Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Holding between $114k–$117k; breakout above $117k targets $120k, downside risk toward $112k.

- ETH: Bullish above $4,500; breakout over $4,770 opens path to $5,000, invalidation below $4,500.

- SOL: Strong momentum; consolidating $222–$260 with potential to retest $295–$300 if $260 breaks.

- HYPE: Breakout above $49 confirmed; momentum healthy with upside toward $60–$80 while holding above $51–$52.

- AURA: Broke long-term downtrend; support at $0.116 critical, upside targets $0.146–$0.186.

BTC:

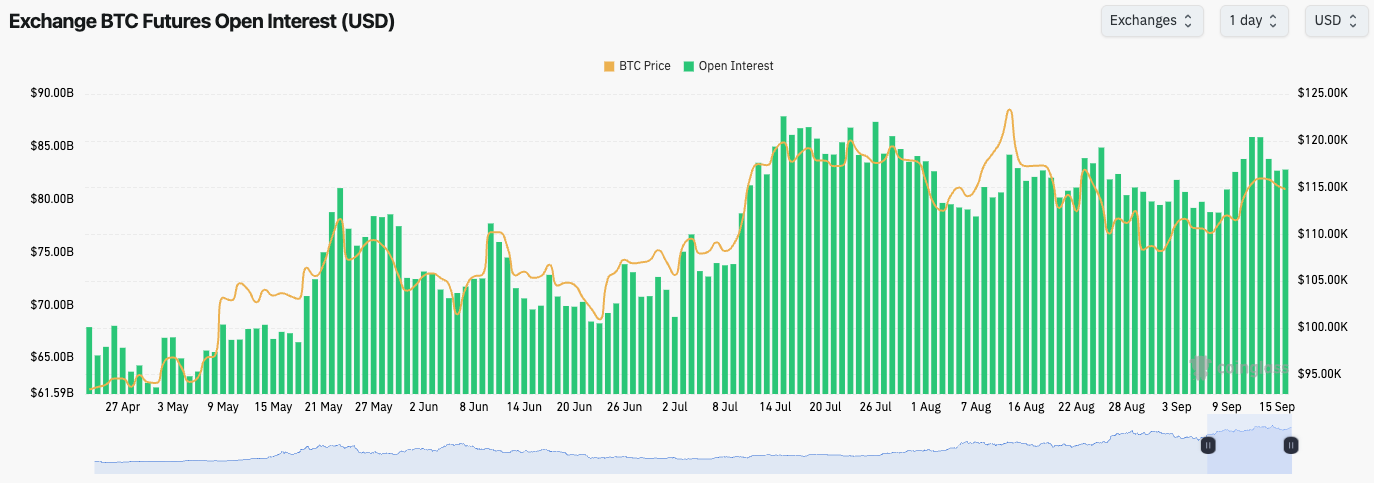

- As BTC moved into $116,600, BTC’s Open Interest has slightly pulled back following the price pull back from that level.

- Funding Rates remain positive but nowhere near frothy levels.

Technical analysis

- BTC broke out of the horizontal resistance of $112,200, and price was able to head to the next resistance of $116,600, where price has initially rejected.

- BTC remains in an uptrend channel, and we’ll therefore be watching the bottom border of the channel as a support for price.

- Should BTC be able to consolidate between $115k-$116k, this can allow a breakout of $117,000 that then targets $120,100.

- However, should BTC break below $114k, then a retest of the major horizontal support of $112,200 is likely.

- To the downside, the key horizontal supports are at $112,200, $110,800, and $108,000.

- The RSI is in middle territory and above its moving average. We’d expect price to be supported at the RSI’s moving average.

Cryptonary's take

BTC has had a clean breakout to the upside, clearing the key horizontal level of $112k, although price now finds resistance at the next key level of $117k. We’re now looking for BTC to show strength by consolidating between $114k and $117k, before building enough momentum that price can breakout of $117k and push on to $120k. However, should we see a break down, it’s possible we see price revisit the $108k-$112k support zone.We’d expect volatility going into the FED Meeting this Wednesday, which might allow BTC time to consolidate in the suggested range ($114k-$117k). A dovish Powell/and FED might then result in price breaking out to the upside.

We continue to hold our BTC Spot positions (including the positions we picked up between $108k-$112k). However, we’ll keenly await the outcome of this Wednesday’s FED Meeting, whilst we also monitor price action for any signs of a break below $114k. Should we get that, we’d reconsider our positioning.

But, our base case is that BTC consolidates between $114k-$117k which allows price to break out to $120k post FED-Meeting.

- Next Support: $114,000

- Next Resistance: $117,000

- Direction: Neutral/Bullish

- Upside Target: $120,100

- Downside Target: $112,000

ETH:

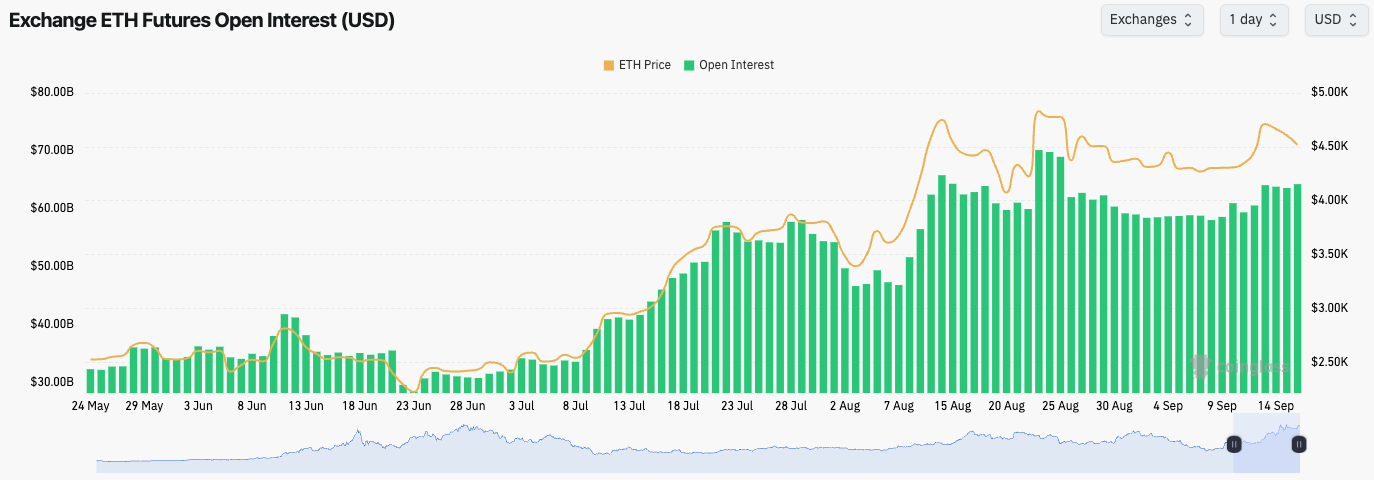

- ETH’s Open Interest remains relatively high but it has stabilised at these levels over the past few days.

- ETH’s Funding Rate is more meaningfully positive, but it isn’t at frothy levels.

- ETH remains somewhat liable to a leverage flush out, although we don’t see this as happening imminently.

Technical analysis

- ETH broke out of its downtrend line having found a strong support at $4,340.

- Price tested $4,770 resistance and was rejected.

- The structure remains bullish while price holds between $4,500-$4,770. A breakout above $4,770 opens the door for a move to $5,000.

- Should price break down from $4,500, then we’d expect price to revisit $4,340.

- The RSI is in middle territory having pulled back and it now testing its moving average as support.

Cryptonary's take

ETH has broken out of its downtrend line with price retesting the key horizontal resistance at $4,770. Despite price rejecting into $4,770, the chart structure remains bullish should price remain range-bound between $4,500 and $4,770. Should we get this going into Wednesday, and then if we get a dovish Powell/FED, this could provide the momentum needed for ETH to breakout of $4,770 and then target $5,000. An invalidation of the above would be if ETH broke below $4,500.We remain holding Spot ETH positions, although we had rotated recently from ETH, and more into HYPE and SOL. However, the Spot ETH we currently hold, we’re holding for the long-term, so we’re not planning to sell that down anytime soon.

- Next Support: $4,500

- Next Resistance: $4,770

- Direction: Neutral

- Upside Target: $5,000

- Downside Target: $4,340

SOL:

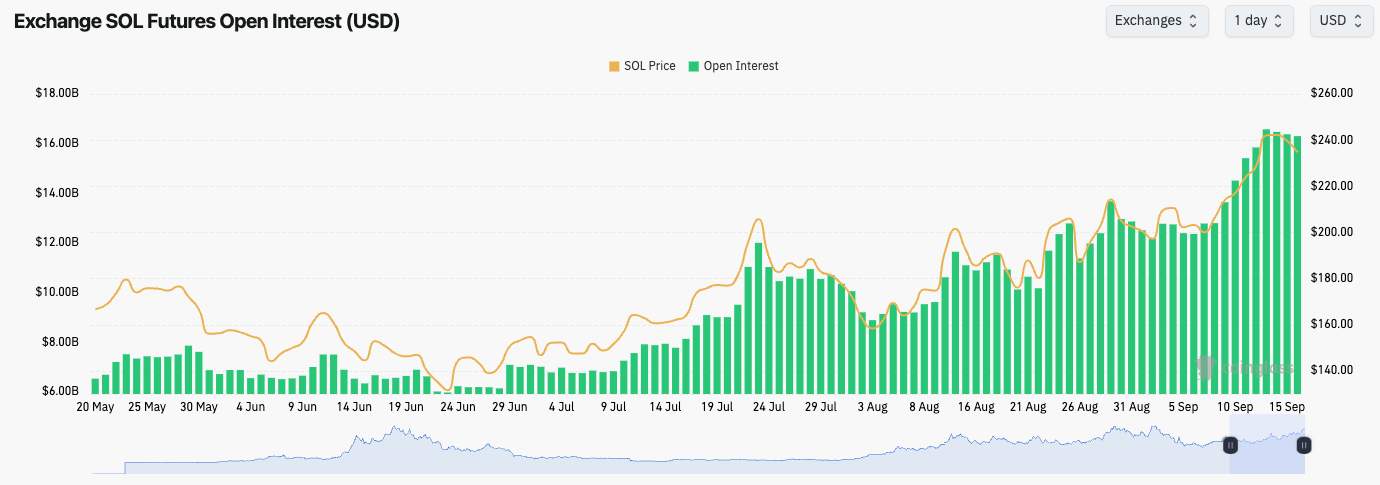

- SOL’s Open Interest has increased over the last week, however SOL’s price increase was supported by a strong Spot bid as well.

- SOL’s Funding Rate has remained contained, which is healthy to see.

Technical analysis

- SOL spent weeks coiling up in a bullish accumulation formation just under the $209 level, with equal highs but consistently higher lows since early August.

- Price recently broke out with good momentum, first reclaiming $209, then pushing through the $222 resistance to establish a new higher range.

- SOL is now consolidating between $222 and $260, with $222 acting as strong support and the yellow uptrend line providing dynamic backing on pullbacks.

- A breakout above $260 would open the door toward retesting the $295-$300 levels, which align with early 2025 all-time highs.

- The RSI briefly hit 71 in overbought territory but has cooled to 66, with an average around 61. Momentum remains strong without being overheated, leaving room for further upside for now.

Cryptonary's take

SOL has delivered a clean breakout structure after weeks of compression, reclaiming key levels and shifting firmly into a bullish range. Push through $222 confirmed that buyers are back in control. With the $222-$260 band now defining the near-term range, SOL looks well-positioned to extend higher as long as support holds.The RSI reset during consolidation has kept the move healthy, easing concerns of exhaustion. With price holding above $222, the focus remains on a potential breakout toward $260. A decisive close above that level would open the path toward the $295-$300 zone, although that target is likely to take more time to play out.

Our base case is continued strength into year-end, with pullbacks toward $222 and $209 offering opportunities for accumulation. An invalidation would only come if SOL breaks below $209 and loses its uptrend line, which currently looks unlikely given the price action.

- Next Support: $222

- Next Resistance: $260

- Direction: Bullish

- Upside Target: $260

- Downside Target: $209

HYPE:

Technical analysis

- HYPE has been consolidating since mid-July in a VCP-like triangular structure, with equal highs forming near $49 and higher lows supported by an uptrend line.

- This accumulation phase led to a breakout above $49 in recent days, pushing price into new price discovery.

- Price has since reached a new all-time high around $57.4, with the structure still holding firmly above breakout levels.

- Support levels to watch include $51-$52 (with $50 as a major psychological level) and $49 as a major base. The trendline also provides dynamic support on pullbacks.

- The RSI is currently at 62, with an average near 60, suggesting healthy momentum with plenty of room for price to extend higher.

- Upside targets remain $60 in the short term, with $70-$80 as realistic objectives into year-end.

Cryptonary's take

HYPE has transitioned cleanly from consolidation to breakout, with the $49 level serving as the decisive line that unlocked further upside. This breakout confirmed the months-long accumulation pattern and has quickly propelled price into new highs. Holding above $51-$52 keeps the structure intact, with momentum clearly in favour of buyers.The RSI setup remains constructive, showing little to no signs of overheating despite the rally. This indicates that HYPE still has the capacity to climb higher in the near term, with $60 acting as the first milestone. Above that, the structure favours medium-term continuation toward $70-$80 as capital continues to rotate into strong performers.

In the near term, pullbacks toward $52 or even $49 would be natural retests of support rather than signs of weakness. Losing those levels would invalidate the immediate bullish setup, but as long as price holds above the breakout zone, HYPE is positioned for continuation.

- Next Support: $51-$52

- Next Resistance: $60

- Direction: Bullish

- Upside Target: $60-$70

- Downside Target: $49

AURA:

Technical analysis

- AURA broke out above its long-standing downtrend line and is now working to establish a base around the $0.116 level.

- Immediate support sits at $0.116, with stronger support lower down at $0.0981, which has proven very strong in the past.

- On the upside, resistance levels to watch are $0.146 and $0.186, which align with the next key horizontal targets.

- The RSI is trading around 44 with an average near 42, showing momentum has moved off muted levels and is recovering into neutral territory.

- Structurally, the breakout from compression is encouraging, and holding above $0.116 would confirm a constructive new base.

Cryptonary's take

AURA has shown bullish signs by finally breaking out from its broader downtrend. The ability to reclaim and hold the $0.116 level as support is critical for confirming this shift. Price action here suggests the start of a healthier structure, with the potential for accumulation at discounted levels before a push higher.Momentum, as seen through RSI, has been muted but is now beginning to climb out of suppressed conditions. This leaves space for the market to build momentum without immediate risk of exhaustion. For now, the setup remains constructive, provided $0.116 continues to act as a floor.

Upside objectives remain $0.146 and $0.186, which would represent key milestones in re-establishing a stronger uptrend. While a retest of the broken trendline is possible, our base case is bullish: as long as support holds, AURA looks primed to extend higher and reprice itself toward larger resistance zones in the weeks ahead.

- Next Support: $0.116

- Next Resistance: $0.146

- Direction: Neutral/Bullish

- Upside Target: $0.186

- Downside Target: $0.0981

Closing Thoughts

We go into a big week this week with the FED Meeting on Wednesday. We covered it briefly in today's "This Weeks' Setup", but we'll do into it more tomorrow in a Pulse, setting you guys up for Wednesday.In the meantime, we've uploaded a new Market Direction where we have identified key levels for prices, where we'd look to buy, where we need to hold, and what the key levels are for break outs!

Big week ahead - LET'S GO!!!