Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

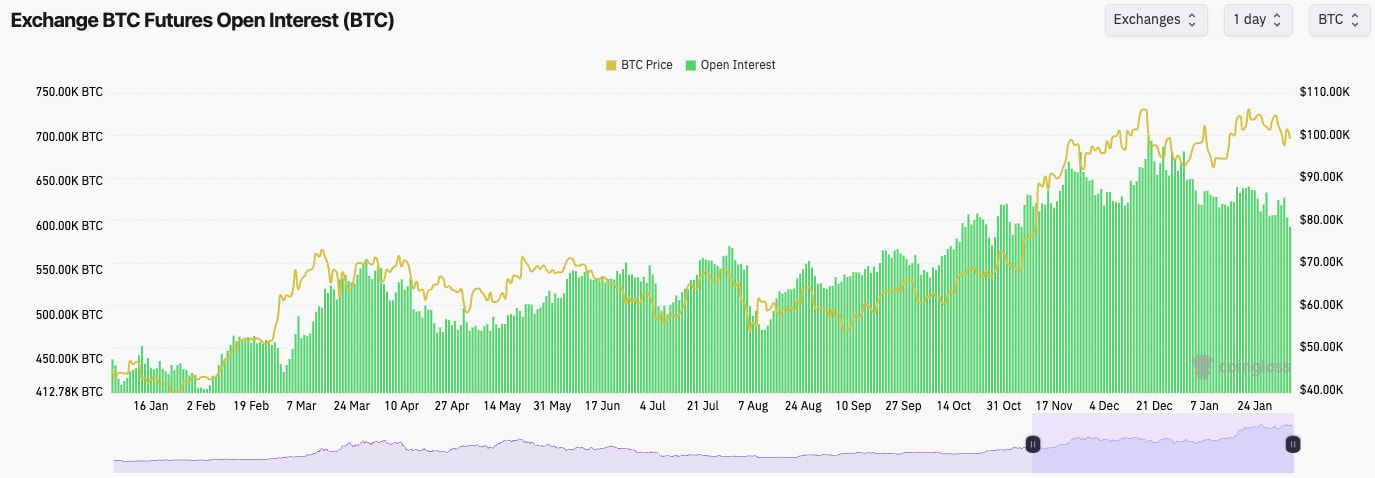

- BTC's Open Interest has been downtrending since mid-December, and we've seen a further 5% decline over the last 48 hours due to the liquidation event on Sunday/Monday.

- Funding Rates have been choppy between slightly positive and slightly negative, indicating traders have been chopped up. We've seen Funding Rates go from negative to positive as the price has moved up (Shorts getting hit) and then the opposite on the way down (Longs being hit).

- Ultimately, there's indecision amongst traders in the current market, and we've seen the froth come out of the market over the last month.

Technical analysis

- BTC rejected from the $105k - $106k level (top of the range) as we expected.

- Price then collapsed below the horizontal supports of $98,900 and $95,700 on the Trump tariff news.

- Price found support at the major horizontal support at the bottom of the range at $91,700. This is a key area we have marked for the last few months.

- Price recovered nicely off the back of progress around deals with Canada and Mexico. It reclaimed $98,900, and the price is now using that horizontal level as new support.

- The RSI is in the middle territory, but it remains beneath its moving average.

- Next Support: $95,700

- Next Resistance: $102,000

- Direction: Bearish/Neutral

- Upside Target $102,000

- Downside Target: $91,700