Market optimism hinges on Trump's potential pro-crypto executive orders.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

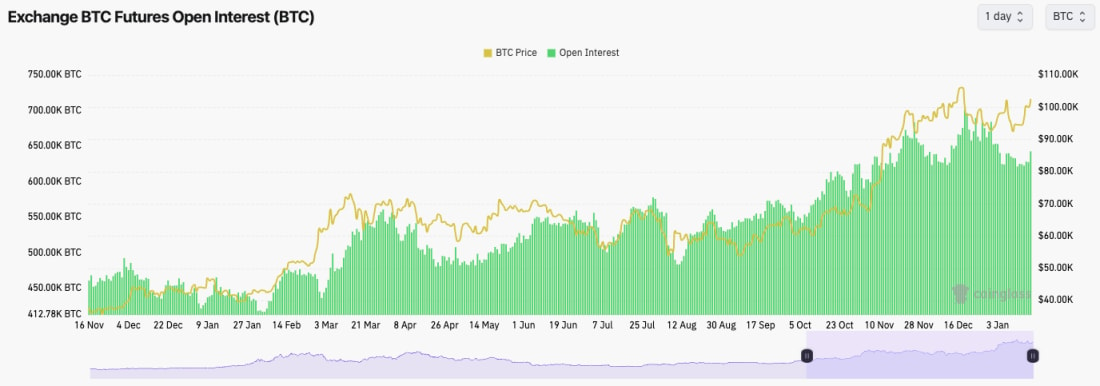

- BTC's Funding Rate has returned to 0.01%, indicating an even balance between Longs and Shorts.

- BTC's Open Interest has kicked up slightly from the lows in the last 24 hours, but not in any meaningful way. This indicates that the recent rally is more Spot-driven than leverage-driven. This is positive for the bulls.

Technical analysis

- BTC wicked into the $90k's and has bounced aggressively, breaking through a number of key horizontal resistances @ $95,700 and then $98,900.

- Price is now breaching the prior local high of $102,600.

- What's also positive is that the price has seemingly broken out of the local downtrend line. We need to see how today's Daily candle closes, but so far, it looks good.

- The RSI is also breaking out of the downtrend line and coming from a middle territory, still with some way to go before it becomes overbought.

- On the RSI though, we do have to be careful of any potential hidden bearish divergences (lower price highs, higher highs on the oscillator). We'll monitor this.

Get the latest Bitcoin price prediction. Dive into our detailed analysis to stay one step ahead!

Get the latest Bitcoin price prediction. Dive into our detailed analysis to stay one step ahead!

- Next Support: $102,000

- Next Resistance: $108,000

- Direction: Bullish

- Upside Target: $108,000

- Downside Target: $102,000

Cryptonary's take

Overall, it's a really solid move. Mostly, this has been driven by hype/positivity around Trump issuing pro-crypto Executive Orders on day 1. It's also been driven by the positive inflation print (less inflation than what the market expected) we saw on Wednesday, plus some dovish FED speak from Waller (granted, he's about as dovish as they get, so take it with a pinch of salt).It's possible the rally will continue into Monday, despite the price being at a local resistance of $102,600, but it has smashed through the other resistances so far. In my opinion (Tom's), Trump will likely have to over-deliver next week for this rally to really continue into a multi-week/multi-month rally into new price highs.

However, if Trump drops a load of overly positive (more than what the market currently expects) pro-Crypto Executive Orders, then it's possible we will see $108k early next week.

Ultimately, I think a lot of the next month depends on what Trump does next week. If he heavily over-delivers, that is what would invalidate my thesis for lower. However, the weaker inflation print on Wednesday has also helped me invalidate my prior thesis.

ETH:

- The Open Interest in ETH didn't even pull back. There's a huge amount of OI on ETH currently. This may be due to new market mechanisms/protocols such as Ethena.

- The Funding Rate is also back to 0.01%, indicating a balance between bulls and bears (Longs and Shorts).

Technical analysis

- ETH wicked into the $2,900's and was close to filling the Yellow box. However, it got a strong bounce, and the price rebounded swiftly into the main horizontal resistance at $3,480.

- Price is now range-bound between the horizontal support of $3,280 and the horizontal resistance of $3,480.

- ETH remains in a downtrend, and for this to bull reverse, it'll need a breakout of the $3,480 and the main downtrend line.

- The RSI is looking better/good here, and it's now resting on top of its moving average. Being in the middle territory, this has room to go higher here.

- A break below $3,200 - $3,280, and ETH likely pulls back to $3,050.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Bullish

- Upside Target: $3,700

- Downside Target: $3,050

Cryptonary's take

Unlike BTC, ETH hasn't broken out of its downtrend currently. For the full bull reversal, we'll need to see ETH break out of the downtrend and reclaim comfortably back above $3,480. However, similar to BTC, a lot of the short-term forecasts rely on Trump next week.If it's better than what the market expects, then the price can break out; if not, then a sell-down. It's hard here; it depends on what Trump does next week. If Trump delivers, then I'd expect to see ETH break out. If the opposite is true, then the $3,200's can be tested.

SOL:

- SOL's Open Interest didn't take much of a dip, but it has kicked up again in the last 24 hours.

- SOL's funding rates are also at 0.01%, the same as those of BTC and ETH.

- This higher rebound has been Spot-driven so far.

Technical analysis

- SOL moved down and wicked into the tops of the old range in the $ 160s, although it was quickly bought up, and the price recovered really nicely.

- SOL did really well to recover the horizontal level of $203, and the price is now butting into the major horizontal resistance of $220.

- Going forward, we would expect $203 to be supported in the short term. If that level is lost, then that opens the door again to our bear case for the near term.

- One thing to watch here is the RSI, which is currently close to putting in a hidden bearish divergence.

Stay updated on Solana's price prediction. Explore our full analysis for the latest market insights.

Stay updated on Solana's price prediction. Explore our full analysis for the latest market insights.

- Next Support: $203

- Next Resistance: $222

- Direction: Neutral/Bullish

- Upside Target: $240

- Downside Target: $203

Cryptonary's take

Seeing the potential hidden bearish divergence, the butt up into the major horizontal resistance, and the fact that the price is up 20% in 3 days, it feels hard to FOMO in here (if I were looking for buys).Again, SOL's price action will depend on the price next week. Ultimately, you want to see $203 held as support. A convincing breakout of $220 and SOL can really start pushing higher, especially if this is off the back of super bullish pro-crypto Executive Orders from Trump.

WIF:

- WIF has had a bounce from the lows, and the price is now moving into the old demand zone between $1.80 and $2.00.

- Note there is a horizontal resistance at $1.96 ($2.00).

- The key level for the price to reclaim to trigger the bullish reversal is $2.20.

- The RSI is breaking out of its downtrend line, having put in a bullish divergence in oversold territory. However, it is now going to put in a hidden bearish divergence (lower high in price, higher high on the oscillator). Just something to keep an eye on for now.

Don't miss the latest dogwifhat (WIF) price prediction. Explore our insights to stay ahead in the crypto market.

Don't miss the latest dogwifhat (WIF) price prediction. Explore our insights to stay ahead in the crypto market.

- Next Support: $1.60

- Next Resistance: $1.96

- Direction: Neutral/Bullish

- Upside Target: $2.20

- Downside Target: $1.60

Cryptonary's take

A reclaim of $2.20 would trigger the bullish reversal for WIF. But for now, it looks to just be a relief rally despite the market feeling euphoric today. WIF might move more substantially upon a SOL breakout which might come if Trump is overly positive next week.However, don't close the possibility that this is just a relief rally on WIF for now in the short term. This may be the start of building out a base to go higher at a much later date, but it doesn't mean the lows can't be retested again. Just be open-minded. Let's see what happens.

POPCAT:

- A really nice move off the lows, having built a base at the $0.50 area.

- Price is now moving into the old order block between $0.70 and $0.85 (give or take, it could be slightly higher than $0.85).

- Price is also trying to break out of the main downtrend line. This is also the case for the RSI. This looks good here.

- The RSI is still in middle territory, but it's likely to put in a hidden bearish divergence (lower high in price, higher high on the oscillator). This is just something to be wary.

- The key level for POPCAT to break out of is the $0.92 horizontal resistance. A breakout of this level would likely be confirmation of the bull reversal.

Looking for an accurate POPCAT price prediction? Read our analysis to know what's next for POPCAT!

- Next Support: $0.54

- Next Resistance: $0.72 - $0.85

- Direction: Neutral/Bullish

- Upside Target: $0.92

- Downside Target: $0.54

Cryptonary's take

POPCAT has bounced really nicely off the lows, but until there is a convincing reclaim of $0.92, it's hard to be majorly positive on it in the short term. Price is also moving into a resistance zone between $0.70 and $0.85, so that's worth noting. If SOL can break out, and especially if it's off the back of Trump Executive Orders next week, then SOL memes could follow.For now, I'm personally (Tom) still not fully convinced. Let's see how it plays out currently; this is max hyper across the board going into Trump next week.

SPX:

- SPX pulled back and tested the $1.00 zone as new support and bounced perfectly from that area, now up 36%.

- TA-wise, there are no bundles to do. The levels of support are at $1.00 and then $0.75, but these are a long way off price now.

- So, what we're looking for here is if SPX puts in a new high or a lower high. Of course, the next main resistance is the prior all-time high at $1.60.

- What's somewhat strange is that this move-up has come with low volume. Which usually isn't great, but it's not uncommon for SPX to pull that kind of move.

- Next Support: $1.00

- Next Resistance: $1.60

- Direction: Neutral

- Upside Target: $1.69

- Downside Target: $1.00