This week has been so hectic and we have seen that the markets have been at the mercy of macro this week.

I am knackered now. This week has really taken it out of me trying to digest it all and make sense of so many different moving parts so that I can then translate my clear thoughts/thoughts to you guys.

But overall, the outcome for risk assets has been more positive than I first thought it would be on Monday when we saw the first details of the Treasuries QRA. It's been a relatively good week, and I think we'll be relatively risk-on for the next few weeks.

Let's dive in!

TLDR

- Macro events impacted markets significantly this week, with the Treasury's higher bond issuance initially bearish.

- Fed Chair Powell countered with a dovish stance, maintaining bias for interest rate cuts and boosting risk assets.

- Labour data showed a 'goldilocks' scenario - moderating unemployment and cooling wage growth, positive for inflation.

- On-chain metrics like Mayer Multiple, UTXO profit, and STH-NUPL suggest Bitcoin is in bullish territory with buying opportunities.

- Bitcoin aims to break above $61,200 resistance, setting up a potential bull flag breakout in late May/June.

- Overall, a risk-on environment is expected, with meme coins likely to outperform over the weekend.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

QRA and Powell on Wednesday

The Quarterly Refunding Announcement (QRA) statement from the Treasury and Yellen was bearish for markets in that there was more bond issuance (as the US needs to finance its debt) than the market expected.The result is that there is more supply of Bonds coming to market in Q2 and Q3, and the US needs to find buyers for this debt when we have recently seen some relatively weaker Bond Auctions.

With more issuance on the way, this is an increase in supply (against what was originally expected), and therefore, Bonds sold off, and Yields went higher. Rising Bond Yields is bearish for risk assets.

Fortunately, Powell turned up a few hours later and saved the day. The interest rate did not change as expected. However, market expectations were for a hawkish Powell, who came in relatively dovish. He pushed back against a rate hike and maintained his seeming bias to want to cut interest rates this year.

We'll likely see 1-2 interest rate cuts this year. Markets obviously took this well, resulting in the dollar index moving lower, bond yields moving lower, and risk assets (and crypto) rising—great for us crypto heads.

Labour market data out today

All around, this is fantastic for markets and risk assets. We got a slight increase in the Unemployment Rate to 3.9%, up from 3.8%, so there is a slight weakening, but it is just moderating, so it is a 'goldilocks' kind of number—perfect for markets.Alongside this, and perhaps the more standout figure, is the Average Hourly Earnings, which came in at 0.2% rather than the continued figure of 0.3% we've seen recently. This is a move lower in wage growth, so it is positive for inflation to come lower going forward. This is a 'goldilocks' number for markets, and it is exactly what they/we wanted to see; hence, the markets have bid on the back of the labour market report.

On-chain data

Let's do a light analysis of on-chain data to understand what it tells us about where Bitcoin is headed.Bear market drawdowns

For those unsure whether the current BTC price drawdown is normal for a bull market or if the drawdown we have just seen is extreme, the chart below shows that it's a very normal drawdown in a bull cycle. In fact, this cycle's drawdowns look very similar to those of the 2017 bull market cycle.

Mayer Multiple

If we look at the Mayer Multiple, we can see that Bitcoin's price is trading closer to the 200DMA, meaning we're in bullish territory. However, we're not paying too much of a premium for BTC at these prices.

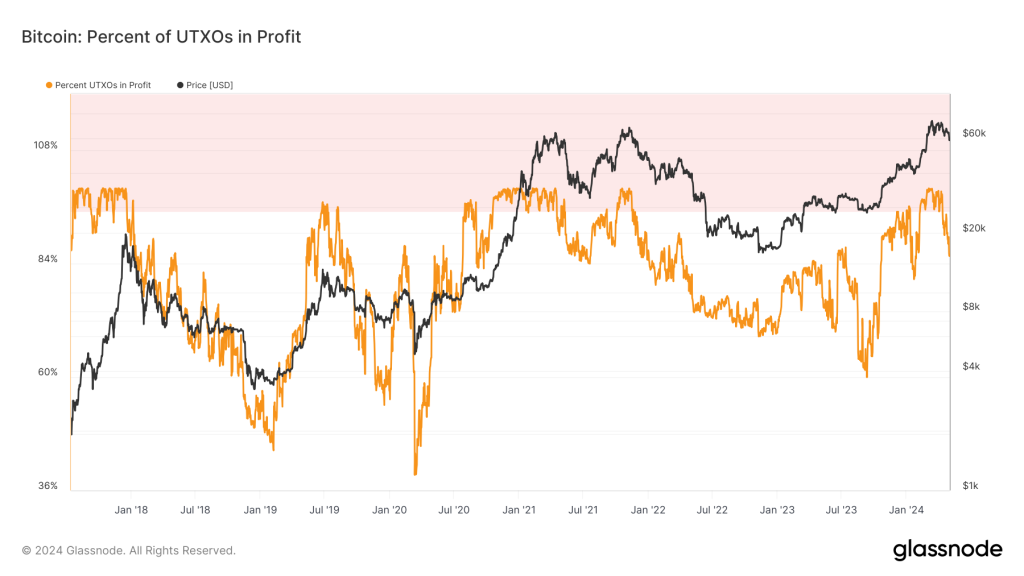

Percent UTXO's in profit

If we look at the far right side of the chart, we can see that there has been a meaningful pullback in the Percentage of UTXOs (BTC) that are in Profit. This is healthy for bull markets and potentially represents a good buying opportunity.

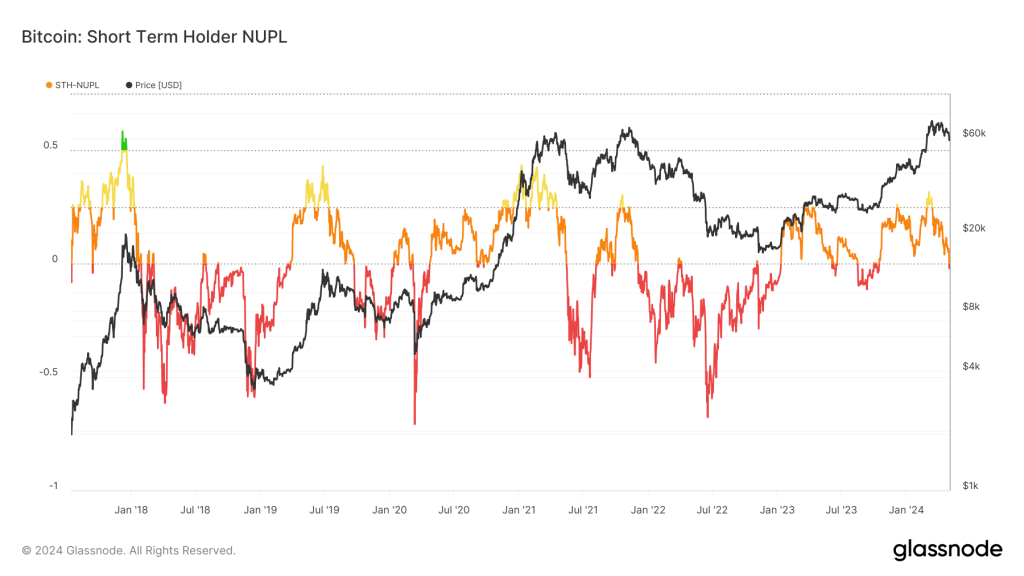

STH-NUPL

The Short-Term Holder Net Unrealised Proft/Loss has reset to the red zone. In prior bull markets, this has represented a good BTC buying opportunity.

BTC

I was impressed with Bitcoin's bid today, but we also need to see this be sustained, with $61,200 likely being a key area of resistance. If BTC can sustain above $61,200 (which we've done really nicely so far), then this would be a move back above local resistance, and BTC can move on higher from there over the weekend. For now, we remain in the large bull flag pattern that we've called for for a long time.

I still see that a breakout to the upside of the bull flag is possible in late May/maybe early June. If we get the above I have outlined, I expect crypto to perform well over the weekend, with memes likely the best performer. Let's see.

Cryptonary's take

This week has been a hectic week on the macro front, and the markets have been whipsawed by the different data points and Fed speeches from Powell.Overall, even though liquidity isn't likely to be ridiculously stimulative, I still see that we're in a risk-on environment. The markets today have been given the all-clear to move higher following Powell's dovish stance on Wednesday that maintained an interest rate-cutting bias that was then backed up today with a labour data report that showed a cooling in the labour market but with nothing breaking.

So, that may help inflation come down, but the labour market is still strong enough that there isn't a real breaking (as of yet); hence, the 'goldilocks' print and markets have really bid and moved higher off the back of it.