In today’s market update, we lay out the game plan for the upcoming months and quarters.

This is your time to take advantage of the upside this market can offer you.

Remain patient but risk-on, and let the Spot positions do the hard work for you.

The upcoming months/quarters are where you reap the rewards you worked for in the last couple of years in what was a brutal bear market.

Topics

- Employment Data & Inflation Data

- Mechanics & On-chain

- Total MCap & SOL vs ETH

- Cryptonary's take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Macro data and its impact on the markets

Last Friday, we had Employment data out.Non-farm payrolls came in at 275k, which was far greater than the forecasts. However, the prior month's reading of 353k was revised down to 229k—politically adjusted, perhaps?

It is safe to say the Democrats are doing what they can to prop the numbers up to make themselves and Biden look better ahead of the November Presidential Election.

The Unemployment Rate increased to 3.9% from 3.7%, just returning to its level a month ago, so this didn't have a huge impact on markets.

What was really positive was that Average Hourly Earnings came in at 0.1%; remember, wages are inflationary, so to see them increasing by far less (than last month's print of 0.5%) is very positive for markets. Ultimately, this was a mixed report, and so markets continued.

We will have inflation data out tomorrow (Tuesday). The expectation is for the data to come in at consensus, similar to or slightly below last month's readings. If the data were to come in at consensus, then the markets would likely continue on higher, as it would indicate a moderation in inflation despite inflation still being above the Fed's mandated 2.0% level.

If there is to be a downside surprise (numbers come in lower than forecasts), the markets would likely rip higher. If we get an upside surprise, the markets will likely react negatively.

Mechanics and on-chain data

When taking a top down approach to assessing the markets with a focus on crypto, the mechanics do play a pivotal role.Currently, the Funding Rate is ridiculously high, so high that it should discourage us from using leverage. A high Funding Rate means that Longs are paying a massive premium to Shorts for the "privilege" of being Long.

When the Longs trade is overcrowded against Shorts, this usually results in a flush out.

The chart below shows just how high the Funding Rate is currently.

Funding Rates

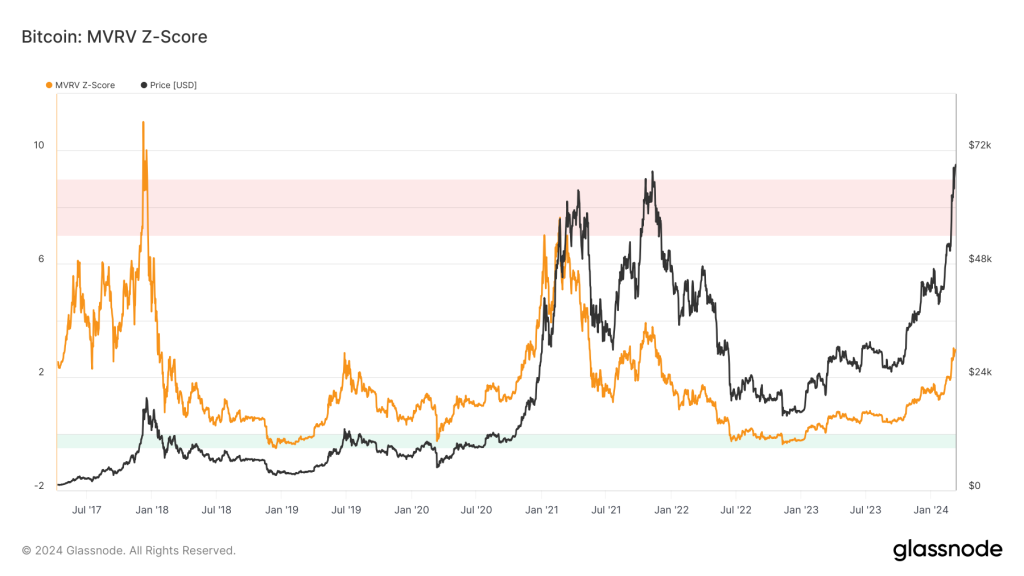

MVRV Z-Score

However, if we look at the 'Market Indicator' on-chain metrics, perhaps the best metric for displaying market tops and bottoms when examining the crypto market from a cycle's perspective is the MVRV Z-Score metric.

This metric is beginning to ramp up, but it's still very low when we look at it from a cyclical approach.

This suggests that we're further along in the cycle, but we've yet to experience the silly phase where prices increase dramatically. This phase usually lasts about six months, but this metric suggests we're at the beginning of this phase.

Total MCap (excl BTC and ETH)

In our prior Market Update, we looked at the Total Market Cap, excluding BTC and ETH, along with the ETH/BTC pair, which looked great for further upside over the coming months and quarters.But the argument may be here: SOL or ETH?

We can look at the SOL/ETH pair for that.

SOL/ETH 3D timeframe

Looking at this on a 3D timeframe, we see it looks prime for a major breakout. It has found support at the 0.03293 level and is now squeezing into the local downtrend line.

A breakout of the red downtrend line and then a push above 0.044 could really propel SOL substantially higher and target that USD all-time high of $250.

Big Index excl SOL 3D timeframe

If we look at the Big Caps Index, this time excluding SOL, we can see that it has broken above a key level. This should indicate that there is potential for a large altcoin season on the near-term horizon.

Cryptonary's take

Looking at the data we presented above, we think the game plan remains relatively straightforward.We're still early in the cycle in that the euphoric phase hasn't yet kicked in, but we're beginning to see the alts indexes and pairs begin to break above key resistance levels where they can then have room to move substantially higher.

However, we're beginning to see the market mechanics fluctuate a lot and move to very high levels. Therefore, we chose to avoid leverage, as the market is vulnerable to flushouts.

But we would be buyers of these flushouts, i.e., when the price comes down substantially due to a leverage flushout, and we will look for this by seeing if the Funding Rates reset.

Of course, we remain in Spot positions and are not looking to sell anytime soon. We will now also look for beta plays of ETH and, most definitely, SOL. These may be SOL ecosystem plays or meme coins.

As we move into this market's euphoric period, the beta (alternative) plays will likely outperform. Therefore, we would continue to look to move our risk appetite further along the risk curve for the upcoming months and quarters, as that's where we expect outperformance as new entrants chase the next play.

Cryptonary, OUT!