Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

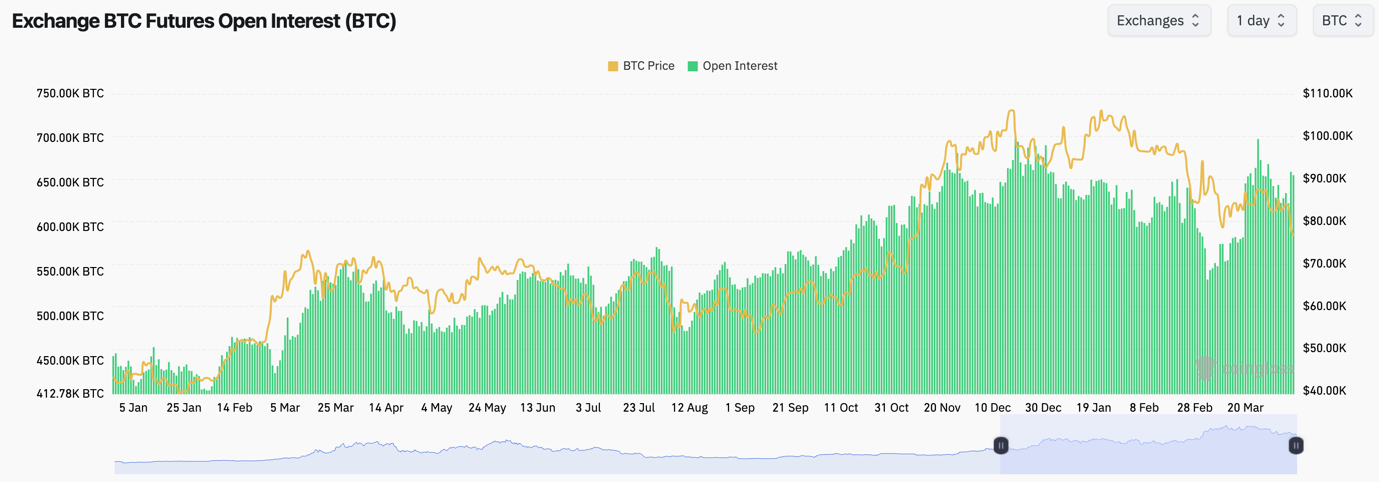

- BTC's Open Interest has spiked up slightly, but that's likely due to the price of the coins falling.

- Funding Rates are positive, but they're subdued.

- There is far less appetite than in previous months for traders to be heavily leveraged in trades.

Technical analysis

- BTC moved into our Short box, and it has rejected down to our target zone of $76k to $78k. Perfect move.

- The key battle for price came at the $81,500 to $82,000 level. When the price lost that level, it moved straight into the $78k level as we expected it might do.

- The new supports we're looking at are between $68,900 and $71,500, so again, another zone, rather than a specific price point.

- To the upside, the new horizontal resistance is now at $81,500 (the old horizontal support).

- In terms of resistance, we also have the main downtrend line. But, once price bottoms, we should see a grind sideways, and price will move into that main downtrend line, and that'll be what then potentially sets us up for a breakout.

- The RSI is once again close to approaching oversold territory.

- Next Support: $71,500

- Next Resistance: $81,500

- Direction: Neutral/Bearish

- Upside Target: $81,500

- Downside Target: $71,500

With the S&P and the Nasdaq down substantially, it's possible that a bottom for BTC isn't too far away. Now that doesn't mean we're looking for Longs here, but we would be very wary of Shorting BTC here, even if there is room for another 10% downside move. But, with the huge overextension to the downside in the S&P and the Nasdaq, a potential relief rally could be quite aggressive if it comes.

For now, we're patient and remaining on the sidelines. But, we're seeing many on the timeline getting really bear'd up here, and to us, that seems a bit too late to be doing that. The time for getting ultra bearish was months ago.

Whilst we think there's more downside to be had in the medium term, we're wary of a potential market bounce (just from very oversold levels). Therefore, we're not looking to Short BTC here, and we're starting to eye levels to buy.

For us, that's between $69,000 and $71,500 (assuming we get there). If we do, we'll begin to add lightly. This may come sooner than we expected, and that's due to Trump's aggressiveness.

What’s Next?

You’ve seen the analysis for BTC. The next trades — ETH, SOL, HYPE, and SPX6900 — are lining up now, with targets ranging from -20% to -45%. We’ve pinpointed the exact short zones, liquidation levels, and our strategy for execution.