Key questions

- How did the latest jobs data catch the market off guard, and what does it mean for the Fed's next move?

- Is the central bank now behind the curve? We explore the potential consequences of delayed action.

- What caused the dramatic moves in the dollar and bond yields, and how might this impact your crypto portfolio?

- Is Bitcoin decoupling from tech stocks? Our analysis reveals an intriguing shift in correlations.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

US labour market data

In the last few hours, important labour market data have come out that the markets were paying close attention to following Powell's remarks on Wednesday. The Fed was closely watching the totality of the data, and they were looking to cut Interest Rates in September and possibly deliver "several" cuts this year.The key question has been, "When the Fed cut rates in September, will these cuts be panic cuts (because of a recession) or normalisation cuts (for a soft landing)"? For a soft landing, the markets and the Fed wanted to see inflation continue its downward trend and that the labour market holds up. And then, in today's labour market data, we got the following:

- Non-Farm Payrolls: Consensus 190k, Actual 114k

- Unemployment Rate: Consensus 4.1%, Actual 4.3%

They're behind the curve, as we expected. We have said for a long while that they should have cut in July, but they didn't forward-guide it in June, so they didn't allow themselves to do the cut in July.

The market now realises that the labour market is "moderating" faster than initially anticipated, whilst companies have also highlighted a weaker and more discriminating consumer (less willing to spend) in their earnings calls.

We did have very positive economic growth reported last week; however, we're seeing more significant moderating in the labour market, and the Fed now seems to be behind the curve in terms of cutting Interest Rates.

The market has reacted to the above in a big way. We're seeing the Dollar and Bond Yields nuke. This is the market pricing in more cuts this year. Yes, there will be more cuts. It was already priced to have 75 basis points of cuts (25bps in September's Fed Meeting, 25 in Nov, and 25 in Dec).

We're now seeing that the odds of a 50 basis point cut in September have increased from 11.5% a week ago to 58.5%. The Fed is behind the curve, and it needs to catch up.

$DXY (Dollar Index) 1D Chart:

$US 2Y Bond Yield 1D Chart:

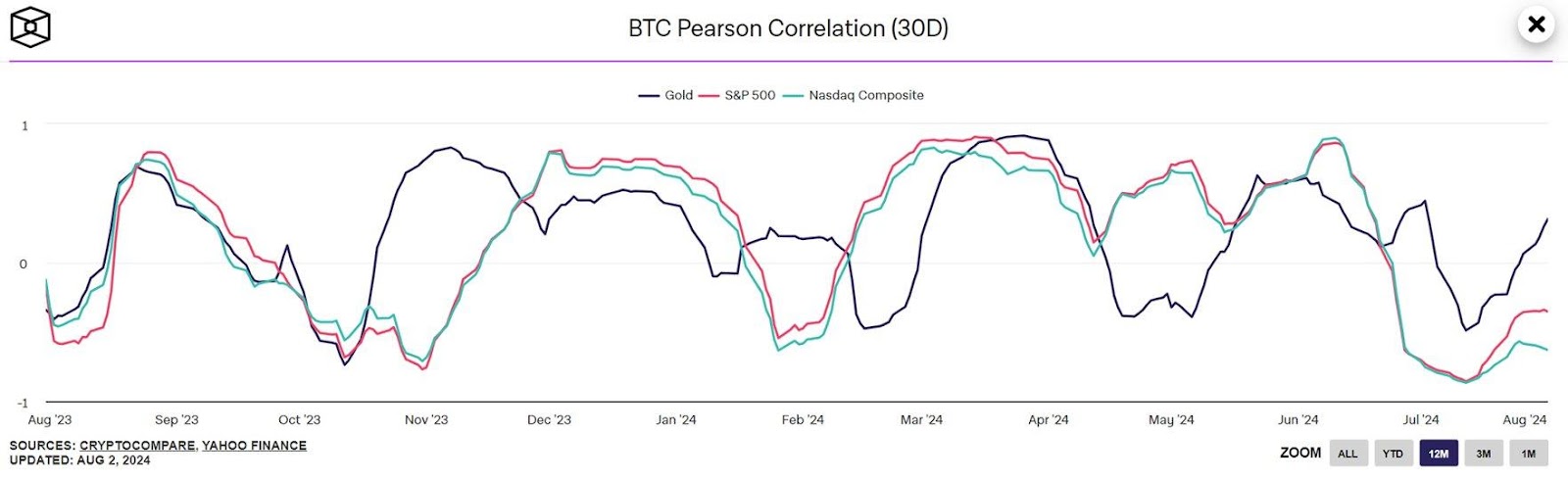

Alongside this, we're also seeing the S&P and the Nasdaq nuking. However, BTC is only down a few percentage points and performing more similarly to gold here. Previously, when Bitcoin was more correlated to tech stocks, BTC would have puked more on a day like today.

We can see below that the correlation to gold has substantially increased recently, whilst BTC's correlation to tech stocks is much lower. If we are seeing the market pricing in increased odds of a recession, then you want BTC to be priced and more correlated to gold than Big Tech stocks.

BTC Pearson Correlation:

$S&P 1D Chart:

$NASDAQ 1D Chart:

Cryptonary's take

Today's data and market reaction absolutely make the next six weeks more tricky to call. There is more data to come out (possibly more weakening/moderating), and the Fed is unable to act until mid-September. The Fed can act if it needs to, but it would really be seen as a sign of panic if they cut interest rates outside of a meeting.Therefore, the attention now moves to the data, of course, but Jackson Hole is from the 22nd to the 24th of August. Powell will speak there, and he has been known to drop bombs there before, having delivered the "more pain" speech back in 2022.

The above pushes back against us becoming more risk-on over the coming weeks, and for now, we'll be maintaining our positions in the barbell strategy (BTC, ETH, SOL, WIF and POPCAT). For those with more cash on the sides, we'd suggest buying in on days when there's a lot of red across the board (everything's down a lot).

Regarding price action, the likelihood is that prices will remain sideways or slightly lower over the coming weeks. However, if we continue to see a moderation in the data, then we'll likely see liquidity increase in the coming months, especially as we move closer to the election.

If anything, I (Tom) think today's data is the catalyst needed for the Fed and the Treasury to begin ramping things up (liquidity-wise) and juicing the markets going into the election. This potentially sets us up for a stronger bull market, but we'll need to survive in the short term (the next month or so) as we're likely to see increased volatility.

My area of interest in Bitcoin is the Yellow box. If we get into the late $50s (I'm not sure we will), I'll bid the barbell portfolio more aggressively.

BTC: