Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BNB:

Market context

Right now, we’re in a market that’s definitely not overly bullish—there’s no clear short-term catalyst that would drive prices higher. Any bullish move from here would have to come as a surprise, meaning it’s not something we can plan for.For that reason, we can only navigate what we can see in front of us, and what we see is $650 acting as clear resistance on BNB. There’s strong selling pressure in this zone, making it an area that’s more suited for taking profits rather than looking for fresh longs.

We’re now back in a motion similar to late 2023, where we expected lower prices before looking to accumulate. The last time we analyzed BNB, we spoke about the Q4 range high and Q4 range low, mapping out how the price would likely gravitate towards these key levels based on sentiment shifts. At that time, we weren’t in an overly bearish environment, but it just shows how quickly the market can shift.

Now, sentiment has tilted more cautiously, and we’re seeing $650 as a resistance zone rather than an area to be aggressively long. This puts $540 back in play as a likely downside target before we reassess accumulation.

Playbook

- $650 is resistance – Expect selling pressure here, not an area for fresh longs.

- $540 likely to come into play – If sentiment remains cautious, we project further downside before accumulation makes sense.

- Long-term still positive – While we expect short-term weakness, this is setting up better opportunities later in the year.

Cryptonary’s take

Right now, short-term caution, and long-term excitement. We’re back in a similar phase to Q4 2023—expecting lower prices before a proper accumulation phase begins. There’s no reason to be aggressively long here, and $650 is resistance until proven otherwise.If you’re an active trader, shorting from $650 with tight risk makes sense, but risk management is key—allocate only what you’re comfortable with. Bigger picture? We want to be buyers lower. The play remains the same: Stay patient, let the market come to you.

Chainlink (LINK):

Market context

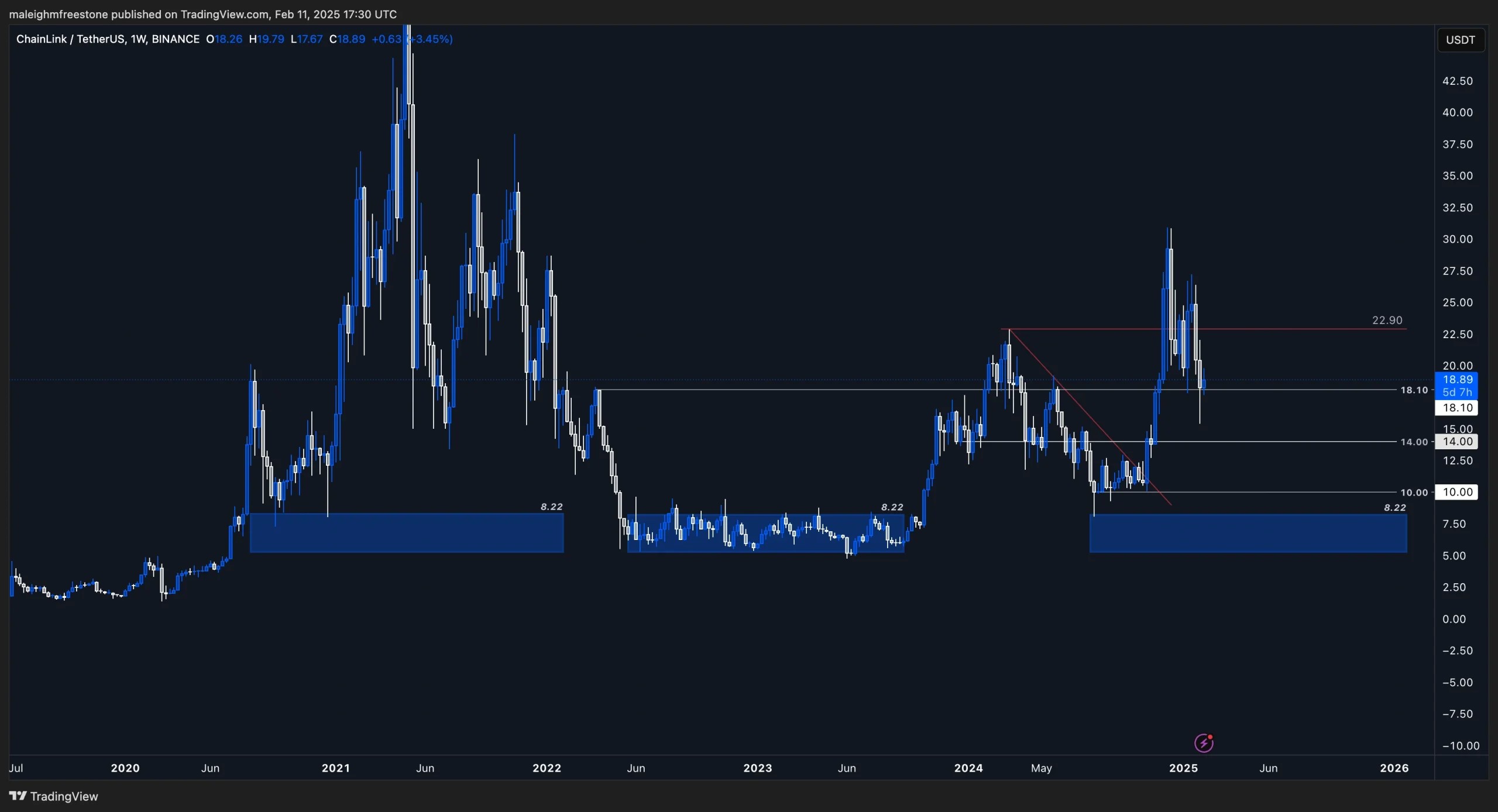

Since 2023, when the bull market started gaining momentum, LINK has been one of the few tokens still maintaining a higher time-frame bullish structure. However, we’re in uncertain territory right now, and patience is key.The $18.10 level has been a key point of interaction—the price has tried to trade into it on the downside but has since reclaimed it. That’s a solid reaction on the weekly time frame, but we need to be cautious. If this level breaks to the downside, then $14 comes into play, which is a highly probable outcome. $10 is also a possible level, as it would mean LINK has completely retraced its entire Q4 move.

Playbook

- $18.10 is the key level – Holding above keeps the structure intact; losing it opens the door for further downside.

- $14 downside target – A break below $18.10 makes this the next area of interest.

- $10 potential – If the market rolls over and LINK fully retraces Q4’s move, this could become relevant.

- Patience is key – Given current market conditions (as covered in our BNB analysis), this isn’t the time to rush in.

- High-level traders could look at shorting opportunities, but that’s not a play for everyone. The best strategy remains to wait for higher-probability long setups in the coming months.

Cryptonary’s take

Right now, it’s all about waiting for the market to come to us. We’re in uncertain conditions, and the best moves happen when you don’t force trades. The two main levels we’re watching are $18.10 (current key level) and $14 (major downside target)If the market remains weak, $10 could come into play, wiping out the entire Q4 move. That’s not a guarantee, but it’s something to keep in mind for accumulation strategies.

Stay patient, let the market set up, and don’t rush into anything—especially if you’re not experienced in shorting. The real opportunities will come when sentiment stabilizes, and capital starts flowing back into strength.