BTC resistance at $86K looms

BTC continues its fight at crucial price levels, with traders eyeing relief rallies and resistance near $86,300. With TradFi markets in a downturn, can Bitcoin sustain its support, or is another leg downcoming? Let’s analyze the latest moves.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

- BTC's Funding Rate is positive but muted, indicating that there's a small bias amongst traders to be Long.

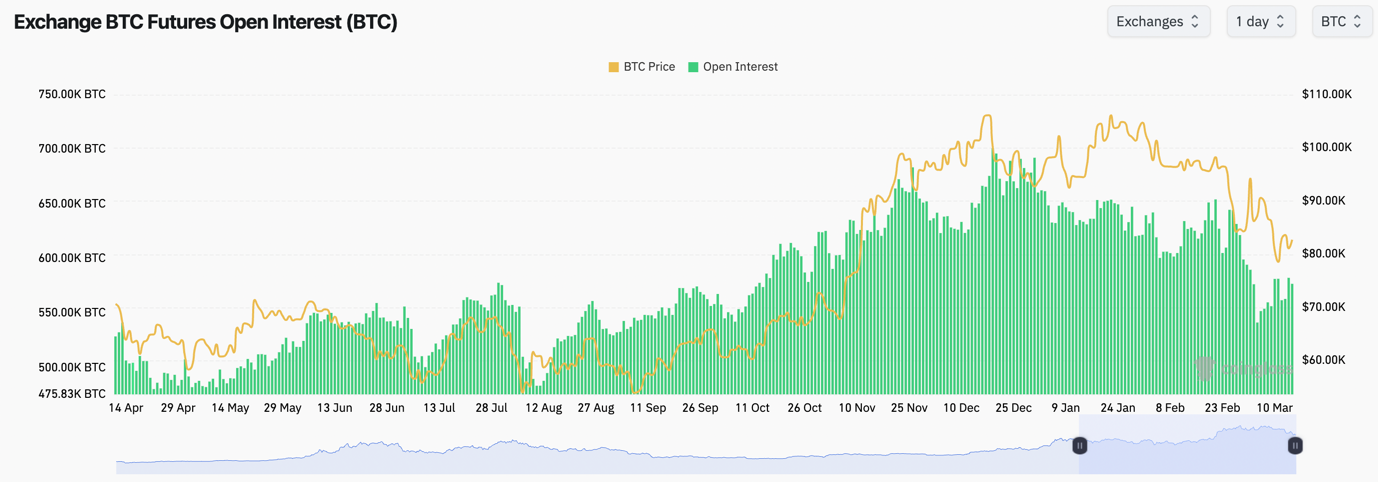

- BTC's Open Interest has been up off the bottom since March 3rd, but it's still in an overall downtrend, indicating that there's not the appetite for leverage that there was at the highs at the start of the year. OI was down from 700k BTC at the start of the year to 582k BTC. This is a meaningful reset.

Technical analysis

- BTC has found some support for now in the late $70k's.

- Price has also put in a lower low, whilst the RSI has put in a higher low, very close to overbought territory (bullish divergence). This could ignite a small relief rally if the TradFi Index can also bounce.

- There is a short-term resistance at $86,300, which price may likely struggle at. However, beyond that, the main resistance is $91,700. We don't expect the price to get near $91,700, let alone breach it in the short-term.

- The major support to the downside is $69,000 to $72,000. We expect this area to be bid quite heavily should BTC trade that low in the coming weeks.

- The RSI is off of oversold territory, and it's battling at its moving average. However, it remains in its major downtrend. We'd get more excited upon an eventual breakout of this downtrend. But, we're not expecting this anytime soon.

- Next Support: $78,000

- Next Resistance: $86,300

- Direction: Neutral/Bullish

- Upside Target: $86,300

- Downside Target: $73,900

Cryptonary's take

Bitcoin has held up relatively well over the last 4-5 days considering how poorly TradFi Index's (S&P and Nasdaq) have traded. However, we do expect that we're in a downtrend, with local rallies likely to put in lower highs and see rejections at local horizontal resistances, the next one is $86,300.If BTC were to get a small relief rally - just due to oversold conditions, it's due one - then we'd look for new shorts potentially between $86,000 and $88,000 (if BTC can get there).

However, we've felt that price has been due for a relief rally for some days now, and we haven't really seen one. Let's see how the price develops over the weekend whilst the TradFi Index isn't trading.

For now, we remain patient. We won't be Shorting lows, but on relief rallies, we'll be looking for Shorts. That current target zone is $86,300 to $88,000. Unless we're given that opportunity, we'll remain sitting on the sides and patient.