Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:- BTC – Bearish structure; key resistance $112K, downside target $105K.

- ETH – Range-bound; support $4,300, resistance $4,500, potential $4,700.

- SOL – Uptrend intact; testing $215–$222, breakout could reach $250.

- HYPE – New ATHs; bullish toward $60 if above $49.

- AURA – Downtrend; must reclaim $0.116, risk down to $0.07.

BTC:

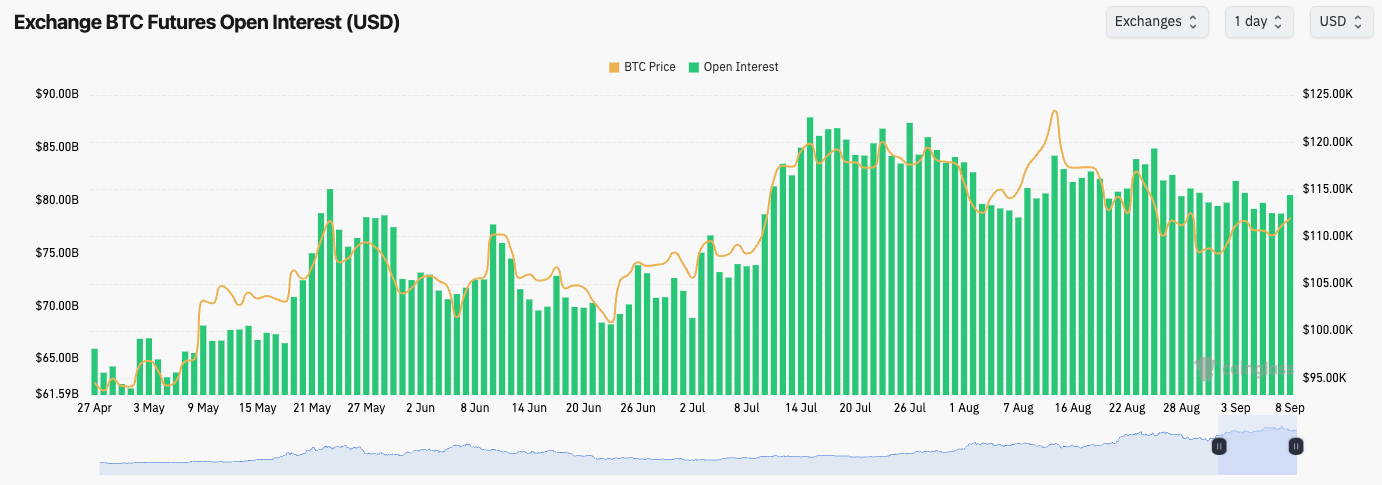

- Open Interest has been grinding lower despite staying at relatively elevated levels.

- In the last two days, we've seen an uptick in Open Interest with the Funding Rate rising substantially i.e., this price move up has been mostly driven by leveraged Longs.

Technical analysis

- Price pulled back and bottomed at the bottom of our Yellow Buy Box (between $108k-$112k, although we have now removed this box just to clear up the chart).

- Price has since broken out to the upside, breaking out of the downward sloping wedge.

- Price is now hitting the local resistance of $112,000, which is a key level for price to overcome in the immediate term.

- Should price clear above $112,000, that opens the door for a move back to the main resistance zone between $116,600-$117,100.

- Price is however forming a bear flag, which would have a breakdown target of $105,000.

- To the downside, the major supports are at $107,000 and $105,000. Below that, $101,000.

- The RSI is in middle territory, but tilting up and now above its moving average.

Cryptonary's take

Overall, price is in a downtrend and it's forming a bearish structure with the bear flag pattern, which would have a target of $105k. We would be strong buyers of BTC should price revisit the $101k-$105k range. An invalidation of the bear flag would be a breakout of $115k, with $112k the key level for price to flip in the immediate term.We remain of the view that Bitcoin is likely in a choppy period for the next 4-6 weeks as the markets digest weakening labour market data. We will look to be dip-buyers should BTC pull back and retest the $101k-$105k area, although for now, this isn't our base case that price will revisit this zone. Therefore, we remain holding Spot positions.

Buy Zone: $101k-$105k (we’re sceptical it hits, so we’d suggest maintaining positioning in current Spot bags).

- Next Support: $108,000

- Next Resistance: $112,000

- Direction: Neutral

- Upside Target: $117,000

- Downside Target: $105,000

What's next?

Major altcoins are coiling at breakout zones as BTC tests overhead resistance; watch for ETH to challenge $4,500 and SOL for a decisive move through $222 soon. Volatility incoming.ETH:

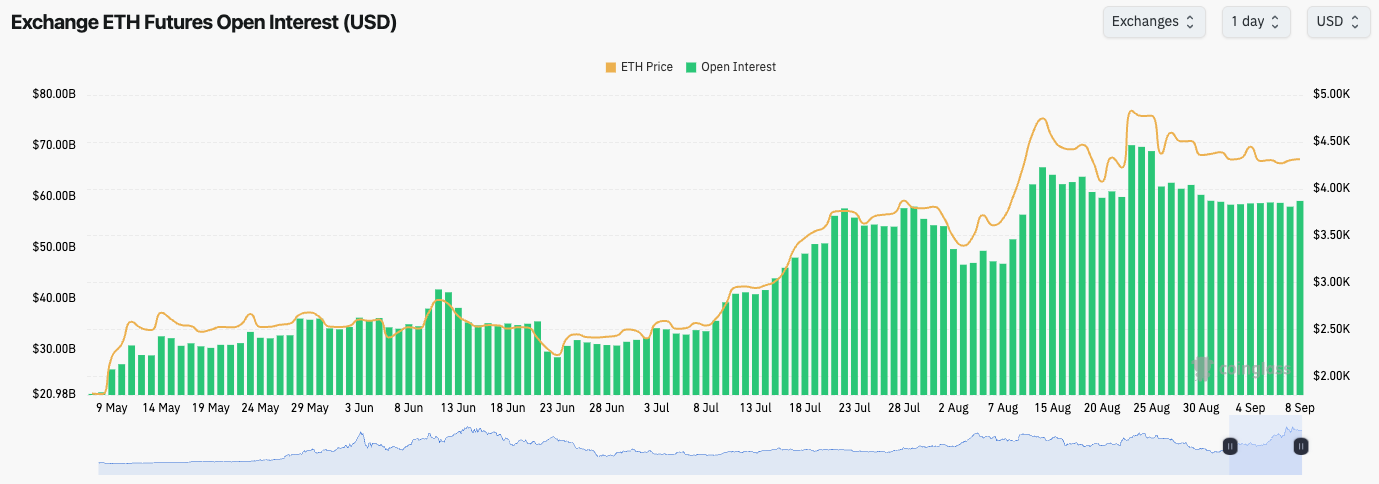

- ETH's Open Interest has pulled back in recent weeks although it remains at elevated levels.

- ETH's Funding Rate remains relatively flat, indicating that there isn't a directional bias amongst traders. This can be expected whilst price is range-bound.

Technical analysis

- ETH rejected into the major horizontal resistance of $4,780, and price has since been range-bound between $4,075-$4,780.

- Price has found a local support at $4,300, with the major support being at $3,970.

- To the upside, the local horizontal resistance is at $4,500, with the major level being at $4,780-$4,850.

- ETH is squeezing into its downtrend line. A breakout of the red downtrend line could send price back to $4,500 as a minimum target.

- The RSI has gone through a period of reset following the back-to-back bearish divergences. The RSI is now in middle territory, although it is still below its moving average.

Cryptonary's take

ETH has seemingly found support in the immediate term at the local level of $4,300, with price now squeezing into its downtrend line. We now expect a breakout for ETH up to $4,500, with the potential for price to reach $4,700, although we do remain sceptical of the higher target currently.In recent weeks, we rotated out of ETH and into other Majors which we felt had more upside (HYPE and SOL, both of which have outperformed). But should ETH revisit $3,600-$3,970 in the coming weeks, we'd look to increase our exposure to ETH again at that price zone.

Buy Zone: $3,600-$3,970 (again we’re sceptical it’ll hit, but should we get a flush, we’ll take it).

- Next Support: $4,300 (then $3,970)

- Next Resistance: $4,500

- Direction: Neutral/Bullish

- Upside Target: $4,500

- Downside Target: $3,970

SOL:

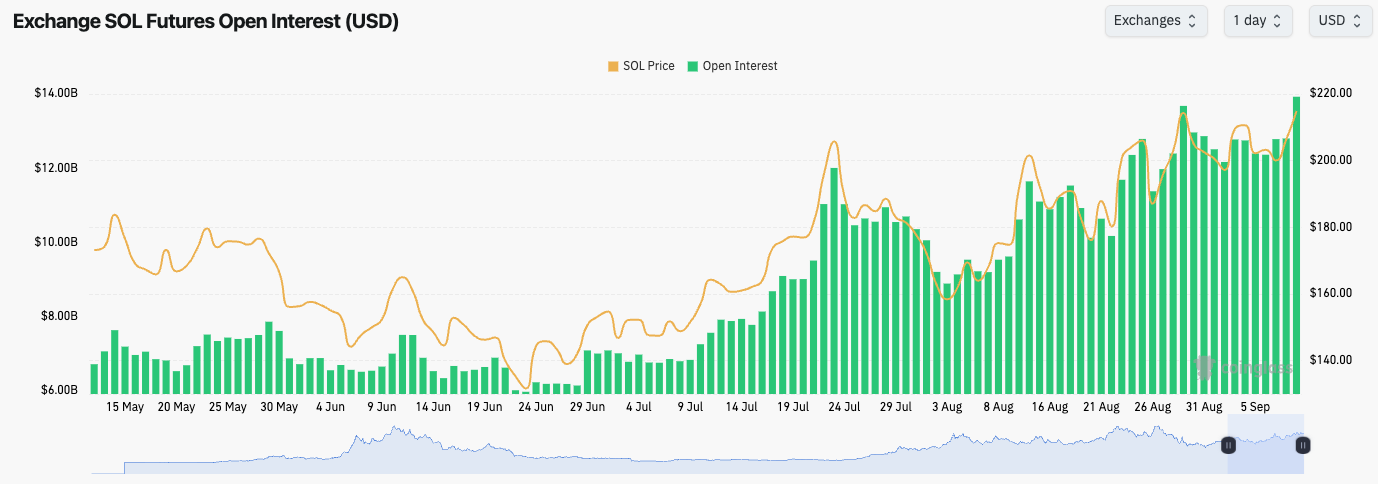

- SOL's Open Interest has increased today which has helped price push into the $215 area.

- SOL's Funding Rate is positive, but still in "normal" territory, indicating that there isn't yet signs of froth on the leverage side.

Technical analysis

- SOL has maintained its uptrend with price now climbing above its main horizontal resistance of $203.

- Price has now moved up and is close to the resistance zone of $215-$222. Should price clear this zone, then there would be more clear room for a move up to $260.

- To the downside now, we'd expect $200-$203 to be a strong area of support. Should that area be lost, then we'd expect $185 again.

- We remain bullish, unless we see a loss of $200 and the main uptrend line.

- The RSI has been range-bound in middle territory for some time now, with it now looking set to potentially breakout to the upside.

Cryptonary's take

SOL has outperformed recently with price holding the $180's well and now climbing up to the horizontal resistance of $222. Should price breakout of $222, and we expect it if markets continue to see the rate cuts as "good" rate cuts, then this opens the door for $250 in the medium term.Buy Zone: $172-$185

- Next Support: $200

- Next Resistance: $222

- Direction: Neutral/Bullish

- Upside Target: $250

- Downside Target: $185

HYPE:

- HYPE held its uptrend line, with price then consolidating above its horizontal line of $45.80, which has been a big level of support and resistance as price has chopped around in recent weeks.

- Price has now broken above $45.80 and then the next horizontal resistance of $49.00, which has led to new price all-time highs today.

- Should the breakout to the upside be sustained, then HYPE can run to $60.00. But we will need to see price consolidate above $49.00.

- The RSI is moving upwards, out of middle territory, breaking above its downtrend line. This is bullish for price, assuming it can be sustained.

- An invalidation would be a breakdown of $45.80, and a loss of the uptrend line.

Technical analysis

- Consolidation above support of $45.80 sets stage for upside if maintained.

- Breakout of $49.00 paves way for run to $60.00.

- RSI structure shows bullish bias so long as uptrend is sustained.

- Invalidation below $45.80 and trend line loss.

Cryptonary's take

HYPE has broken out to the upside with price now looking set to reach $60.00 in the short to medium-term. We remain holders of Spot HYPE positions, and we'd look to accumulate on dips should they come.Our expectation is that HYPE can continue its move higher here, but our view would be invalidated should price break back below $45.80.

Buy Zone: Retest of $45.80

- Next Support: $49.00

- Next Resistance: $55

- Direction: Bullish

- Upside Target: $60.00

- Downside Target: $45.80

AURA:

- AURA battled at its downtrend line and the horizontal resistance of $0.145, and despite price briefly breaking out, it couldn’t hold and sustain a breakout.

- Price has since lost the $0.145 horizontal level, and price has pulled back to the next major level of $0.116.

- Price is battling now at $0.116, with price having moved below that level and find support just north of $0.10.

- AURA is now running into the horizontal level of $0.116 and the main downtrend line. Should price be able to break out of the downtrend line, then that sets up an upside target of $0.145.

- Should the $0.098 horizontal support be lost, then we'd expect the next support to be at $0.07, which would be a 70% correction from the highs.

- The RSI is just shy of middle territory, but it's below its moving average.

Technical analysis

- AURA failed to sustain breakout above $0.145 and fell back sharply.

- Battling at $0.116 and main descending trend line; reclaiming is critical for upside.

- If $0.098 is lost, much deeper retrace to $0.07 expected.

- RSI still weak, no bullish momentum yet.

Cryptonary's take

AURA is in a clean downtrend, and should a breakout to the upside come, then we expect it to be violent. But to get that confidence in the short-term, we need to see horizontal levels be reclaimed and for price to build support on top of them. For us, that next key level is $0.116. Should price reclaim that, then a breakout of the downtrend line, targeting $0.145 is likely. This idea would be invalidated should we see a breakdown of $0.098.Long-term we remain optimistic and convicted in AURA that it can breakout of all-time highs and rival other multi-billion $ memes.

Buy Zone: $0.098-$0.116

- Next Support: $0.098

- Next Resistance: $0.116

- Direction: Neutral

- Upside Target: $0.145

- Downside Target: $0.07

Closing Thoughts

We remain positioned and we're beginning to see some breakouts with SOL and HYPE leading, whilst BTC and ETH remain range-bound, and AURA is holding its support and looking to breakout of its downtrend line.We're in for a big week with macro data on the horizon with the Inflation data being the big one on Thursday.