We've seen prices pull back but most plays have pulled back to their buy zones, or just above, so we're maintaining a proactive stance and looking to accumulate coins into their buy/support zones that we've mentioned above.

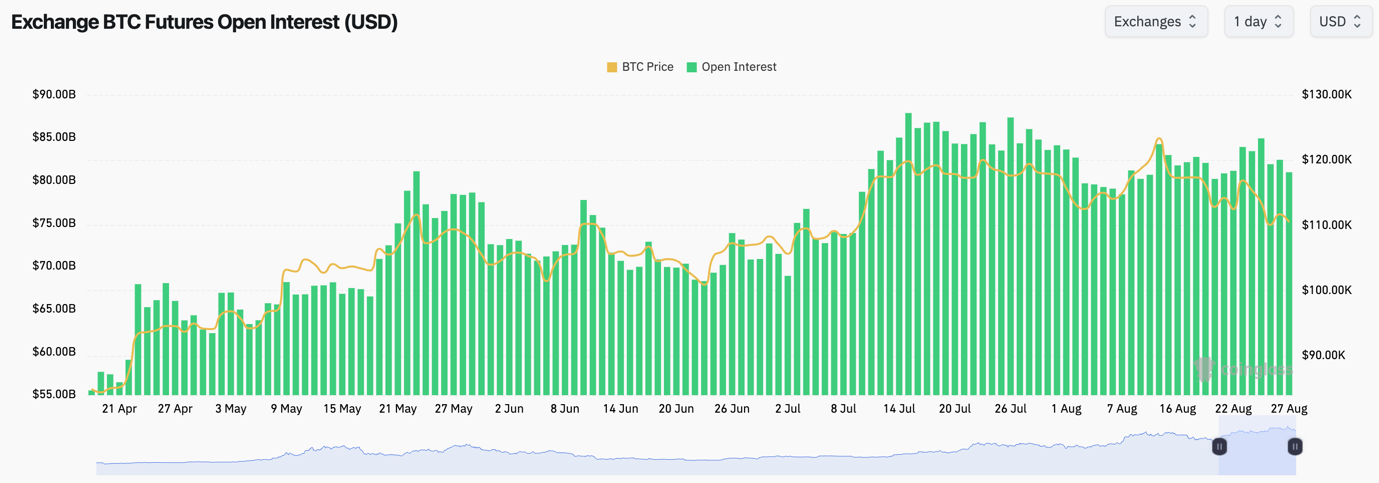

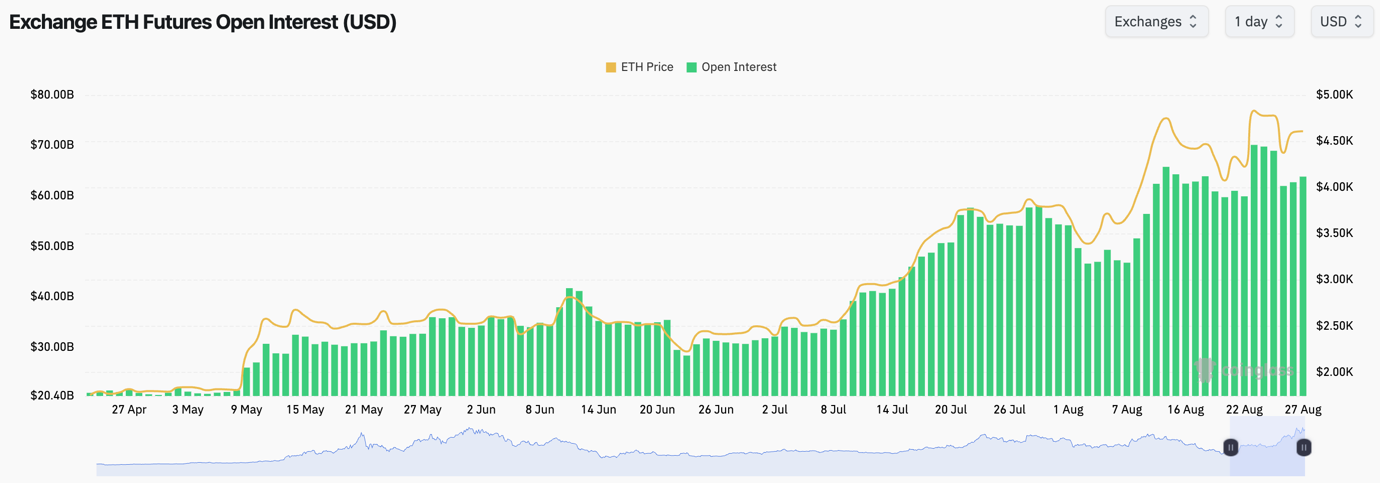

BTC seems to be in a consolidation period, potentially even ETH looks to start to be doing the same here also. But, that has given way to others (HYPE and SOL) to start moving, which we believe we've begun to see.

PS - Nvidia Earnings out today. I will cover this in a Market Pulse later. Expectation is for good Earnings and positive guidance. This would help the market and risk assets to continue remaining buoyant.

LETS GO!!!