Market Direction

Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Consolidating in a pennant. Watch $114k resistance and $107k for downside break. Neutral bias, patient until clear break.

- ETH: Follows BTC. $4,250 resistance is the level to flip for bullish momentum. Range trade until a breakout.

- SOL: Double bottom potential. $213 breakout targets $237. Breakdown below $175 puts $155 and $120 in play.

- HYPE: Stronger than majors after Robinhood news. $44 resistance next, upside targets $51 and $59 if breakout holds.

- AURA: Still re-accumulating, neutral to bullish. Above $0.10 triggers $0.15. Breakdown below $0.05 seems unlikely but is key support.

BTC:

- Open Interest and Funding Rates: Consolidation reflected in neutral funding and relatively stable open interest since 10/10. Market hands waiting for a breakout – watch for OI spike on structural break.

Technical analysis

- Price coil continues in pennant after 10/10 crash. $114k is the resistance to recapture for higher targets.

- Break above $114k gives clear run to $119k and $124k. Below $107k, $100k-102k is next key area, with possible SFP reversal attempt.

- $98k-$100k is last line for macro bullish structure – loss here is a significant caution signal for bulls.

Cryptonary's take

BTC is in a holding pattern with a neutral bias as it coils in a pennant. Patience is the move—wait for the break of $114k for bullish confirmation, or eye $107k/$100k on downside break. React decisively to price structure shift.- Next Support: $108,000 – $110,000

- Next Resistance: $114,000

- Direction: Neutral

- Upside Target: $119,000 – $124,000

- Downside Target: $100,000 – $102,000

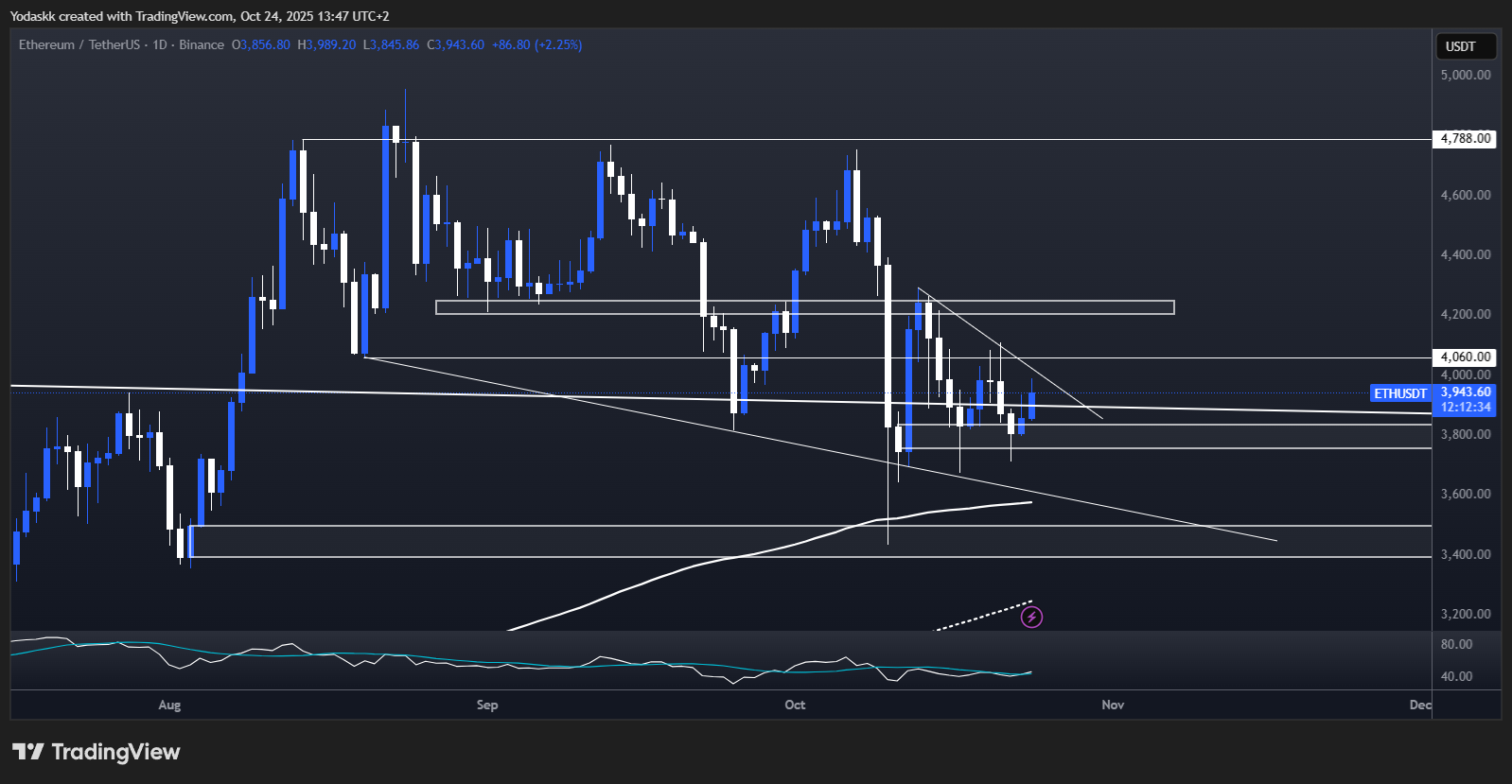

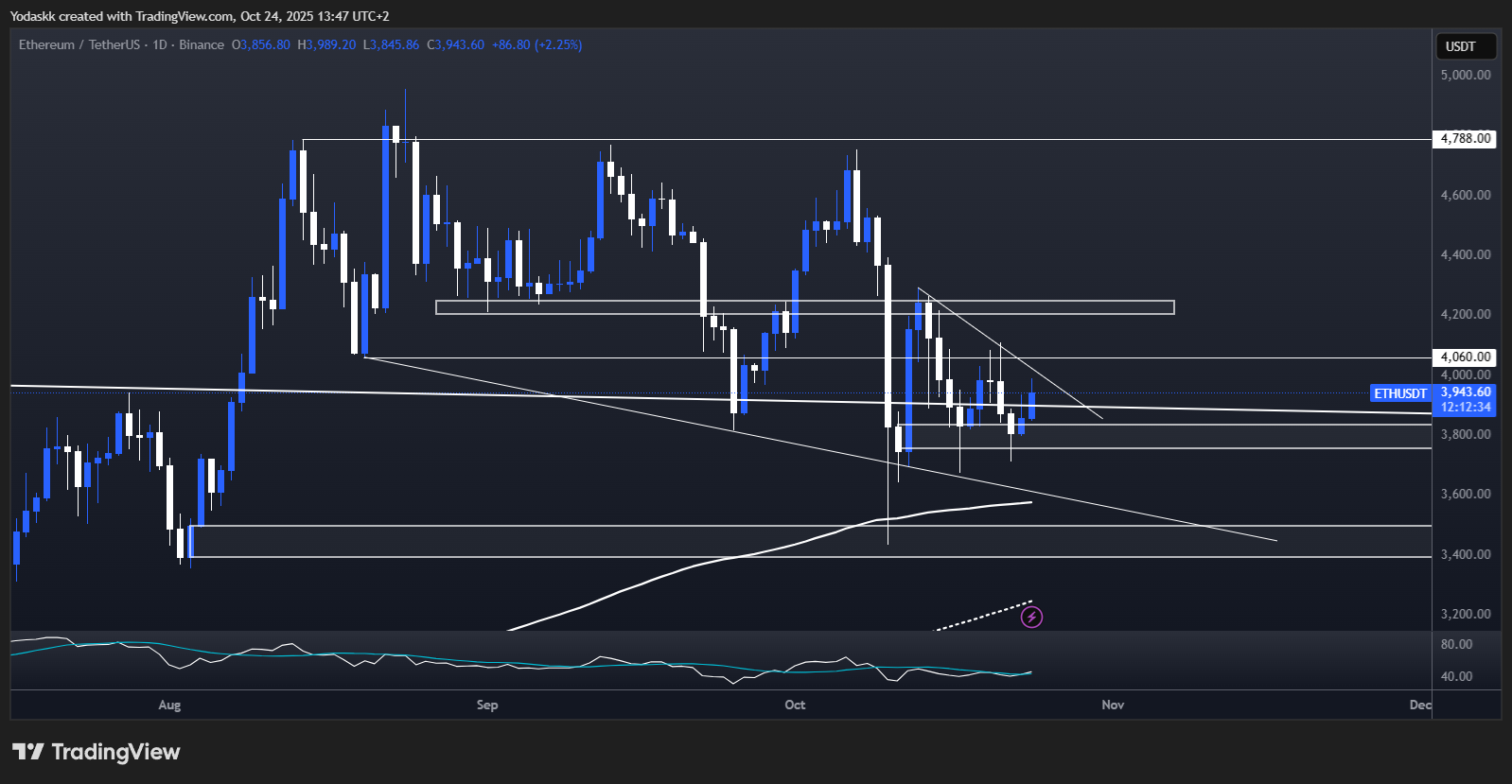

ETH:

- Open Interest and Funding Rates: Market structure mimics BTC, with open interest cooling and neutral funding—ETH will track BTC’s direction tightly this week.

Technical analysis

- Pennant forms after selloff; stuck in $3,700-$4,100 local range. Needs BTC’s lead for next breakout.

- Reclaiming $4,250 is the first bullish trigger; $4,800 comes next. Bear side below $3,700 puts $3,400-$3,500 in focus with crucial supports there.

- Watch for SFP setups at extremes as volatility builds.

Cryptonary's take

ETH remains at the mercy of BTC’s pennant structure. Stay nimble: patience within the range, then reactive to resistance reclaim or major support breaks. Next major move will have momentum.- Next Support: $3,750 – $3,800

- Next Resistance: $4,250

- Direction: Neutral

- Upside Target: $4,800

- Downside Target: $3,400 – $3,500

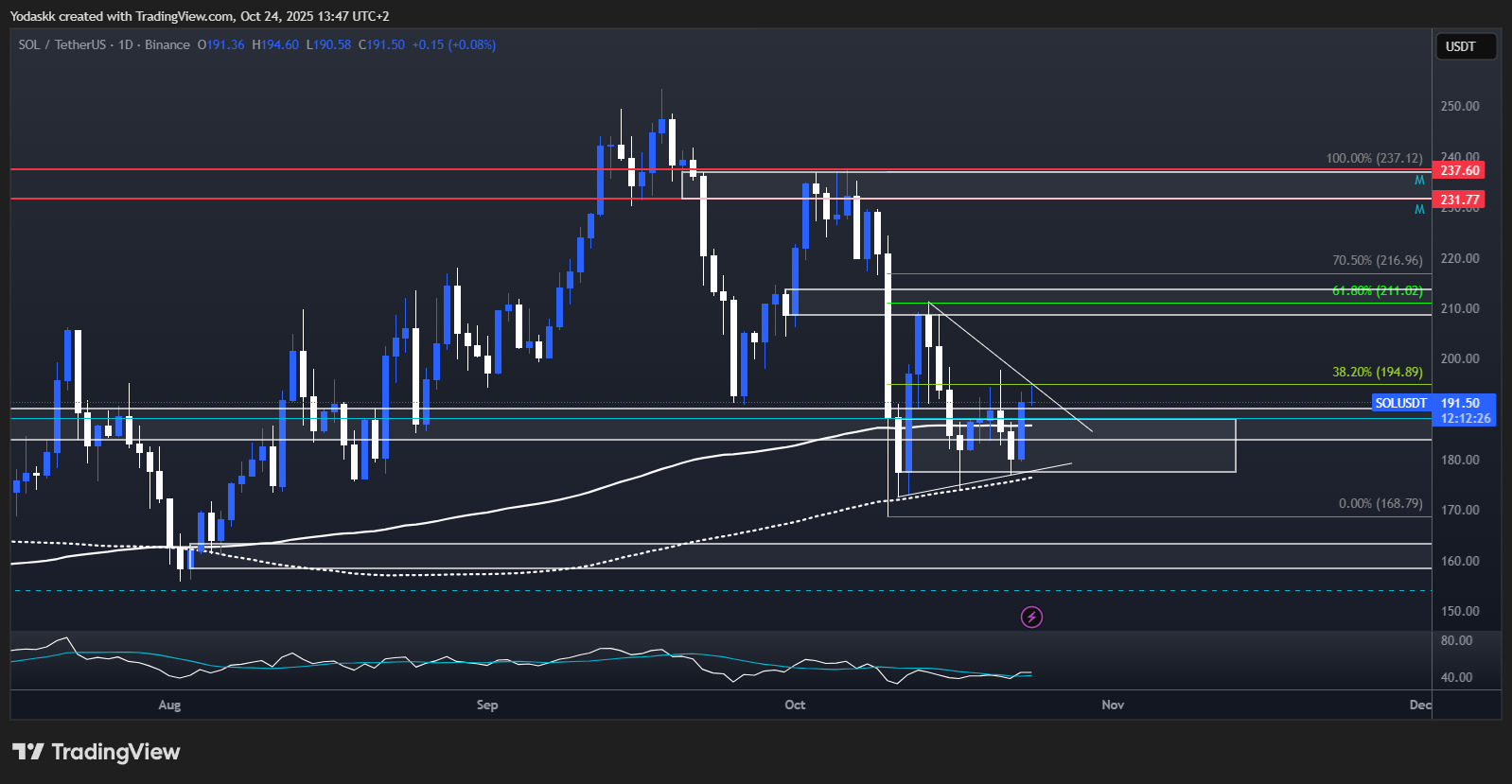

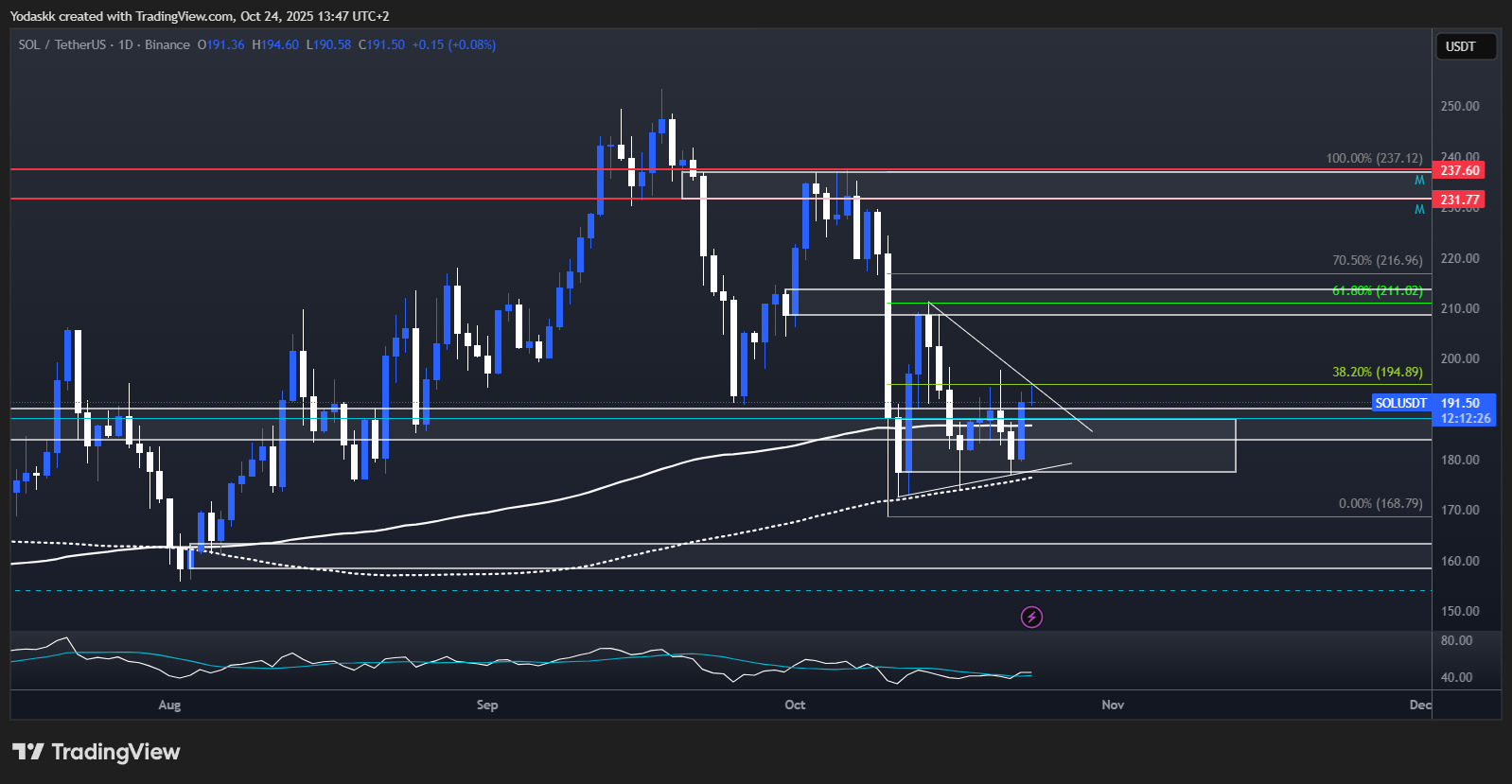

SOL:

- Open Interest and Funding Rates: Choppy OI mirrors underlying price compression. Funding neutral. SOL is ultra-responsive to BTC’s structural break.

Technical analysis

- Pennant forms post-crash. $213 breakout sets up double bottom confirmation and $237+ extension.

- Below $175 triggers wider range play down to $155 then $120—prime areas for long-term positioning.

- Momentum will escalate on major support/resistance break with BTC.

Cryptonary's take

SOL is compressing for an explosive move. Double bottom structure is promising, but follow BTC for macro cues. Breaks at $213 or $175 will set the next major trend leg.- Next Support: $178 – $190

- Next Resistance: $213

- Direction: Neutral

- Upside Target: $237

- Downside Target: $155 – $120

HYPE:

- Open Interest and Funding Rates: Spiked OI as Robinhood news hit. Funding slightly positive—watch for outperformance if BTC breaks out.

Technical analysis

- Closed above 200-day averages, and daily double bullish divergence printed.

- Breakout above $44 targets $51 and $59. Bullish structure is clear if BTC doesn’t break down.

- A fall below $35 targets $32, then $28 – big buying opportunity at major fib levels.

Cryptonary's take

Strong relative leader. Bullish divergence, new listing, and outperforming structure suggest HYPE will overperform if market breaks higher—but will still follow BTC’s lead.- Next Support: $35 – $36

- Next Resistance: $43 – $44

- Direction: Neutral

- Upside Target: $51 – $59

- Downside Target: $32 – $28

AURA:

- Open Interest and Funding Rates: Quiet OI and sideways funding, typical of re-accumulation zone. Signs of long-term positioning.

Technical analysis

- Stable between $0.065 and $0.10. Re-accumulation phase in play.

- Reclaim $0.10 and a move to $0.15 is on deck. Dip below $0.05 is unlikely—would be a long-term buying signal if triggered.

Cryptonary's take

Showing strength on dips and signs of larger accumulation. Neutral to bullish, focus on breakout and adding on unlikely shakeouts below long-term support.- Next Support: $0.065

- Next Resistance: $0.10

- Direction: Neutral to Bullish

- Upside Target: $0.15

- Downside Target: $0.05