Market Direction

Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Ranging $108,000–$119,000 with key support at $108k. Reclaim $119k to aim for ATH, lose $108k targets $100k.

- ETH: Bounce near $3,750. Needs $4,250+ to confirm V-recovery. Next support $3,750–$3,850. Following BTC for direction.

- SOL: Eyes on $213 breakout; target $237+. Weakness below $175 risks move to $155. ABC correction structure.

- HYPE: Bullish above $44, push to $51 possible. Drop below $36 looks to $28–$30 area. ABC corrective pattern.

- AURA: Accumulating $0.065–$0.1. Key bullish trigger above $0.1, downside risk to $0.05/$0.04. Holding up strongly.

BTC:

Technical analysis

- Still ranging between $108,000 and $119,000 after massive liquidity wick.

- Reclaiming $119k is critical for upside and a new ATH attempt.

- Breakdown below $108k targets the major liquidity pocket at $100k–$102k.

- Price action still sensitive to macro headlines (Trump-China in focus).

Cryptonary's take

We are watching closely for a potential V-reversal. Optimistic, but want clear confirmation from both price reclaim and macro development.- Next Support: $108,000

- Next Resistance: $119,000

- Direction: Bullish

- Upside Target: $124,000

- Downside Target: $100,000

ETH:

Technical analysis

- Strong bounce off weekend lows, back near $4,250 resistance for V-recovery confirmation.

- Failure at $4,250 means $3,750–$3,850 remains main demand zone.

- Breakdown trigger below $3,700—need to watch BTC for market signals.

Cryptonary's take

ETH remains a bounce play for now, but needs market-wide strength to accelerate. Keep an eye on BTC for broader confirmation.- Next Support: $3,750

- Next Resistance: $4,250

- Direction: Neutral to Bullish

- Upside Target: $4,800

- Downside Target: $3,700

SOL:

Technical analysis

- ABC correction from $250 high looks mature.

- $213 breakout is major trigger for $237+ extension.

- Below $175 risks a move to $155 and deeper correction.

Cryptonary's take

SOL's setup is clean—clear risk-to-reward if $213 can break. Beware if the broader market rolls over, as SOL historically moves hard.- Next Support: $180

- Next Resistance: $213

- Direction: Bullish

- Upside Target: $237

- Downside Target: $155

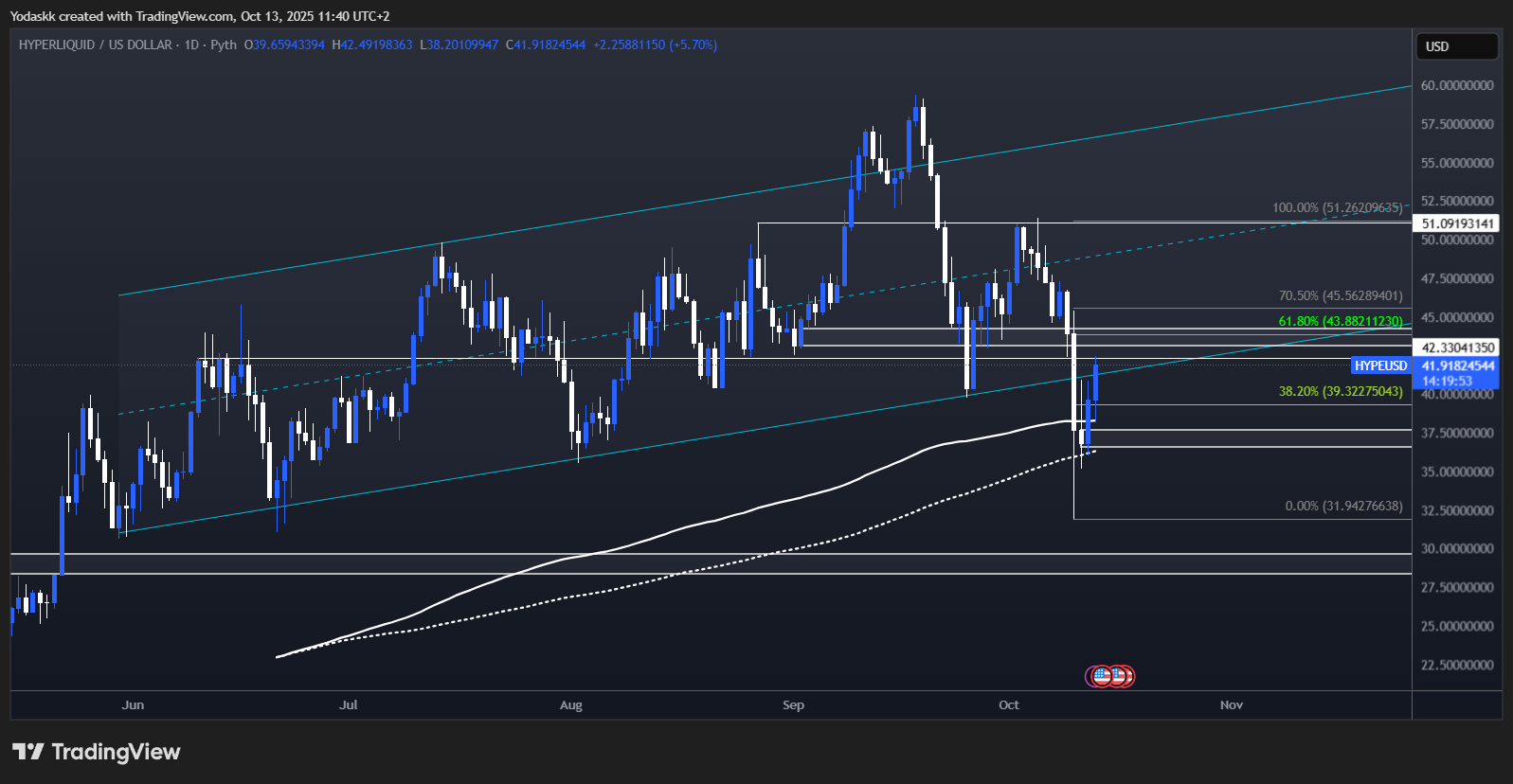

HYPE:

Technical analysis

- ABC correction from $59 high—tight range $37–$51 now in play.

- $44 breakout triggers a run toward $51, possibly higher if risk rotates back to alts.

- Weakness below $36 sets up $28–$30 flush.

Cryptonary's take

HYPE is holding better than weaker altcoins. A major move depends on BTC stabilizing; no rush—accumulate on weakness.- Next Support: $37

- Next Resistance: $44

- Direction: Neutral to Bullish

- Upside Target: $51

- Downside Target: $28

AURA:

Technical analysis

- Ranging $0.065–$0.1, showing accumulation behavior.

- Above $0.1 triggers move to $0.15 and $0.24 ATH; weakness below $0.05 risks $0.04 flush.

- Held up better than most alts during selloff.

Cryptonary's take

AURA offers a high reward-to-risk accumulation zone. Watching BTC to confirm market bottom, but relative strength is clear.- Next Support: $0.065

- Next Resistance: $0.1

- Direction: Bullish

- Upside Target: $0.15

- Downside Target: $0.05

Video Timestamp:

- BTC : 0-5min

- ETH : 5:10-8:05

- SOL : 8:05-10:55

- HYPE :10:55-13:20

- AURA : 13:20-16:50