Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Holding $116.6k–$120.1k range; breakout $130k, breakdown $112k.

- ETH: Strong above $4k, eyeing $5k; support at $4.3k.

- SOL: Ranging $185–$203; upside $222, downside $155.

- HYPE: Needs $50 breakout for $60–$70; support $43–$46.

- AURA: Bullish above $0.148; targets $0.245 if $0.177–$0.186 reclaimed.

BTC:

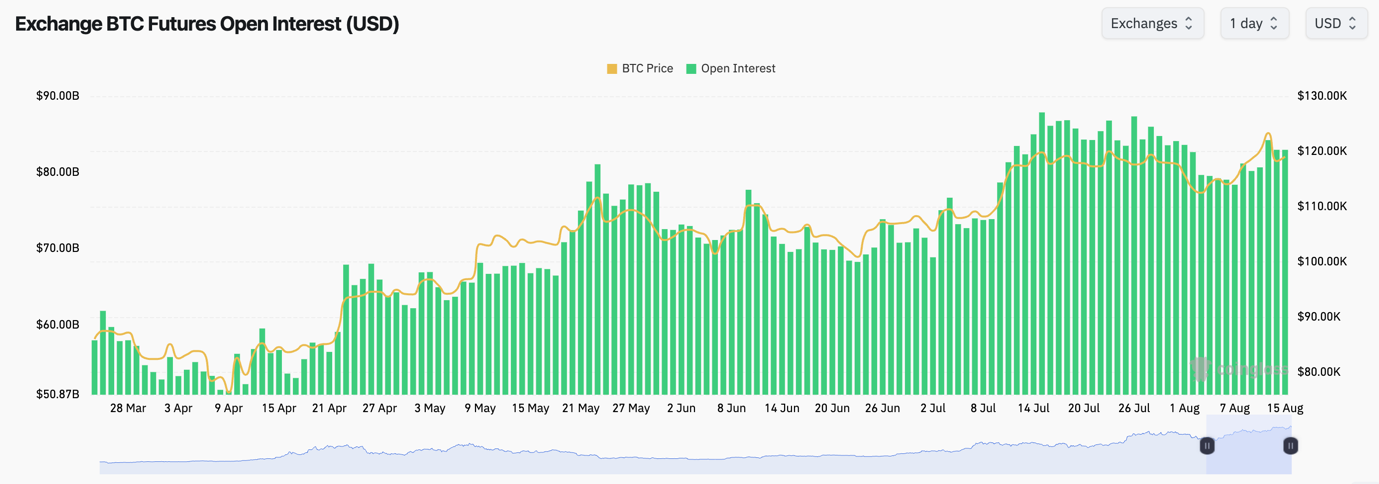

- BTC has seen a 4-5% drawdown in its Open Interest, which isn't too much considering the price drawdown we saw yesterday when the price pulled down from $123k into the $117k's.

- BTC's Funding Rate has dropped slightly, but only back to 0.01% (having been at 0.0135%).

- Yesterday's drawdown was mostly due to Spot selling due to hotter-than-expected PPI data, rather than a leverage flush out, although we did see some leverage come off.

Technical analysis

- BTC broke out of the horizontal resistance at $120,100, but the price pulled back on the same day upon hotter-than-expected PPI data.

- Price broke back below $120,100, but found support at $116,900, which is the key horizontal support.

- BTC remains in its uptrend, but price is squeezing toward the downtrend line without seeing the upside we thought we might see this week.

- The key support for price to hold is $116,600, but should the price break below that level, then we'd expect a retest of $112,000. The $112,000 zone would be a long-term buying opportunity for us.

- Upon the price breakout of $120,100, the RSI pushed close to overbought territory, but the RSI pulled back substantially on the price pullback, and it has now reset to a neutral level.

Cryptonary's take

BTC has undergone substantial volatility in the last 48 hours, with price breaking out of its range highs of $120,100 but immediately pulling back and breaking back below them upon the hotter than expected PPI data. BTC has now returned to $116,600-$120,100, with the next break of the range likely being a key move.We expect the market to digest yesterday's hotter PPI print and for the market to begin moving back higher. However, today's price action will be key in determining this. Therefore, we'd be buyers of a BTC breakout of $120,100 (but more for a trade rather than adding for a long-term Spot position), or we'd wait for a breakdown to $112,000, where we'd look for long-term Spot entries.

It's tricky to know how the market will digest yesterday's PPI print, although a September cut is still baked in and therefore we expect a constructive environment to remain.

- Next Support: $116,600

- Next Resistance: $120,100

- Direction: Neutral

- Upside Target: $130,000

- Downside Target: $112,000

What's next?

ETH’s $4,760 resistance and SOL’s $203 ceiling are key battlegrounds. Watch for HYPE’s $50 breakout for the real momentum shift and AURA holding $0.148 for bullish confirmation.ETH:

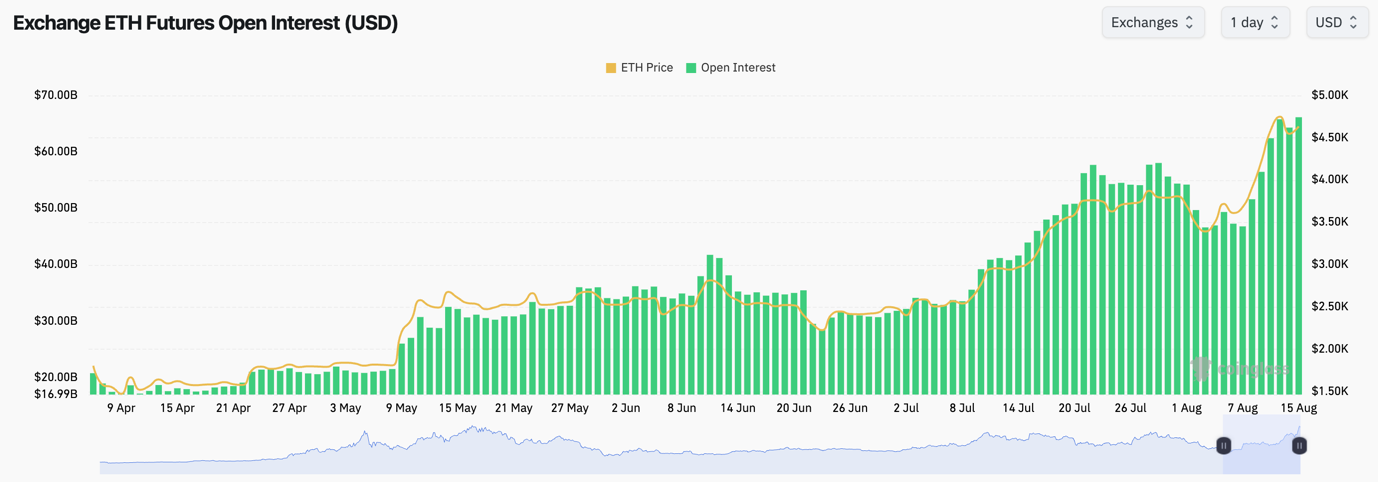

- ETH's Open Interest pulled back by 8-9% on yesterday's hotter PPI print, although bouncing back today, but the price was swiftly supported by a meaningful Spot bid.

- The Funding Rate remained relatively consistent at 0.01% which suggests that there weren't too many over-levered Longs that needed to be flushed out.

Technical analysis

- ETH broke out of $4,000, and the price swiftly pushed onto $4,750, as the chart structure suggested it would.

- Price is now forming a bull flag at its highs, which would have a breakout target of $5,000.

- Should price pullback, we'd now expect the $4,300 level to be a support for price, with $4,000 being the major horizontal support, which we don't expect to even be retested.

- To the upside, the local horizontal resistance is the recent high of $4,760.

- The RSI has formed back-to-back bearish divergences (higher highs in price, and lower highs on the oscillator) in overbought territory. This is one concern for us, but for now, the RSI is above its moving average, and it is using it as support.

Cryptonary's take

ETH has broken out above a long-term horizontal resistance of $4,000, and price has quickly re-rated substantially higher upon this break out. With ETH, and ETH Treasury companies now dominating the narrative, there is going to be an underlying bid for ETH at least over the near-term. We therefore expect pullbacks to be shallow, and we'd consider adding on more meaningful pullbacks.In terms of a pullback range for now, we'd be targeting $4,000-$4,300, but again for shorter term Spot trades (i.e., a trade from $4,200 into $5,000 for instance), rather than outright Spot buying. The optimal time for Spot buying was back between $2,200 and $2,450 when we were very vocal about our buys.

- Next Support: $4,300

- Next Resistance: $4,760

- Direction: Neutral/Bullish

- Upside Target: $5,000

- Downside Target: $4,000

SOL:

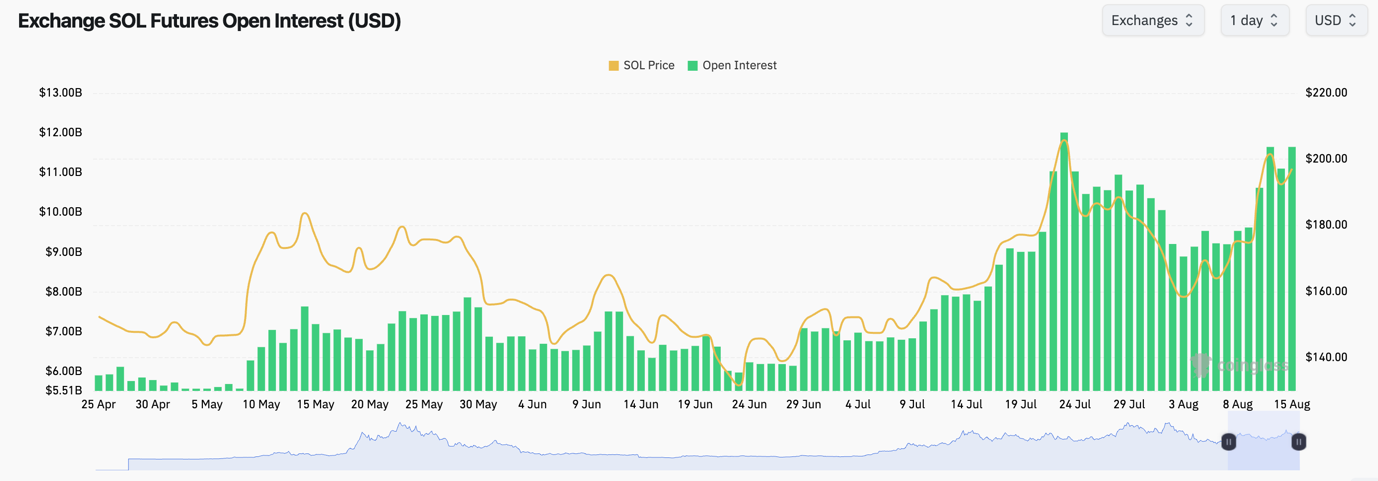

- SOL's Open Interest pulled back by approximately 7%, whilst the Funding Rate pulled back from 0.0145% to 0.008%. Open Interest has bounced back slightly today.

- The above is more representative of a small leverage flush out, although not an extreme one.

- On yesterday's price pullback, a Spot bid came in which supported price in the high $180's, although we've seen the Spot bid diminish slightly today, but this is normal and not a concern.

Technical analysis

- SOL briefly breached above the major horizontal resistance of $203 with price also reclaiming back above the uptrend line.

- Unfortunately, upon the hot PPI data, price rejected from $203 and pulled back below its uptrend line, with price eventually finding support at the local horizontal support of $185.

- Price is now likely to remain range-bound between $185 and $203 for the coming days as the market digests yesterday’s PPI print.

- Should price break below $185, we'd expect price to find strong support between $155 and $165. But for now, we expect $185 to hold.

- To the upside, should price break out above $203, $222 is the next major horizontal resistance. Should ETH continue higher (we expect it will), then we'd expect SOL to also move higher in the form of a 'catch-up' trade.

- The RSI is up trending and in the middle territory for now. If the price remains range-bound for more days, that'll allow the RSI more time to consolidate, which would aid a bullish setup.

Cryptonary's take

For now, SOL has been rejected from the key level of $203, with price likely remaining range-bound between $185-$203 for more days. We remain of a bullish bias, although it's possible we see other coins (ETH, HYPE, etc) outperform SOL over the coming week, unless SOL can become the "catch-up" trade should ETH get too overheated.We would look to add SOL buys below $185, should we be given it, down to $155. However, we wouldn't look to chase price above $185, and we'd just hold our Spot positions for now.

- Next Support: $155

- Next Resistance: $203

- Direction: Neutral

- Upside Target: $222

- Downside Target: $155

HYPE:

- HYPE found support between $36.50-$39.40, with price breaking out of the $39.40 horizontal resistance.

- Price then broke out of the local downtrend line and formed a bull flag above the downtrend line, but below the horizontal resistance of $45.80.

- Price has broken out above the horizontal resistance of $45.80, with price now retesting the underside of the uptrend line. However this may also act as resistance.

- Should price pullback, there is support at $45.80, and then below that, a key support level is $43.20. We'd be buyers of HYPE should it pull back to that level.

- To the upside, the major horizontal resistance is at $49.80 (the all-time high), and then the psychological level of $50.00.

- Should price breakout above $50.00, we'd expect a meaningful move higher into $60.00, and possibly even into $70.00 in the weeks that follow.

- The RSI remains in a broader downtrend with it now approaching its main downtrend line. It's also just above middle territory but still some way away from being overbought.

Cryptonary's take

HYPE is one of the plays we'd continually look to accumulate on dips with a view to selling the position in 6-12 month’s time well north of $80.00.HYPE is currently at a critical level where it is battling to stay above its horizontal support of $45.80, but price will need more substantial momentum to meaningfully break out of $50.00 that would then send price onto $60.00-$70.00.

For now, we remain dip buyers, and we'd be looking to accumulate should price dip below $43.20.

- Next Support: $45.80

- Next Resistance: $49.80

- Direction: Neutral/Bullish

- Upside Target: $60.00

- Downside Target: $43.20

AURA:

- AURA broke out of its downtrend line and the horizontal resistance of $0.177, although price rejected into the local resistance of $0.186 (a new level that recently become more prominent).

- Price was not able to hold above $0.177 in the short-term and price has pulled back to the key horizontal support of $0.148 which has established itself as a strong support.

- Should the $0.148 level be lost, then $0.116 would become the key support, however, it isn't our base case that price will lose the $0.148 support.

- Should price reclaim the $0.177 and then $0.186 resistances, then price will likely swiftly reprice to $0.245.

- For now, price is still holding the 'Cup-and-Handle' chart structure, although price would need to hold above $0.148 for this to remain intact.

- The RSI has meaningfully reset now, so this indicator isn't a concern.

Cryptonary's take

AURA has consolidated and held a bullish structure (the 'Cup-and-Handle') for two months now, which is a positive development in that it proves its staying power. However, AURA will need to begin moving higher and to reclaim the two key horizontal resistances (at $0.177 and $0.186) if it's to see meaningful upside in the coming weeks and months. Whilst the 'Cup-and-Handle' pattern remains intact, we remain bullish short-term. However, should this pattern get invalidated then we'd expect a longer "chopsolidation" in the short-term.We remain bullish AURA and we expect this to eventually move into the multi-billion $ meme cohort of coins.

- Next Support: $0.148

- Next Resistance: $0.177

- Direction: Neutral/Bullish

- Upside Target: $0.245

- Downside Target: $0.116

Closing thoughts

We're in a tricky short-term period following the hotter PPI print that came out yesterday. It'll be important now to see how the market responds to this print, and we might not know the true reaction until we're into a few more trading days of next week.We continue to monitor our positioning, and assessing all areas of the market. We remain constructive and still believe that we're in a dip-buyers market.

Stay vigilant, but positioned, with the view to buying any meaningful pull backs that we might be given.

Let's Go!