Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

- BTC's Funding Rate is positive but muted, indicating that there's a small bias amongst traders to be Long.

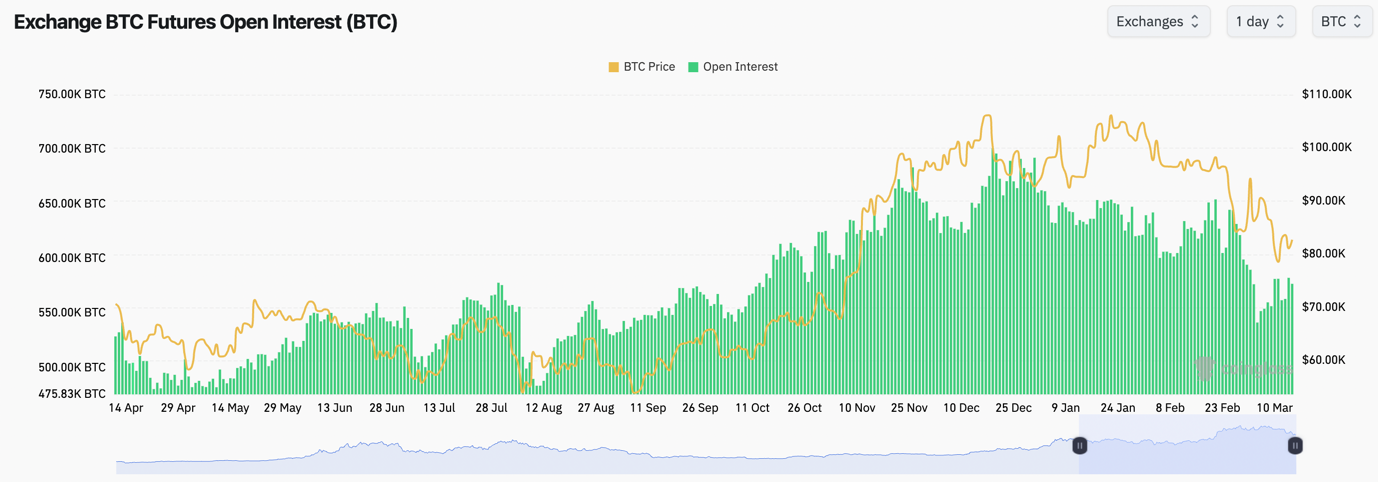

- BTC's Open Interest has been up off the bottom since March 3rd, but it's still in an overall downtrend, indicating that there's not the appetite for leverage that there was at the highs at the start of the year. OI was down from 700k BTC at the start of the year to 582k BTC. This is a meaningful reset.

Technical analysis

- BTC has found some support for now in the late $70k's.

- Price has also put in a lower low, whilst the RSI has put in a higher low, very close to overbought territory (bullish divergence). This could ignite a small relief rally if the TradFi Index can also bounce.

- There is a short-term resistance at $86,300, which price may likely struggle at. However, beyond that, the main resistance is $91,700. We don't expect the price to get near $91,700, let alone breach it in the short-term.

- The major support to the downside is $69,000 to $72,000. We expect this area to be bid quite heavily should BTC trade that low in the coming weeks.

- The RSI is off of oversold territory, and it's battling at its moving average. However, it remains in its major downtrend. We'd get more excited upon an eventual breakout of this downtrend. But, we're not expecting this anytime soon.

- Next Support: $78,000

- Next Resistance: $86,300

- Direction: Neutral/Bullish

- Upside Target: $86,300

- Downside Target: $73,900

Cryptonary's take

Bitcoin has held up relatively well over the last 4-5 days considering how poorly TradFi Index's (S&P and Nasdaq) have traded. However, we do expect that we're in a downtrend, with local rallies likely to put in lower highs and see rejections at local horizontal resistances, the next one is $86,300.If BTC were to get a small relief rally - just due to oversold conditions, it's due one - then we'd look for new shorts potentially between $86,000 and $88,000 (if BTC can get there).

However, we've felt that price has been due for a relief rally for some days now, and we haven't really seen one. Let's see how the price develops over the weekend whilst the TradFi Index isn't trading.

For now, we remain patient. We won't be Shorting lows, but on relief rallies, we'll be looking for Shorts. That current target zone is $86,300 to $88,000. Unless we're given that opportunity, we'll remain sitting on the sides and patient.

ETH:

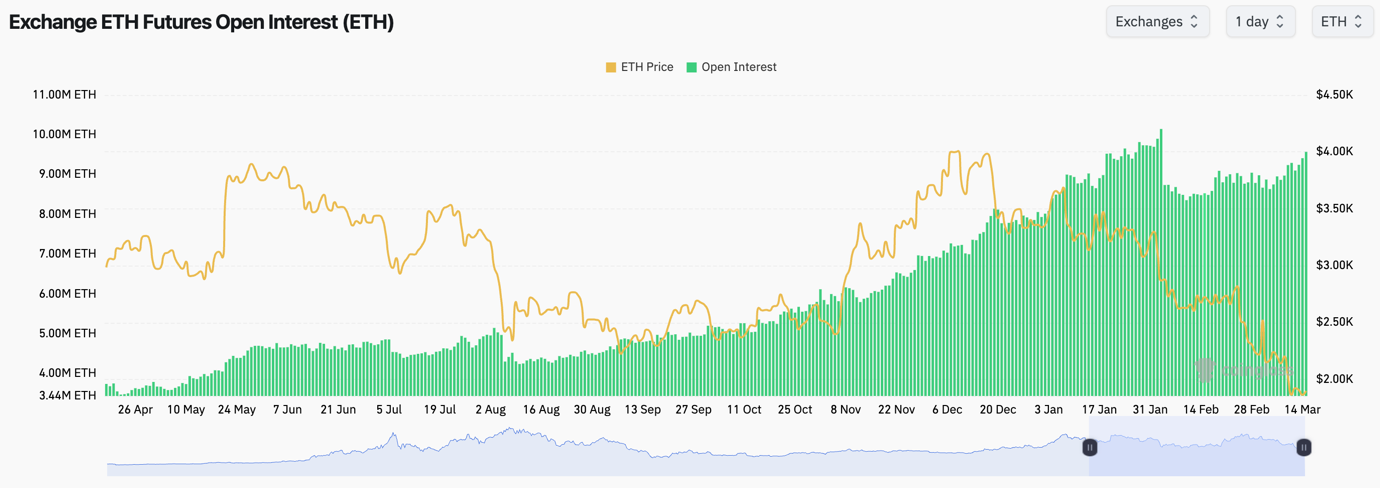

- ETH's Open Interest (by number of coins) still remains very high. Since the early February flush out, ETH's OI has climbed back close to its all-time highs, now just 5% down from its highs. This shows that there is still strong demand for the carry trade in ETH (Long Spot, Short Futures, profit from the Funding Rate).

- ETH's Funding Rate is just about positive, and it has fluctuated between slightly positive and negative. This indicates that there's no clear bias or confidence among traders.

Technical analysis

- A really ugly chart that has been essentially down only now for some time.

- We commented at the beginning of the week that ETH had just broken below the $2,160 horizontal support level, and it was butting up into it, essentially as new resistance. It wasn't reclaimed, and ETH dropped drastically lower.

- Price then bounced perfectly off of the $1,745 horizontal support and has since formed a pennant pattern.

- ETH is now forming a bearish pennant which has a bias to break lower. The target of this would be a move back down to $1,745.

- Interestingly, ETH's RSI has put in two bullish divergences now (lower low in price, higher low on the oscillator). This may help the price to bounce.

- If ETH can bounce (our confidence is low), then $2,160 would be the likely top-level target. We wouldn't expect the price to breach above this level in the near term.

- To the downside, if $1,745 is lost, then $1,530 is the next horizontal support.

- Next Support: $1,745

- Next Resistance: $2,160

- Direction: Neutral/Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

Despite ETH forming a bearish pennant, and if this were to break down, we think the price can retest $1,745 and bounce again from that level. However, our thinking is that ETH can potentially bounce here in the short term and potentially find a local resistance of $2,160.We're not sure we'd bet on this, because essentially it would be trading against the trend, but we can also appreciate that this is likely due a relief rally in the short-term.

SOL:

- SOL's Open Interest has fallen off a cliff since its mid-January highs. However, this is also due to the coin's price falling so dramatically as well. OI, measured by the number of coins, is relatively high, but we have to take that with a 'pinch of salt' because it now takes less $ to leverage 1 SOL (price is now substantially less than it was 8 weeks ago).

- Therefore, SOL's OI doesn't provide us with a strong trading signal here, but it is important to still be watching it.

- SOL's Funding Rate is flat at 0.00%, so there's no clear bias between Longs and Shorts.

Technical analysis

- SOL dipped below the major horizontal support of $120, but fortunately, it was quickly reclaimed.

- The RSI was in oversold territory, but it hadn't printed any bullish divergences. It now has, and that might be enough for the price to get a small local relief bounce.

- The local resistance level is likely in the zone of $138 to $142. So, if there was a small relief rally, we'd expect $138 to $142 to be a potential sticking point.

- Above $142, the major horizontal resistance is at $162.

- To the downside, if the $120 level is lost (and we think over the medium term, it can be lost), then $98 is the next major horizontal support.

- Next Support: $120 (then $98)

- Next Resistance: $138

- Direction: Neutral

- Upside Target: $138

- Downside Target: $98

Cryptonary's take

SOL could also potentially be set up for a small relief rally here in the immediate term. However, we'd expect $138 to $142 to be the sticking point.We also wouldn't look too long for these bounces (potential bounces). However, we would be more inclined to short local highs, although BTC seems to be the better play in the immediate term.

HYPE:

- Disappointing to see HYPE break down like it has. We called the bear flag pattern correctly, and since the price has drawn down substantially.

- At the beginning of the week, we thought HYPE might be able to hold the $14.50 level, but unfortunately, the price wasn't able to.

- Price is now trying to form a bottom at $12.00, and so far, the response has been more positive.

- We're seeing the RSI come out of oversold territory and breach up into its moving average (it'll need to claim and sit comfortably above it) to see further upside for price.

- On the RSI, note there haven't been any bullish divergences put in yet, so any new price lows might create that. Something to watch.

- $14.50 is now potentially going to be a local horizontal resistance. If the price can be claimed above that level, then that'll open the door for a move back to $17.30. However, we're sceptical of a move back to $17.30 in the short term.

- Next Support: $12.00

- Next Resistance: $14.50

- Direction: Neutral

- Upside Target: $17.30

- Downside Target: $9.00

Cryptonary's take

It seemed many market participants were hiding out in HYPE in the hope that it'd hold up price-wise because of the buybacks. However, when price lost key levels and general market sentiment was poor, sellers came in.Price has now fallen to fresh lows, but it's very oversold, indicating that a bounce might be possible in the immediate term. However, a bounce isn't something we'd like to play as it's trading against the wider trend.

Also, if the price does put in a bounce, we're sceptical that it'll get a meaningful upside, hence therefore making the potential bounce less of an attractive play.