However, the "smarter" markets, such as the Bond market, aren't really buying into the Fed's narrative. This could have a longer-term implication for risk assets/crypto.

We have also laid out what we expect the environment to be like in the coming months and how we're looking to play it.

Let's dive into it below.

TLDR

- Markets rallied after the Fed signalled potential rate cuts in 2024, but bond yields suggest scepticism over the Fed's dovish stance.

- On-chain metrics and trading indicators have become overheated, indicating a potential pullback or consolidation period for crypto prices.

- Bitcoin could trade rangebound between $60k and $69k for 2-8 weeks to allow indicators to reset before the next bullish leg higher.

- Big-cap crypto indexes are facing resistance, supporting the case for some consolidation before attempting fresh breakouts.

- The overall outlook remains bullish, with any pullbacks seen as buying opportunities ahead of the next upswing.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

The Fed, Powell and the markets' reaction

Going into the FOMC and Powell's Press Conference, the key things we were looking for were whether there was a change in the Dot Plot from 3 interest rate cuts down to 2 rate cuts in 2024 and whether there would be talk of a reduction in QT, i.e., reducing the runoff of the Fed's Balance Sheet each month.The Dot Plot remained the same, with three interest rate cuts in 2024. However, the Fed admitted that it saw stronger economic growth, strong employment, and slightly higher inflation than initially suggested in its Dot Plot in December 2023.

So, overall, they've recognised that inflation may be more difficult to get down to their 2% mandated target, yet they've maintained 3 interest rate cuts.

Surely, you taper this back to 2 interest rate cuts if you see inflation not smoothly coming down to target? The reason is that if the Interest rate is not as restrictive as the Fed thinks it is (it's not squashing growth or employment or the inflation rate as much as they'd like), then you can't cut interest rates and make the rate even less restrictive otherwise you'll have an inflation problem again.

The Bond market recognises this, which is why Yields are flat/up today—they're not buying that the Fed will cut three times this year. How can they work with an economy that is as strong as it is?

The rate needs to remain restrictive (higher for longer), particularly with a strong economy, if they want the inflation rate to come down. If the Bond market bought that there would be 3 interest rate cuts this year, it would have rallied, i.e., Yields would have fallen substantially. Yet they're flat/higher...

Alongside this, Powell brought up QT (the Fed running off its Balance Sheet) and suggested that they may begin to taper the runoff, i.e., sell (in this case mature) fewer assets each month.

This is a net positive for liquidity. Perhaps the reason for this is that the Reverse Repo Programme is drawing down to 0, having been at $2.5 trillion two years ago. This has been over a $2 trillion stimulus to markets over this period.

The fact that Powell brought this up indicates that the committee (the FOMC) had discussed it and may look to introduce this sooner rather than later. Powell suggested that the Fed were looking to taper to prolong QT by doing less each month but dragging out the process for longer.

Again, perhaps this is another story that the bond market just isn't buying; hence, yields are flat/up.

Markets' reaction

Personally (Tom), I see Powell and the Fed as having been overly dovish yesterday, and with further thought, I believe they've shown their hand - they want rate cuts.They acknowledged stronger economic growth and a stronger labour market, and they expect inflation to be higher than previously anticipated over the next 18 months. Yet they stick with 3 rate cuts rather than 2. Alongside this, in the Press Conference, Powell was asked about;

- the very loose financial conditions, and he didn't bite back = dovish.

- Hotter than expected January and February inflation points, Powell somewhat dismissed it as "a bumpy ride down to 2% inflation" = dovish.

- Dismissive of the tapering to the Balance Sheet = dovish.

Overall, the above is good for risk assets in the short and medium term but less so in the long term.

On-chain and trading indicator metrics

We will keep this section shorter.We have covered in prior updates that some of the on-chain and Trading Indicators have been in overheated/overbought territory for a while, which has historically seen them pull back from this area.

This would likely mean a deep pullback in prices or a period of consolidation. This may mean that Bitcoin remains rangebound between $60k and $69k for a time that allows these metrics some time to cool off before the next potential leg higher.

We would see this as bullish for the market if there were 2 to 6 weeks where prices remained rangebound and, therefore, reset these indicators. It's important to remember that there must be periods of consolidation, even boredom, to have a sustained move higher.

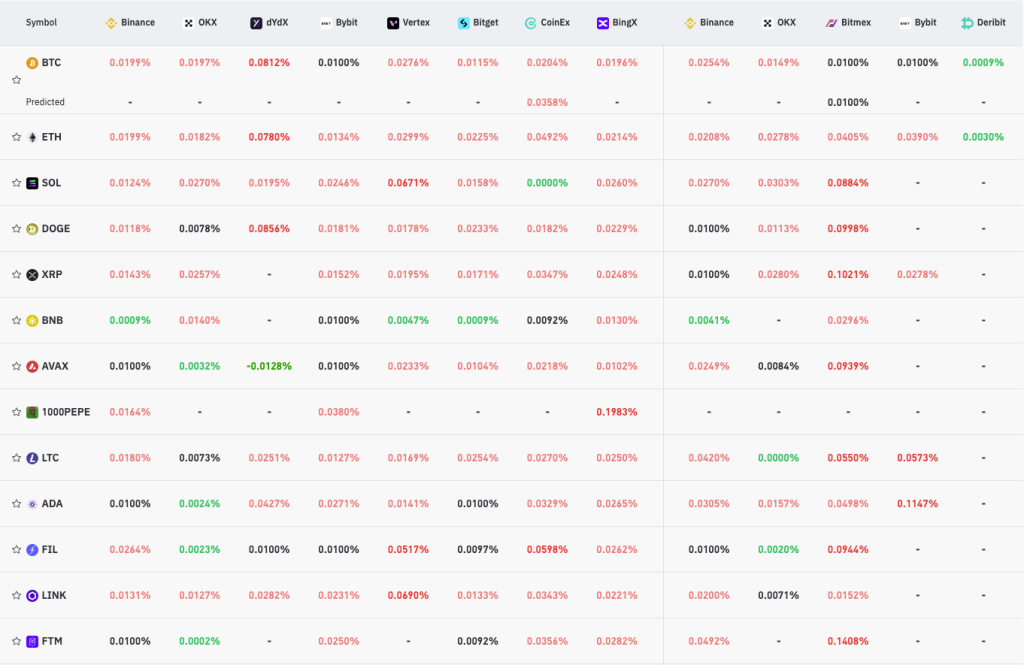

Secondly, we have been closely focusing on the market mechanics. We've seen very high Funding Rates and high Open Interest, indicating that there's a large leverage build-up with the bias to be Long. We're now seeing that despite Open Interest being 10% off from its highs, funding has reset considerably, closer to that 0.01% level (a far healthier level).

This shows a rebalancing in positioning, which was needed and a reason we have been less risk-on in the prior few weeks.

Look at the Binance pairs below. They are all in the 0.01-0.02% territory—this is much better.

Funding Rates

Indices + BTC analysis

To help us gauge the current market and whether we're potentially moving into a consolidation period, we like to look at the indexes to see if they're breaking out, breaking down, or moving into a range.Below, we can see the Big Caps Index, including SOL, and the Big Caps Index, which excludes SOL.

Big caps index, including SOL

The Index, including SOL, is now at a major horizontal resistance, so this may be a point where it pulls back slightly and consolidates for some time before attempting a fresh break out.

Big caps index, excluding SOL

The Index excluding SOL had broken out into a new range (above 22.00) but has found resistance just beneath the next horizontal resistance at 27.90. It may be the case that price establishes itself in this new, higher range before attempting a breakout at a future date. Looking at both these Indices, you'd expect a pullback or at least a period of consolidation, which may last longer than just 1-2 weeks.

BTC

When looking at Bitcoin on the 3D timeframe, you'd expect price to consolidate for a period of time or even pull back slightly. However, price has moved practically vertically higher since the beginning of February.The last time price moved dramatically higher and consolidated for a period was between early December 2023 and early February 2024 (2 months). Considering we're still pre-Bitcoin halving, it wouldn't be unnatural to see Bitcoin consolidate and remain rangebound for 2-8 weeks, potentially between $60k and $69k.

If this were to happen, it would likely be very positive for Bitcoin's future price action to consolidate just 10% shy of all-time highs, going into a Bitcoin halving and a Fed rate-cutting environment along with a huge fiscal spend (positive liquidity).

This would also allow many of the on-chain metrics and trading indicators to reset more substantially, allowing the market to have an even greater next leg higher for prices in the coming month or two.

Cryptonary's take

Prices have gone substantially higher over the past 6-8 weeks, pushing many metrics to overbought/overheated areas while we also see relative levels of euphoria on the Twitter timeline.When looking at all of this, we see it as natural that a slight pullback, but more probably just a period of price consolidation, is likely for the market.

Despite this, we remain bullish and see this scenario presented above as only helping to aid an even more bullish next leg up for prices in the weeks after the next Bitcoin halving.

Therefore, we are not looking to sell any of our Spot bags, and we're looking to add to our bags if there are further pullbacks in prices in the coming weeks, although we expect prices to remain relatively rangebound in this period.

But ultimately, a pullback or a period of consolidation could be expected here before the market makes a more significant move higher in the coming month or two.