Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- BTC: Ranging between $110k–$116.6k after losing support; $110k–$112k is key buy zone.

- ETH: Rejected at $3,970; likely to revisit $3,280–$3,480 support.

- SOL: Broke trend; $144–$165 is expected consolidation zone.

- HYPE: Bearish; support at $36.50–$39.40, value zone below $36.50.

- AURA: Recovering; reclaim of $0.177 could trigger rally toward $0.214.

BTC:

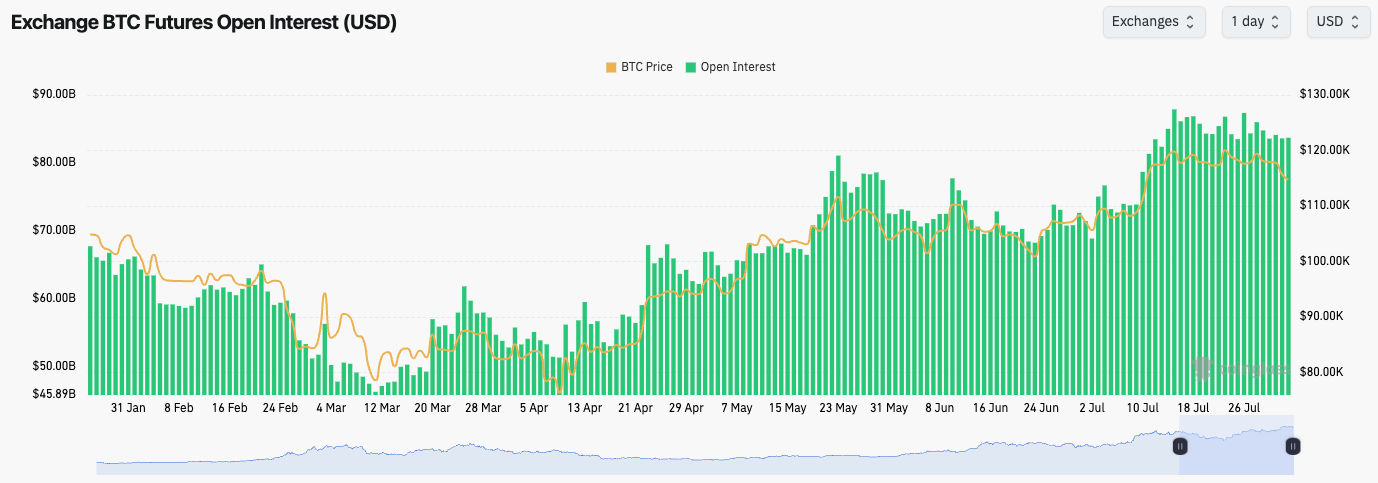

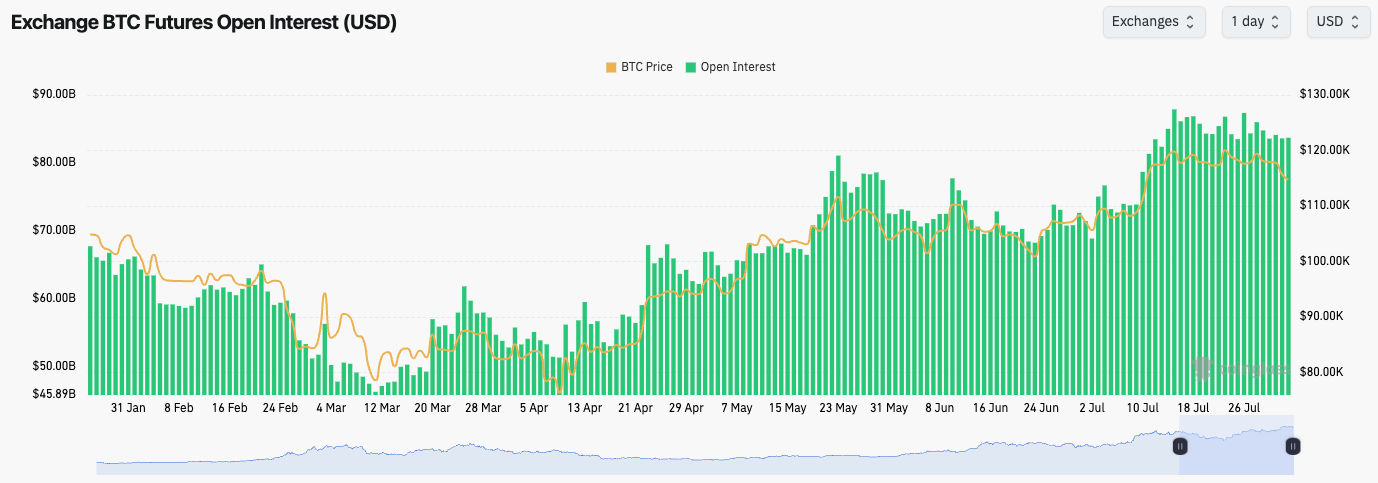

- Open Interest for BTC has stayed flat over the last few days, whilst Funding Rates remain positive, they have dropped.

- This slight resetting in Funding is a positive sign and a signal of a healthier market.

BTC's Open Interest (by USD value):

Technical analysis

- BTC has rejected into the horizontal resistance of $120,100.

- Previously, BTC had held the horizontal support of $116,600, however that level has now seemingly been lost today.

- Today, BTC will close a 3-day candle, should it close below $116,600, then this would suggest a period of pull back/consolidation over the coming weeks.

- BTC has now pulled back to $114,300, completely filling the CME gap that was previously put in.

- Should BTC pull back further, we expect the $110k-$112k range to be a strong level of support, and for prices to not fall below this level.

- This pull back has reset the RSI into neutral territory, a healthy development.

Cryptonary's take

Following a hawkish FED, risk assets have pulled back with BTC losing the $116,600 horizontal support. It's now likely that BTC ranges between $110k and $116,600 over the coming weeks. An invalidation of this would be a significant reclaim of $116,600. We'll look to take advantage of dips, with the $110k-$112k being the support zone that we'd really like to get Spot buys in. We expect that BTC will hold that support range, should price revisit it, which for now isn't our base case. For those looking for buying zones with a view to a long-term hold, the area we'd recommend would be between $112k-$115k.

- Next Support: $112,000

- Next Resistance: $116,600

- Direction: Neutral/Bearish

- Upside Target: $120,000

- Downside Target: $110k-$112k

What's next?

Every crypto asset on watch is retesting must-hold zones. ETH is sitting above $3,480 support, while SOL eyes $155. Don’t miss AURA and HYPE if key levels break—big opportunities ahead.

ETH:

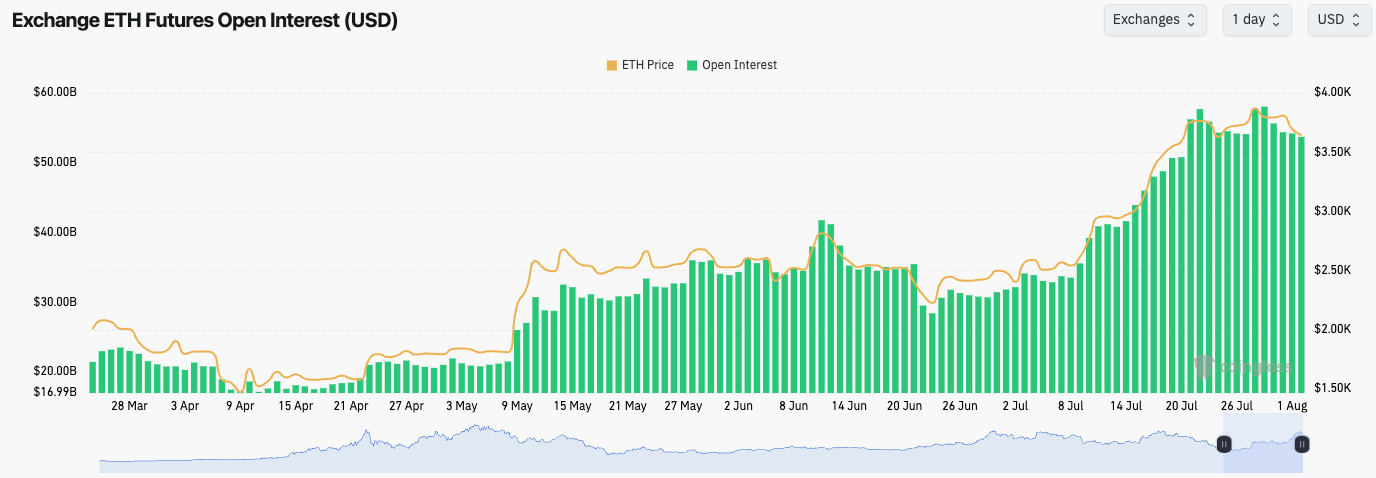

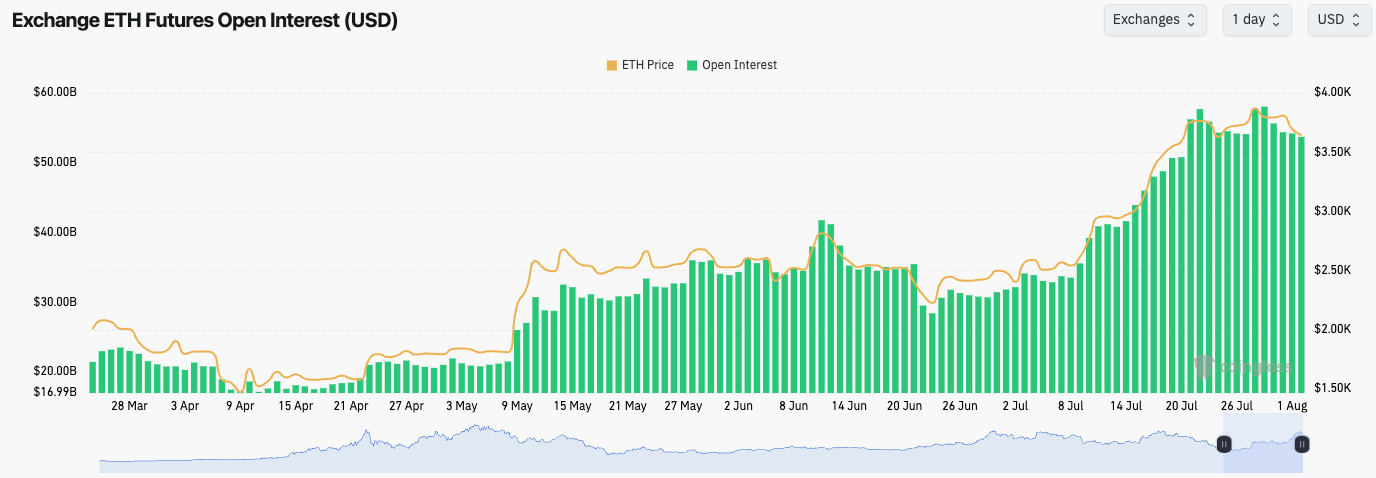

- ETH's Open Interest has remained high whilst the Funding Rate has popped back higher today, having down trended for the last week.

- This suggests that we saw a slight unwinding and resetting in positioning, despite Open Interest remaining at very elevated levels.

ETH's Open Interest (by USD value):

Technical analysis

- ETH broke out of the bull flag pattern and price pushed up to the major horizontal resistance of $3,970, where price then rejected.

- Price has since pulled back towards a local zone of support between $3,480 and $3,620. We're now looking at the horizontal level of $3,620 as a local level.

- This small pull back for price has allowed the RSI to reset a tad, coming back from overbought territory having previously been very overbought and having put in back-to-back bearish divergences.

- To the downside, lower horizontal supports sit at $3,280 and $3,480.

- To the upside, $3,970 is the resistance, but should the price break out above that, then $4,500 is the next level.

Cryptonary's take

Considering the move higher that ETH put in over the last month, it has held up very well around its highs. However, price has now pulled back slightly. ETH likely consolidates in the coming weeks, with $3,480 as our base case revisit zone. We'd look to re-add to our ETH bags should price revisit $3,280-$3,480 zone.

- Next Support: $3,480

- Next Resistance: $3,970

- Direction: Bearish

- Upside Target: $4,500

- Downside Target: $3,280-$3,480

SOL:

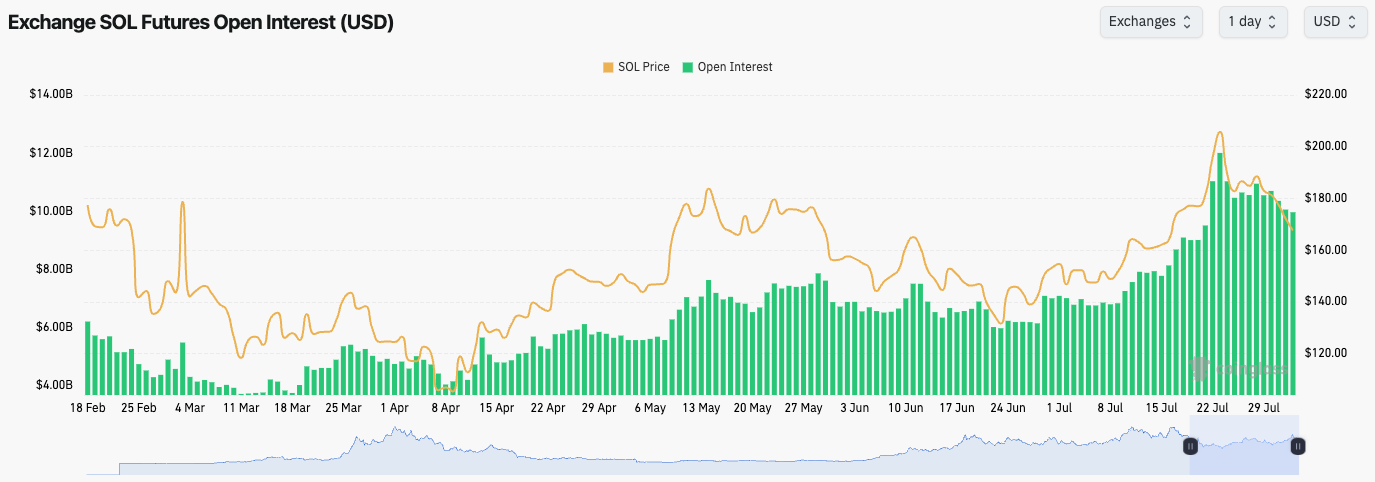

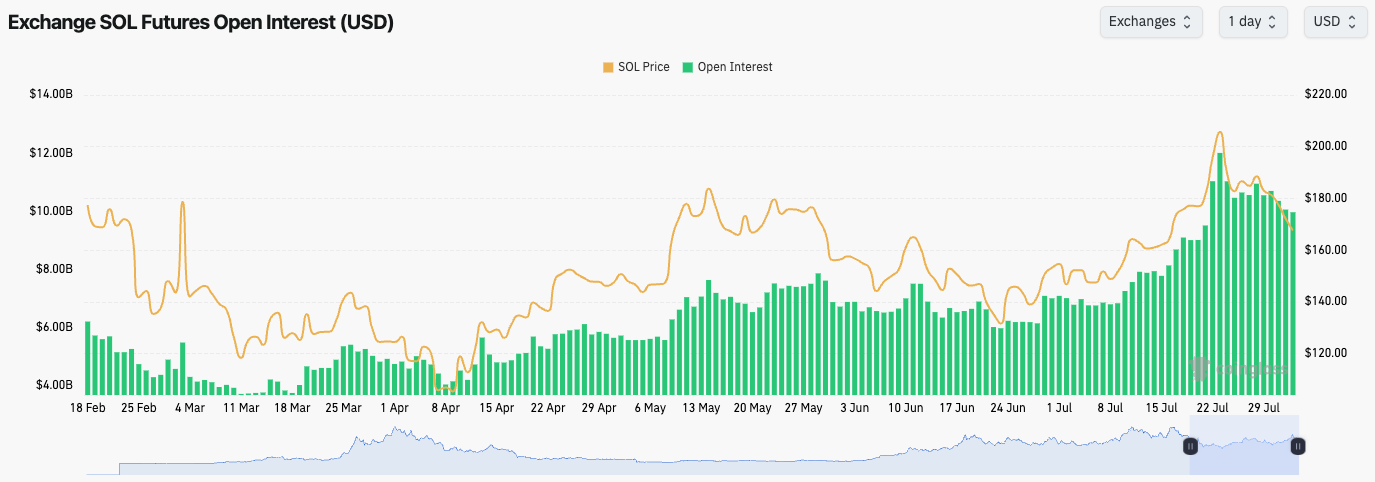

- When price rejected from the $203 horizontal resistance, Open Interest came down considerably in the days that followed. Since, SOL's Open Interest remained flat, and has ticked up slightly in the last day.

- The Funding Rate remains positive and just shy of the 0.01% level.

- SOL has perhaps the healthiest leverage setup amongst the Majors.

SOL's Open Interest (by USD value):

Technical analysis

- SOL rejected at the $203 horizontal resistance, and price pulled back to the horizontal level of $185, where price consolidated and stalled into the uptrend line.

- In the last few days, price has lost the uptrend line, and this has led to price breaking substantially lower.

- Price is now pulling back to the $154-$165 support zone. We'd expect to see prices find some support in this range in the short-term and go through a period of consolidation in this zone.

- Should the price break below $154, there are key horizontal supports at $144 and $134.

- On this price pull back, the RSI has meaningfully reset pulling back to the 40's. Just 10 days ago, this indicator was measuring as majorly overbought at 83.

Cryptonary's take

Price has pulled back from the $203 level and it's broken below a key uptrend line. Now that price is out of the main uptrend, it'll likely need a period of consolidation in a range of support (probably between $144 and $165). Should price fall below $155, we'd be buyers again of SOL for the long-term between $134-150. Price could hold above $144, but we view sub-$150 as value territory for long-term positioning.

- Next Support: $155

- Next Resistance: $185

- Direction: Bearish/Neutral

- Upside Target: $185

- Downside Target: $134-$144

HYPE:

- HYPE remained below its downtrend line, and the price struggled to break above the horizontal level of $45.80.

- As price moved sideways to downwards, it lost momentum, and then went on to lose its uptrend line.

- Price has since pulled back to the horizontal support of $39.40, and price is battling at that level, looking like it's potentially going to lose that level.

- Should price lose $39.40, there is a local support at $36.50, however the major zone of support is between $32.00-$33.00.

- Should price hold $39.40, and bounce, $45.80 is the key horizontal resistance for price to reclaim, however, we don't see this as likely in the short-term.

- On this move down, the RSI has pulled back to levels which are just slightly above oversold conditions.

HYPE's Open Interest (by USD value):

Technical analysis

- HYPE has pulled back from the highs and now looks to be putting in a more meaningful pull back having lost its uptrend line.

Cryptonary's take

HYPE has pulled back from the highs and now looks to be putting in a more meaningful pull back having lost its uptrend line. We expect HYPE to bottom in the mid-$30's. We'd look to add HYPE between $36.50-$39.40, but should the price fall below $36.50, we'd add HYPE more aggressively between $32.00-$36.50.

- Next Support: $39.40

- Next Resistance: $45.80

- Direction: Bearish/Neutral

- Upside Target: $45.80

- Downside Target: $32.00

AURA:

- Price pulled back from the all-time high of $0.24 and put in a meaningful correction that's typical of memes in terms of its magnitude.

- Price wicked down to $0.12 overnight due to a large seller, but price has recovered phenomenally having moved deep into value territory.

- Price has since recovered the key horizontal level of $0.148, but it remains below the horizontal level (now resistance) of $0.177. Should price reclaim $0.177, we'd consider this a very bullish signal.

- Price is now also grinding into the local downtrend line. Should price break out and reclaim $0.177, then $0.210 would be the next short-term price target.

- To the upside, the major horizontal resistances are at $0.214, and then $0.245.

- The RSI has reset to middle territory, which is positive, and needed.

AURA's Open Interest (by USD value):

Technical analysis

- AURA has recovered phenomenally with price now grinding into the downtrend line. Should price reclaim $0.177, we'd expect a swift move up to $0.214.

- Should the price dip back below $0.148 to $0.12, that would be a great value territory with a view to holding the position for the long-term. Our 6-to-12-month targets remain above $1.00, so even at current levels, AURA still offers strong value.

Cryptonary's take

AURA has recovered phenomenally with price now grinding into the downtrend line. Should price reclaim $0.177, we'd expect a swift move up to $0.214. Should the price dip back below $0.148 to $0.12, that would be a great value territory with a view to holding the position for the long-term. Our 6-to-12-month targets remain above $1.00, so even at current levels, AURA still offers strong value.

- Next Support: $0.148

- Next Resistance: $0.177

- Direction: Neutral/Bullish

- Upside Target: $0.214

- Downside Target: $0.12

Closing thoughts: