flushed out a significant amount of the Open Interest. OI is now at $17.0b, down from $19.2b a week ago.

What's interesting here is that in alts, the price decreases have flushed out the excess Longs, which has reset the Funding Rate.

However, on BTC, we now have Longs beginning to pile in here, raising the Funding Rate, which is interesting today, considering it’s the FED Press Conference, and we’ll likely get volatility.

Be careful with leverage trades before the FED Press Conference at 7PM UK time.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Technical analysis

- BTC is forming a pennant pattern above the horizontal support of $40,900. Pennants are usually continuation patterns, indicating that this may break lower.

- The main uptrend line is awfully close to price now. If price breaks below this level, this would invalidate the bullish momentum and may lead to lower prices.

- Local resistance is at $42,000, with local and more major support at $40,900. The support beneath this is $38,000.

- The RSI has reset on many timeframes now, even the 3D and Weekly, which remain in overbought territory. However, they have pulled back. We may see further pullbacks in the next 2-6 weeks to further reset the 3D and Weekly.

Cryptonary's take

The main event today, and arguably of the month, is today's SEP (Summary of Economic Projections) and FED Press Conference.It's possible price grinds higher into the event. And then, when the SEP is released, price moves up again as it is likely to show a FED that may cut more than they last indicated in the last SEP.

However, Powell is likely to be hawkish and smack markets (in general) back down. The easing we've seen in financial conditions isn't what the FED wants, and it risks inflation rearing up again.

Powell will most likely have to go for it today and try to be significantly hawkish in his tone and smack this market back down.

Overall, BTC is at a key level.

We'd say Bitcoin's success today will be to stay above $40k. If it can, we can probably expect more range-bound price action between $40k and $42k, at least for this week.

We will look for more DCA zones, but for now, the first of these would be at and sub $38k.