BTC, ETH, SOL, HYPE — relief rally ending or just getting started?

The market is preparing for its next big move — and it could hit without warning. Bitcoin is nearing overbought conditions, ETH is coiling at downtrend resistance, and SOL’s open interest is spiking. In the background, liquidity is thinning. You need to see the setups before they explode.

BTC:

- BTC's Open Interest has pulled back slightly, but it still remains relatively high.

- Price was driven up by Spot buying and Shorts being squeezed, although we've now seen this reset.

- Funding rates are fluctuating but mostly remain flat.

Technical analysis

- As we found out yesterday, price was driven higher by large Spot buyers (Saylor being a big one), and Shorts being squeezed.

- Price has now remained at the bottom of the mid-level of the range at $95,700. The major range we're looking at now is the $91,700 support and the $98,900 horizontal resistance.

- If the $91,700 support is lost, we'd expect $90,000 to be a potential support as it's a psychological level; however, if that's broken, then $86,000 would be the target.

- To the upside, if the price can climb above $95,700, then $98,900 is the upside target.

- The RSI is now just shy of being overbought, with a bearish divergence now also having formed (higher high in price, lower high on the oscillator).

- Next Support: $91,700

- Next Resistance: $95,700

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $86,000

Cryptonary's take

Price has climbed higher in a really strong manner, although we'd have preferred that this wasn't somewhat due to Saylor bidding. Price is now close to being overbought, whilst putting in a bearish divergence, whilst also butting up into the horizontal resistance of $95,700.It's possible that price goes higher here, with $98,900 the likely complete top (should price go higher), however, we remain cautious here and we're expecting a pull back over the coming week, with a larger pull back coming in the medium term.

Whether the price local tops around $95k or $98k is hard to say, but we do believe a local top is close as the macro environment doesn't support BTC clearing above $100k and heading to all-time highs currently.

What's next?

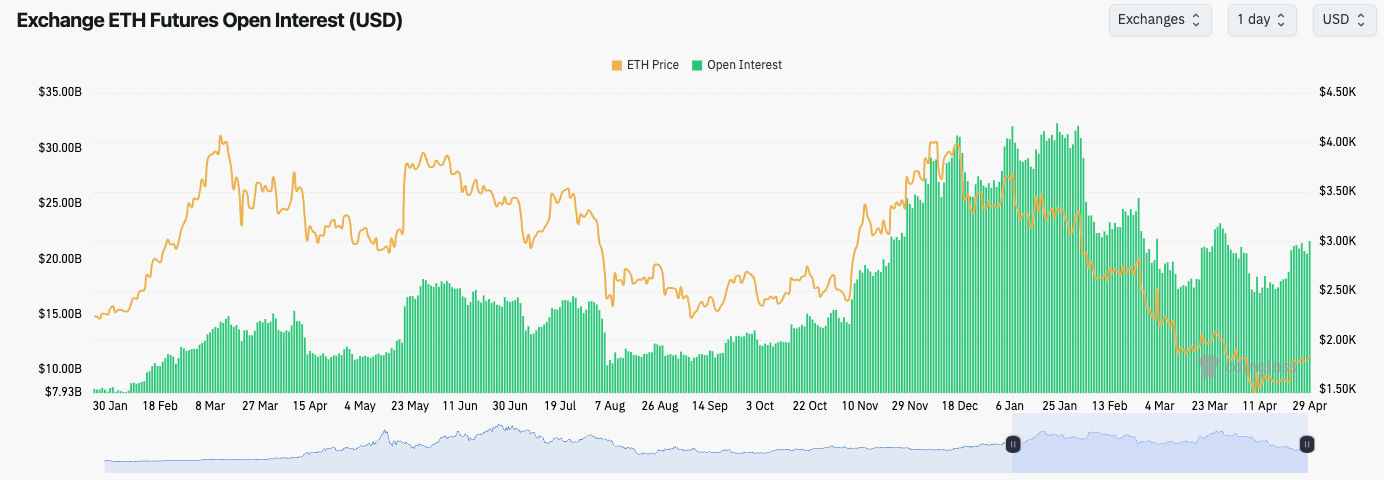

ETH, SOL, and HYPE are approaching volatility pivots. Once these ranges break, there’s no coming back. Full setups, targets, and liquidation zones revealed inside.ETH:

- ETH's Open Interest has ticked up slightly, but the Funding Rate has also come down somewhat; however, they still remain slightly positive. This suggests that some Shorts have begun stepping in.

Technical analysis

- ETH has found support above the key horizontal level of $1,745, whilst price grinds along into the main downtrend line.

- If ETH can break out of its main downtrend line, the upside targets would be $2,000 and then $2,160.

- To the downside, the key level for ETH will be maintaining above the $1,745 horizontal support, but if that level does break, then $1,530 is the likely target area.

- The RSI is in middle territory, and nowhere near being overbought. This suggests that there can still be further upside for price.

- Next Support: $1,745

- Next Resistance: $2,000

- Direction: Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

For us, it's difficult to bet on upside in this market when we have concerns over the macro environment over the coming months. However, if you are looking to bet on upside, ETH is the play, and it looks attractive to Long in comparison to other plays.If the general market can hold up (not meaningfully pull back), then ETH can break out and test $2,000 and then $2,160 in the short term.

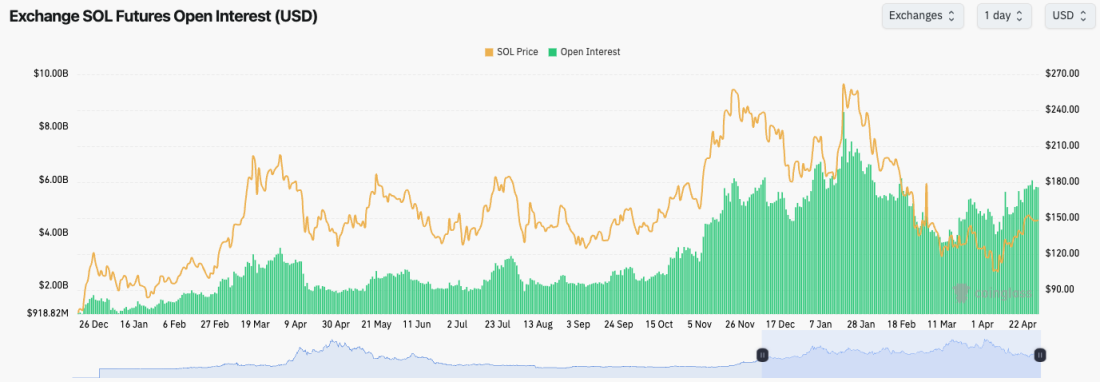

SOL:

- SOL's Open Interest has kicked up quite substantially, suggesting that traders still have an appetite to take risks.

- The Funding Rate is flat, however, suggesting that Longs are matching Shorts. A move to $155 could potentially lead to a short squeeze.

Technical analysis

- Price broke above the prior high (March high), which was positive to see, and price is now battling at a key horizontal level of $148.

- To the upside, the key resistances are at $162 and $180.

- To the downside, $134 is a local support, with $120 a more significant support below that.

- Interestingly, price was in a local uptrend, and it has recently lost that local uptrend line, as we can see.

- The RSI isn't overbought, but it's not really in middle territory either. It is, however, currently sitting on top of and supported by its moving average. It'll be important to see if this metric holds as support.

- Next Support: $148

- Next Resistance: $162

- Direction: Neutral/Bearish

- Upside Target: $162

- Downside Target: $134

Cryptonary's take

Its possible SOL can move up to $162, but we expect that might be all that's left in this move, and we're expecting a local top to either be in or be put in this week close to $162.So, we think the next week can still give some upside, but limited upside; however, beyond that, we're not confident, and we expect $120 to be revisited again over the coming 4-6 weeks. Beyond that, and the $100 level, we do still expect that level to be in play, for June time.

HYPE:

- HYPE lost its uptrend line and pulled back to the next horizontal support at $17.00 and bounced from that level.

- Price is now retesting the prior high, but it's also moving into the underside of the local resistance level of $19.60, which may be a rejection area.

- If $19.60 is broken to the upside, then $23.00 can be reached, although there are a few local resistances along the journey. Upside is probably limited here.

- To the downside, $17.00 is the next level, with $14.50 the next level below that.

- The RSI is high, but not overbought, whilst the RSI is now also below its moving average and butting up against it as a potential new resistance.

- Next Support: $17.00

- Next Resistance: $19.60

- Direction: Bearish

- Upside Target: $19.60

- Downside Target: $14.50

Cryptonary's take

It's possible that HYPE can see further upside here, although upside is likely to be limited as there are a number of local resistances between $19.60 and $22.00.We expect that HYPE will reject here in the coming week, pull back down, and break below its lows at $17.00 and look to retest $14.50 over the coming 2 weeks. For now, we remain patient with HYPE, and we still expect that we'll be able to buy HYPE sub $12.00. For now, patience.