Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- As BTC has retraced from $99k back to $92k, Open Interest (the amount of leverage in the system) has pulled back very slightly, although it still remains very high.

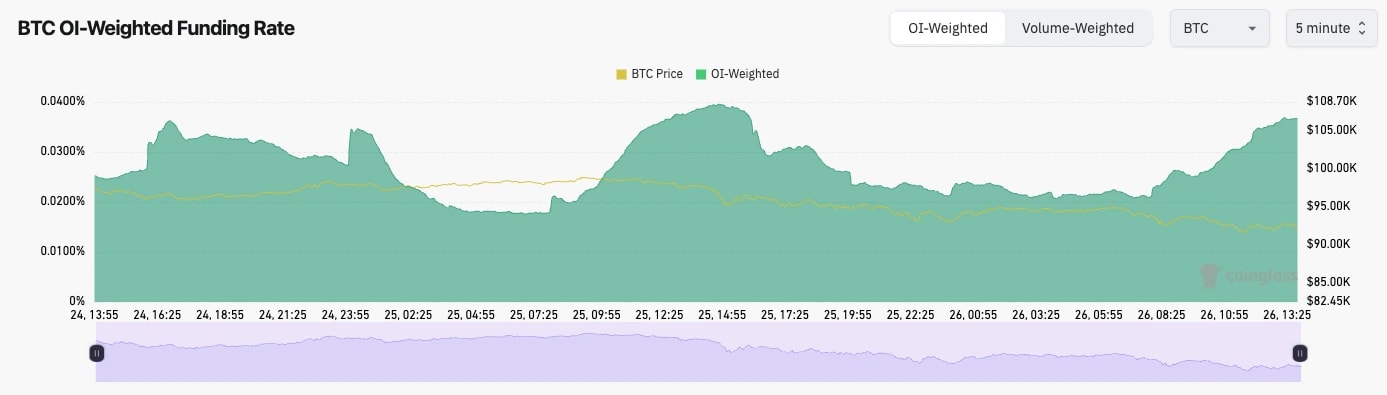

- The Funding Rate has also crept back up again to 0.038%, indicating that new Longs have piled in on this 7% price pullback for BTC.

- In bull markets, it's common to see the amount of leverage be high. However, currently, this doesn't strike us as enough of a flush out yet. Therefore, it's possible that BTC could still see slightly more of a pullback here, potentially somewhere between $87k and $92k.

BTC funding rate (5min timeframe):

Technical analysis

Technical analysis

- BTC broke out of the bullish pennant at the $92k level and immediately moved on to $99k, where it was met with large sellers at $100k. As to be expected at that psychological level.

- The price was extremely overbought, and as we mentioned in our last update, it had caused a bearish divergence. This is now playing out with price pulling back.

- This pullback has seen the RSI pull down from extremely overbought territory to 61. This is welcome, and we'd even welcome slightly more.

- Price is now resting on top of the old local resistance ($92k) and the new local support of $92k.

- Beneath $92k, there is a more significant support zone between $87k and $92k. We expect the price to find support in this zone, and we'd be extremely surprised if the price were to fall below $87k in the short term.

- On the upside, the resistance is at an all-time high of $99,500.

- Next Support: $91,500

- Next Resistance: $99,500

- Direction: Neutral

- Upside Target: $99,500

- Downside Target: $87,000

Cryptonary's take

Price was up 46% in 3 weeks (since the election), and a pullback was absolutely needed. And we had called for this for the last week, where we have exercised some caution across the board. This pullback for price is very normal in a bull market, and it might feel worse in that most don't have much exposure to BTC, and rather Alts and Meme's, which, in our view, are yet to really have their run.We expect BTC to find support over the next week, probably below $92k, but between the range of $87k and $92k. What we're looking for is a break into the range (between $87k and $92K) and enough of a breakdown that we see the Open Interest pull back more substantially and Funding reset. We expect this over the next week. Once/if we get that, we'd look at that as being the local bottom.

For now, we're sitting tight in Spot positions, as we signalled for last week. We are in a majorly bullish environment overall, so it would feel wrong to sell Spot when we expect much more from this market over the coming months. We remain in Spot, with no plans to sell soon.