Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

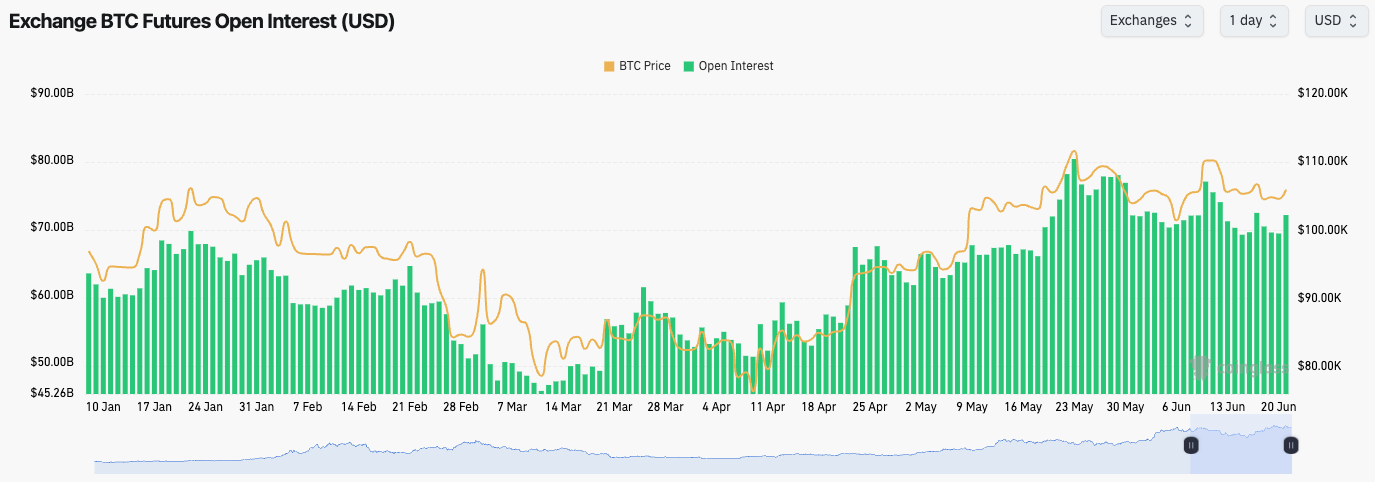

- BTC's Open Interest remains high overall, having ticked up slightly as price has moved from $103k back to $106k.

- Funding Rates are positive, but they're not meaningfully high, suggesting that there is a balance between Longs and Shorts here.

- We're not expecting a flush out, but a small flush out might be healthy here, just to reset Open Interest further.

Technical analysis

- BTC remains in a pennant pattern with price having found support at the bottom border of the pennant.

- Price is now squeezing into a horizontal resistance at $106,900. If price can break through this level, then this sets up a move to $110,500 (the next horizontal resistance).

- If price does break below the bottom border of the pennant, then the horizontal supports are at $102,500 and then $98,900.

- The RSI has meaningfully reset and it's now in middle territory. However, it is underneath its moving average which may act as a form of resistance.

- Next Support: $102,500

- Next Resistance: $106,900

- Direction: Neutral/Bearish

- Upside Target: $110,500

- Downside Target: $98,900

Cryptonary's take

With the ongoing Iran/Israel conflict and with tensions elevated, investors/traders are not looking to risk-on with meaningful size and are likely adopting a more cautious stance for now. This may negatively impact Bitcoin in the short term, and it might mean that the price breaks down from the pennant rather than up.We expect BTC to pull back to $102,500, with the potential for $98k to be reached. If $98k is reached, we'll begin building a position in BTC, whilst we'd also bid down to $92k, although we don't currently expect more downside below $98k.