While the potential for large price swings exists, opportunities are also ripe for the taking.

TLDR

- BTC looks positioned for range-bound trading between $63,000 and $69,000 in the near term, with $75,000 as an upside target on a breakout.

- ETH appears close to a local top and is due for a pullback from overbought levels, with $3,000 being an attractive buy zone.

- Among the altcoins, RUNE has recovered well by retesting $6.10 but may need more time before attempting to clear the $6.53 resistance.

- PYTH is a potential outperformer this bull cycle if it can revisit support around $0.54-$0.58.

- Despite its promising fundamentals, SHDW has been a laggard, leading to concerns around opportunity cost if it cannot break out above $1.50 soon.

- Lastly, MINA's chart looks constructive for further upside if it can hurdle the nearby downtrend resistance.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Overall market mechanics

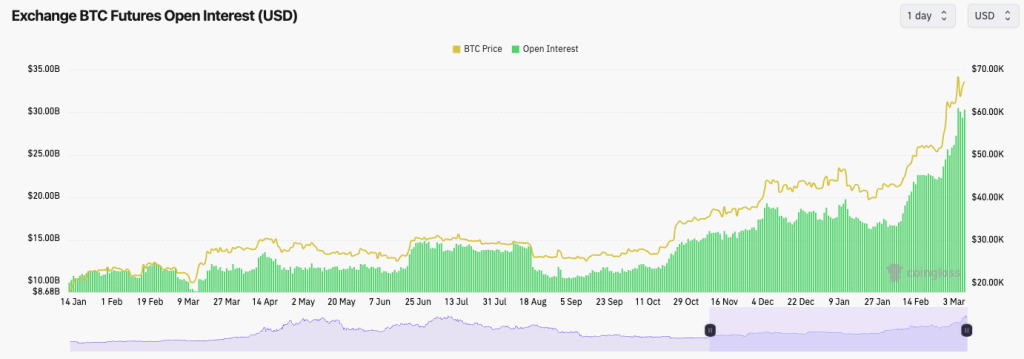

The general mechanics of the market remain overheated, with Funding Rates very high, and Open Interest remains high despite us seeing the flush out on the move down to $57k/$58k.That Open Interest (leverage) that was wiped out was all put back on the move back up to $66k.

So, for now, an overheated leverage market is usually vulnerable to volatility; therefore, the play is to remain in Spot positions and minimise leverage trades.

Funding Rates

BTC Open Interest

BTC

- It'll be positive for Bitcoin if price can remain between $63,300 and $69,000.

- On some exchanges, but not Bitfinex, price filled the Yellow Buy Box between $57,400 and $58,600. This price point should provide strong support if price does move down again.

- If there is a breakout above the all-time high, we expect BTC to increase to $75k.

Cryptonary's take

While an imminent breakout is possible for BTC's price, we wouldn't be surprised to see price remain range-bound between $63k and $69k.Due to the mechanics, we suggest avoiding leverage positions. We prefer to remain in Spot and let BTC decide where it heads next. If there are any major dips, particularly those under $60k, we would be a relatively aggressive buyer of these dips.

ETH

- ETH looks close to a local top here.

- ETH is very overbought on all major timeframes, while price has moved close to the major overhead resistance at $3,967.

- ETH has respected a clean uptrend line, with local horizontal support at $3,525 and a stronger support range between $3,000 and $3,140.

- The Yellow Buy Box has shifted higher as ETH has made new local highs.

Cryptonary's take

The game plan for ETH is similar to that of BTC in a way.Stick to Spot positions and refrain from using leverage when the market mechanics are overheated, or you risk being liquidated in tight positions.

ETH has had a huge rise over the past six weeks, so a pullback will likely come at some point. We'd look to be buyers of a major pullback, particularly if it is as large as pulling ETH back below $3,000. If it did happen, it would likely happen very quickly.

RUNE

- These are really pivotal few days for RUNE price action-wise.

- Price breaking below the uptrend line (Yellow line) and moving into the horizontal support of $4.78 was really key for RUNE to get a strong bounce from this level. Luckily, that's what we've got so far.

- Price is now retesting the previous local highs around $6.10. A clean break above and an attempt at the major overhead horizontal resistance at $6.53 will be key to assessing the overall strength of this move.

- The RSI is in a really clean spot, so this shouldn't provide any worries about price potentially moving higher.

Cryptonary's take

RUNE has done very well in recovering price-wise and is now retesting the prior highs at $6.10. The key for RUNE will be attempting a break above $6.53. If that can happen, then that opens the door for RUNE to go substantially higher. If it doesn't, RUNE's price will likely stay subdued. Our feeling here is that RUNE may remain subdued for more time first; we do not expect an imminent breakout.PYTH

- PYTH has perfectly filled its Yellow box and is a project that may do well in the bull market.

- PYTH has a strong support area between $0.54 and $0.58. If the price revisits this area, it may be a good range to begin buying PYTH.

- The RSI is in the middle territory, indicating little headwind from this trading indicator for price to go higher.

Cryptonary's take

PYTH is likely to be a solid performer in the upcoming bull market. If you have little or no exposure to PYTH, building a small position may be worth if price can retest the support zone between $0.54 and $0.58.SHDW

- FTX has been selling SHDW, which is potentially what has somewhat suppressed the price in the recent week.

- The game plan has remained the same, though. We have consistently accumulated between $0.92 and $1.05.

- We have seen price try to move higher several times. It's important that we get some follow-through soon. Otherwise, you do have to consider the opportunity cost of your SHDW investment as other plays move, and SHDW doesn't rally.

- The RSI is again low, therefore not providing any headwind for price to move higher.

Cryptonary's take

SHDW is in the perfect sector and has a high potential to do well in this cycle. Other plays, such as $RNDR and $NOS, have performed very well, while SHDW has remained a laggard.We would expect SHDW to do some catching up, performance-wise, over the coming months, particularly if the FTX sell pressure stops. If the lack of performance continues, it may be wise to consider other plays simply due to opportunity cost. We're looking for SHDW to break above the $1.50 level for a more significant upside to be realised.

MINA

- Looking like it's in a nice spot here. MINA briefly lost the horizontal support of $1.28 in the flush out a few days ago but bounced perfectly from the $1.02 horizontal support and the prior Yellow Buy Box.

- Price has now found support back above the $1.28 horizontal level while also being in its uptrend and closing in on the local downtrend line. A break above the local downtrend line (red line) would be bullish for price, and it would likely see price test $1.50 before moving on to $1.73.

Cryptonary's take

Charting-wise, MINA looks very positive here.Of course, it depends on whether the price can break above the red downtrend line, but if it can, the upside is considerable in the short term. If you lack exposure to MINA, even the current price may be good for a buy, as MINA may experience a breakout soon.