Tariffs, inflation, and BTC volatility — can markets hold up?

The cryptocurrency markets have been showing interesting patterns lately, with Bitcoin experiencing significant price fluctuations amid economic uncertainty. In this report, we analyse the current economic landscape, examine earnings data, and provide our outlook on Bitcoin's potential price movements in the coming months. Let's dive in.

Topics covered in this Market Update.

- This Week's Economic Data

- Earnings and Reactions

- Our Outlook

- Cryptonary's Take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

This week's economic data

We have a heavier week on the data front this week before we go into a FED Meeting next week on Wednesday, May 7th. However, this week, we have:- Tuesday: JOLT's Jobs data - expected to come in at 7.5m

- Wednesday: GDP - expected to be soft at 0.5%; however, this is probably already in the price

- Wednesday: Core PCE - expected to come in softer at 0.1%, positive for markets, although this is pre-tariff data

- Friday: Non-Farm Payrolls and Unemployment Rate - expected to come in lighter at 130k and for Unemployment to remain unchanged at 4.2%

Earnings and reactions

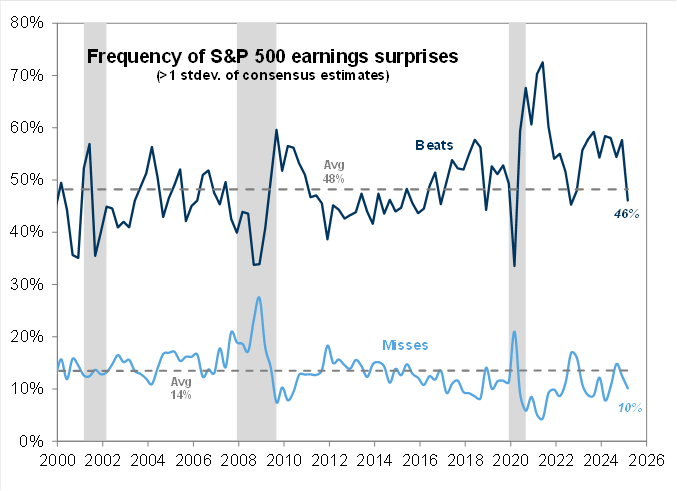

Earnings season began last week, and this week we have 40% of the S&P companies reporting their Earnings. The overall summary of last week was that companies' Earnings weren't as bad as participants initially expected they might be with the forward guidance that was given, also not as bad as initial expectations. This does potentially suggest that we're not seeing a slowdown materialise, at least not yet.But the underlying reaction has been that Earnings beats haven't been rewarded (the median stock outperformed by 50bps vs 101bps historic average), and misses have underperformed to the downside (the median stock down 247bps vs the 206bps historic average).

Performance of earnings:

What’s next?

GDP is stalling at 0.5% while short-term inflation expectations surge—how long can BTC hold near $95k before tighter financial conditions trigger the next major pullback?Our outlook

We're going to cover this today from a top-down approach. In recent updates, we have covered a lot of individual topics/segments in greater detail, so we're expecting that you're taking that knowledge into the rest of this update as context, and we'll now dive into this from a more zoomed-out view.Top-down, let's cover the key components:

- Tariffs/Trade War; in our view, markets have rallied off the back of an unwind of the uncertainty around tariffs and the trade war. We've already hit peak uncertainty, and the worst case in terms of tariffs, which is the 145% the US has now placed on China. We're now unwinding that as the Trump administration's tone softens, and we're now seeing talks of trade partners coming to the negotiation table. So, this is a partial unwind of very bearish news, hence the relief rally. But, even if tariffs come all the way down to 10-15% flat, that's still worse long-term, and the market hasn't yet priced for this.

- Inflation: due to tariffs, in the short term, we're likely to see a spike in inflation in May and June, before it pulls down again upon a pullback from businesses and consumers. But, one note and this is important in the eyes of the FED, is that short-term inflation expectations have risen substantially, and this likely pushes FED cuts out further.

- Labour Market: For now, the labour market is hanging in there. This is due to companies slowing down on expansion plans, but things are not yet bad enough that they're looking to offload staff. And we're not sure we'll get a meaningful uptick in Unemployment. The reason is that companies are likely to be 'shutting up shop' until there is more clarity. And with the expectation that there are going to be deals, and we've dialled back from the extreme, companies may just look to weather this storm for now.

- FED rate cuts: Currently, the market is pricing extremely low odds of a May Meeting interest rate cut, with June priced at a 65% chance of a rate cut and July basically at 100%. However, if we're right, and we expect inflation to move higher in May and June, then a 65% chance of a FED rate cut in June doesn't make sense. We'd expect there to be no interest rate cuts in both May and June, and for July to become unlikely for a cut. Our thinking is, how can the FED cut if inflation substantially upticks whilst the labour market potentially holds up as corporates look to hold onto staff whilst they await clarity out of the administration?

Summary:

If we're expecting interest rate cuts to be pushed out due to higher inflation whilst the labour market holds tight, that'll mean a tightening in financial conditions over the coming 1-2 months, which should result in a significant pullback for risk assets.For now, the uncertainty and the lack of easing (excess liquidity being added to markets) suggest to us that we're likely to be range-bound in markets, and markets are probably close to the top of that range. Therefore, in the coming 4-6 weeks, we expect a retest of at least the low $ 80k for BTC, at least level. The question for us is whether BTC sees new lows or not. We're 50/50 on it currently. Yes, 50/50. But we expect a retest of the low $80k's as very likely.

We have drawn in the below chart the ranges for BTC price on the 3D timeframe, and we've also overlaid the FED Meetings, and arrows as a rough guide as to what we think this year's price action might look like.

BTC Zoomed Out 3D Timeframe:

Cryptonary's take

Over the coming months, we expect price action to be range-bound, whilst we expect the majority of this year's upside to come in Q4 (maybe late Q3), followed by a bullish 2026 with the FED easing rates from Q4 2025 to mid-year 2026 in order to pull the US out of a slowdown. In the short term, we believe BTC is close to the top of its range; however, we're not particularly looking to Short it currently either.Markets are tricky, and sometimes being sat on the sidelines and waiting for greater clarity is the right play, even if that's not what some of you may want to hear. Personally, and this is me (Tom) speaking now, I don't feel any pressure from personal trades or from the market here. I don't feel FOMO, and there isn't a strong argument for me to be risking on in any meaningful way, and that's in spite of seeing some community members really feel the FOMO here.

As mentioned above, markets are extremely difficult, and this move has gone further (upside-wise) than we initially expected, however, we do expect it to be just a relief rally. We'd expect BTC to locally top around $95k to $98k.

Let's see how the coming weeks play out.