BTC and SOL rally, ETH lags, HYPE overheats — is a multi-asset shakeout coming?

BTC is consolidating at all-time highs, but RSI is flashing red. ETH can’t reclaim $2,720, while SOL prepares for a breakout and HYPE runs red-hot after a 4x move. With funding rising and volatility looming, one of these charts is about to snap — hard.

TLDR:

- BTC:Broke ATH, consolidating $105K–$ 112 K. Neutral/Bullish. Target: $120K.

- ETH:Stalled below $2,720. Bearish tilt. Watch $2,420 support.

- SOL:Bullish setup. Targeting $200 if $184 breaks. Support at $162.

- HYPE: Overbought after 4x run. Caution advised. Support at $27.30.

BTC:

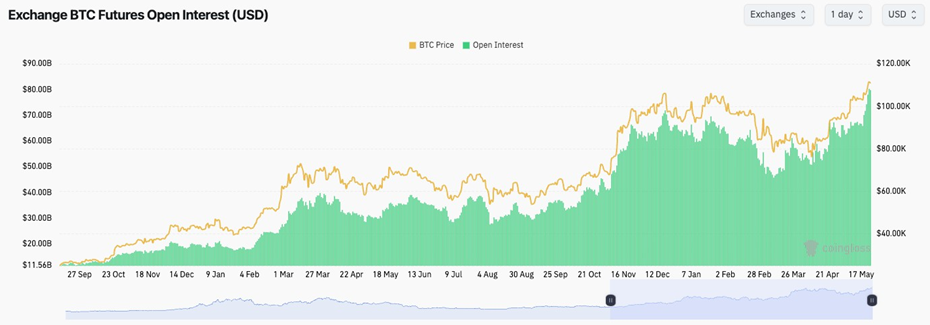

- BTC's Open Interest has soared to new highs, whilst Funding Rates have turned positive, although they're not in frothy territory.

Technical analysis

- BTC has broken out of its all-time highs and the key horizontal resistance of $106,700.

- Price has stalled at $112,000, with price now pulling back and retesting the $106,900 horizontal level, which is now new support.

- Should price break below the $106,900 horizontal support, the $105,000 support is just below. However, if we see a breakdown below $105k, the price will likely pull back to

- $95,700.

- In terms of upside, if the price can break back above the all-time highs of $111,900, then we expect the short-term price target to be $120,000.

- The RSI is just below overbought territory; however, its moving average is overbought, and it's the most overbought it's been since Trump won the election.

Cryptonary's take

BTC has broken out to new all-time highs, and it's possible that the price can continue moving up in the short term. However, our expectation here is that price consolidates between $105k and $112k for a small period (potentially a week).This would be healthy for the uptrend to continue, as it would allow the overbought indicators some time to reset. We would look to buy Spot BTC between $91,000 and $95,700, but in the meantime, we're not chasing price, and we're remaining patient.

- Next Support: $106,900

- Next Resistance: $112,000

- Direction: Neutral/Bullish

- Upside Target: $120,000

- Downside Target: $105,000

ETH:

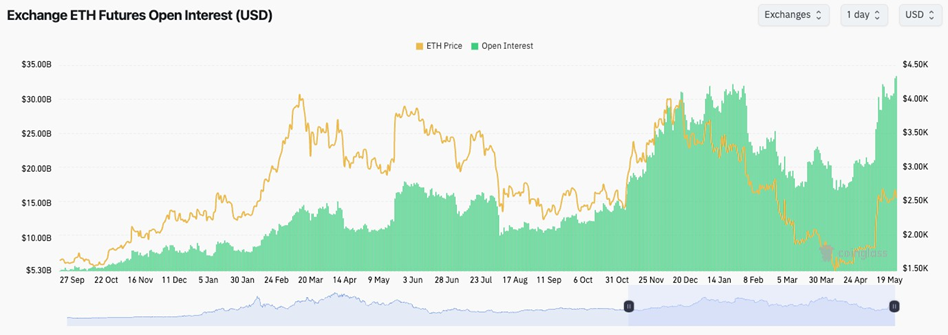

- ETH's Funding Rate is positive but more muted than BTC and SOL's.

- ETH's Open Interest remains at very elevated levels, meaning that there is a large leverage buildup, although from Funding, we can tell that the positioning is relatively even.

Technical analysis

- ETH's price has fluctuated between the local horizontal resistance at $2,720 and the major horizontal support at $2,420.

- If price loses the $2,420 level, then the next major support is at $2,160.

- To the upside, if $2,720 can be overcome, then $3,050 is the next major horizontal resistance.

- The RSI was in overbought territory, although it has now pulled back slightly. However, the moving average is in overbought territory, and it is now beginning to roll over.

Cryptonary's take

ETH has had a big and quick move up; however, momentum now looks as if it's stalling with the RSI rolling over and price being unable to break out above $2,720. If price loses $2,420, then we'd expect a revisit of $2,160.If price revisits $2,160, we'll assess at the time if we add to ETH at those levels. It'll likely depend on how deep of a pullback BTC goes through in this same scenario.

For now, though, we're remaining patient, and we're not looking to accumulate any ETH here as we're expecting price to pull back here over the coming 1–2 weeks.

-

- Next Support: $2,520

- Next Resistance: $2,720

- Direction: Neutral/Bearish

- Upside Target: $2,720

- Downside Target:

SOL:

- SOL's Open Interest has increased to new local highs as the Funding Rate returns to more positive territory.

- This suggests that most of the leverage built up is now Longs.

Technical analysis

- SOL has since consolidated between $162 and $180, following the breakout from its bull flag.

- Price is currently supported by the main uptrend line and the horizontal support at

- $162.

- To the upside, the resistances are at $184 and $203 ($200 psychological level).

- A breakout above $184 (that stabilises and closes above $184) would likely see the price retest $200. This would be a clean 10% move higher.

- The RSI has pulled back from overbought territory, although it is below its moving average, which is currently acting as a resistance.

- If price closes a new local high (higher than the May 14th high), the RSI will form a bearish divergence (higher high in price and a lower high on the oscillator). For now, this isn't a concern, although we're closely watching it.

Cryptonary's take

It looks doable for SOL to break out to $200 in the short term, however, we would expect that to be a key testing area where we would then expect price to pull back from. But, if price loses its uptrend line, we expect price to decline to $148, although this area would likely see dip buyers step in. We would also look to take advantage of a pullback like that and buy SOL at $148 should it pull back to there. We expect it can, it just might take more time with further upside beforehand (in the short term).

- Next Support: $162

- Next Resistance: $184

- Direction: Bullish

- Upside Target: $200

- Downside Target: $148

HYPE:

- HYPE's Funding Rate went hugely positive (annualised out at 210% per year), meaning Longs have now become over-levered, and this is now a frothy environment, which is becoming vulnerable to flush outs.

- HYPE has been in a clean uptrend without any major pullbacks.

- Price continued grinding up until it found resistance at the major level of $28.00, rejecting twice. However, on a clean break out, the price has now shot higher.

- Price is now into price discovery, but the indicators (the RSI) are extremely overbought on the Daily timeframe. This suggests caution currently.

- The RSI's moving average is also in overbought territory, which suggests that a pullback or a period of consolidation is likely in the short term.

- If price does see a substantial pullback, the area we'd look to for a meaningful reaction would be the horizontal support at $27.30.

Cryptonary's take

HYPE has had a huge move higher, up 4x off the bottom. At this price, HYPE looks overvalued in the short term, alongside it being very overbought on the indicators. We would now wait for a sizeable pullback in order to consider potential entry zones.We're not chasing HYPE in the short term, and from a technical viewpoint, it looks very over-extended to the upside. So, for that reason, we chose to remain patient, and we'll look to get entries in the future on a larger pullback.

- Next Support: $27.30

- Next Resistance: $37

- Direction: Neutral/Bearish

- Upside Target: $37

- Downside Target: $27.20