Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- Bitcoin's Open Interest is at a new cycle high (in terms of measuring by the number of coins), and it's at an all-time high in USD terms.

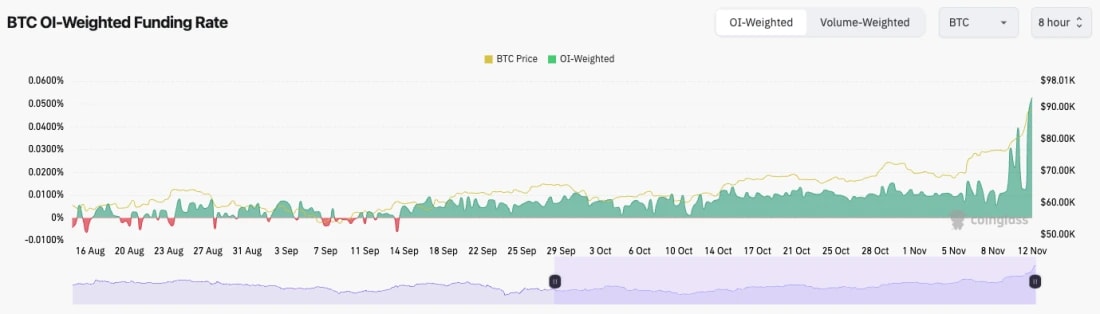

- The Funding Rate is also very high and now at alarming levels, at 0.07%. This is 75% annualised. So, traders are paying 75% per year to Shorts to hold their current Longs. Excessive.

- This setup likely needs and often results in a flush-out. We expect that this will also be needed here.

Technical analysis

- Overall, this chart is great, and we've seen a high timeframe breakout, which has seen BTC visit close to $90k. Mega.

- The move has been basically straight up, and even though it was, for the most part, driven by Spot buying, straight-up moves can have, and need pull backs.

- The last major resistance that was broken to the upside was at $73,600. It's now more tricky to find a new potential area of support.

- Looking at the lower timeframes, there is local support here at $85,500. But Funding is still high, and OI hasn't been flushed yet, so there's probably more downside to come to generate that flush out.

- Therefore, the possible support we're looking at is between $81k and $82k.

- To the upside, the all-time high is the next resistance.

- The RSI is also extremely overbought at 75. This suggests some downside, or at least a period of consolidation is needed for this indicator to reset.

- Next Support: $81,000 - $82,000

- Next Resistance: $89,000

- Direction: Neutral/Bullish

- Upside Target: $89,000 (and then $100,000)

- Downside Target: $82,000

Cryptonary's take

We now fully expect that we're in the "euphoria" phase of the cycle, so we're expecting at least a number of months of strong upside price action. However, in the immediate term, BTC looks overbought here, while the leverage is high and overpositioned. It's likely we'll flush out of that leverage, and the price will likely pull back because of that.But major dips are for buying. So far, we've seen BTC and DOGE begin their breakouts. In the coming weeks, the rest is likely to follow.

Keep leverage light, preferably none at all. Dips are for buying, and the clue as to when to buy is when Funding Rates reset.