In this article:

- Tomorrow's FED Meeting.

- Chinese Stimulus.

- Cryptonary's Take - Impact on Crypto

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Tomorrow's Fed meeting

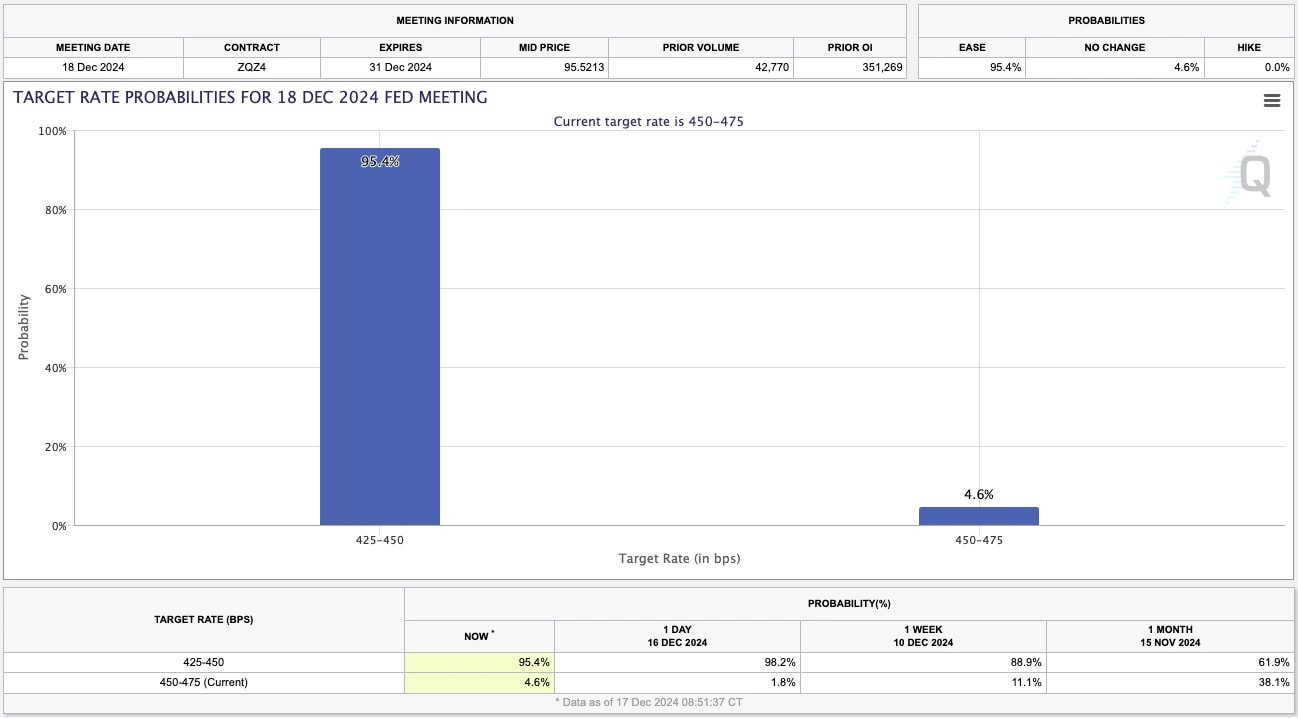

Expectations for tomorrow's FED Meeting are for the FED to cut by 25bps, with the markets now pricing in a 95.4% chance of a cut tomorrow. The market is; however, pricing for no cut in January and a March cut is currently 50/50 (50.3% to be specific).Target rate probabilities for the 18th Dec Fed meeting:

With a 25bps rate cut now fully expected and priced in, markets will be looking to the newly updated Summary of Economic Projections (the last was released back in September).

The market is currently pricing for just 2 Interest Rate cuts in 2025 (but the FED's September SEP shows 4 rate cuts in 2025), and that's due to the economic data remaining robust while the labour market is continuing to hang in there.

But, we have begun to see some slight pockets of weakness recently on that front. However, Powell will be wary of this, and therefore, this opens the door for Powell (and the newly updated Summary of Economic Projections) to come in tomorrow more dovish (or less hawkishly) than the markets are currently predicting.

With growth still strong, a more dovish than expected Powell tomorrow could fuel a further move higher for risk assets if Powell indicates that he and the FED see themselves cutting by more than 50bps in 2025.

China stimulus

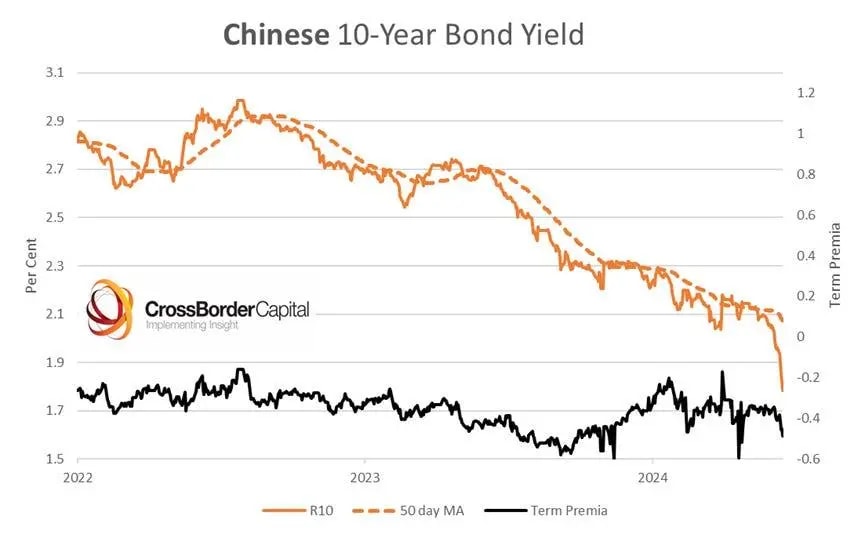

From a macro viewpoint, we're at a really interesting point here. China is experiencing deflation in what is already a really weak economy. The Chinese 10Y Bond has seen a 40bps decline in its Yield, indicating that investors are flocking to Bonds rather than Equities/property for safety.Chinese 10Y bond yield:

China is in desperate need of monetary and, more importantly, fiscal stimulus to revive a crumbling economy that's desperate for help, and large help is needed to restore confidence and, therefore, more sustained demand.

China's Politburo has said they would implement a "moderately loose" monetary policy rather than a "prudent" policy. The last time they used this language was post 2008, when they then unleashed large monetary and fiscal stimulus that pulled China and the rest of the world out of a global recession.

However, so far, we've had a number of false starts, where the Politburo has suggested they'll increase stimulus, but they haven't committed to any hard numbers in terms of the size of new stimulus (rather than just bringing forward local government debt/bailouts). And, in our opinion, they're unlikely to do so until Trump's inauguration.

Trump wants to impose hefty tariffs, and although this is likely just a strong negotiating tactic to bring the Chinese to the negotiating table to get a deal done, China could really do without this.

So, the reason China hasn't yet gone and unleashed a large fiscal stimulus package is that if they do so, the Yuan will weaken substantially against the Dollar - due to the Chinese stimulating (easing) and the US engaging in less easing (meaning a stronger Dollar against the Yuan).

Both sides are holding strong currently (on their positions ahead of negotiations, likely in January), the US maintaining a strong Dollar and the Chinese not engaging in easing so as not to weaken their currency, despite the Chinese desperately needed to ease/stimulate.

The above potentially sets us up for some macro scares early next year. However, we're not positioning for this. The US/Trump want a deal, and the Chinese need one, and following that, some relief.

And that's the key: even though there could be some volatility in the short-term (next 1-2 months), beyond that, we're likely to see significant easing globally which is likely to only aid Bitcoin to go much higher.

Cryptonary's take - Impact on crypto:

Now, it's possible we will see some scares between now and the first few weeks after Trump's inauguration, although we're not expecting anything major.We also expect Crypto (and mainly Bitcoin) to continue to perform positively in this period as new money continues to be onboarded ahead of what's expected to be a much more positive regulatory environment going into 2025.

The key question you guys will ask us is about the Alt/Meme season.

Currently, we're still in this PVP (Player-vs-Player) environment rather than a PVE (player-vs-everyone) environment. So, you're mostly just seeing rotations continue to play out. TOTAL3 remains high and isn't pulling back majorly, so this also supports rotations are occurring.

TOTAL3 MCap:

Right now, the 'hot sector' seems to be AI and even, to some extent, DeFi; meanwhile, Memes are taking a breather. However, we see 35% to 55% retracements in the major memes.

This is typical historically based on what we've seen, and therefore, we have to ask ourselves, 'Is the cycle over?' From the macro and on-chain that we look at and have put out in updates and previous updates, we think absolutely not.

So, the conclusion is that we continue holding and expect rebounds in prices in the coming months as we expect BTC to continue grinding higher. Our upside targets for memes remain. No changes.

One other thing to note is that as other sectors run, and major memes hold at their lows or even go very slightly lower, the major memes begin to look more attractive again in relation to other coins/sectors. We think we're either at or very close to these levels.

BTC: