BTC, ETH and More: Breakouts, Consolidation, and Key Levels in Focus

From BTC reclaiming key support to ETH resetting divergences, and SOL breaking $250, the market is entering a decisive phase. Here's our breakdown of the technicals, trends, and upside targets ahead...

Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Holding above $117k is key — a breakout toward $120k–$123k possible, while a breakdown risks $112k. Trend remains neutral/bullish.

- ETH: Consolidating between $4,500–$4,770; upside targets $5,000–$5,500 if breakout holds. Trend is bullish.

- SOL: Recently surged from $180 to $250; likely short-term consolidation between $232–$260 before targeting $300. Trend neutral.

- HYPE: Trading in $52–$57 range; potential for breakout above $59 toward $65–$70 after consolidation. Trend neutral/bullish.

- AURA: Double bottom breakout above $0.116 sets up targets at $0.145 and $0.177–$0.186. Trend is firmly bullish.

BTC:

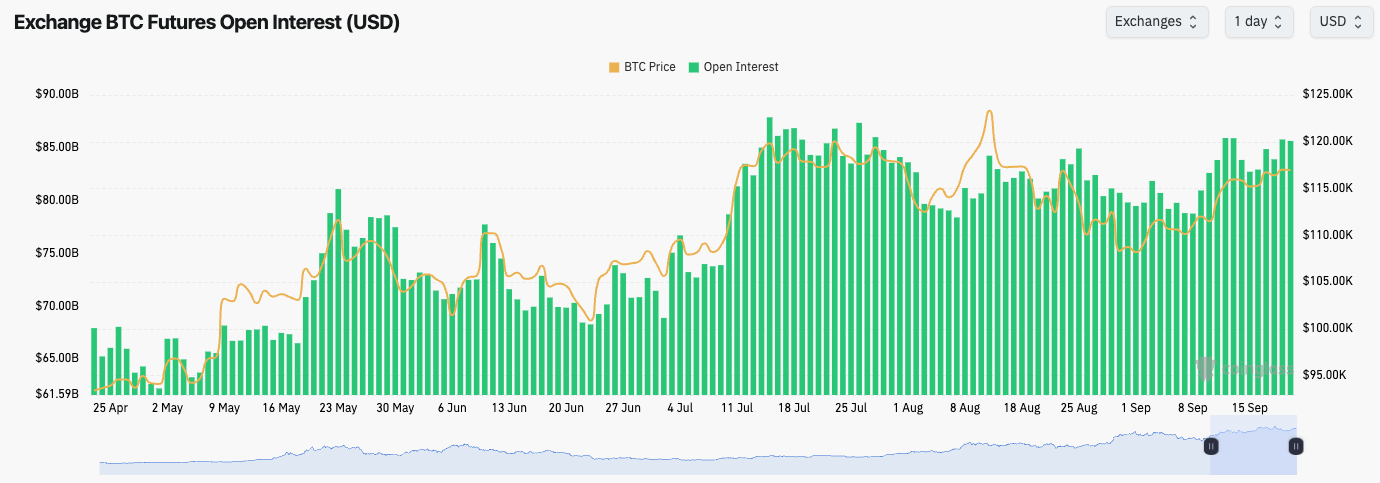

- Bitcoin's Open Interest remains elevated but it hasn't pushed up to new highs whilst the Funding Rate is contained.

- This suggests that there's a relatively large leverage build up, but that positioning is balanced, so we're unlikely to see a meaningful flush in the immediate term.

Technical analysis

- After spending several days consolidating below the $117k horizontal resistance, BTC has managed to reclaim above that level, with price now attempting to use it as new support level.

- Price remains in an uptrend channel, having used the bottom border of the channel as support on several occasions since the move up from $108k.

- The key horizontal level is now $117k. If price settles below that, price is likely to retest $112k. Should price settle above $117k, the next move is likely a move up to $120k.

- A breakout of $120k sets up a move to $123k (the all-time high).

- The RSI is in middle territory and above its moving average. This suggests that more upside can be had for price. If the RSI was overbought, with price pushing into the resistance of $117k, that would concern us. But fortunately, we have a positive setup as far as the RSI is concerned.

Cryptonary's take

BTC is in a clean local uptrend with price now battling to reclaim a key horizontal resistance at $117k. The next few days' price action will be key in determining the next move. An acceptance above $117k opens the doors for a move to $120k, and possibly even $123k. But a breakdown below $117k, especially if $115k is lost, means the odds of a move back to $112k are more likely.We remain positioned in BTC holding our Spot bags from lower entries, and our recent entries between $108k-$112k - the Yellow Buy Box we gave filled perfectly.

We expect BTC to grind higher into month-end, although price may consolidate at $117k over the coming days, which may give alts and memes the opportunity to outperform.

- Next Support: $115,000

- Next Resistance: $117,000

- Direction: Neutral/Bullish

- Upside Target: $120,000

- Downside Target: $112,000

ETH:

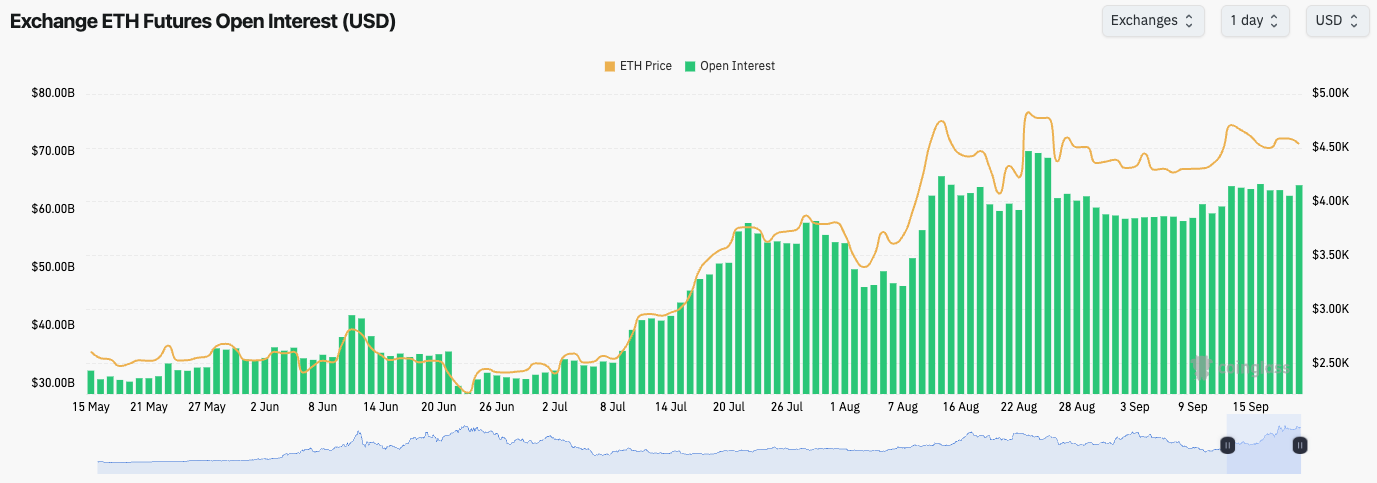

- ETH's Open Interest remains elevated although it has pulled back from the late August highs.

- The Funding Rate is positive but close to neutral (0.00%), suggesting that positioning (between Longs and Shorts) is relatively balanced.

Technical analysis

- ETH broke out of its downtrend line, and swiftly broke out above the $4,500 horizontal resistance.

- Price rejected into the major horizontal resistance of $4,770, and price has since retested the $4,500 support.

- Price has remained range-bound between $4,500 and $4,770. In the immediate-term, these are the key levels ($4,500-$4,770).

- Should ETH breakout of $4,770, then $5,000 and $5,500 become the next achievable upside targets.

- A break below $4,500, and ETH can retest the $4,300 local low.

- The RSI is in middle territory, having had time to reset the back-to-back bearish divergences with it now sat on top of its moving average.

Cryptonary's take

ETH is starting to look positive again here for a meaningful breakout of $5,000. Previously, we had a large move up to $4,770 from $2,400 in just a few months. This put in back-to-back bearish divergences which saw price pullback and be range-bound for the last month. That has now reset, and ETH is consolidating above $4,500. It's possible that capital rotates back to ETH from recent runners (HYPE and SOL) and that’s what see's ETH breakout above $5,000.We remain positioned in ETH, and should we see a breakout of $4,770 in the near-term, and we're expecting that we will, then ETH can make a breakout to $5,500.

An invalidation of this thesis would be if ETH lost $4,300. A loss of $4,500 is ok, if it is relatively quickly reclaimed.

- Next Support: $4,500

- Next Resistance: $4,770

- Direction: Bullish

- Upside Target: $5,000

- Downside Target: $4,300

SOL:

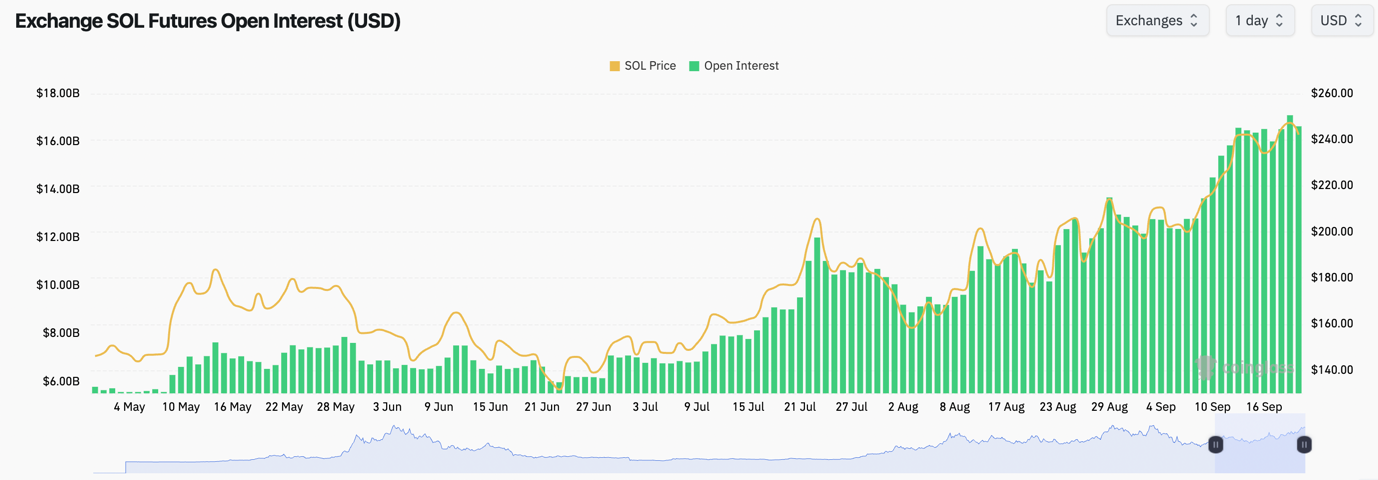

- SOL's Open Interest has remained high, whilst the Funding Rate has been positive, although the reason for SOL's recent price increase, has been due to a significant Spot bid, rather than a leverage run up. This is a healthy move higher for SOL.

Technical analysis

- SOL was able to gain enough momentum to push for a sustained breakout of $220, once it had consolidated at $200 for several weeks.

- Price then swiftly broke out of $220, and reached the horizontal psychological level of $250, where it has initially found resistance.

- The RSI is close to overbought territory, with the recent local price peak creating a bearish divergence (higher high in price, lower high on the oscillator). This makes us cautious in the immediate term for SOL, and therefore we might be due for a period of consolidation.

- To the upside, the horizontal resistances are at $250, and $260. Beyond that, $300.

- The supports to the downside are $232, and $220.

Cryptonary's take

SOL has outperformed over the last month with its price being $180 just 4 weeks ago. It's now possible that we see a period of consolidation for SOL between $232 and $260, similarly to how ETH has consolidated in the last month between $4,300 and $4,770.We would like to now see SOL consolidate and reset its indicators (RSI) in the short-term, before pushing for a breakout above $260 in the medium term. We therefore remain positioned, and we'd add to SOL Spot bags should we see a retest of $230-$232, although we'd look to cautiously add with small size.

Other than that, we continue to hold our Spot SOL positions into year-end as we expect SOL to be north of $300 by then.

- Next Support: $232

- Next Resistance: $250

- Direction: Neutral

- Upside Target: $260

- Downside Target: $220

HYPE:

- HYPE broke out of the key horizontal resistance of $49.00, and price has since pushed into the high $50s.

- Should price pull back, the $49.00-$52.00 is the major support zone for price.

- Price has formed a higher high, but the oscillator has formed a lower high, although just short of overbought territory. This is still a bearish divergence, and this may result in price consolidating between $52.00 and $57.00.

- Should price consolidate and reset the bearish divergence in the RSI, that would then set up a move for a breakout above $59.00, targeting $70.00, although this may take some time.

- Despite the bearish divergence, the RSI has pulled back close to middle territory already, so this may be a sign that a consolidation period might just take a few days.

- Should price pull back to $52.00, we would see this as an area to buy and to add to our long-term Spot HYPE bags.

Cryptonary's take

HYPE has continued to show outperformance, along with SOL as ETH has had a period of consolidation. It's now possible that we see SOL and HYPE consolidate further as ETH has the potential to outperform in the near-term. But we're not expecting a lengthy consolidation period for HYPE.We continue to hold our Spot HYPE bags, and we would look to add at $52.00 should it be retested. However, we would look to add HYPE with just small size at $52.00, should we be given it.

- Next Support: $52.00

- Next Resistance: $59.00

- Direction: Neutral/Bullish

- Upside Target: $65.00

- Downside Target: $49.00

AURA:

- AURA has formed a double bottom pattern at the $0.098 level, with price now pushing higher.

- AURA has broken out of its downtrend line and it has reclaimed its key horizontal level of $0.116.

- A consolidation above $0.116, sets up for a move higher to the next horizontal resistance at $0.145.

- Above $0.145, the major horizontal resistance zone is between $0.177-$0.186.

- The key support zone to the downside is $0.098-$0.116. However, should that level be broken to the downside, we would expect large buyers to step in, as has been the case when price has briefly wicked below $0.098.

- The RSI is in middle to low territory with it now resting on top of its moving average. This is supportive for more upside in the short-term.

Cryptonary's take

AURA has formed a constructive double bottom pattern with price breaking out of a long-term downtrend line. This chart structure would suggest an upside price retest of $0.145 in the short-term, with a further upside target of $0.177-$0.186 in the medium term.We remain positioned in AURA and we're expecting Blue Chip memes to outperform as capital rotates down the risk curve following Majors breaking out to local highs and likely new all-time highs in the not-too-distant future.

It's our long-term view that AURA has much further upside, and it can re-price in line with other multi-billion Dollar memecoins.

- Next Support: $0.098

- Next Resistance: $0.145

- Direction: Bullish

- Upside Target: $0.177-0.186

- Downside Target: $0.098

Closing Thoughts

We've had a big week this week with the FED delivering on the expected 25bps rate cut and markets rallying off the back of it. Our expectation is for a market to cautiously continue in its grind higher and hence we remain positioned in Majors and select memes.We've sent you guys off this week with a new Market Direction, breaking down the charts and what to expect price action wise over the coming days/week.

I am personally taking this weekend off and closing the laptop lid.

See you all Monday.

Lets Go!!!