Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Testing new range, $108k must be reclaimed or risk downside structure break.

- ETH: Clinging to lower support, needs $4,250 for bullish setup. Watching RSI divergence and orderblock levels.

- SOL: Holding major support, $213 resistance is key; breakdown brings $155-$120 into play.

- HYPE: Breaking down, $38 is the make-or-break level for bounce or further drop to $28.

- AURA: Remains bullish, $0.10 to reclaim, danger below $0.05; eyeing $0.15+ if trend holds.

BTC:

- Price Range: $101,000 – $108,000

- Bias: Neutral

- Resistance and Key Level to Reclaim: $108,000

- Support Zone: $101,000 – $102,000

- Breakdown Trigger: $98,000 – $100,000

The V-reverse scenario (a sharp price recovery that mirrors the drop) seems to be off the table with a break of $108k support. We need to see $108k reclaimed to stay bullish, and it looks like we’ll need to see some re-accumulation in the $101k - 108k range. A retest of Friday’s wick at $102k is definitely on the table. If it fails to break out or fails to make a swing high, that would be a bit of a bummer, but we’ll keep our eyes peeled and stay positive!

Technical analysis

- BTC is fighting to reclaim the $108k resistance after losing it as support yesterday.

- If $108k isn’t regained soon, expect a retest of $101k-$102k, with downside risk to $98k.

- Range gets riskier down here; watch for bullish reversal or further structural pain.

- Bounce off support or clear rejection will determine short-term direction and trigger moves in majors.

Cryptonary's take

BTC's price action is drifting into a dangerous area, with critical supports continuously tested. Until $108k gets reclaimed with confidence, caution dominates and bounces may remain weak. A decisive close below $101k opens the door for harsh liquidations.- Next Support: $101,000

- Next Resistance: $108,000

- Direction: Neutral

- Upside Target: $119,000

- Downside Target: $98,000

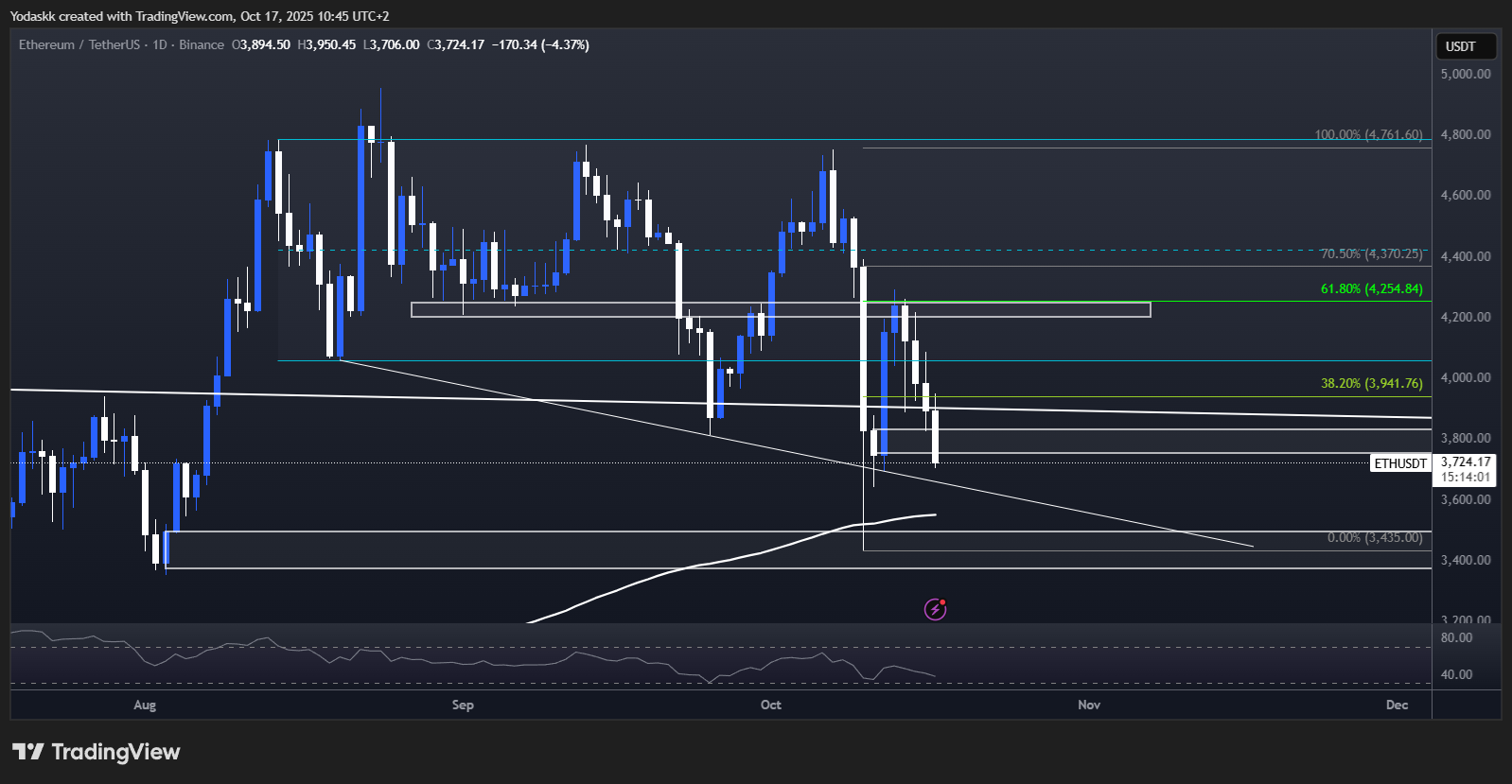

ETH:

- Price Range: $3,750 – $4,250

- Bias: Neutral

- Resistance: $4,250

- Support Zone: $3,750 – $3,850

- Breakdown Trigger: $3,700

For now, ETH might retest our lower support again, depending on how BTC moves. The $3,400 - $3,500 area is important because there’s a daily orderblock, the 200D EMA (long term critical moving average), and the low of Friday’s wick that could trigger a reaction.

Technical analysis

- ETH must reclaim $4,250 for any meaningful bullish reversal – otherwise, it’s at risk of testing deeper lows.

- Watch daily RSI for divergence signals as a possible bounce trigger.

- Breakdown below $3,700 increases risk of larger wave down to $3,400-$3,500 region with lots of liquidity trapped below.

Cryptonary's take

ETH closely follows BTC’s lead. Unless BTC bounces, ETH may breach its critical support and drop to $3,400-$3,500. Any bullish divergence on the RSI needs fast confirmation.- Next Support: $3,750

- Next Resistance: $4,250

- Direction: Neutral

- Upside Target: $4,800

- Downside Target: $3,400

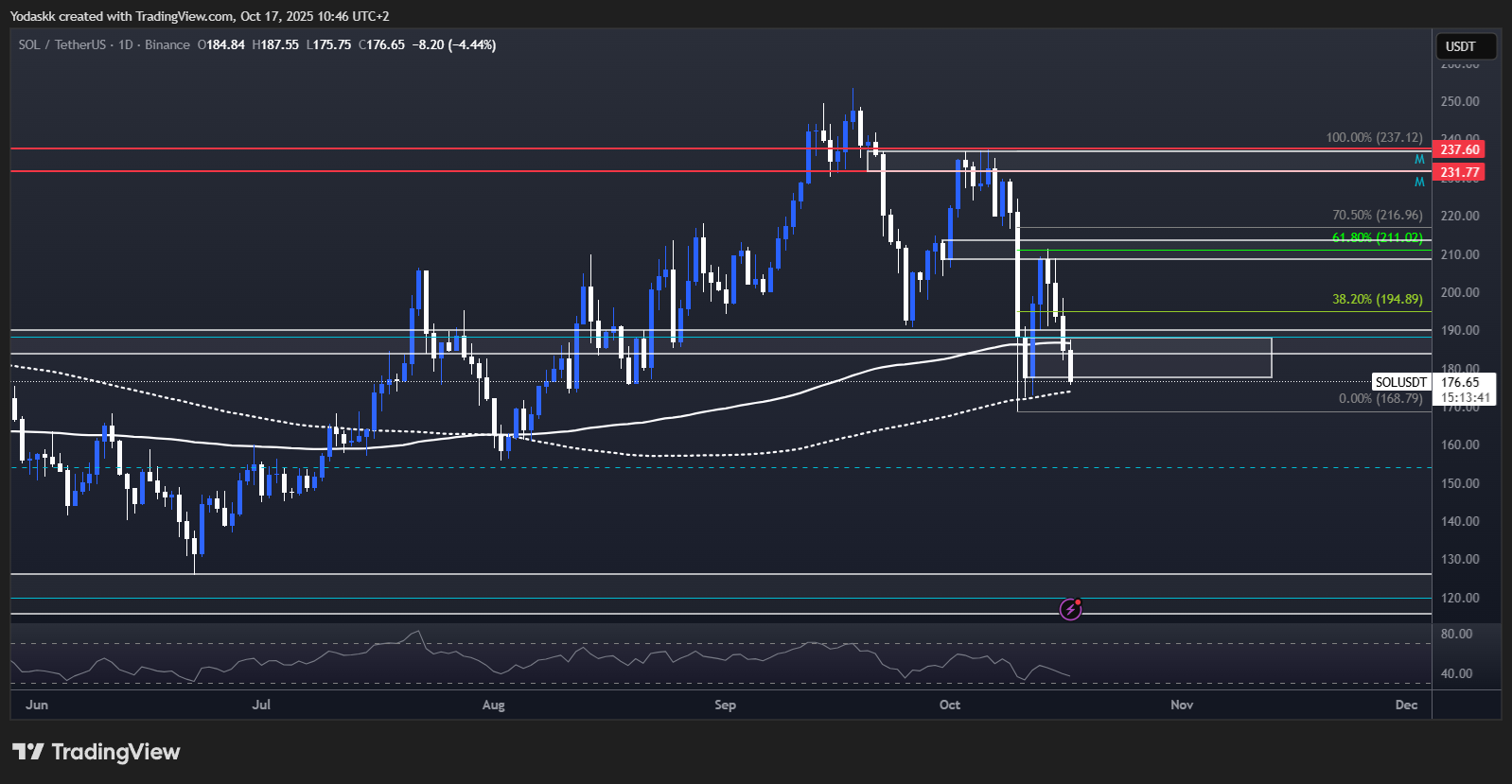

SOL:

- Price Range: $178 – $210

- Bias: Neutral

- Resistance and Key Level to Reclaim: $213

- Support Zone: $178 – $190

- Breakdown Trigger: Break below $175

Technical analysis

- SOL fighting at key 200D SMA support around $178 – bounce or breakdown imminent.

- Below $175 signals risk toward $155 or even $120 with increased volatility.

- Bullish break above $213 reopens $237-$253 upside with resistance stair-step.

Cryptonary's take

SOL is hanging by a thread. Lose $175, and momentum shifts sharply bearish, with lower targets opening. Bulls need strong buyer response to avoid further decline.- Next Support: $178

- Next Resistance: $213

- Direction: Neutral

- Upside Target: $237

- Downside Target: $120

HYPE:

- Price Range: $28 – $44

- Bias: Neutral

- Resistance and Key Level to Reclaim: $38

- Support Zone: $28

- Breakdown Trigger: Break below $36

Technical analysis

- Currently breaking down from critical support at $37-$38.

- Loss of $36 sends HYPE toward $32 and then strong support at $28.

- Bullish scenario if quick reclaim above $38; next target $44.

Cryptonary's take

HYPE downside momentum growing. Bulls need quick reclaim of $38 to avert further selling. Below $36, risk bounces toward $32 and $28. Waiting for clearer signals before adding.- Next Support: $28

- Next Resistance: $38

- Direction: Neutral

- Upside Target: $44

- Downside Target: $28

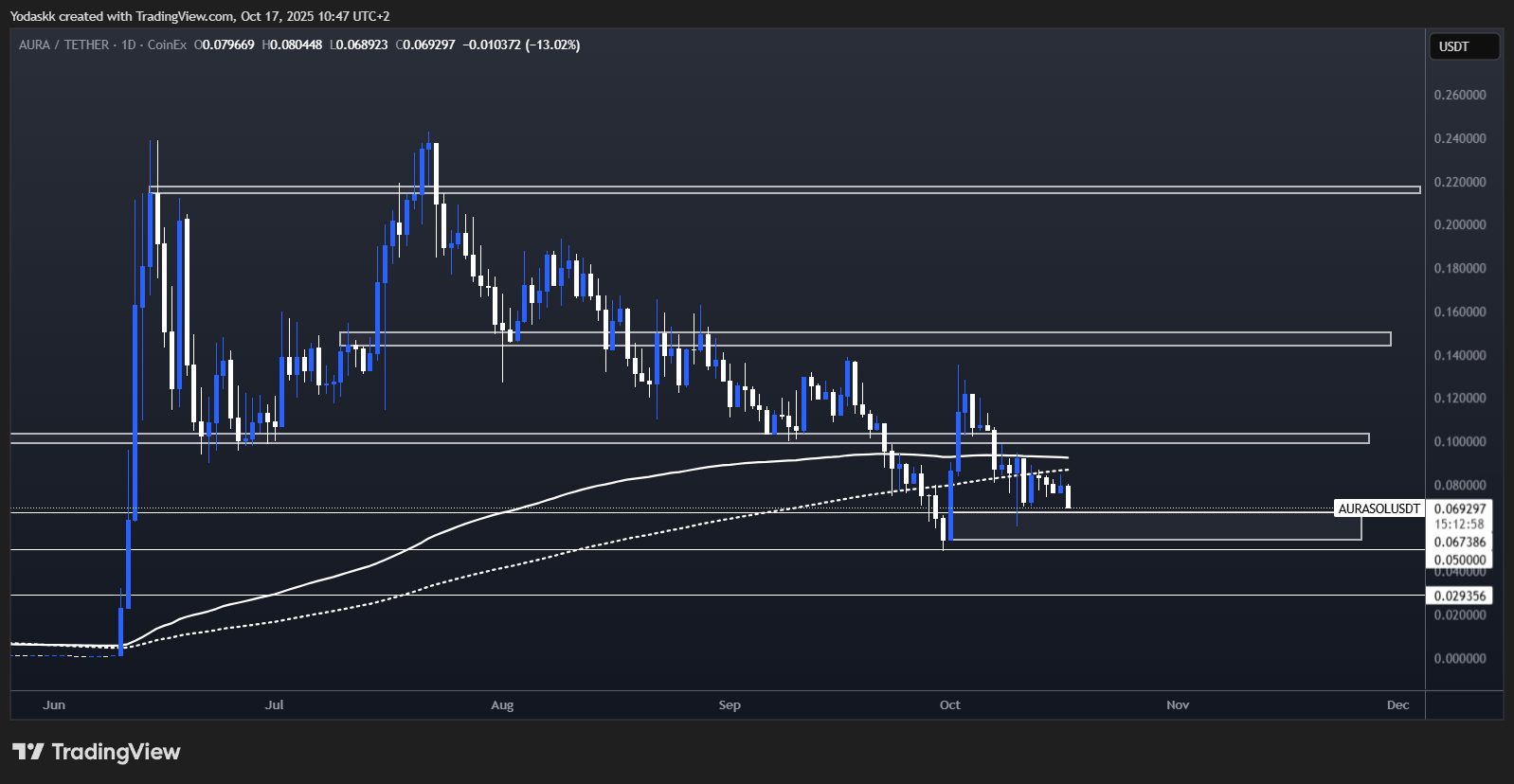

AURA:

- Price Range: $0.065 – $0.1

- Bias: Bullish

- Resistance and Key Level to Reclaim: $0.1

- Support Zone: $0.065

- Breakdown Trigger: Break below $0.05

AURA is currently hovering around $0.072, bouncing between the $0.10 resistance and the $0.065 support that was tested again today. If we manage to reclaim the 200-Day EMA+SMA (a crucial long-term trend indicator), we could see a jump to $0.15 and even hit an all-time high faster than you might think.

But here’s the catch: if AURA dips below $0.05, it’ll attract the attention of investors who are looking for a dip-buying opportunity. We don’t think that’s going to happen, so we’re sticking to our steady DCA strategy from now on.

Technical analysis

- Hovering above $0.065 with volatility, $0.10 as key resistance for a renewed breakout.

- Closes above long-term moving averages (EMA/SMA) could fire up next rally to $0.15 – $0.18.

- Breakdown below $0.05 likely attracts buyers, but macro thesis weakens.

Cryptonary's take

AURA stands out as one of few strong assets in this market. Critical to watch for daily close above $0.10 for confirmation of continued bullish trend.- Next Support: $0.065

- Next Resistance: $0.10

- Direction: Bullish

- Upside Target: $0.15

- Downside Target: $0.05