BTC, ETH, SOL, DOGE & SPX – reversal or another leg down?

Crypto markets remain choppy as Bitcoin hovers near key resistance, Ethereum eyes a breakout, and Solana tests support. Dogecoin and SPX also present crucial setups—let’s break down what’s next for these major assets.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

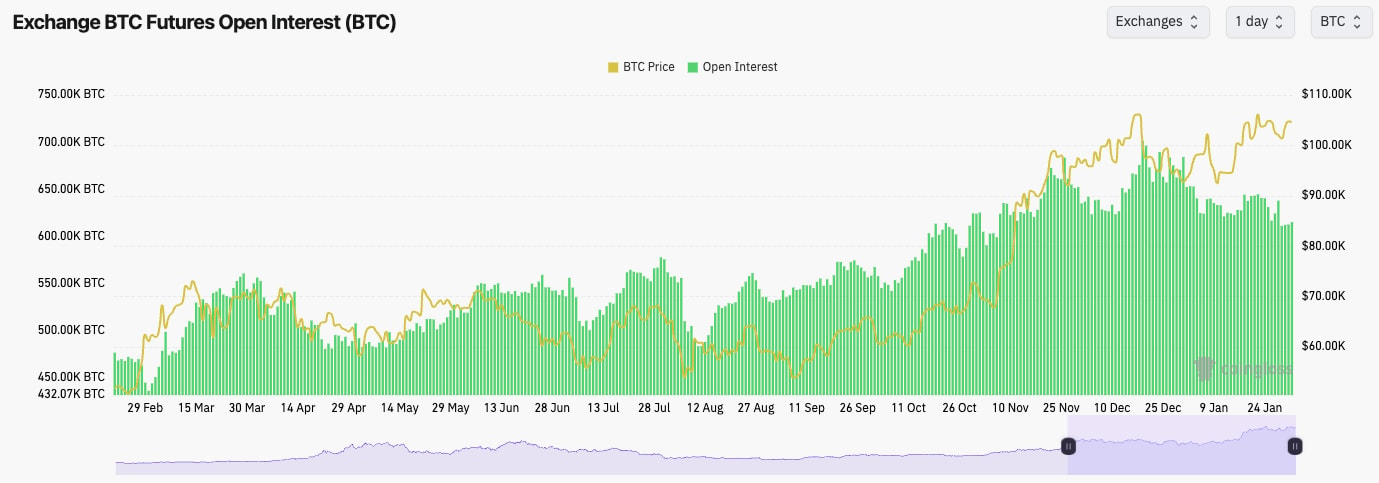

BTC:

- We're seeing a lower BTC's Open Interest trend, which suggests there's less demand amongst traders to leverage it. This is positive but also expected when the market is in more choppy conditions.

- Funding Rates range from 0.00% to 0.01%, indicating there's an even balance between Longs and Shorts.

Technical analysis

- Next Support: $98,900

- Next Resistance: $106,900

- Direction: Bearish/Neutral

- Upside Target: $106,900

- Downside Target: $95,700

Cryptonary's take

Bitcoin currently ranges between $95,700 and $106,900. Whilst we're in this post-Trump inauguration period where too much good news was priced in (the market had overpriced against a realistic reality), it's possible now that we do see a pullback for BTC in the coming 1-2 weeks. It's possible BTC pulls back to $95,700 to say $98,900.We have highlighted this with a yellow arrow on the chart. We'll add two other things to this. Firstly, if BTC does pull back 5-10%, it doesn't necessarily mean Alts/memes will have another major pullback. Looking across the board, we feel most of the Alts/Memes have done the substantial portions of their pullbacks, but we also think they'll be range-bound for a while.

Secondly, in a range-bound market, it doesn't mean there won't be good pockets of outperformance. For example, $HYPE over the last 3-5 days has heavily outperformed.

ETH:

Technical analysis

- ETH is interesting here. The price bounced off the main horizontal support of $3,050.

- Price is now attempting a break above the horizontal level of $3,280 whilst it's also looking to break out of the main downtrend line.

- The key for a major breakout here will be for the price to break the main horizontal resistance at $3,480.

- If the price can break out at $3,480 (we're sceptical in the short-term), then $3,700 is the target.

- The RSI is also attempting a breakout above the downtrend line and the moving average. We really need to see this move stick to potentially see a more substantial upside.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: $3,700

- Downside Target: $3,050

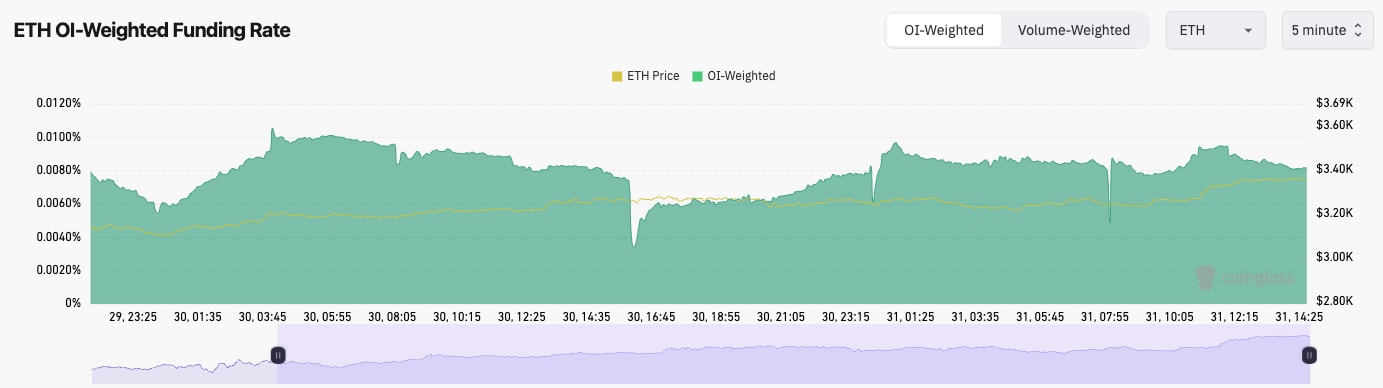

Cryptonary's take

ETH is at a really key level here as it is trying to break out. A breakout of the downtrend line and $3,480 horizontal resistance is a big ask, so we are sceptical. But this is what's needed to get that breakout.If the price were to break out, it would be a huge sign-off strength, and this may actually lead to other plays/sectors also having more substantial rebounds. Unfortunately, we're not expecting a substantial breakout in the short term, and we're still thinking that ETH can revisit $3,050 before it touches the Yellow Box. But we're expecting $3,050 as a minimum retest again.

SOL:

Technical analysis

- SOL bounced off the main horizontal support of $220, and the price has now bounced up to the local horizontal level of $240.

- Price is in a larger range here between $220 (horizontal support) and the major horizontal resistance at $263.

- The RSI is in the middle territory, but it's below its moving average.

- Next Support: $220

- Next Resistance: $263

- Direction: Neutral

- Upside Target: $263

- Downside Target: $220

Cryptonary's take

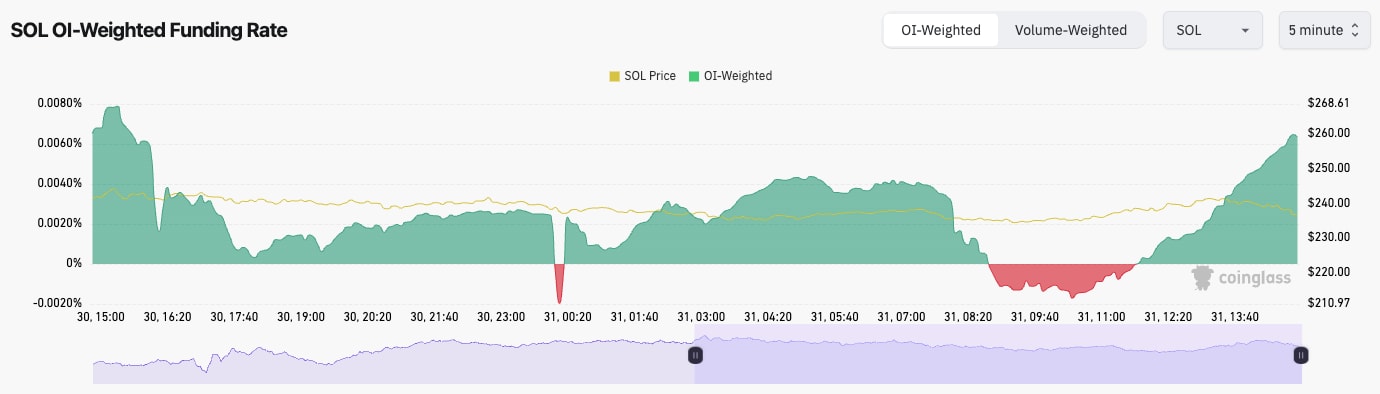

There's no need to go heavy in detail here. SOL is just a range bound between $220 and $263, and we're expecting that to continue in the short term. Of course, a breakdown of the key levels ($220 and $263) will be the key thing to watch. Be patient with this and just let time give you/us more candles and, therefore, more information. There's no point getting stuck into (trading) something that's in the middle of a larger range. If we had to call it, we'd say there's more chance of a retest of $220 first than a retest of $260.DOGE:

- DOGE has once again held the major horizontal support at $0.30, and the price has bounced from there.

- Price is attempting a breakout of its main downtrend line, as well as its local downtrend line.

- The key level for the price to reclaim will be the horizontal resistance of $0.35. Beyond that, $0.39 is the main horizontal resistance.

- The RSI is in the middle territory, but it's also now butting up into its moving average, which may become resistance.

- Next Support: $0.30

- Next Resistance: $0.35

- Direction: Neutral/Bullish

- Upside Target: $0.40

- Downside Target: sub $0.30

Cryptonary's take

Again, whilst we're sceptical of a major breakout, we're still watching intently. A breakout for DOGE above $0.35 would likely be mega and give other Alts/memes the fuel to run higher also. DOGE is also now the only major meme that's held its structure (it hasn't broken below key support of $0.30), whereas everything else (major memes-wise) has.If DOGE can recover and break higher, that would be great for other memes. We're sceptical of a major breakout, and we think $0.35 might be a sticking zone for the price, but let's see how this unfolds over the weekend.

SPX:

- SPX has performed well in that many other coins have had sizeable pullbacks, where SPX has held between $1.00 and $1.60.

- Price has bounced from the lows and the horizontal support of $1.00, and it's now breaching the downtrend line.

- It's possible we see SPX pull back, find some support at $1.20, and then have a more substantial breakout from there.

- The main horizontal resistance will be at $1.55.

- In terms of support, $1.00 to $1.20 is a big zone of support for SPX.

- One thing we do note is the downtrending volumes. This is somewhat a cause for concern, but it may also mean the price can shove higher if the volumes really kick up and their bids.

- Next Support: $1.20 (then $1.00)

- Next Resistance: $1.60

- Direction: Neutral

- Upside Target: $1.60

- Downside Target: $1.00