Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Range-bound between $112.6k–$116.6k, leaning neutral; key downside zone for long-term buys sits at $101.5k–$106k.

- ETH: Lost major uptrend, resistance at $4,300–$4,500; likely to retest $3,800–$4,000 with deeper buy zone at $3,300.

- SOL: Pulled back from $250, bearish bias; potential accumulation zone at $170–$185 if market weakens further.

- HYPE: Rejected $49, now bearish; accumulation levels expected between $36.5–$40, with stronger support near $30.

- AURA: Broke bullish structure, trading near $0.06; reclaim of $0.098 needed for reversal, otherwise downside risk to $0.051–$0.040.

It’s possible we see a wider market pullback, however, Cryptonary’s view is to DCA into conviction plays at support levels. A BTC move into the low $100k’s would likely provide phenomenal entries on Alts/Memes, and we plan to take advantage of this (should we get it). We have identified key buying zones in the below analysis. For those comfortable with Shorting, Shorting can be an option here for those looking to hedge their overall portfolio. But these shouldn’t be taken with huge size nor should they be seen as long-term holds. We have covered this in a Market Pulse.

BTC:

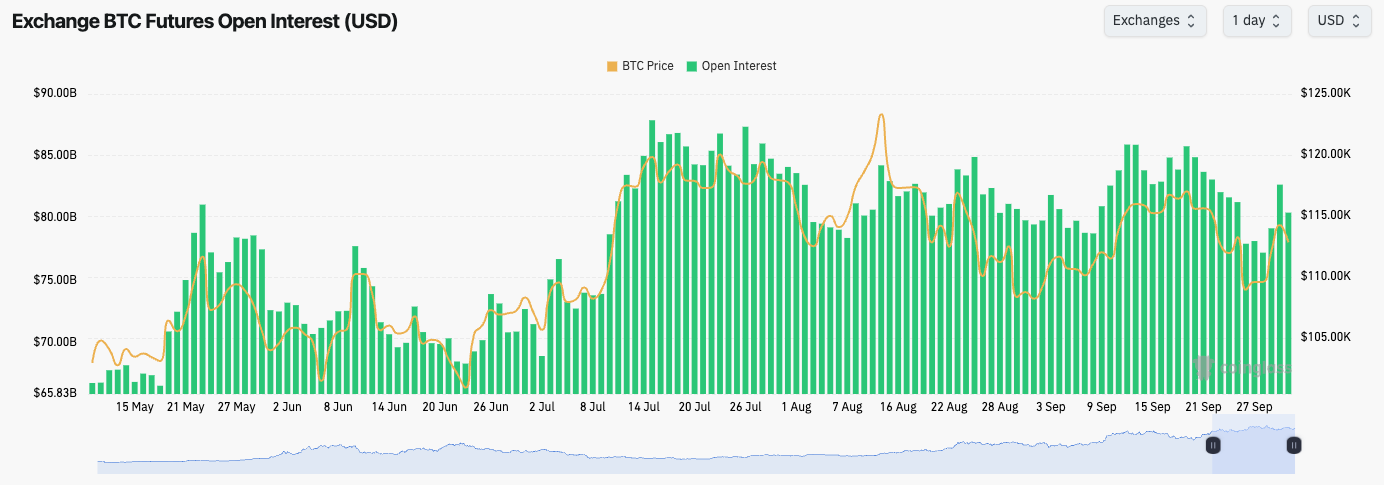

- BTC's Open Interest saw a more meaningful move lower a few days ago, as price moved down from $113k into the $108k's.

- The Funding Rate has remained positive, but nowhere near frothy levels.

- In recent days, the leverage setup has returned to a healthier one.

Technical analysis

- BTC bounced from the $109k’s and swiftly recovered above a key horizontal level of $112k.

- To the upside, the major horizontal levels are at $115,000 and $116,600. So far, the price has moved into $115,000 and it has initially been rejected.

- Price has now pulled back from $115,000 and it's now retesting $112,600 as support.

- Should the $112,600 level be lost, $108,000 is the key level. Should the price break below $108,000, then we'd expect the major buy zone to be tested, between $101,500 and $106,000.

- We would be aggressive buyers of BTC should it retest $101,500-$106,000.

- A breakout above the $116,600-$117,500 zone would be the signal for a bullish reversal.

- The RSI has bounced back to middle territory, but it is now battling at its moving average.

Cryptonary's take

As BTC has moved into the $109k's, it has put in a higher low, but price has also put in a lower high at $117,900. Price is now in the tighter range between $112,600 and $116,600. It's possible that price moves into $115k's from here, but it's our expectation that price rolls over and we see price pullback to retest the recent lows of $109k.BTC is mostly just choppy and range-bound here. During this, we're remaining patient and we're looking to take advantage of more meaningful dips. For us, that area would be $101,500 to $106,000. In this price zone, we'd look to add significantly to our long-term BTC Spot bags.

- Next Support: $112,600

- Next Resistance: $115,000

- Direction: Neutral

- Upside Target: $117,500

- Downside Target: $109,000

What's next?

ETH is retesting $4,300 resistance while SOL eyes $185 support. HYPE approaches key accumulation zones. Will bulls defend, or do we hit major downside targets in the days ahead?ETH:

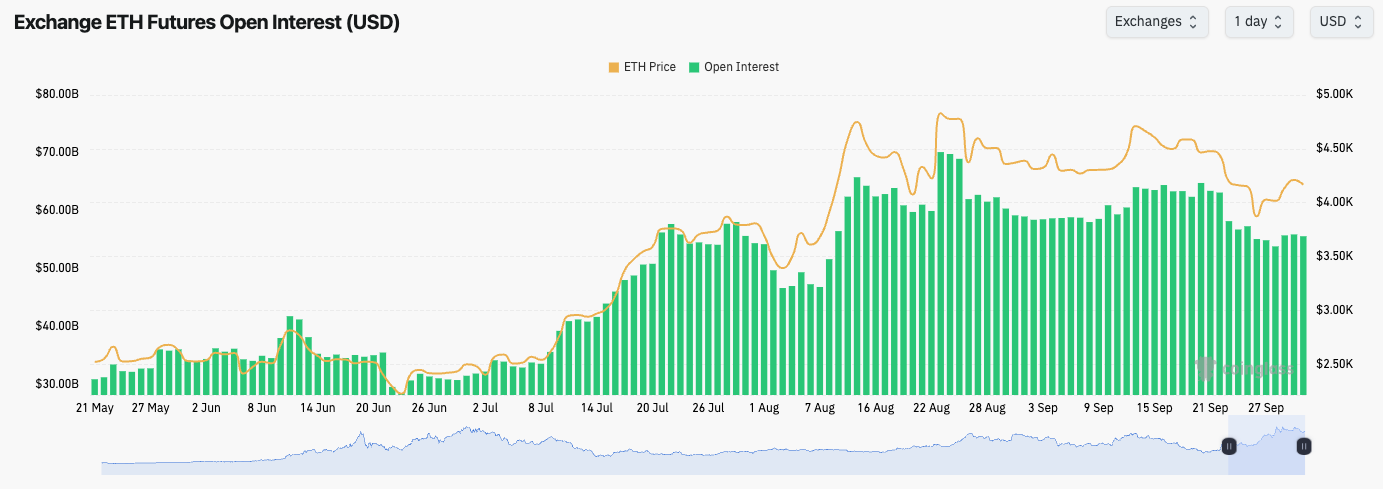

- ETH's Open Interest has continued its downtrend, with OI pulling back from $70b at an ETH price of $4,800, to now OI being at $55b.

- ETH's Funding Rate went negative for a brief period following the move below $4,000. It has now returned to being positive, but it remains volatile.

Technical analysis

- ETH broke below its main uptrend line and its horizontal support of $4,500. This resulted in a quick move down to the $3,800's.

- Price has since bounced, although it is now just shy of a horizontal resistance at $4,300.

- The key levels to the upside are $4,300, $4,500 and $4,770. A reclaim above $4,500 would be the bullish reversal.

- To the downside, the main support zone is between $3,800 and $4,000. Below that, the major horizontal level is at $3,300. Should ETH revisit $3,300, we'd be buyers at that level for the long-term.

- The RSI has bounced from oversold territory with it now moving into its moving average but battling it as a resistance.

Cryptonary's take

ETH has broken below its major uptrend line with price now below some key horizontal levels. Price is currently testing into the underside of one of the first major horizontal levels. We're expecting price to reject into the $4,300 area, and for price to eventually roll over back into the $3,800-$4,000 area.In terms of buying ETH, we would look to buy it should ETH pull back into the $3,300 level. Should BTC get into $101,500-$106,000, then a $3,300 ETH would be possible. An invalidation of this idea would be a reclaim of $4,500 as this would likely setup a retest of $4,800 and potentially lead to a breakout of new all-time highs.

- Next Support: $4,000

- Next Resistance: $4,300

- Direction: Neutral/Bearish

- Upside Target: $4,500

- Downside Target: $3,300

SOL:

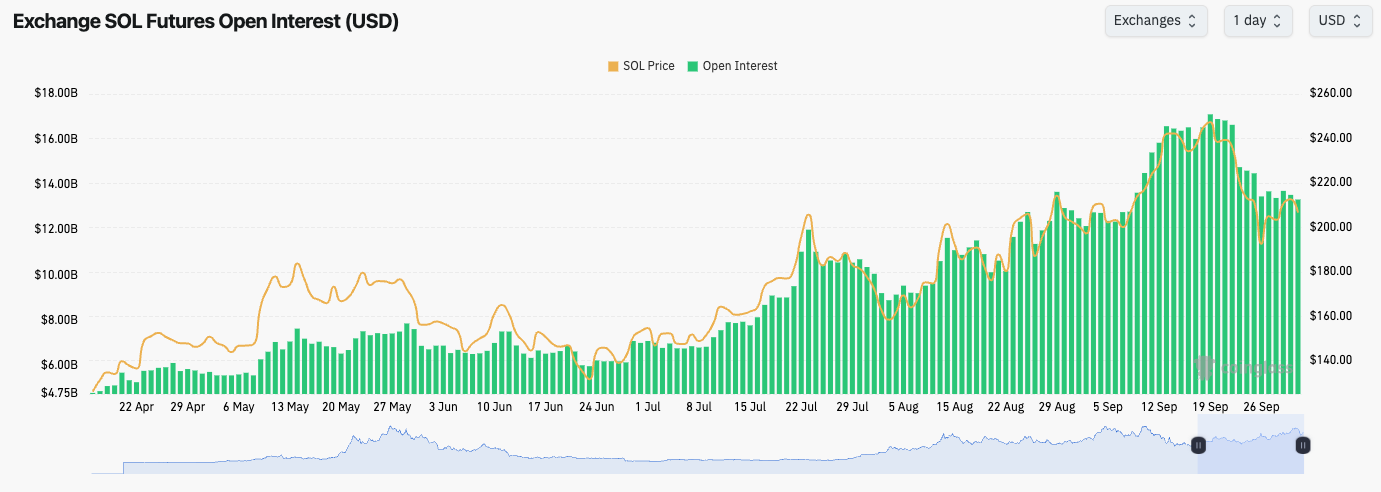

- SOL's Open Interest has pulled back approximately 20% since mid-September, whilst Funding Rates are now also sat in negative territory.

- This is a relatively healthy flush out for SOL.

Technical analysis

- SOL rejected into the $250 area with price now having broken below its local uptrend line, although still above its main uptrend line.

- The main horizontal resistance is above the price at $220 ($222), although the local level of $212 is currently suppressing the price.

- To the downside, the key supports are at $203, $185 and $170.

- We would consider bidding SOL should it pull back to the $170-$185 range.

- The RSI has bounced from close to oversold territory with it now being just shy of its moving average and a potential resistance.

Cryptonary's take

SOL has pulled back significantly from the $250 level with the price now below its local uptrend. Should we see a further pullback for the wider market, then we'd expect SOL to revisit $185. If price tests the $170-$185 zone, we'd likely be buyers of SOL again in that range.An invalidation of the above idea would be if SOL reclaimed the $222 level again. For now, though, we don't see this as likely, and we're expecting the price to rollover again and at least retest that $185 area.

- Next Support: $185

- Next Resistance: $222

- Direction: Bearish

- Upside Target: $222

- Downside Target: $170

HYPE:

- HYPE rejected into $59.00, and price has since drastically pulled back below the key horizontal level of $49.00 and the main uptrend line.

- Price has bounced from $40.00 with price now retesting the underside of $49.00 and the underside of the uptrend line. But the price has seemingly rejected from this level.

- In the short-term, the $45.80 is a key level to determine bullish or bearishness. Above, bullish. Below, bearish.

- To the downside, the key horizontal supports are at $36.50 and $39.40. Should price revisit this zone, we'd look to accumulate HYPE.

- If the price were to test below $36.50 down to $30.00, we'd expect buyers to step in. We view this as the ultimate re-entry for HYPE buys.

- The RSI has bounced back into middle territory, although it is now butting into its moving average and it's using it as new resistance.

Cryptonary's take

We view HYPE as one of the leaders of this "cycle", although in the short-term, it likely won't be immune to wider market volatility which we believe is possible. Therefore, we wouldn't rule out a move back to the lows, with the potential for price to break below the $40.00 lows and to visit the zone between $36.50-$39.40.However, should the price move into the $36.50-$40.00 zone, we'd be buyers of HYPE in that area, with more aggressive buys coming below $36.50 down to $30.00. An invalidation of the above thesis would be a reclaim of $49.00.

- Next Support: $40.00

- Next Resistance: $49.00

- Direction: Bearish

- Upside Target: $49.00

- Downside Target: $36.50

AURA:

- AURA has broken its potential double bottom pattern having broken below the key support of $0.09.

- Price has then traded down with the longer-term downtrend line, with price now finding some local support at $0.06.

- Below $0.06, the key horizontal supports lie at $0.040 and $0.051.

- The signal for the bullish reversal would be a reclaim of $0.085, which then sees price also reclaim $0.098. $0.098 is the most key level to reclaim.

- The RSI is now in oversold territory although there aren't any bullish divergences yet. But this would suggest that a bounce may be imminent, although we'd likely need to see a wider market rally.

Cryptonary's take

AURA has unfortunately lost its bullish structure having fallen below the $0.098 horizontal support with price needing to reclaim this level to return AURA to a bullish chart structure.Should we see further downside then $0.040-$0.051 is possible. But, with the RSI already in oversold territory on the Daily timeframe, a bounce higher for price is the more likely outcome in the short-term.

Most memes are down considerably in the last few weeks, and AURA has not been immune to this. However, should we see the market move higher in the coming weeks, we'd expect memes to take part in that, and that's when AURA may see more substantial upside.

- Next Support: $0.051

- Next Resistance: $0.098

- Direction: Neutral

- Upside Target: $0.116

- Downside Target: $0.051

Closing Thoughts:

We have uploaded a new Market Direction.I will repeat the 'Market Context' section here as I believe it is an important part of the update.

Market Context:

It's possible we see a wider market pullback, however, Cryptonary's view is to DCA into conviction plays at support levels. A BTC move into the low $100k's would likely provide phenomenal entries on Alts/Memes, and we plan to take advantage of this (should we get it). We have identified key buying zones in the below analysis.

For those comfortable with Shorting, Shorting can be an option here for those looking to hedge their overall portfolio. But these shouldn't be taken with huge size nor should they be seen as long-term holds. We have covered this in a Market Pulse. *

Please note, the above isn't something to panic over at all. If anything it should be seen as a big opportunity to be able to buy up at more favourable prices.

'Be greedy when others are fearful'.

Let's Go!