BNB technical analysis: Trading opportunities in $500-$622 range

What stands out is that BNB is trading near its all-time highs, sitting in the upper part of this range, much like Bitcoin or Solana. However, unlike Solana, BNB has managed to trade near its all-time highs of $622 consistently since December 2023.

Market context

When zoomed out on the monthly timeframe, BNB appears to be trading within a massive range, with the highs around $622 and the lows near $200. This large range has held over time, and on the weekly timeframe, we can see another range forming within that broader context.Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

On August 5th, BNB briefly went down to around the $400 region but has largely maintained a range between $500 and $622. This highlights strong range-bound behaviour. With recent geopolitical sell-offs, BNB reached that $622 level but swung back within the range as it failed to break out.

Market mechanics

Funding rates

Funding rates for BNB are relatively flat with no significant bias to either side, although there was a slight spike on September 24th, that still wouldn't suggest there was to much bias to longs either. Funding has been flat for awhile which could speak to this range bound price action.

Open interest

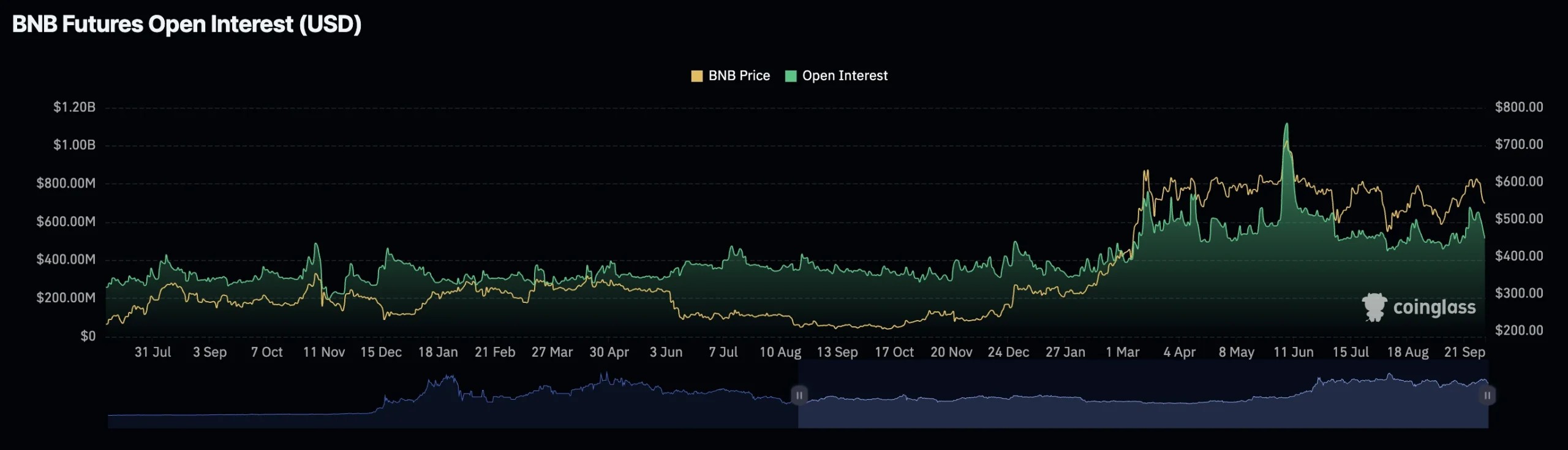

Open interest has dropped from 658M to around 513M over the course of 10 days. This isn't a drastic drop, but it does suggest that some leverage has left the system, which could offer less resistance for price movement within the range.

Liquidation levels

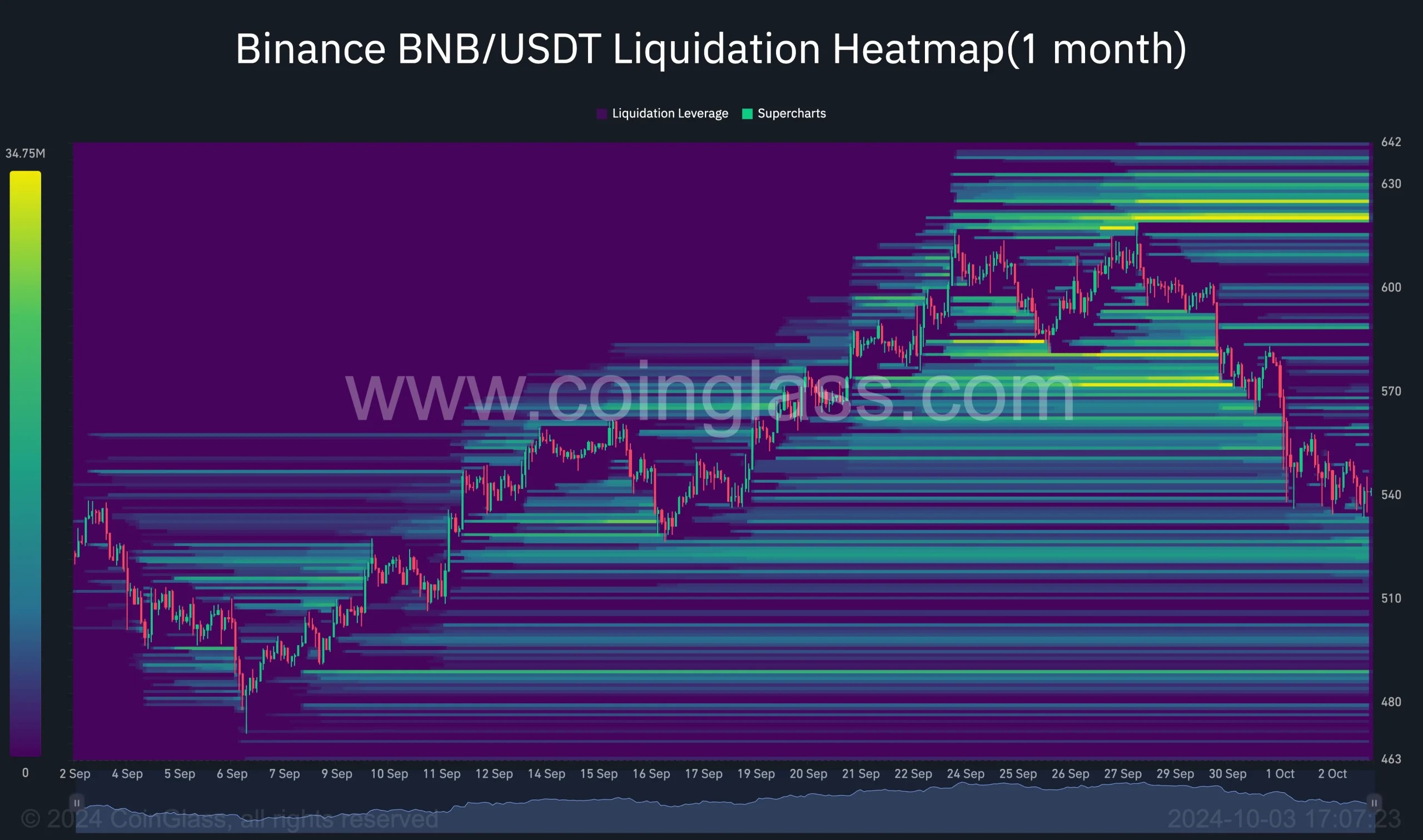

Significant liquidation levels sit around the $620-$622 range, which reinforces the upper boundary of our range and the likelihood of price action returning to this level. The heatmap shows heavy buildup around $622, making this a key resistance level.

Risk management strategy ( If you are a holder and looking to take advantage )

- Spot Accumulation: Accumulate around $500, the range low, with a stop just below $490 in case the price breaks down further.

- Aim: Aim for a swing up to $622, giving you a healthy risk-to-reward setup.

- Leverage: If leveraging, scale in around $500 with a tight stop just below $490. This would allow you to ride the price back to the top of the range while managing risk effectively.

Cryptonary's take

BNB remains a strong asset this cycle, holding up well and consistently trading near its all-time highs. The range between $500 and $622 has been reliable, making accumulation at the lower end of this range a favourable strategy for both spot and leveraged traders. With heavy liquidation levels at $622, it's likely that we'll see this level tested again, especially as BNB has continuously respected this range over the past months.BNB stands out as one of the top performers within its cycle, and this range-bound opportunity offers a clear, defined play for traders. We don't have a financial interest in this asset. This is an analysis purely for educational purposes.