ETH struggles to hold $2,420, while SOL targets $186. WIF eyes a $2.20 retest, POPCAT consolidates, and SPX shows resilience at $0.75. Balanced funding rates suggest possible upcoming volatility.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

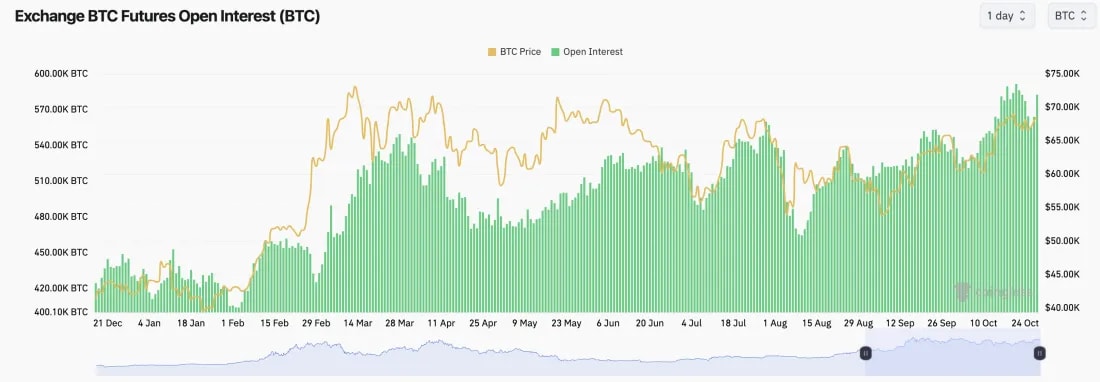

BTC:

- On the move down to $66k last Friday, nearly 10% of Open Interest by coins was wiped out. This is a small, but a nice flush out on that move. However, we have seen OI move back up to it's highs over the last 24 hours.

- However, Funding Rates remain contained in positive territory, hanging around the 0.01% level, which is a very normal level and doesn't indicate over heating.

Technical analysis

- BTC initially rejected the overhead horizontal resistance at $68,900 and pulled back to our first marked area between $65,000 and $66,000.

- Price has since bounced really convincingly and is now retesting the underside of the horizontal resistance at $68,900 again, but this second time, the RSI isn't in overbought territory.

- To the downside, we'd expect the $65,000 to $66,000 area to continue to act as major support.

- To the upside, $68,900 is the main level for the price to break out above. Beyond that, it's the all-time high at $73,600.

- Next Support: $66,000

- Next Resistance: $68,900

- Direction: Bullish

- Upside Target: $73,600

- Downside Target: $66,000

Cryptonary's take

BTC looks really positive here. You'd want to see price pullbacks bounce off the main areas of support, which is what we've got, and now the price is butting into the main horizontal resistance. It seems that risk appetite is becoming more comfortable for some people as it looks more likely that Trump might win the US presidential election.We wouldn't be surprised if BTC doesn't break above-price all-time highs pre-election. But we do think BTC can break above $68,900 between now and the election and be butting into all-time highs at and around election day.

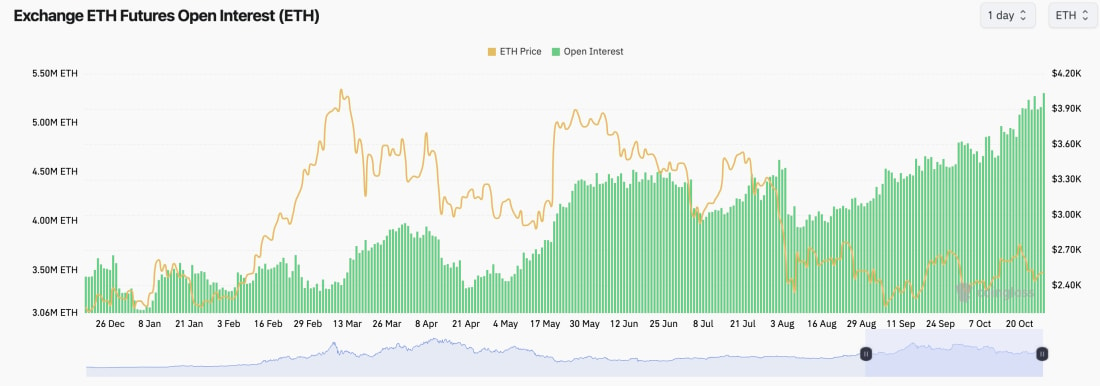

ETH:

- ETH is becoming increasingly interesting from a mechanics point of view.

- ETH's Open Interest continues to grind to new highs (measured in the number of coins).

- Meanwhile, the funding rate remains low but positive. This is still a good setup overall.

Technical analysis

- ETH broke out of the main downtrend line, but it couldn't sustain a breakout.

- After the failed break out, price broke beneath the horizontal support of $2,550, the local uptrend line, and it also fell back in to the downtrend line. Not good.

- The RSI has more meaningfully reset, and the price has found some support at the local level of $2,420, which perhaps are the only positive aspects here.

- To the downside, $2,420 needs to hold as local support really, or a break down to $2,150 could be possible.

- To the upside, the local level to reclaim is $2,550; beyond that, it's $2,750.

- Next Support: $2,420

- Next Resistance: $2,550

- Direction: Neutral

- Upside Target: $2,750

- Downside Target: $2,150

Cryptonary's take

ETH continues to underperform here and highlights this as BTC and SOL (the Majors) break out. ETH can't just hold the $2,550 level, but it actually breaks below that support. It's becoming more difficult to advocate for ETH with this kind of performance despite the chart suggesting that the lows are potentially in.However, just because the lows might be in doesn't necessarily mean that ETH will now perform well/outperform BTC and SOL. Overall, we're not too confident about ETH here as it just can't maintain any meaningful price level for a sustained period of time. If BTC breaks out, then ETH could reclaim $2,550 and potentially push on to $2,750, but we still see it as underperforming.

SOL:

- SOL's Open Interest (by number of coins) has really climbed higher over the last 10 days, suggesting more leverage has been being put on here.

- Interestingly, SOL's Funding Rate is flat, close to 0.00%. This indicates that some of the leverage that has gone on is Shorts and that there is a relatively even balance between Longs and Shorts.

Technical analysis

- So far, a really clean move, where price broke out of the $162 horizontal resistance, pulled back, tested it as new support and bounced higher from that level. Good to see.

- The price is now $178 as local resistance.

- Beyond $178, $185 to $190 will likely act as a strong resistance zone for SOL.

- In terms of support, $162 should be a local support, with $150 as a stronger support.

- Price is in a local uptrend so we wouldn't be surprised to see this broken and price potentially retest $162.

- Next Support: $162

- Next Resistance: $190

- Direction: Neutral/Bullish

- Upside Target: $186 - $190

- Downside Target: $162

Cryptonary's take

Price has quietly risen without gaining much attention or euphoria regarding the timelines. We see this as very positive, and likely the case is that we see the euphoria come back only upon a breakout of $190, possibly $200, as that'll be a psychological zone.This price grind higher has also probably been positive for the SOL ecosystem as we continue to see memes do well. In the coming days, we wouldn't be surprised to see $162 be retested again; however, we do see the inevitable direction as a move back up to $186-$190, so we're unsure if we'll even see $162 retested in the short-term here.

WIF:

- WIF broke out of it's major downtrend line, and then pushed up to $3.00 before beginning a local downtrend, that has sent WIF back to the low $2.00's.

- There are a lot of supports between $2.00 and $2.20, which is also where we have our Yellow Buy Box. If WIF revisits this box, we'll add to our bags.

- On the downside, $2.00 to $2.20 is the major support zone we're looking for.

- To the upside, $2.55 is the key level to reclaim, with $3.00 being the level beyond that.

- This move down over the last fortnight has meaningfully reset the RSI which is positive to see.

- Next Support: $2.00 - $2.20

- Next Resistance: $2.55

- Direction: Neutral

- Upside Target: $2.55, then $3.00

- Downside Target: $2.00 - $2.20

Cryptonary's take

Charting-wise, WIF still looks good here, even if it pulls back to $2.00 to $2.20; we'd just see this as a healthy retest. We do believe that in the coming week, WIF can more meaningfully fill the Yellow Buy Box. We'll be buyers in this area, as we'd expect that to potentially be a local bottom, especially if we get a Trump win next week.POPCAT:

- POPCAT has maintained it's larger uptrend with price having squeezed in to the top of the resistance box in recent days.

- Whilst the price has generally ground higher, the RSI has a slight downtrend.

- On the downside, $1.20 to $1.30 should act as an important zone of support for POPCAT.

- On the upside, it's quite clear. Price needs to clear all-time highs, with $1.60 now being the resistance area.

- Next Support: $1.20

- Next Resistance: $1.60

- Direction: Neutral/Bearish

- Upside Target: $1.60, then $1.80

- Downside Target: $1.20

Cryptonary's take

This feels quite a crucial moment for POPCAT, as the price has created new highs, but the RSI has become more compressed; it then feels as if the next move could be an explosive one. It may even be the case that BTC's next move determines this next move, i.e. if BTC breaks out, so can POPCAT and vice versa.What's positive is that POPCAT is pretty sweet here, around the $1.50 mark, and there isn't much talk/euphoria around it (aside from a few Murad tweets, I suppose).

In all honesty, I (Tom) am very unsure of the next direction for POPCAT's price here. I can see a scenario where BTC breaks out (especially if it's upon a Trump win), and POPCAT goes ballistic into price discovery. But I can also see the scenario that if BTC breaks below $65k (this isn't our current thinking, though), then POPCAT could retest $1.20.

SPX

- Price revisited the Yellow Buy Box but it wasn't there for long. Price has since had a really nice bounce and ground higher.

- Price has found support above $0.75 and used that horizontal level a number of times now as support, and the price has responded which is great to see.

- Beneath $0.75, $0.65 to $0.68 is likely the level.

- Now, to the upside, $0.90 and then $0.95 are the levels. Beyond that, $1.00 is a psychological level. But, if the price can get above that level and settle there, that would be extremely positive.

- One aspect that might worry us here is that the volumes are becoming lighter, but that is also somewhat to be expected.

- Next Support: $0.75

- Next Resistance: $0.95

- Direction: Neutral

- Upside Target: $0.95

- Downside Target: $0.75

Cryptonary's take

A really nice grind higher from SPX over the last week, and if BTC can break out, then that might be the push that SPX needs to break out above its all-time highs. However, if not, then SPX might revisit the $0.68 to $0.75 area.Currently, I (Tom) am not sure about the price direction, as I think these next moves are probably more based on what BTC does, with BTC being towards the top of its range and needing a break out to likely give that oxygen to the rest of the space to also break out.