Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

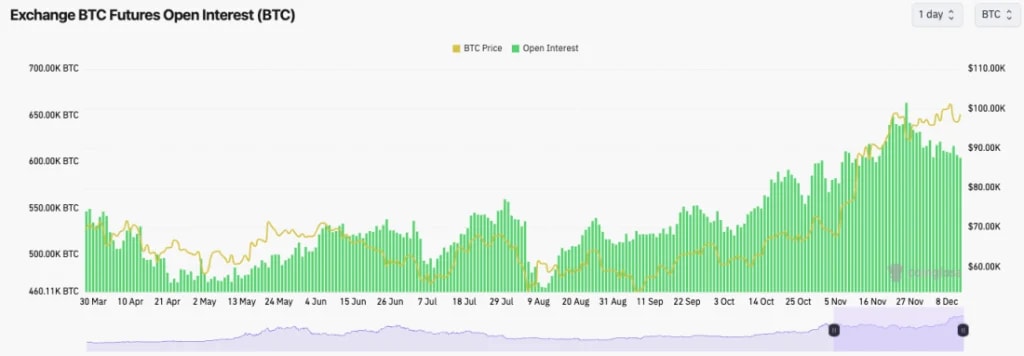

- BTC's Open Interest has pulled back by 10% over the last week. This reset was needed.

- Funding rates have also returned to normalised levels (around 0.01%), having been at extremely elevated levels a week or so ago.

Technical analysis

- Quite messy price action and technical analysis here, to be honest.

- We had the deleveraging event for BTC last week, and since then, the price has recovered, having tried a run back to the highs but ultimately rejected.

- Locally, we now see $94,100 to $95,700 as a new local support zone.

- The main horizontal resistance remains at an all-time high at $104,000. However, there is now also a local resistance at $101,500.

- The last week of price action has seen the RSI meaningfully reset, and it is now not very close to overbought territory.

- Next Support: $94,150

- Next Resistance: $101,500

- Direction: Bullish

- Upside Target: $104,000

- Downside Target: $94,150

Cryptonary's take

After the deleveraging events we've seen recently, it may take more time for confidence to come back in. But, as a minimum, we're expecting the price to be range-bound here for more days/a week. Although, we do think the next major move will be higher and a breakout to the upside. If we do see a further period of consolidation, we wouldn't see this as a bad thing. We look at the current setup very positively.BTC is at $99,300 (a 5% move from all-time highs) and it is following a major leverage flushing out. This looks really healthy and clean to us here. We're expecting higher either this weekend or next week. The only thing to keep in mind with trading going forward is next week's FED Meeting on the 18th.