Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest (by the number of coins) has increased again as the price has hit a new all-time high. However, OI still remains slightly below the highs prior to the leverage flush out.

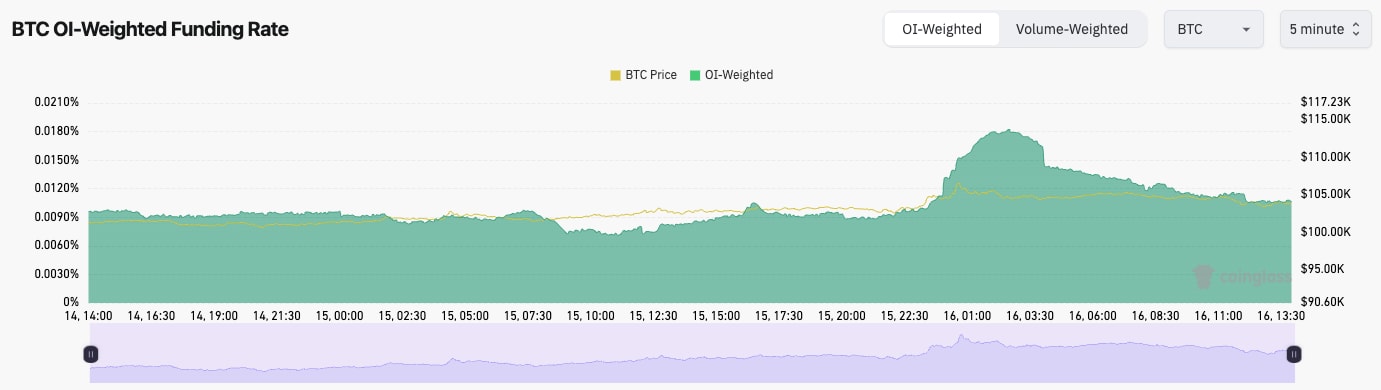

- The Funding Rate has also remained positive but flat at just 0.01%.

- Overall, this is a positive setup from the mechanic's viewpoint, with BTC moving into all-time highs.

Technical analysis

- TA-wise, the BTC chart is quite awkward-looking here, with not many clear levels.

- BTC popped higher last night into a new price all-time high, but it has pulled back slightly today.

- Over the last two weeks, BTC has hammered out the $99,000 level as a new horizontal level, so we are now looking at that as a new horizontal support.

- The major zone of support is between $87,100 and $91,500; however, we're not confident that BTC will revisit those levels again. If it did revisit, we'd be buyers in that area.

- To the upside, yesterday's all-time high of $106,500 is the new horizontal resistance, and then you're looking at psychological levels, e.g., $100k, $120k, etc.

- The RSI is no longer overbought, but we have formed a bearish divergence again (a higher high in price and a lower high on the oscillator).

- Next Support: $98,950

- Next Resistance: $106,500

- Direction: Bullish/Neutral

- Upside Target: $115k (by Christmas)

- Downside Target: $95,700

Cryptonary's take

Overall, BTC does feel really strong with any meaningful dip being swiftly and aggressively bought up, and that's price action you have to pay attention to. Since breaking above $100k, BTC has had a number of pullbacks, and this has now formed a number of strong support areas, which we see as important for BTC to end up pushing up even further.In the immediate term, we're unsure of BTC's direction. We appreciate that BTC has been very strong, and we expect it to continue in this way. However, this week's price action might be determined by the FED Press Conference on Wednesday, although we are expecting a dovish Powell, who we think could reassure the markets on a further rate-cutting path in 2025.