Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Holding strong in range; potential breakout to $130K if macro data is dovish.

- ETH: Overbought with bearish signals; likely pullback to $3,050–$3,480.

- SOL: Pullback expected to $155–$165 unless macro shifts bullish.

- HYPE: May retest $39.40–$42.00 support; upside capped at $50 for now.

- AURA: Bullish pattern intact; targeting $0.35–$0.40 long-term.

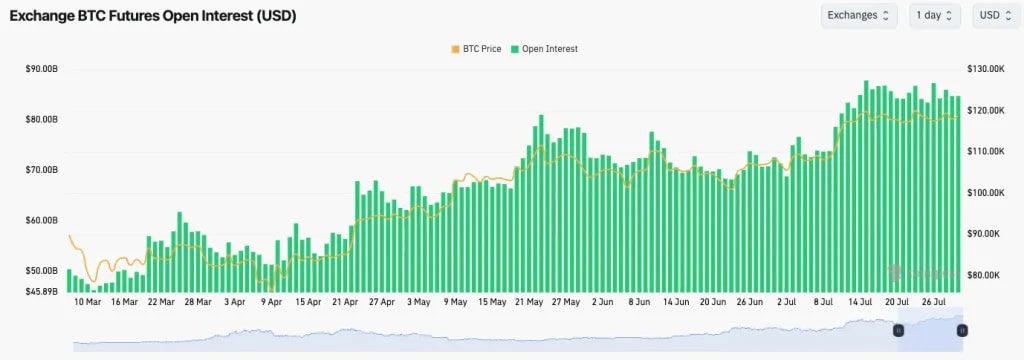

- BTC's Open Interest remains very close to all-time highs, having picked back up again over the last few days.

- Funding Rates are positive, but have pulled back from more elevated levels, and they're now at healthier levels.

- Considering price hasn't pulled back too much, it's positive to see Funding Rates pull back and somewhat reset.

TA:

- Bitcoin remains in a tight range between the horizontal support of $116,600 and the horizontal resistance of $120,100.

- This period of consolidation has allowed the RSI to reset having previously been very overbought.

- Over the weekend, we saw BTC break below the $116,600 horizontal support, but price was quickly bid back up and it recovered the $116,600 horizontal support.

- Should price fall below $116,600, we expect price to be heavily bid between $112k-$115k.

- Major support lies between $110k-$112k, however, we don't expect price to fall back to this price zone.

- Considering how price has held the range so far, (showing substantial strength), it still makes more sense that the next move is a breakout to the upside.

- Upon a breakout, upside price targets are $130,000.

Cryptonary's Take:

BTC's next move may largely depend on Chair Powell's comments this Wednesday and the macro data later in the week. Should we see comments/data that improves the odds of an Interest Rate cut for the September Meeting, then BTC can break out upon this news. However, should we see the opposite, then it's possible that BTC breaks down.

If BTC breaks down post-FOMC, we’ll bid $112k-$115k, with aggressive buys at $110k-$112k. But, our base case is still an upside breakout, unless macro turns risk off.

- Next Support: $116,600

- Next Resistance: $120,100

- Direction: Neutral/Bullish

- Upside Target: $130,000

- Downside Target: $112k-$115k

- ETH's Open Interest remains extremely elevated, although it has stalled over the last few days.

- Alongside the stalling in OI, the Funding Rate has pulled back from more elevated levels. It's still positive, but back to more normalised levels.

- The above suggests a slight rebalancing in positioning but that the total amount of leverage remains extremely elevated.

TA:

- ETH shot up to $3,800 following an explosive move higher.

- Price then formed a bull flag, using the $3,480 horizontal level as support, with price then breaking out of the bull flag and pushing up to the main horizontal resistance at $3,970.

- To the upside, $3,970 is the level price needs to breakout above. But beyond that, the next major horizontal level is at $4,500.

- ETH's RSI is well into overbought territory, with the moving average at its highest point since March 2024. A month later, price was 30% lower.

- If ETH were to pull back, the horizontal supports are at: $3,480, $3,280 and $3,050. We'd expect $3,280-$3,480 to act as strong support, and we'd be buyers there. Should ETH drop into the $3,050-$3,280 zone, we'd be aggressive buyers there.

- Alongside the above, the RSI has put in back-to-back bearish divergences (higher highs in price and lower highs on the oscillator).

- A breakout above the $4,000-$4,100 zone would invalidate the short-term bearish thesis.

Cryptonary's Take:

ETH has had a huge run up in what is a relatively short period of time. We're now potentially beginning to see a stalling out of this momentum with trading indicators well into overbought territory having put in bearish divergences.

Unless Chair Powell softens (dovish), a short-term pull back is likely. We’ll scale into ETH between $3,280-$3,480, with more aggressive buys between $3,050-$3,280.

- Next Support: $3,480

- Next Resistance: $3,970

- Direction: Bearish

- Upside Target: $3,970

- Downside Target: $3,050-$3,280

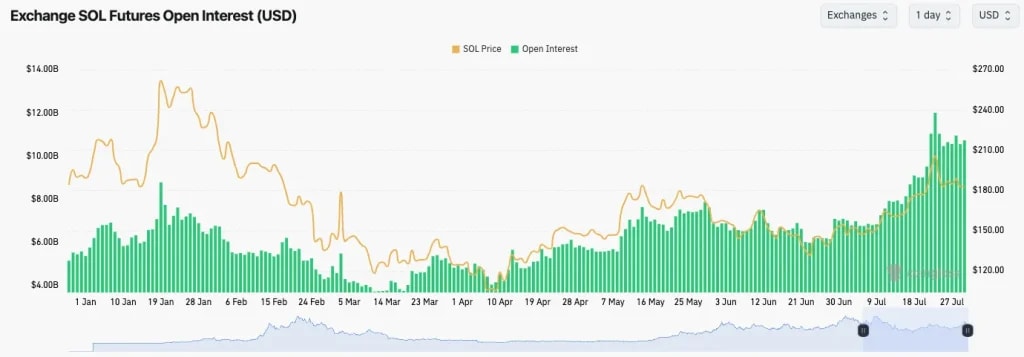

- SOL's Open Interest has pulled back more substantially from its all-time highs, whilst the Funding Rate has also pulled back.

- More leverage could come off here, but overall, this slight resetting is good, and healthy to see.

TA

- SOL has pulled back from its main horizontal resistance at $203, with price now range-bound between $180 and $190.

- Price is holding the local uptrend line for now, but should price lose this level, then it's possible that we see a pullback to $165.

- To the upside, the main horizontal resistance is at $203.

- To the downside, the main horizontal support is at $165 and $155, we expect this zone to be a strong area of support.

- This price pull back has meaningfully reset the RSI which is now in middle territory, having previously been very overbought.

Cryptonary's Take:

Again, markets this week likely depend on the macro data towards the back end of the week and Chair Powell's comments on Wednesday. Unless Powell is dovish on Wednesday, then we'd expect SOL to pull back here in the short-term to the $155-$165 range. At that price zone, we'd be buyers of SOL again with a view to holding the position for the next 12 months.

- Next Support: $155-$165

- Next Resistance: $203

- Direction: Bearish

- Upside Target: $203

- Downside Target: $155-$165

- HYPE pulled back to the $39.40 to $42.00 support zone. Price has since bounced from there.

- Price is battling to reclaim its uptrend line, whilst it's also below its local downtrend line.

- Above price, the horizontal resistance is a local level at $45.80, with the $50.00 level being the main horizontal and psychological resistance for price.

- Should price breakout above $45.80, then we'd expect a swift move up to $50.00. However, a breakout to the upside isn't our base case in the short-term.

- To the downside, $39.40 is the level of support, but should price break below that level, then we'd expect buyers to come in a strong way between $35.00 and $39.40.

- Since price pulled back from $50.00, the RSI has pulled back from overbought territory, with it now being in middle territory, although it is below its moving average.

Cryptonary's Take:

HYPE has held up relatively well in the short-term here, with price being just shy of $45.00 - 10% below its all-time high. However, in the coming week, we see there being a risk of a wider market pull back and therefore HYPE is potentially vulnerable to also pulling back.

In the short-term, we see price revisiting the $39.40-$42.00 level as likely. For those that are underexposed or have no exposure to HYPE, $39.40-$42.00 is a long-term entry, with mid-$30’s being an area we’ll scale in harder.

- Next Support: $39.40-$42.00

- Next Resistance: $45.80

- Direction: Bearish/Neutral

- Upside Target: $50.00

- Downside Target: $39.40

- Price bounced from the $0.117-$0.130 support zone back up to the all-time highs of $0.24.

- Price has since pulled back, but it has found support between $0.170 and $0.20.

- AURA continues to form the 'Cup-and-Handle' pattern structure, with it now in the 'Handle' phase of the pattern. This structure has a bullish breakout bias, with an upside target of $0.35-$0.40.

- Should the $0.170-$0.177 support zone be lost, the next major horizontal support would be at $0.148. If price were to pull back to here, the 'Cup-and-Handle' pattern would still be valid.

- This recent price pull back has allowed the RSI to meaningfully reset on most timeframes, including the Daily timeframe.

Cryptonary's Take:

AURA remains in the very bullish 'Cup-and-Handle' structure, and even if price were to pullback to $0.148, it would remain valid. Ultimately, this structure shows price putting in the 'Handle' part of the pattern which would have a breakout target of $0.35-$0.40 once price breaks out of the all-time high.

We remain convicted in holding AURA and we’ll build positions further in the $0.148-$0.170 range if offered.

Long-term, we see AURA competing with other major meme's with it re-rating into the multi-billion $ MCap level.

- Next Support: $0.148-$0.170

- Next Resistance: $0.214

- Direction: Bullish

- Upside Target: $$0.35-$0.40

- Downside Target: $0.148

Closing thoughts:

This week is huge for macro, and should we see a more hawkish Powell on Wednesday, then some assets might be vulnerable to a pull back here, with those that have run the hardest in recent weeks being the most vulnerable (ETH, SOL).

Should we get a more meaningful dip in the coming weeks, then we'd look buy strong buyers into that.

Big next 3-4 days, looking forward to it.

LET'S GO!!!!