BTC, ETH, SOL, HYPE: Is this the bottom—or just another bull trap?

The calm before the storm? BTC faces resistance, ETH hovers at a key point, and SOL is on the verge of a breakout. Meanwhile, HYPE struggles at a critical level. As the market holds its breath, will these coins defy expectations or fall short?

The calm before the storm? BTC faces resistance, ETH hovers at a key point, and SOL is on the verge of a breakout. Meanwhile, HYPE struggles at a critical level. As the market holds its breath, will these coins defy expectations or fall short?

BTC:

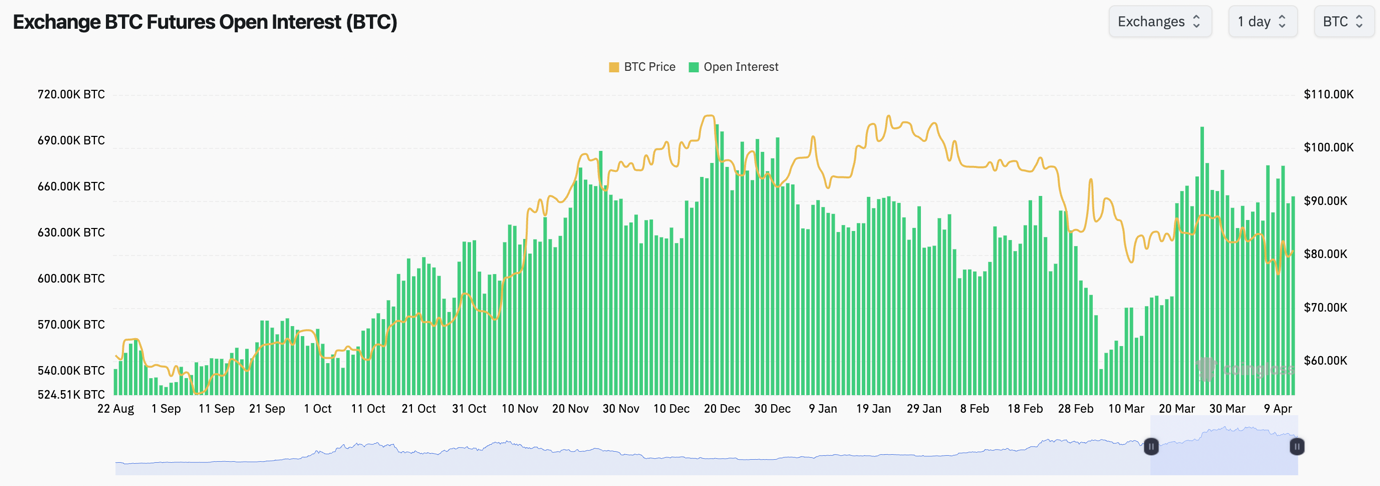

- BTC's Open Interest has remained slightly elevated over the last week or so, suggesting there is still some appetite for leverage exposure.

- Funding Rates are subdued and remain tight to 0.00%, with there being a slight negative skew currently, indicating that there is a small lean amongst traders to be Short.

Technical analysis

- Price moved down towards the top of the Green Buy Box, and price bounced from $74,700.

- Price then bounced into a new resistance zone that we have identified between $82,500 and $84,200. In our view, this is now the key level for price to reclaim.

- Price remains in its main downtrend, and we'll be closely watching for a breakout of this main downtrend line.

- In terms of downside, we expect $71,500 to $75,500 to be major support.

- The RSI broke out of its downtrend, and it's put in back-to-back bullish divergences (lower low in price, and higher low on the oscillator), whilst it's also above its moving average. We could see this reflected in helping prices go higher.

- Next Support: $74,700

- Next Resistance: $84,500

- Direction: Neutral/Bullish

- Upside Target: $87,000

- Downside Target: $74,700

Cryptonary's take

In the short term, price action is really hard to call here. If we had to call here, we could see the price pulling back slightly and then maybe moving up into the downtrend line and potentially pushing for a breakout. We've identified this with arrows on the chart.In terms of accumulating BTC, or playing this move, in all honesty, we're not too confident; it's extremely hard to call considering the whip-sawing price action we've been seeing lately as we constantly get the headline tennis playing out.

In the short term, we have low confidence. But, the game plan will be to accumulate in the Green Buy Box between $63,400 and $75,500, should we see retests, which we expect to see over the coming months.

What's next?

ETH is nearing a 4-month breakout. SOL and HYPE are both flashing back-to-back bullish divergences with major upside potential.ETH:

- ETH's Open Interest (by the number of coins) remains at highs. This is due to the coin's value going down substantially (reflected in higher OI by the number of ETH), but there is also still the appetite for funds to be taking advantage of the carry trade (Long Spot, Short Futures, and profit the Funding Rate).

- However, ETH's Funding Rate has recently flipped to being negative, as we can see below, suggesting there is more of an appetite amongst traders to be Short, but we might look to take the other side of this.

Technical analysis

- ETH has been in an aggressive downtrend now for 4 months, having reached extreme oversold levels, not seen since August 2024, and August 2023.

- Price is currently battling at the horizontal level of $1,530, whilst price is also squeezing into the local downtrend.

- The key level for price to reclaim to the upside is the $1,745 horizontal level. If this happens and the price can break out of the downtrend line, then $2,000 (psychological level) is the target.

- On Tuesday, the RSI went into extreme oversold levels. It has since bounced, and it's now pushing up against its downtrend line, whilst it's also got above its moving average.

- In terms of accumulation levels for ETH, we see ETH as being close to a bottom. We'd be accumulating for the long-term (maybe smaller sizing against HYPE SOL etc), between $1,230 and $1,550.

- Next Support: $1,230

- Next Resistance: $1,745

- Direction: Neutral/Bullish

- Upside Target: $2,160

- Downside Target: $1,230

Cryptonary's take

As we said, ETH has been in an aggressive downtrend for 4 months now, and it's down 65% from its highs. With us potentially beginning to turn on the macro front, it might be wise to begin turning from a bearish to a more bullish bias and to be looking to pick up longer-term Spot bags. For that, we'll be eyeing the range between $1,230 and $1,550.In the short-term, we think ETH might be good to attempt a breakout of its downtrend line here. However, the critical testing area will be $1,745, if ETH can reclaim that horizontal level, and then breakout of the downtrend line, $2,160 is the target.

SOL:

- SOL's Open Interest (by number of coins) remains very high.

- The Funding Rate is positive, meaning there is a slight bias amongst traders to be Long. We would also rather be Long SOL rather than Short here.

Technical analysis

- SOL broke down from the $120 horizontal support and swiftly moved down to the next horizontal support at $98.

- At $98, SOL put in back-to-back bullish divergences (lower lows in price, and higher lows on the oscillator). This could help fuel a move higher.

- The RSI is in a downtrend, but it's above its moving average, and also now with those back-to-back bullish divergences.

- Price is currently butting up against the underside of the horizontal resistance at $120, which also converges with the local downtrend line. If SOL can flip this level, then $140 to $147 is possible.

- To the downside, the horizontal supports are at $98 and $81. We'd be accumulating in that range should the price revisit there over the coming weeks.

- Next Support: $98

- Next Resistance: $120

- Direction: Neutral/Bullish

- Upside Target: $140

- Downside Target: $98

Cryptonary's take

In the short term, SOL could breakout to the upside here if it flips the $120 horizontal support and the downtrend line, although this is a tricky level to flip. We'll be watching the reaction at this price point very closely.In terms of long-term accumulation, we're eyeing $81 to $110. We'll look to accumulate in this range should the price retest this range, and we'll build positions over the coming weeks/months.

HYPE:

- HYPE broke below the major horizontal support of $12.00 and wicked into single digits. However, this was just a deviation (for now), and the price has bounced aggressively.

- Price put in a bullish divergence when it fell below $12.00 (new price low, but higher low on the oscillator). Price has since bounced, but it is now putting in a hidden bearish divergence (lower high in price, higher high on the oscillator). We should be slightly wary of this.

- Price is now above the $14.50 horizontal level, which is great; the next key level is $17.00. But, we do think this could be a stopping point for HYPE in the short-term.

- The key level for price to reclaim that would be a big indicator to us that price can go much higher is $18.50.

- If price revisits $10.00 to $12.00 (we expect it will), we'll begin building longer-term Spot bags.

- Next Support: $12.00

- Next Resistance: $17.00

- Direction: Neutral

- Upside Target: $18.50

- Downside Target: $10.00