Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Consolidating below ATH; bull flag forming; watch for leverage flush.

- ETH: Up 50% in 2 weeks; overbought with high leverage risk.

- SOL: Broke key resistance; more upside possible, but frothy setup.

- HYPE: Range-bound; downside risk if $44 breaks.

- AURA: Bullish cup-and-handle forming; breakout toward $0.40 likely.

BTC:

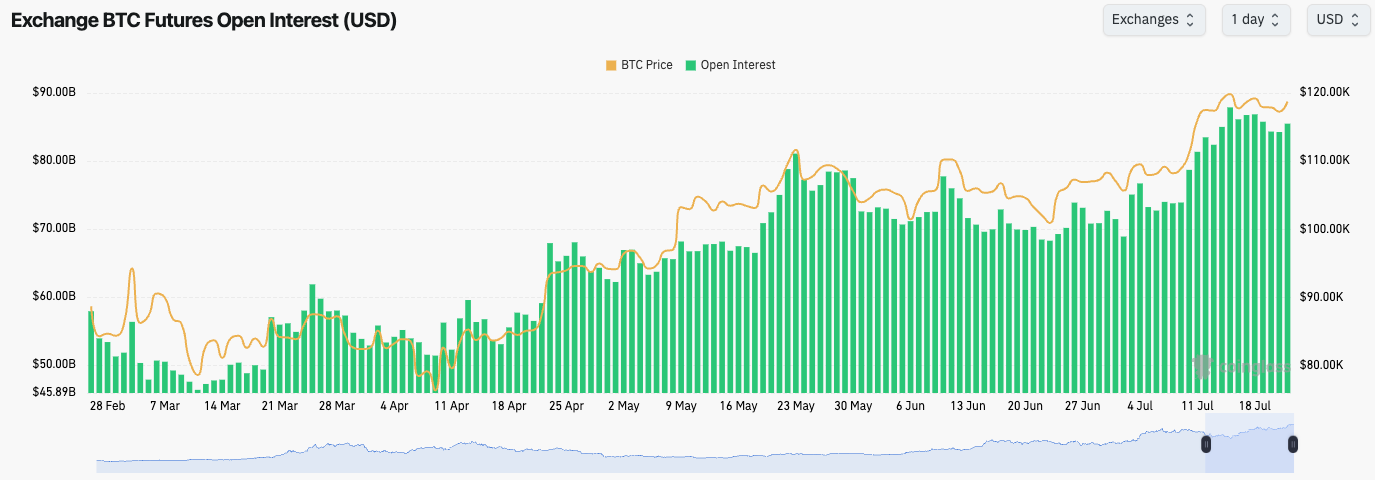

- Bitcoin's Open Interest has held at the highs, with little to no pull back yet as price has held at the highs also.

- The Funding Rate remains north of 0.01%, meaning that Longs are paying a premium to Shorts to be Long.

- The amount of leverage isn't majorly frothy yet, but it's moving that way. We're likely due for a flush out at some point in the short-term, meaning late Buys/Longs looking to get in now, would be vulnerable to that potential flush out.

Technical analysis

- BTC remains close to the all-time highs and consolidating just beneath them.

- Price is seemingly forming the bull flag pattern as we expected it might, we just needed more time for price to develop and for the structure to form.

- A bull flag breakout would have an upside target of $130k.

- To the upside, the main horizontal resistance is at the all-time high of $123,000. Another resistance, although not a heavy one, is the top border of the bull flag.

- Should price break down and invalidate the bull flag (although not our base case), the support zone remains between $112k-$115k. We'd be aggressive buyers should BTC revisit this zone.

- With price consolidating just below all-time highs, this has allowed the RSI time to reset, with it now pulling back below overbought territory and it's below its moving average. This is a healthy reset so far.

Cryptonary's take

BTC is forming the structure we anticipated, consolidating beneath ATH with a healthy RSI reset. A breakout above $123k would target $130k. We're cautious of the leverage side becoming too overheated and frothy and therefore a potential leverage flush out occurring, but aside from this, BTC is forming a healthy structure. Should a pullback/flush out occur, we'd expect the price to retest $112k-$115k. Should the price retest this level, we'd look to add to our BTC Spot bags, with a view to holding for the next 12 months.- Next Support: $115k

- Next Resistance: $123k

- Direction: Neutral/Bullish

- Upside Target: $130k

- Downside Target: $112k

ETH:

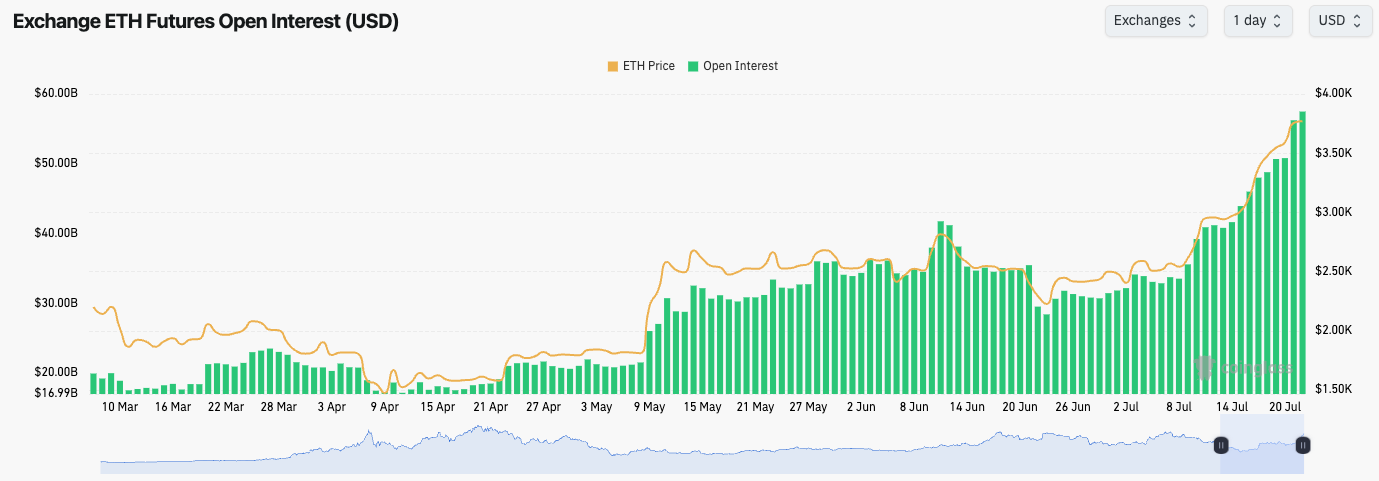

- ETH's Open Interest has remained at very elevated levels, with the Funding Rate now also at high levels (0.017%), indicating that Longs are paying a significant premium to Shorts to be Long.

- ETH's leverage setup suggests that a leverage flush out is possible in the near-term.

- Should a leverage flush out produce a substantial pull back in price, we'd be buyers of ETH upon a significant price pull back.

Technical analysis

- ETH has broken above all horizontal resistances, with the $3,970 resistance now just 5% away. This is a significant long-term horizontal resistance.

- ETH has essentially been straight up with the price now up 50% in 2 weeks.

- ETH's RSI is in overbought territory, and at very lofty levels. This is the most overbought ETH's RSI has been since January 2021. This would suggest caution should be had in terms of buys/Longs at the current price.

- Should ETH pull back, $3,480 is the next major horizontal support, with there being strong support down to $3,280.

- A local support for ETH is at $3,630.

Cryptonary's take

ETH has had a monumental run in a short timeframe, and the indicators (such as the RSI) suggest that ETH is very overbought. We'd suggest caution in the short-term in terms of adding to Longs or Buys of ETH at the current prices. Leverage remains high, and Longs have chased the price higher. This increases the probability of a leverage flush out, which would see price put in a meaningful pull back. Should price pull back, $3,630 is a local support, however, we wouldn't be interested in adding to our long-term ETH position unless price were to dip back to the $3,280-$3,480 range.- Next Support: $3,480

- Next Resistance: $3,970

- Direction: Neutral

- Upside Target: $3,970

- Downside Target: $3,280

SOL:

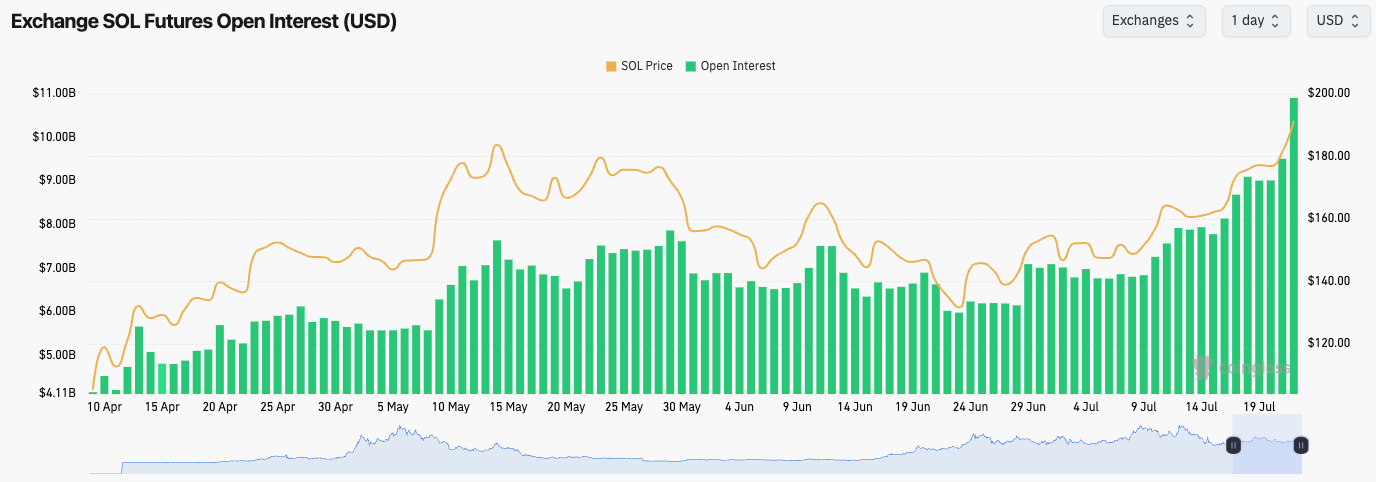

- SOL's Open Interest is at all-time highs, whilst the Funding Rate is at highly elevated levels (0.03%). This suggests that Longs are chasing prices higher, and leverage flush out (price down) is increasingly likely.

Technical analysis

- SOL was running into two key horizontal resistances; first at $165 and then at $185.

- Today, the price has broken above $185. We'll need to see a convincing Daily candle closure above $185 to cement the breakout.

- To the upside now, the next horizontal resistances are at $203 and $222. Should the price break upwards beyond those levels, then there's clear room up to $260.

- Should price pull back, the horizontal levels of support are at $185 and $165.

- The RSI is now very overbought, and with previous instances having seen pull backs.

Cryptonary's take

SOL has broken out of its key horizontal resistances later than the rest (BTC and ETH). It is possible that SOL continues to run higher here in the immediate term to the resistance range of $203-$222. However, with the leverage setup beginning to look frothy, we'd be looking to be more cautious here in the short-term. This doesn't mean we'd be looking to sell Spot bags, but we wouldn't be looking to add Spot bags at this current price ($191) with the current leverage setup.Should there be a more meaningful pull back/flush out, then we'd look to add to our longer-term Spot bags. These levels would be between $155 and $165. This would be a sizeable pull back, but a pullback this magnitude isn't our base case currently.

- Next Support: $185

- Next Resistance: $203

- Direction: Neutral

- Upside Target: $222

- Downside Target: $165

HYPE:

- HYPE pulled back from the psychological resistance of $50.00, but price has managed to hold above its local uptrend line.

- Price bounced from the local support zone of $42-$44, which was the prior all-time high for HYPE.

- Price is essentially now range-bound between $44.00 and $50.00.

- Should we see a price break below $44.00, that would also be a breakdown of the uptrend line and price might pull back to $39.40 (the major horizontal support).

- If price were to pull back to the major support of $39.40, we'd be buyers of HYPE at that level, particularly those who are underexposed.

- The RSI showed back-to-back bearish divergences, increasing short-term downside risk.

Cryptonary's take

HYPE has consolidated just beneath its all-time highs with price holding above its local uptrend line. However, short-term momentum is potentially stalling, and with the other Majors consolidating, and potentially pulling back, this increases the likelihood for HYPE to see a more meaningful pull back. Should price break below the local uptrend line, then price might revisit the key horizontal support of $39.40. Should price pull back to that level, we'd be buyers of HYPE there.

- Next Support: $44.00

- Next Resistance: $50.00

- Direction: Bearish/Neutral

- Upside Target: $50.00

- Downside Target: $39.40

AURA:

- Note: we have previously analysed AURA from a 4hr chart timeframe, going forward we will analyse it from the Daily chart timeframe.

- Price managed to hold the $0.13 level which was a critical support for price. This allowed the price to move higher and reclaim horizontal resistances above.

- The key horizontal resistance to the upside was at $0.146. Price broke out of $0.146, and that allowed price to swiftly move up to the key psychological level of $0.20, with price comfortably crossing above $0.177 (another horizontal resistance).

- Price then consolidated between $0.20 and $0.214, before the price once again broke out to the upside.

- To the upside, the main horizontal resistance now is at $0.24, the all-time high.

- Price has formed the 'Cup-and-Handle' pattern as the early structure suggested it might. This formation is now playing out, with a breakout to the upside looking increasingly imminent.

- A 'Cup-and-Handle' upside breakout target would be $0.35-$0.40.

Cryptonary's take

AURA went through the typical pattern of retracing 65% and shaking out the weak holders. Price was then able to form a base between $0.08 and $0.11 which then then setup the 'Cup-and-Handle' pattern. Price is now completing the right side of the cup, with structure leaning toward an imminent breakout. The upside target would be $0.35 to $0.40. It is possible that the price consolidates in the immediate term between $0.20 and $0.24. However, the candle structure is leaning more towards an imminent break out to the upside.

- Next Support: $0.214

- Next Resistance: $0.240

- Direction: Bullish

- Upside Target: $0.40

- Downside Target: $0.20

Closing words

Another Market Direction will come on Friday, with a Market Update on Wednesday.This week is a quieter week on the macro front, so it's possible we see a continuation of the grind higher for prices. Next week is more jam-packed from a macro perspective. We have important data plus a FED meeting, so there are more hurdles next week for prices.

Overall, prices can continue to grind up here, but we wouldn't suggest adding to positions at current prices, as the leverage setups do look quite overheated. Best to wait for flush outs/pullbacks to add to long-term bags.

Let's Go!!!