Bitcoin's $36K ceiling: Will Powell's remarks tip the scales?

Today, the crypto market is hanging on every word from the Fed’s quartet of speakers. Fed-speak will determine whether trades hit the 'buy' or 'sell' buttons – so this calm before the storm is deceptive. Let’s unpack what’s likely to happen today.

TLDR

- Bitcoin is currently in a delicate position within an ascending wedge

- Recent market movements included a short squeeze that propelled BTC prices upwards

- Today's Fed-speak may influence bond yields and the dollar, potentially putting downward pressure on Bitcoin.

- We expect Bitcoin’s price to fluctuate between $33,300 to $36,000.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

With a lack of any meaningful economic data this week, the focus is on the Fed-speak. We’ll also see how Fed members address the dovish view the markets took following Powell’s last FOMC Press Conference. Today’s speakers are Fed Chair Powell, Williams, Barr and Jefferson, who are usually relatively neutral. So it’ll be interesting to see if they try to walk the market back somewhat.This could see bond yields move slightly higher and continue to fuel the Dollar to rebound. This should, in turn, provide some resistance to risk assets - which could negatively impact Bitcoin and crypto.

Let’s now dive into the technicals for BTC.

Technical analysis

Bitcoin remains in this ascending wedge/channel and tested yesterday’s highs just shy of $36,000. As price moved into this level, we saw a large amount of shorts liquidated at $35,600. And then, some relatively large spot sellers stepped in at $36,000. This wiped out a lot of the short open Interest in the market.Supports to the downside remain $34,000 and then $33,300, but there is now a significant build-up of long liquidations at $34,000 to $34,300. If price were to drop into this area, this could potentially escalate and drive BTC down to $33,300.

BTC 1D

Market mechanics

The mechanics continue to drive price, which is exactly what we saw yesterday. Let’s assess the changes.Firstly, the RSI on the daily and the 3D remains very overbought. A move lower would reset a lot of this and will be needed at some point. However, this doesn’t mean we can’t go higher first.

The funding rates are now back to being quite positive but not to the point where they indicate too many longs. Therefore, this is no longer an unhealthy setup like it was yesterday.

Yesterday, we had a lot of shorts pile in, which then saw a large spot bid come in to drive price higher into $35,600 to liquidate many shorts. Price continued up to $35,900, where larger spot sellers then resisted it.

There is no longer a large short build-up, and despite open interest being high, price could grind higher here as long as we don’t see large spot sellers move back in.

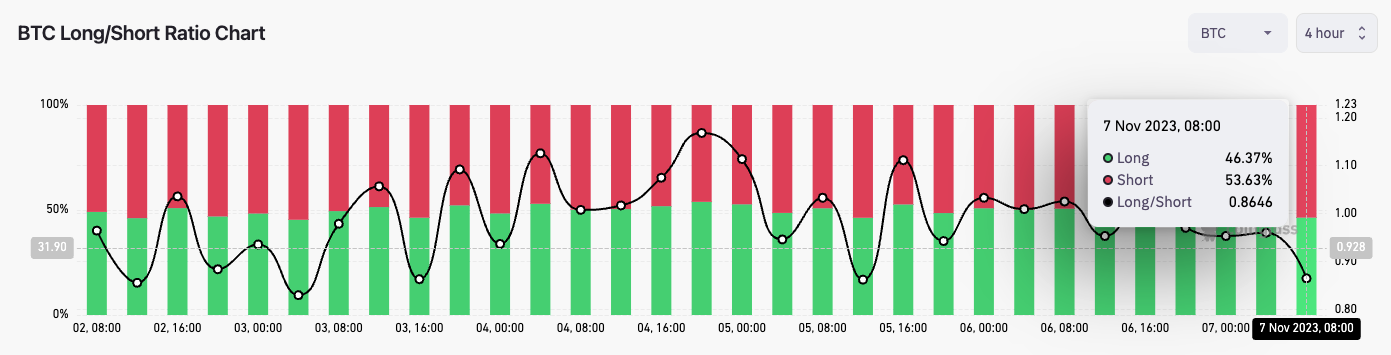

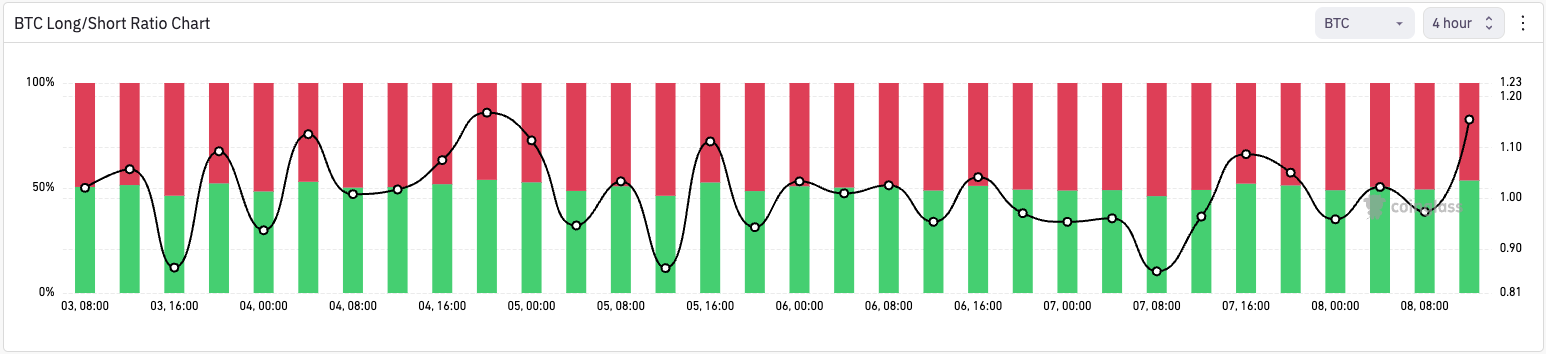

The chart above shows us today’s long/short ratio (top) against yesterday’s long/short ratio (bottom). Look at the far right-hand side; yesterday, we were heavily in the green, indicating lots of shorts (retail) and, therefore, likely to be squeezed - which is what we got. Today, we’re seeing the opposite, still not a healthy setup, and potentially open to being squeezed = price down.

Now, looking at the liquidation heatmap, we can see how the short liquidation build-up at $35,600 was wiped out yesterday on the short squeeze driven by the spot bid. If we then look at the liquidation heatmap, we can see the major liquidation levels for shorts is at $35,600 and for longs at $34,000.

Cryptonary’s take

Following yesterday’s short squeeze, price was driven higher, and the short open interest has now reset. Therefore, we may see the opposite today of longs being squeezed out = price down.We also have Fed-speak today, where we may see members try and walk back some of the dovish sentiment. If this happens, which we expect it will, bonds may sell off slightly (yields up), and the DXY (Dollar Index) will likely continue to get a bid. This could be suppressive to risk assets, meaning the S&P ($SPX) may struggle to continue its move higher, and in turn, this may negatively impact Bitcoin.

We feel that Bitcoin will remain in a range between $33,300 to $36,000. A breakout of $36,000 would ignite more bullish momentum in altcoins. The same as yesterday, don’t let leverage trading shake you out here, as the mechanics are volatile and moving to relatively extreme ends.

Bitcoin’s price below $33,300 would be a good DCA’ing opportunity for long-term investors.

As always, thanks for reading.

Cryptonary, out!