Bitcoin overheats amid jobless surge, Fed cuts, and election uncertainty

This week, key market attention is on retail sales and rising jobless claims, which are mainly due to strikes and hurricanes. Bond yields are improving, showing steady growth. Israel's actions have lowered oil prices, Bitcoin seems overheated, and the FED is still planning for rate cuts.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

In this report:

- Data This Week & FED Speak

- Bond Market Signal

- Iran/Israel Update

- BTC Market Short-Term Overheated

- Bond Market (10/09 update)

Data this week & FED speak

The data over the next two weeks is light, and we don't really get going again with the more important data points until the 29th (Job Openings data). However, the market will still be on watch this week, where we have Retail Sales and then Initial Jobless Claims, both on Thursday.Retail Sales is expected to come in showing an increase, ie, a still spending consumer, positive. Jobless Claims is expected to come in higher, forecasted to be 269k, a rise from 258k. Now, this would be concerning to see Jobless Claims continuing to rise.

However, with the hurricanes and the strikes in the US, this is most likely why we're seeing the rise in the Jobless Claims figures we're getting each week.

Therefore, even though these Jobless Claims figures would be bad, the market is looking through them for now, as the data is very nuanced due to the strikes and the hurricane.

Yesterday, FED Waller (voting member) suggested that the impact of the strikes and the hurricane in the US could impact the jobs report by more than 100k jobs.

So, we should expect the next Non-Farms print to be far less, and most likely sub-100k jobs added in the US. Now again, this would be bad if there were natural job losses rather than losses due to strikes (that have now mostly been settled) and a hurricane.

We expect the market to look through this "bad" next jobs report that we get on November 1st. This likely doesn't change the path for cuts, and it's still most likely that we will see 2 x 25 bps Interest Rate cuts this year. However, some Interest Rate cuts have been priced back out over the coming 12 months.

Bond market signal

Just a few months back, the Bond market was pricing in a large amount of Interest Rate cuts (a total of 9) over growth fears and that the FED would need to aggressively cut Interest Rates in order to get back ahead of it.However, we've seen that growth, the labour market, and the consumer has continued to hold up. This has therefore led to less Interest Rate cuts likely being needed and therefore Bond Yields have rebounded from their lows.

We called this back in September (check update from 10/09/24).

US2Y yield from the 10/09/24 market update:

US2Y yield today:

Bond Yields have re-priced higher (and perfectly followed our arrows for direction). But as I was saying back then, fewer Interest Rate cuts are a good thing because growth, the consumer, and the labour market remain positive. Therefore, risk assets can continue grinding higher. We've got exactly this, so everything is going to plan as we forecasted.

Iran/Israel update

The war between Iran and Israel is something we have to be keeping up to date with as if there is a serious escalation; this could be a 'black swan' event for markets.Following Iran's ballistic missile attack on Israel, markets/the world looked to Israel as to what its response would be. The most likely options for Israel were to bomb oil fields, take away Iran's revenue, bomb Iran's nuclear sites, or continue bombing military sites.

Israel has now suggested just yesterday that they'll respond by bombing military sites, despite Biden last week suggesting that the bombing of oil fields was "being discussed". The bombing of military sites is seen as a de-escalator compared to the other two options.

Oil has moved lower off the back of this (as Oil fields not being bombed in Iran is being priced back out of the market). Cheaper oil is good for risk assets; it's less inflationary meaning the FED can keep cutting rates rather than worrying about Oil prices going higher.

Oil:

BTC market short-term overheated

Whilst recent market structure has been bullish, we're now beginning to see a few signs that the market might be slightly overheated in the short-term.The Bitcoin Heater by Capriole shows the relative heat in the Bitcoin Perps and Futures and Options markets weighted by Open Interest. We can now see that it has reached over-heated levels. On the last two occasions this happened, BTC pulled back 6% and 18% respectively.

Bitcoin heater:

![]()

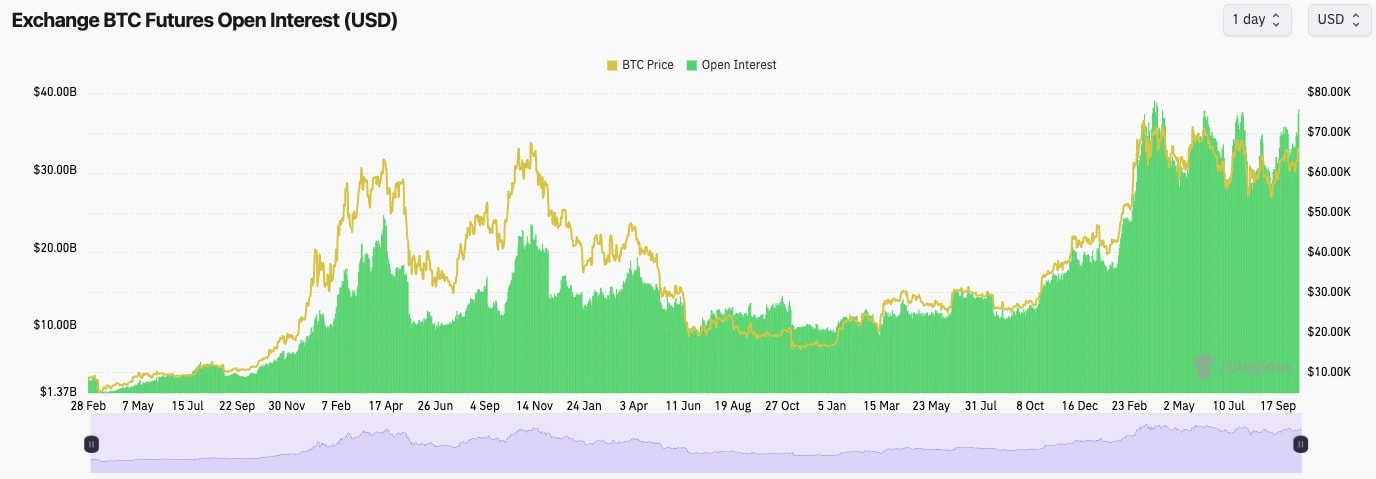

Alongside this, Bitcoin's Open Interest has increased to levels last seen at the March 2024 price top. Funding Rates are very positive but contained still.

Bitcoin's open interest:

Both the above suggest that we may be due for a slight pullback in prices in the short term.

Cryptonary's take

Whilst the macro backdrop is as positive as it is, we find it hard overall to not be constructive on Crypto and just generally very Long (holding all Spot positions). However, in the short term, we do have some slight headwinds that may prevent Crypto from breaking out of the range:- Weakening jobs data, although this is nuanced due to the strikes and hurricanes, so we expect this to pass.

- There is slight overheating in the Crypto leverage market, although it's nothing close to March in terms of positioning (in March, we saw heavy Long-bias positioning; that's not so much the case today, just a lot of leverage).

- BTC at the $66k resistance level.

- Uncertainty around US Elections.

We do expect that these above headwinds will pass once we're beyond the US elections, which we expect to be positive for markets, assuming there is a clear result and it isn't a contested election.

In my (Tom) personal opinion, I believe Trump will win and this'll be that catalyst the market seems to somewhat be looking for to then going full risk-on.