Bitcoin is on a tightrope: Choppy waters ahead!

With the Federal Reserve's latest comments sparking uncertainty, BTC's technicals and market mechanics offer a mixed bag of signals. So, what's a trader to do? With the ever-present tug-of-war between fear and greed, it’s a test of nerves. Let’s break down the data and see what's really going on behind the scenes.

TLDR

- Bitcoin maintains its uptrend with the potential for a slight downturn, but there’s now an air of economic uncertainty and potential interest rate.

- Key resistance and support levels were identified at $37,700 and $31,800, respectively, with Bitcoin currently pressed against a crucial support line.

- A high number of shorts and the current state of the RSI suggest Bitcoin may face a minor pullback, with $34,000 as a pivotal point.

- Short-term expectations indicate a range-bound Bitcoin; we advise traders to be patient and avoid the risks of a volatile, narrow margin.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

Kashkari to the stand.Risk assets, in general, held up relatively well yesterday. This is despite Kashkari’s comments suggesting that the fight against inflation isn’t over. He hinted that he would rather overtighten and deal with the consequences than under-tighten and risk inflation running up again. He essentially suggested one more rate hike (in either December or January) or to stay higher for longer than the market is currently pricing in. Pre-market, the S&P and the Nasdaq are both due to open slightly lower. At the same time, the Dollar Index moved up 0.32% today following Kashkari’s comments yesterday.

Let’s now dive into the technicals for BTC.

Technical analysis

Bitcoin is still in an uptrend channel but is now squeezing against the bottom border - potentially looking like it can break down from here.The major horizontal resistance above us is $37,700, with the major horizontal support at $31,800. But, there are more local supports between $31,800 and the current price of $34,700. The local support is at $34,000 and $33,300.

BTC 1D

But the market will likely be driven by the mechanics over the next few days. Let’s take a look there.

Market mechanics

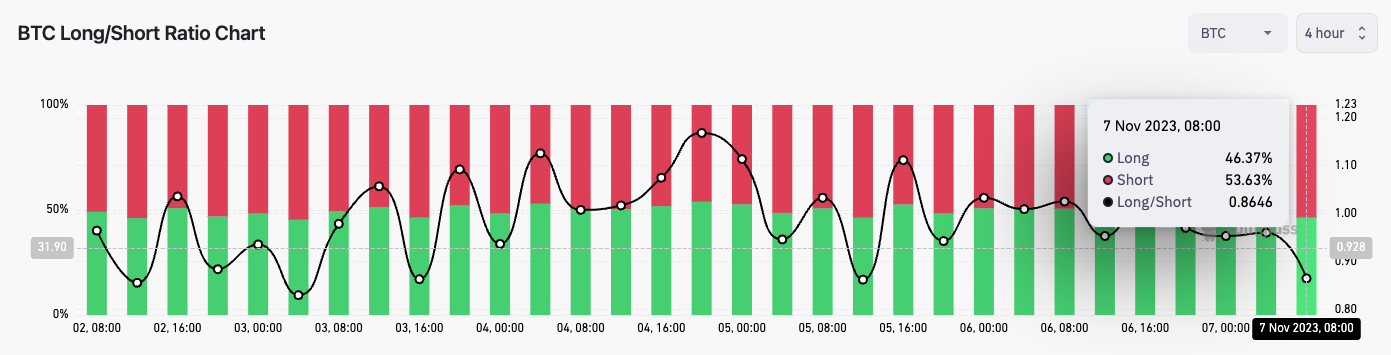

The RSI is trending down on the daily and the 3D timeframes, but it remains heavily overbought, particularly on the 3D. So, this suggests a pullback.When we then look at the funding rates and the open interest, we’ve seen the funding rate remain positive but coming off overly positive levels, which suggests that there has been a large build-up of shorts in the last 4-8 hours. We can see this in the long/short ratio.

The above shows us that more individuals are short than long, suggesting more retail participants are short. Note: the open interest remains high, so there is a leverage build-up here.

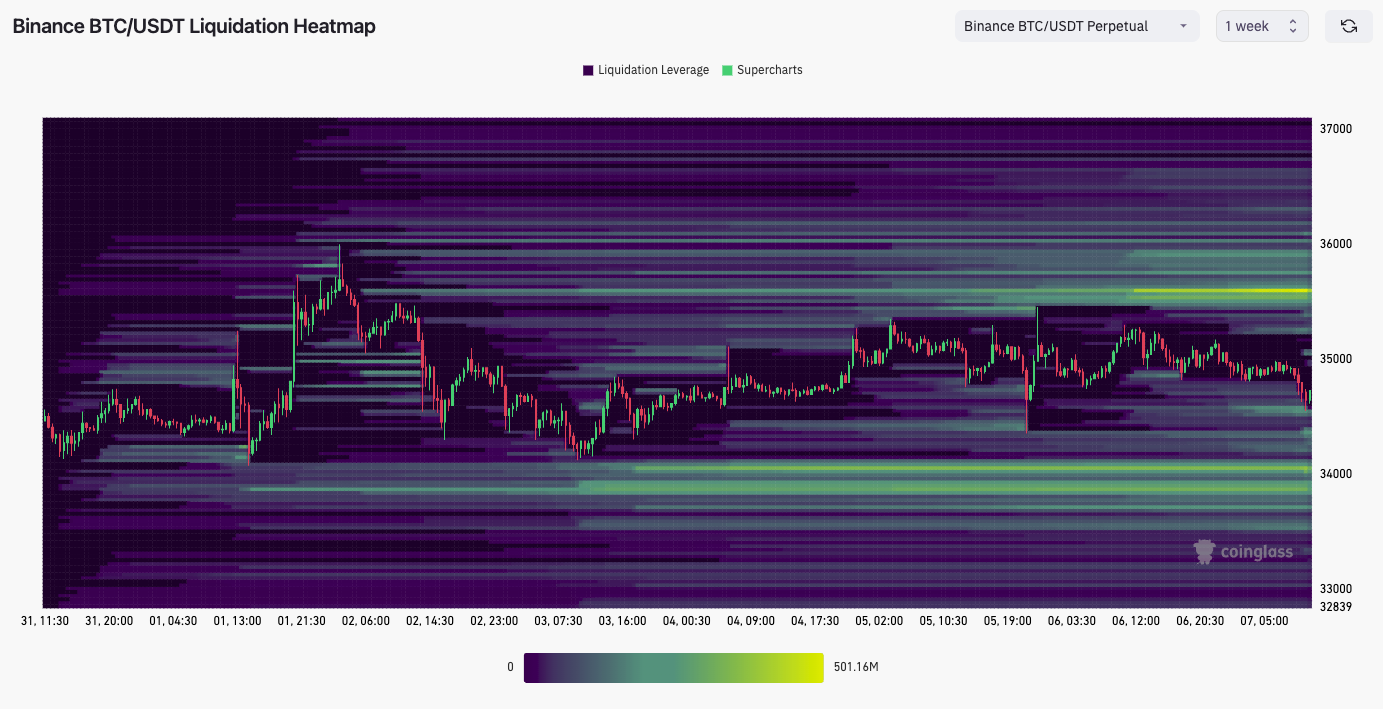

If we then look at the liquidation heatmap, we can see the major liquidation levels for shorts is at $35,600 and for longs at $34,000.

Cryptonary’s take

The above shows a relatively highly leveraged market likely to shake out both sides. If price does go lower, it looks like $34,000 will be the level but would likely bounce from this level. If Shorts begin to close out, then this will likely take BTC slightly higher.With the Dollar moving slightly higher, this is likely to suppress risk assets going much higher in the very near term. So, this is a short-term headwind for risk assets. This headwind and an overly leveraged crypto market lower our overall conviction about any significant further upside in the short term.

We expect the market to be somewhat range-bound within this tighter range between $34,000 to $35,600 over the coming days, and we don’t expect any major breakouts in either direction.

Stay patient; don’t let yourself get chopped up trying to trade in a tight range.