BTC, ETH, and More: Ranges Holding, Eyes on Breakouts

Majors are recovering from recent pullbacks, reclaiming key support zones and showing healthy resets in leverage. If these levels hold, we could be staring at another breakout leg over the next few weeks.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- BTC: Holding $116.6K–$120.1K range after bounce; upside target $130K, downside support $112.1K.

- ETH: Testing $3,970 resistance; breakout could push to $4,500, with buy zone $3,480–$3,620.

- SOL: Needs to reclaim $185–$203 to restore bullish trend; long-term target $260–$300.

- HYPE: Attempting to invalidate bear flag; bullish above $45.8 with $50 target.

- AURA: Cup-and-handle pattern forming; breakout above $0.245 may lead to $0.35–$0.40 short term.

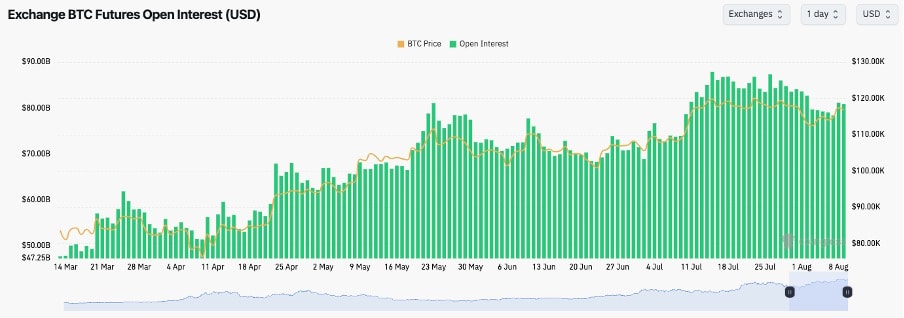

- BTC's Open Interest has pulled back from the highs whilst Funding Rates have reset to more moderate levels, but they remain positive.

- This is a healthy resetting for the leverage market, and it's positive for price action going forward.

TA:

- BTC has bounced from the horizontal support of $112k, and the support of the main uptrend line.

- Price closed a positive Daily candle yesterday, with price breaking back into the range and reclaiming the horizontal level of $116,600.

- We'll now be looking for BTC to show strength and remain in the range of $116,600 to $120,100.

- The main resistance to the upside is at $120,100.

- The RSI has meaningfully reset (now in middle territory), with it now rising above its moving average.

Cryptonary's Take:

BTC bounced from the very top of our Yellow Buy Box between $106,00-$112,100 with price now reclaiming the key horizontal level of $116,600. This is strong price action, particularly with the pull back having reset some of the indicators.

We'd now like to see price hold the $116,600-$120,100 range, and then eventually breakout to the upside. The key now will be as to whether this is a lower high for price, and price pulls back from here and refills the Yellow Buy Box more in the coming 1-2 weeks. We're split here, although we're leaning to further consolidation between $116,600-$120,100 and then a breakout to the upside.

However, should price revisit the Yellow Buy Box (between $106,00-$112,100) we'd be strong buyers of BTC.

ETH:

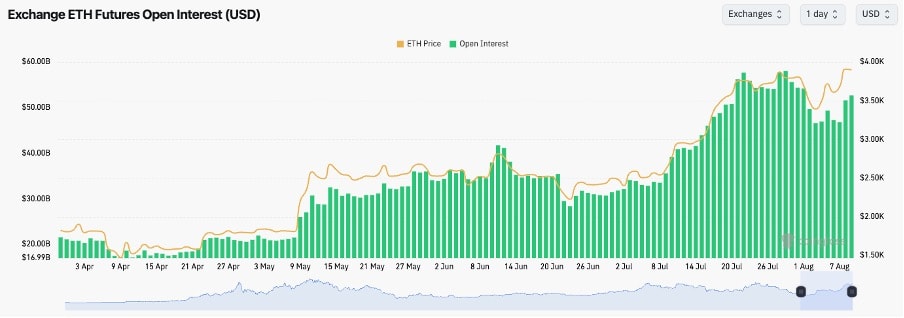

- ETH's Open Interest pulled back slightly from the highs, but OI is up 5% in the last day as the price of ETH has bounced from $3,600 to $3,900. Therefore, Open Interest remains high.

- The Funding Rate is also back to being meaningfully positive. This indicates a movement back to traders preferring Longs against Shorts, but the current rate is at healthy levels.

TA:

- ETH bounced perfectly from the key range we had previously identified between $3,280-$3,480.

- Price bounced and swiftly recovered the $3,480 horizontal level, with price now moving back to and retesting the highs at $3,970, initially finding some resistance there.

- Should ETH break out of $3,970, the next upside target would be $4,500.

- To the downside, the key horizontal levels remain at $3,280 and $3,480. But we'd now also bring in the local level of $3,620.

- Should ETH pull back to $3,280-$3,620, we'd be buyers of ETH.

- The RSI reset substantially but it's now moved higher, and now just shy of overbought territory, and it's potentially rejecting into its moving average.

Cryptonary's Take:

The current level ($3,970) is a key level for ETH. Should price breakout above $3,970, then it's likely that ETH swiftly moves up to $4,500.

Should ETH be locally double topping here, then it's possible price pulls back to retest the recent lows. However, with the ETH Treasury company narrative in full steam, we'd be sceptical of another pull back to the recent lows. We'd therefore up our buying levels of ETH to $3,480-$3,620, should we see a pullback for price in the near-term.

Our base case does remain that ETH breaks out of $3,970, to $4,500. Our question now is whether we see that pull back to $3,480-$3,620 before price breaks out.

SOL:

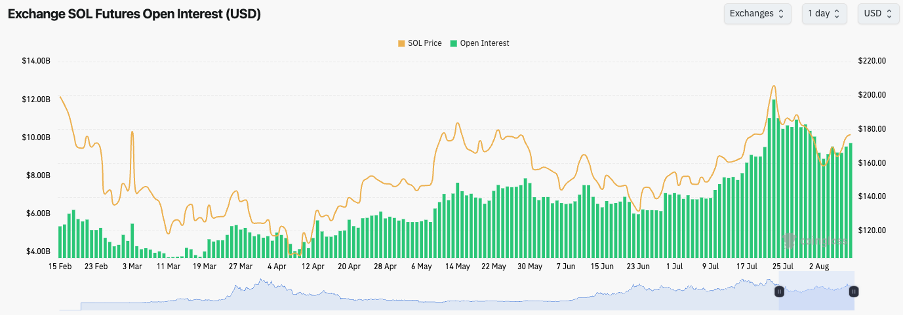

- SOL's Open Interest is down from the highs, and it hasn't meaningfully increased despite price bouncing from $157.

- SOL's Funding Rate is positive, but it's in healthy territory.

- Overall, SOL's leverage market setup looks positive, and the healthiest out of the Majors, but this might also be the reason we haven't seen the price bounce like we've seen in ETH. A frothier market can result in out-sized performance.

TA:

- SOL pulled back to the local support of $155 (a level we marked out), after price broke below its uptrend line.

- Price remains below its uptrend line, although price has broken out of its local downtrend line, but price might find resistance at the horizontal level of $185 in the short-term.

- The horizontal resistances above the current price are at $185 and $203.

- To the downside, the key supports for price are at $155, $144, and then $120.

- The price pullback has meaningfully reset the RSI which is now in middle territory with room to go higher.

Cryptonary's Take:

Out of the Majors, SOL is perhaps the one that has struggled in terms of performance. Price is now out of a key uptrend, and for the structure to return to a bullish structure, price will need to reclaim $185 as a minimum, and likely $203.

We would look to add to our longer-term SOL bags between $120-$160, although we don't expect anything sub-$150. Long-term targets remain between $260-$300, and we see this call as a relatively conservative call.

HYPE:

- Price broke below its uptrend line having rejected at the horizontal resistance of $45.80.

- Price seemingly found support at the $36.50 horizontal level, and price formed a bear flag, which would usually have a bias to breakdown. However, price is now pushing at the top border of the bear flag and attempting to invalidate the bear flag.

- Price is now at a local resistance of $41.20, having broken out of the main horizontal level of $39.40.

- Should price breakout of the bear flag (invalidating it), price will still need to cleanly breakout above the downtrend line.

- Beyond the downtrend line, the main horizontal resistance remains at $45.80. Should price breakout above there, then $50.00 is the next target.

- The RSI has meaningfully reset, with it now in middle territory and above its moving average. This is a positive setup.

Cryptonary's Take:

HYPE is currently battling in a bear flag formation; however, price action has shown strength with price now attempting to invalidate the flag.

Should price revisit the $36.50 to $39.40 zone, we'd be buyers of HYPE for the long-term, with more aggressive buys coming below $36.50 down to $32.00. Price action has been strong, so sub $36.50 looks unlikely now.

AURA:

- Price managed to find support at the key horizontal level of $0.148, having been heavily bought up by dip-buyers during the wick lower.

- Price has since then been able to breakout of the downtrend line, and reclaim the horizontal resistance of $0.177, with price now using that level as new support. This is a bullish development.

- Should price fall back below $0.177, the next key horizontal support would be at $0.148. It would be important for price to remain above this level to maintain the bullish structure.

- To the upside, the key horizontal resistances are at $0.214 and $0.245.

- Beyond $0.245, a breakout of the 'Cup-and-Handle' pattern would send price up to $0.35-$0.40. This price structure remains, with AURA looking bullish on all major charting timeframes.

- The RSI has also meaningfully reset, and it's in middle territory, meaning that there is substantial room for upside.

Cryptonary's Take:

AURA has consolidated over the last few months between $0.09 and $0.24, with price forming the 'Cup-and-Handle' structure, and this structure now playing out. We're now in the 'Handle' part of the structure, and a breakout of $0.214 and then $0.245, would be the bullish impulse that would then likely send price to $0.35-$0.40.

$0.35-$0.40 remains our shorter-term timeframe price target. However, if we look beyond that, say until Christmas, we'd expect AURA to be trading between $0.70-$1.20. We remain of the view that AURA is a buy and hold, with a long-term view to holding the position.

Closing Thoughts:

All the coins we cover look strong for upside, perhaps other than SOL. Should we see more pull backs, we'd look to continually add to positions. But across the board, everyone should be substantially allocated having taken advantage of pullback zones.

We're expecting a very positive next 3-4 months for the market, even if we have another 1-3 weeks of chop. It's also possible that we have a bull that lasts another 12 months - matching the Interest Rate cutting cycle, as lower rates drives risk assets.

We're substantially allocated, and we're looking forward to what the upcoming quarters might bring.

LETS GO!!!