Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market context

We had that blue range box on BNB between $500 and $622. The key thing we've been focusing on is the head and shoulders pattern formed in candlestick form. The left shoulder was printed on Monday, 1st July. The neckline followed on Monday, 22nd July, with the head forming on 5th August via a weekly wick candlestick. The neckline was respected on 19th August, and the right shoulder was accurately tested on 2nd September.Looking back, this neckline acts as a box resistance range, especially when considering the March-April period, when we saw numerous wicks, indicating significant selling pressure in that region. A breakout above this level would be crucial, signalling that buyers are stepping in and are willing to hold rather than sell at these levels.

Market mechanics

- On 9th October, we saw a massive ramp in the funding rate, heavily skewed to the negative, meaning sellers were paying a premium to be short. This has since rebalanced, and open interest has been relatively flat since June, with no major spikes.

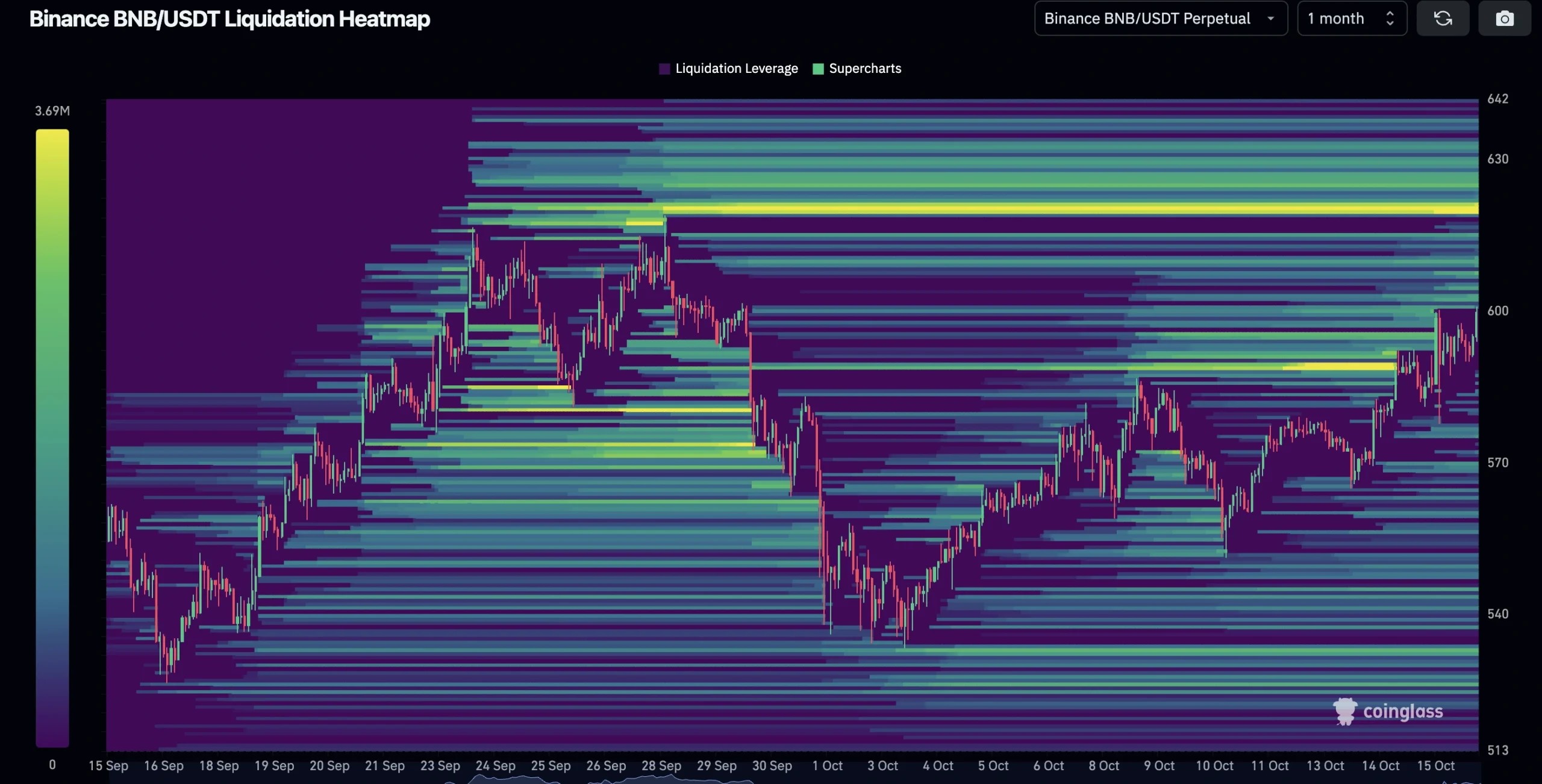

- The liquidation heat map shows a significant build-up of short positions above $600, which could be squeezed as we push upwards. There's even more liquidation potential just above $620, making this range particularly interesting for a potential squeeze.

Playbook

- If BNB can break and close strong above $622 and we see continued buying, then we'll be looking at a $622-$720 range. The wick from 3rd June correlates nicely to Bitcoin's push-up to approach its all-time highs.

- Currently, Bitcoin is rampaging at $68,000, back towards its 2021 all-time highs, which could carry BNB above $622. How long it stays there is uncertain, as there has been significant selling pressure between $622 and $720, much like Bitcoin's own struggles at its key levels.

Key levels

- $500-$622 (current range)

- $620-$720 (potential target after a breakout)

- Watch for short liquidations, and price squeezes above $600 and $620.