In this article:

- Data This Week.

- Trump Inauguration Excitement.

- Cryptonary's Take & How We're Playing It.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Data this week

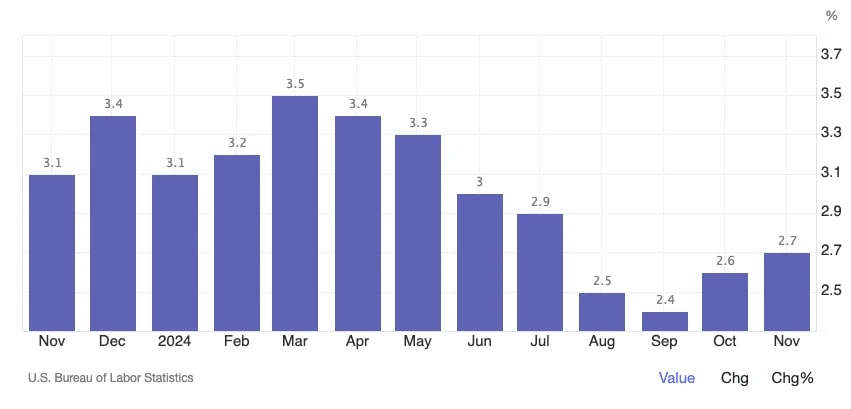

The key data this week is PPI data today (Tuesday), followed by the inflation data on Wednesday. PPI today is expected to come in today at 0.3%, whilst Core Inflation on Wednesday is expected to come in at 3.3% again (still well above the FED's mandated 2.0% target), and Headline Inflation is expected to increase to 2.9%, up from 2.7% last month.This likely hasn't been helped by Oil's move from $69 on Christmas Day to $77 today. If the data were to come in as forecast, then the Headline US Inflation rate would be in a 3-month increase - not what the market would want to see.

US headline inflation rate YoY:

Our expectations are that we'll see these numbers or slightly hotter numbers, but we're not expecting a downside surprise. The likely market reaction to this would be a small sell-off in risk. And we potentially see the Dollar and Yields move back up to their recent highs.

Trump inauguration excitement

Regarding the inauguration, the narrative on Crypto Twitter has shifted from a 'sell the news' event to a 'buy the news' event, it seems. Yesterday, the Washington Post reported that Trump is expected to sign a number of executive orders next week, specifically regarding crypto de-banking.If this comes, and there's probably a good chance it will do, then this is absolutely positive for the space in the long term, but it likely only results in a short-term move up in prices. But, overall, it may not change a lot in the immediate term.

Beyond that, it's likely the crypto industry will want to see a lot more from Trump so that it can continue getting excited. However, in the short term, this is potentially asking a lot, particularly if the Executive Orders are around crypto de-banking and nothing around a Strategic Bitcoin Reserve.

Yesterday, we also had a report that Trump's economic advisors are in the early stages of building a proposal (again, early stages, so that'll take time, it won't be straight away, and the market may have to live with that uncertainty for a while) for graduated tariffs of 2-5% a month.

This is different from larger one-time price hikes. Graduated tariffs are somewhat inflationary because it's a month-on-month increase in prices, and the chances are that these costs will be passed on.

However, 2-5% is less than the 10-60% one-time tariffs that had been initially thrown out, so on the back of this report, the Dollar and Bond Yields pulled back slightly, which allowed the S&P and the Nasdaq to bounce and close the gap that had been opened at the start of the trading day yesterday.

DXY (dollar index) 1D timeframe:

US 10Y Bond Yield 1D timeframe:

SPX 1D timeframe:

(This is the S&P500, not SPX, the meme coin).

NDX 1D timeframe:

Cryptonary's take & how we're playing it

So, the recovery yesterday was positive for sure, and it was fuelled by the S&P and Nasdaq gapping lower and then moving higher and closing those gaps. Crypto followed and was then also fuelled by the report of potential positive Executive Orders from the Trump team upon the inauguration.However, it's possible we will see hotter inflation data today and tomorrow, which will lead to a slight market pullback that is then bought/Shortened into the inauguration.

Beyond that (the inauguration), there's a lot of uncertainty, and with the liquidity outlook ahead, we're still not fully convinced for now. So, maybe there are a few trade opportunities over the next week, but that's probably all we'd see it as.

What would change our view?

Essentially, we'd be looking for the Dollar to roll over (top) and for Yields to do the same to become really risk-on again. This might come in a number of ways;- Trump tariffs are not as extreme as current expectations.

- Weakening economic data prices back in 1 or 2 more interest rate cuts. However, we do see this as unlikely in the short term.

- Trade deals are being done, with the key one being China. If this happens, and the Chinese announce a stimulus package following it, that would be a sign to be fully risk-on again.

- However, we don't expect this in the immediate term. This will likely take some time, but we do think this comes at some point.

- The announcement of a strategic Bitcoin reserve, in which the US is outright buying BTC. We see this as unlikely.

How we're playing it

BTC's daily candle yesterday was really positive, having been bid heavily into the $90k area and closing at just shy of $95k. For now, the main resistance remains $98,900.Personally (Tom), I don't see that being breached in the short term, but we are only a few percentage points away, so let's see. We see the $102k level (the last local high) as very unlikely to be breached.

With the inflation data today and tomorrow, it's possible we see a slight pullback if the data comes in hotter, which we're expecting it to do. However, there's a chance that this small sell-off is bought/Long going into the inauguration next week.

For now, I (Tom) do personally prefer to stay in a decently sized cash position. If we see a significant improvement across the board and we remove large elements of uncertainty, that'll open the door to becoming more heavily risk-on again.

Even if that means paying higher prices, I'd be happy to do that if it means the uncertainty is behind us and our confidence of upside going forward is significantly increased. But right now, that's not where we're at.

Last note

Some Memes and Alts are beginning to look as if they're starting to form a bottom base (I'm watching WIF and POPCAT in particular as they're at the furthest end of the risk curve, and they've also undergone substantial sell-offs). It's absolutely possible that this isn't a bottom, and if BTC breaks below $90k, we expect Alts/memes to be hit again.But, for them, we think the majority of the sell-off is done because the pullbacks have been so big already. And yes, it doesn't mean they can't pull back another 10-30%, either.

If we get relief at some point, this doesn't necessarily mean that the bottom is in. Risk assets need liquidity, and the outlook currently isn't good. That can change if the FED juices liquidity again or China begins fiscally stimulating their economy.

But right now, there aren't any signs of either. But, if the Trump team is quick, this can be changed. There is huge uncertainty at the moment, and this is a tricky market to work out and, therefore, navigate. Let's see what we get, and we'll keep assessing as we go.

BTC: