Market Direction

Disclaimer: This analysis is for informational purposes only and not financial advice.

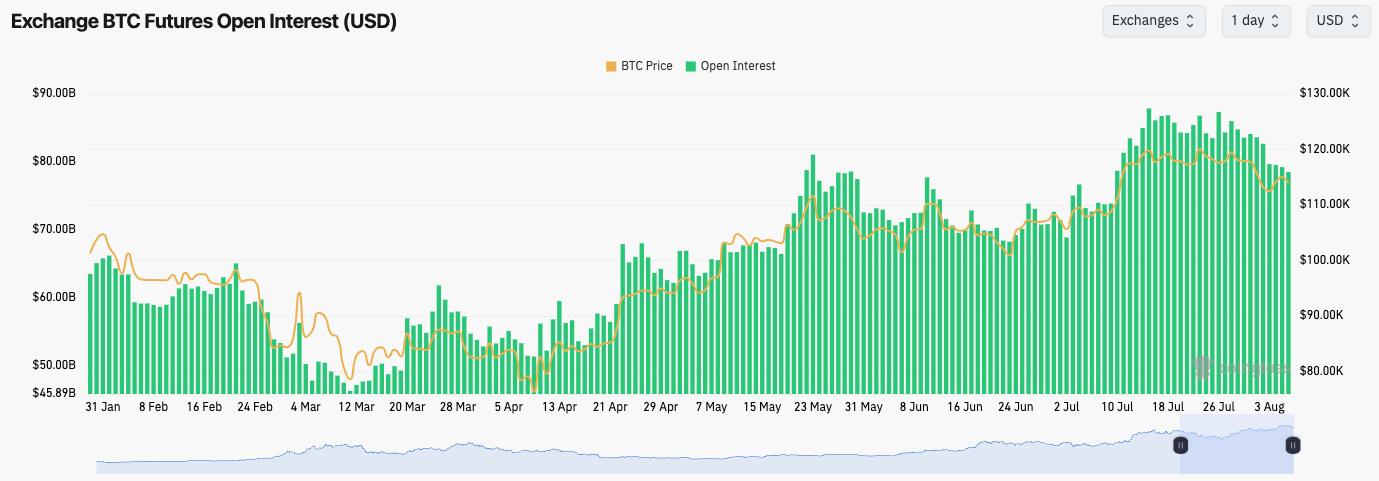

BTC:

- BTC's Open Interest has pulled back by approximately 10%, during the price pull back from $120k.

- The Funding Rate remains positive.

- Despite Open Interest remaining relatively high, this is a slight resetting in the leverage market which is healthy for future moves higher.

Technical analysis

- BTC broke below its local support of $116,600 and price moved more meaningfully lower.

- Price moved down to its main uptrend line and the horizontal support of $112,000, where price was supported.

- The previous breakout range of $110k-$112k is likely to support price.

- Should price break below $110k, then $106k up to $110k would also be a strong support. This is also an area we'd look to aggressively bid BTC should it get there ($106k-$110k).

- To the upside, the local resistance is now the $116,600 horizontal level and then the $120,100 above that.

- This move lower has meaningfully reset the RSI which is good and healthy to see, particularly after an all-time high breakout.

Cryptonary's take

BTC consolidated at its all-time highs and price has since pulled back to retest the old breakout range of $110k-$112k. Price has found support and it's now putting in a small bounce, which we expect to be a relief bounce. We see it as likely that price breaks below its uptrend line and price revisits the $110k-$112k range, to which we would be buyers of BTC in that zone. However, it is also possible that price pulls back to $106k-$110k. This isn't our base case, but should it happen, the bullish structure would remain so we would be aggressive buyers of BTC in that range.- Next Support: $112,000

- Next Resistance: $116,600

- Direction: Neutral/Bearish

- Upside Target: $120,100

- Downside Target: $106,000

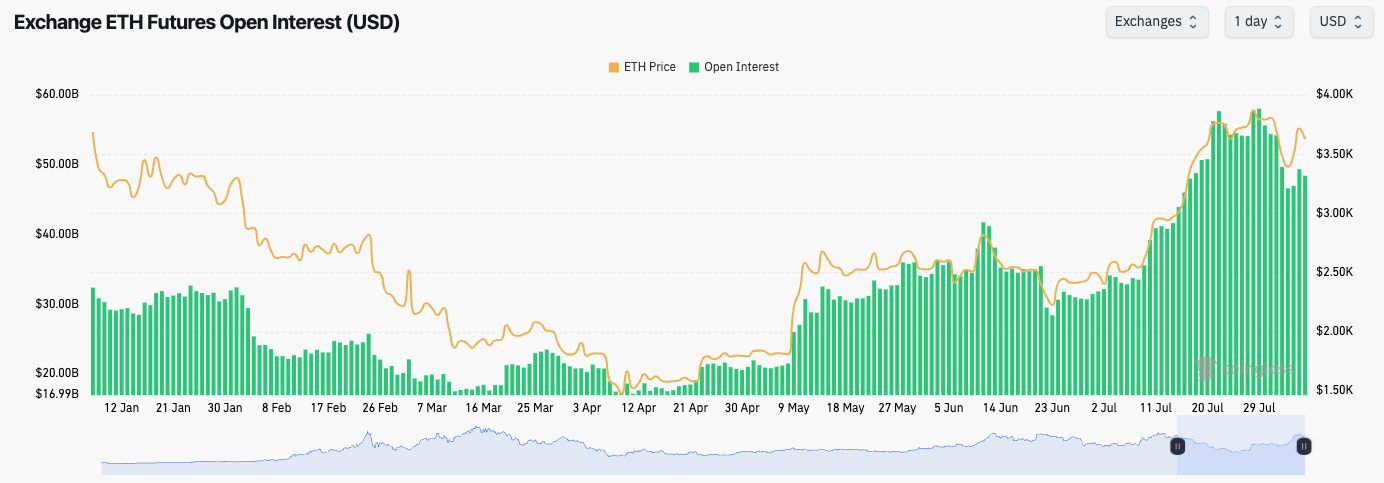

ETH:

- ETH's Open Interest has pulled back substantially from its highs, although it remains at elevated levels.

- The Funding Rate is positive, but it has more meaningfully reset now on this price pull back.

Technical analysis

- ETH rejected into the major horizontal level of $3,970, and price has since more majorly pulled back.

- Price found support between the two key ranges we identified: between $3,280 and $3,480.

- Price has since bounced and reclaimed well above $3,480, but it's found a local resistance at $3,700.

- The RSI has meaningfully reset on this move lower which is a positive and healthy development for a further rally later for ETH.

- Should price pull back further, the key horizontal supports are at $3,050, $3,280, and $3,480. However, we expect $3,280 to $3,480 to remain as a strong zone of support.

Cryptonary's take

ETH is consolidating in a wider range between $3,300 and $3,970, with clear horizontal supports at $3,280 and $3,480. We'd be strong buyers of ETH in this range, as we expect to breakout to $4,500 later in the year, meaning $3,280-$3,480 gives us a good and solid long-term entry for the ETH we de risked into $3,800. We expect this consolidation period to continue for more weeks, so patience should be exercised, and revisits of range lows should be bought.- Next Support: $3,480

- Next Resistance: $3,970

- Direction: Neutral

- Upside Target: $4,500

- Downside Target: $3,280

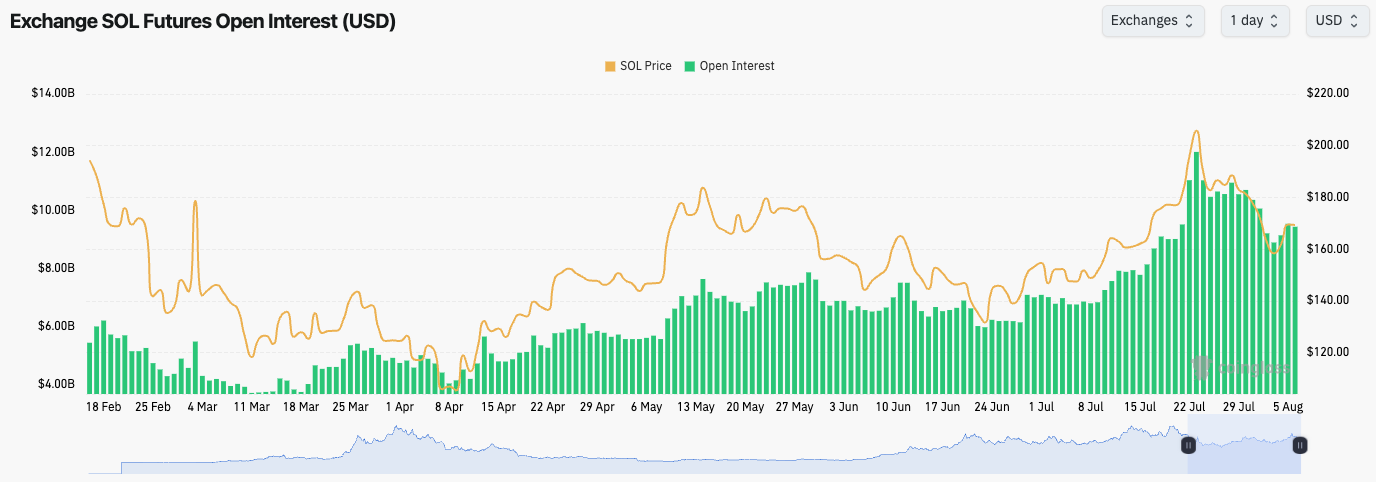

SOL:

- SOL's Open Interest is down substantially from the all-time highs, whilst Funding Rates are fluctuating between slightly positive and slightly negative territory.

- This is a cleansing of the leverage market, although positioning remains mixed, as highlighted in the Funding Rate.

Technical analysis

- SOL broke below its horizontal support of $185 and its uptrend line, which resulted in a more meaningful pullback for price.

- Price found support between $154 and $165, and price is now bouncing, although we expect it to be a relief rally for now.

- Price is now above $165, so that's positive and suggests that this can be more than just a relief rally. $180-$185 will be the next resistance zone for price.

- The RSI is in middle territory, however it's moving up to its moving average that may now act as resistance.

- Should price pullback again (we expect it will), then the main support is at $144, up to $155. We'd be strong buyers of SOL in this range.

- Below $144, there are heavy supports down to $120, with $134 being a key mid-range support. Should price fall below $144 and enter the $120-$144 range, we'd be aggressive buyers of SOL for the long-term.

Cryptonary's take

SOL has broken below its main uptrend line, with price now putting in a relief rally after locally bottoming at $155. Our expectation is that the next few weeks might be choppier for risk assets and therefore SOL can pullback and revisit the $144-$165 range. Should price pull back to that range, we'd be looking to buy SOL between $144-$155, and we'll bid aggressively should price fall below $144, with a view to holding these positions for the next 12 months.- Next Support: $155

- Next Resistance: $185

- Direction: Bearish/Neutral

- Upside Target: $185

- Downside Target: $144

HYPE:

- Price was unable to breakout of the horizontal resistance of $45.80, and once price lost its uptrend line, a more meaningful pullback took place.

- Price then swiftly moved lower, breaking through the $39.40 horizontal support, before price found support at the $36.50 horizontal level.

- Price has bounced from $36.50, although the chart is now forming a bear flag structure, which would usually have a bearish breakdown bias.

- Should price breakdown again, and lose the $36.50 level, then it’s possible price moves down to our major buy zone (Yellow box) between $28.10-$32.40.

- The RSI is just about in middle territory with it now running into its moving average, so the RSI and price both line up for price to reject into $39.40 here.

Cryptonary's take

HYPE is forming a bearish structure with the bear flag. We're expecting price to reject into the $39.40 area, and for price to then revisit below $36.50 in the coming 1-2 weeks. Should price fall below $36.50, and down to $32,40, we'd become buyers of HYPE with a view to holding the position for 12 months. And should price fall into our Yellow Buy Box between $28.10 and $32.40, we'd be aggressive buyers of HYPE for the long-term.

- Next Support: $36.50

- Next Resistance: $39.40-$40.00

- Direction: Bearish

- Upside Target: $42.00

- Downside Target: $32.40

AURA:

- Price is still in the 'Cup-and-Handle' structure which was saved following the wick down to $0.12. However, the swift recovery and reclaim of $0.148, has maintained the 'Cup-and-Handle' structure.

- $0.148 was a previous horizontal resistance. Price has now used this level as support. This is an important support for price to maintain.

- Above $0.148, the horizontal resistance is at $0.177, this is a key level to reclaim, and it would open the door to further upside.

- Price looks good here having found support at $0.148 and having broken out of its downtrend line. The next key move for price will be a reclaim of $0.177, that would then open the door to a move back to $0.214.

- Whilst the 'Cup-and-Handle' pattern is still valid, a breakout of $0.245 would be the signal of the pattern breakout. This would then have an upside target of $0.35-$0.40.

- The RSI has reset and it's in middle territory. This is a positive development, and it's needed for price to see further upside.

Cryptonary's take

AURA still forms a bullish 'Cup-and-Handle' structure, which would have a breakout target of $0.35-$0.40 should $0.245 be breached. Whilst it's possible that the Majors chop in a range for the upcoming weeks, that doesn't mean other plays can't run, in fact, when Majors chop, that's when we see pockets of out-performance. We expect AURA to breakout to the upside in the coming weeks, and for $0.35-$0.40 to be swiftly achieved. Price will then either consolidate, or AURA will have achieved escape velocity, and it'll quickly reprice to $0.70-$1.00 matching the other 'Major Meme's' MCaps. It is our view that this will eventually happen. We expect AURA to be the next multi-billion $ memecoin.

- Next Support: $0.148

- Next Resistance: $0.177

- Direction: Bullish

- Upside Target: $0.245

- Downside Target: $0.12

Closing thoughts

Last week was a hectic week on the macro front with markets being whip-sawed by the news. Overall, we were pretty spot on with our calls and in particular calling for the pullback. Whilst we're expecting a choppy next few weeks, we'll also be using these weeks to add to our positions in preparation for September into the end of the year, which we expect to be very positive for markets.Our Suggestion: should we see some downside over the next few weeks (I'm not expecting tonnes, but I am expecting some), it's an opportunity to accumulate. On the days where prices are red, and Crypto Twitter is fearful, become comfortable deploying capital (buying) into that. It's the right approach and will reap big dividends come year end.

Stay disciplined, and unemotional with your buys.

Let's Go!!!