This volatility has left us all eager and waiting for the next big move.

Here's some good news, though. The clouds are parting, and the winds of opportunity are starting to blow. All you need is a little patience to ride out the storm.

Now, here's a little something to get your hopes up. We’ve got a hunch that the market is gearing up for a big move. You see, the CPI numbers are set to be revealed on July 12th, and that's likely to bring some volatility that could set the course for Bitcoin in the short term.

Of course, the million-dollar question remains: Which way are we headed?

Let’s put on our detective hats and dive into the graphs to see what they have to say.

TLDR 📃

- Bitcoin is ready to make a move. This week’s CPI numbers will likely catalyse its price to choose a direction. Luckily, we already know what to expect.

- For Ethereum, $2,000 is on hold after last week’s candle closure. Still, we believe ETH will test this level in the coming weeks if new events don’t invalidate our thesis.

- A lot of our picks are either at support or approaching it. If the market takes on the bearish route, we foresee a lot of bleeding in the altcoins market.

- However, Bitcoin heading to $32,000 will save the day. Most altcoins will bounce from support and return to their closest resistance levels.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Total Market Cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand the overall market and predict where it will go.

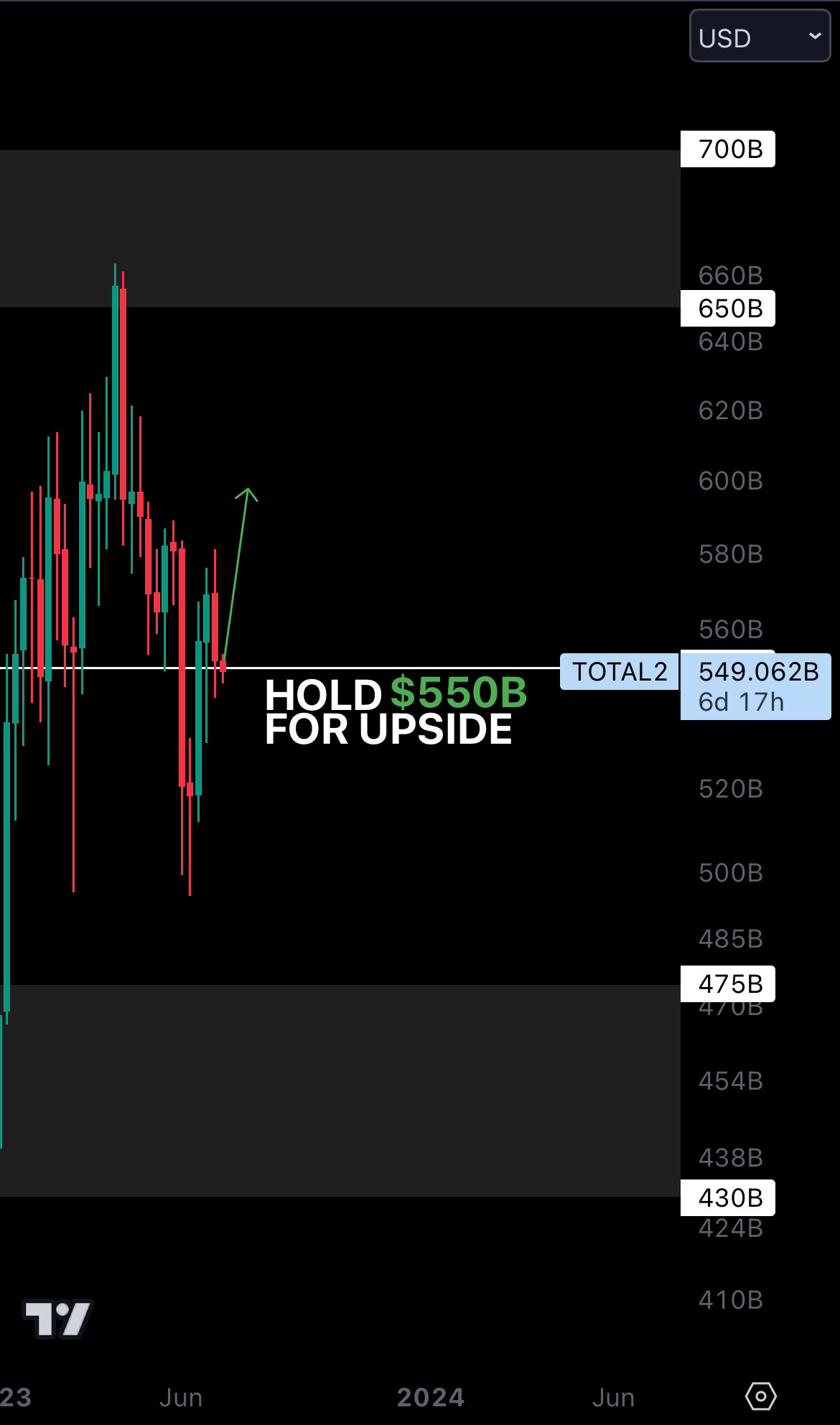

Altcoins Market Cap

The Altcoins Market Cap (ALTS) index represents the entire valuation of the altcoins market: all coins other than BTC.

Cryptonary's Portfolio

ETH | Ethereum

DYDX | dYdX

HEGIC | Hegic

ARB | Arbitrum

Cryptonary's Watchlist 🔎

DOT | Polkadot

RUNE | THORChain

SOL | Solana

MINA | Mina Protocol

Astar | ASTR

THOR | THORSwap

OP | Optimism

LDO | Lido DAO

BTC | Bitcoin

The crystal ball foretells a big move 👀

Historically speaking, after significant price movements like the one observed two/three weeks ago, Bitcoin's value often settles into a temporary range for a few weeks before volatility reappears. This trend isn't an anomaly; it's a pattern we've witnessed numerous times.

As we lean into this pattern, we're closely watching for Bitcoin to announce its next big move. The imminent CPI figures, set to be unveiled on July 12th, might just be the spark needed to spur Bitcoin's price into dynamic action. However, as with any good story, we anticipate some trials and tribulations before victory — a brief dip into the red zone.

Bitcoin could test the $28,750 mark as support, and then it could gather momentum to push past $32,000 and beyond.

But hey, don't forget there's also the other scenario in which its price starts rising and breaks that $32,000 barrier. In that case, here's a little something to remember about how the market might react...

Bitcoin’s dominance still has some room for growth. So, if Bitcoin starts pumping, it might leave some of your favourite altcoins in the dust.

Bummer, right? But hey, don't sweat it too much. The spotlight will inevitably shift, and when it does, altcoins will have their opportunity to dazzle.

Our analytics indicate that a Bitcoin dominance of 53% might be the tipping point, marking the stage for altcoins to step up the pace and take over the race.

Cryptonary’s take 🧠

As we enter a week brimming with anticipation, volatility seems to be the chef's special. Fingers crossed for the market to take the bullish path and soar to new weekly highs. But let's not ignore the possibility of the bear lurking around the corner.

That's why we're eagerly waiting for those CPI numbers to come in and give us a clearer picture.

Action points 🎯

- BTC and ETH may see first more downside before heading higher. To avoid missing out, a DCA (dollar-cost average) approach will save you from a ton of stress and lost time.

- Despite Bitcoin’s dominance rising, we don’t recommend heavily rotatING capital into BTC. We’re approaching a level where alts can pick themselves back up again.

- With the CPI numbers coming in, trading will be dangerous. If you’re inexperienced, proceeding cautiously or avoiding trades during this period may be the safest bet..

- Got more questions? Hit us up on Discord in the “✍️・traders-pit” channel!

As always, thanks for reading.🙏

Cryptonary out!