Market Direction

Bitcoin’s next move: $87K or $98K?

As Bitcoin hovers near key support, market sentiment remains fragile. With macro risks in play and resistance holding firm, traders prepare for potential downside. Let’s analyze the latest BTC trends and key levels shaping the market’s next move.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

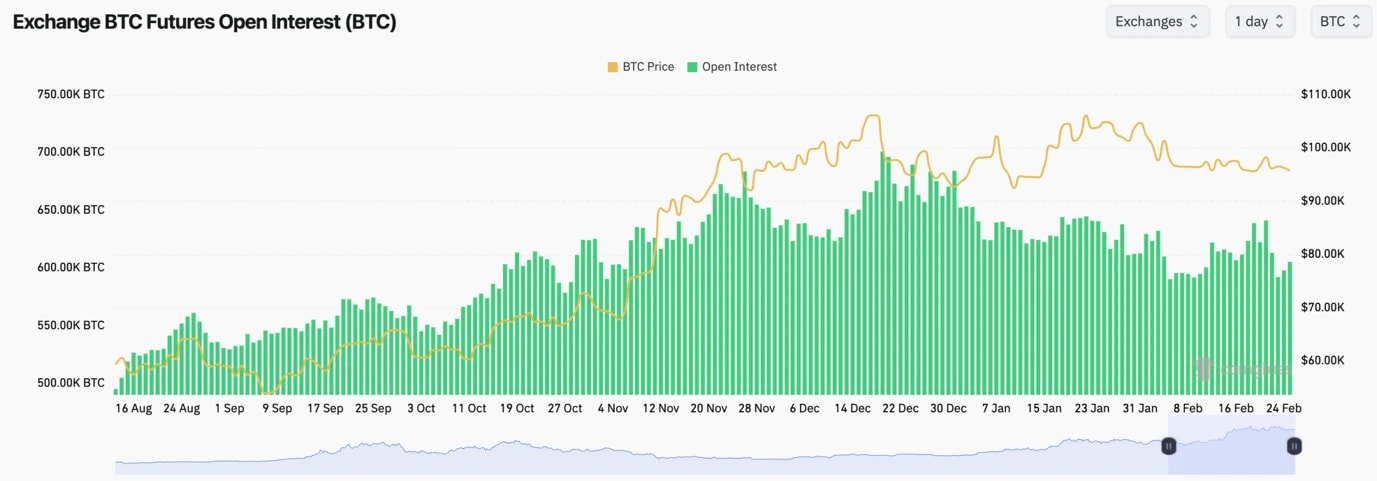

- We're still in a general downtrend for Open Interest, and it was interesting to see the OI pop higher into $99k before the price pulled back and OI came back down and into new lows.

- Interestingly, Funding Rates have mostly stayed positive, meaning Longs are still more dominant.

- This has been contrarian to the rest of the space where we've seen a lot of ALTS have negative Funding Rates.

Technical analysis

- Amazing really to see that Bitcoin has remained tight in its range.

- Bitcoin is still ranging between the major horizontal resistance of $98,900 and the horizontal support of $95,700.

- On Friday, the price tested the horizontal resistance and the local downtrend line, but the price was rejected and it's now back to the lows of the range. As we expected, the upside is capped.

- The RSI is still in a downtrend but remains in the middle territory and it's battling at its moving average.

- On the downside, if $95,700 breaks, $91,700 is the next level. We expect this level to be tested again at some point in the coming weeks.

- Next Support: $95,600 (then $91,700)

- Next Resistance: $98,900

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $87,000

Cryptonary's take

Whilst it's possible for Bitcoin that we still get these small pops higher, and granted the range lows have continued to hold, but we do expect them to break. In the coming weeks, we see a more material breakdown coming with $91,700 being the likely target, although the price may extend to the high/late $80k's - $87k to $91k say.We still lack catalysts in the short-term, whilst there are macro headwinds with Trump policies (companies are cautious until they see the effects of the policies). This can potentially set us up for more downside in the coming weeks. And for now, this is what we're expecting and positioning for. If the price retests north of $98k, Shorts can be considered.