Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

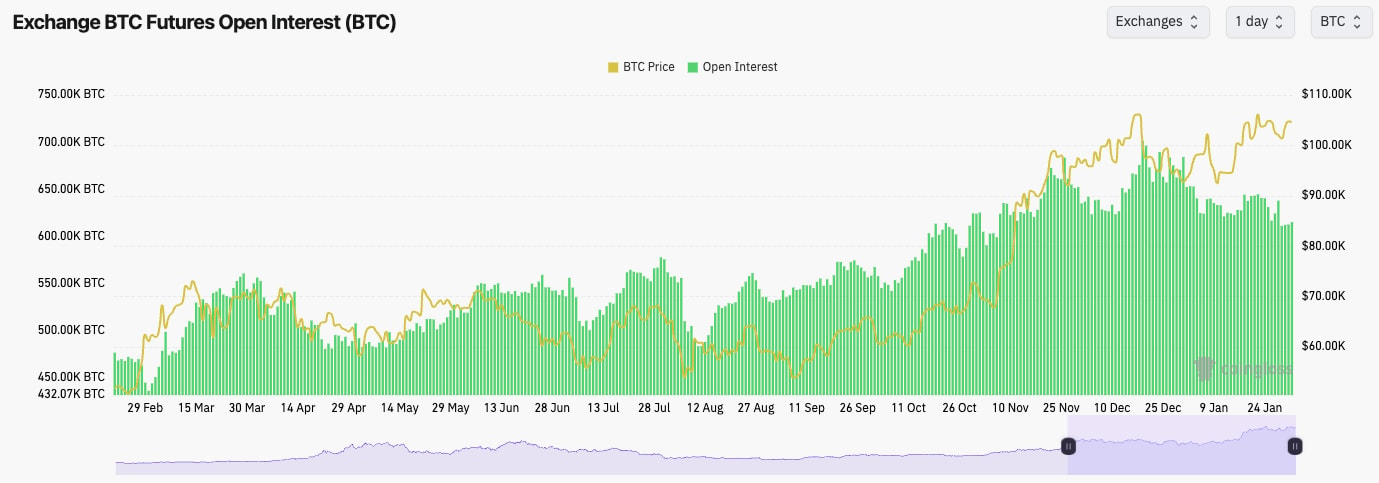

- We're seeing a lower BTC's Open Interest trend, which suggests there's less demand amongst traders to leverage it. This is positive but also expected when the market is in more choppy conditions.

- Funding Rates range from 0.00% to 0.01%, indicating there's an even balance between Longs and Shorts.

Technical analysis

- Next Support: $98,900

- Next Resistance: $106,900

- Direction: Bearish/Neutral

- Upside Target: $106,900

- Downside Target: $95,700

Cryptonary's take

Bitcoin currently ranges between $95,700 and $106,900. Whilst we're in this post-Trump inauguration period where too much good news was priced in (the market had overpriced against a realistic reality), it's possible now that we do see a pullback for BTC in the coming 1-2 weeks. It's possible BTC pulls back to $95,700 to say $98,900.We have highlighted this with a yellow arrow on the chart. We'll add two other things to this. Firstly, if BTC does pull back 5-10%, it doesn't necessarily mean Alts/memes will have another major pullback. Looking across the board, we feel most of the Alts/Memes have done the substantial portions of their pullbacks, but we also think they'll be range-bound for a while.

Secondly, in a range-bound market, it doesn't mean there won't be good pockets of outperformance. For example, $HYPE over the last 3-5 days has heavily outperformed.