Yesterday's better-than-expected inflation print sparked a rally across risk assets as markets. The nascent reflation trade has lit a fire under Bitcoin, which is primed for a retest of $38k resistance after leveraged longs were flushed out.

With technicals and mechanics aligning, BTC is set to resume its upside breakout. So, where’s the crypto market headed? Let’s find out.

TLDR

- Inflation data beat expectations, boosting hopes of less aggressive Fed rate hikes.

- Markets are now betting on the soft landing scenario and earlier rate cuts.

- BTC leveraged longs flushed out, allowing room for an upside move.

- Technicals and mechanics align for a retest of $38k resistance.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

Yesterday, the inflation data came in below expectations. In response, the markets rallied to celebrate the Fed rate hike cycle being over. The market is also happy that inflation is proving less sticky than initially imagined.Following this, rate cuts were priced in earlier than originally. This is the market calling for a soft/no landing scenario for the U.S. economy. Hence, we saw assets higher yesterday. If you include today's pre-market price action, the S&P and the Nasdaq were up 2%, with the Dollar Index down a whopping 1.44%.

Overall, this is a risk-on environment, and although crypto pulled back yesterday - as we flushed out a lot of the excess leverage - the market looks good here.

Let’s now dive into the technicals for BTC.

Technical analysis

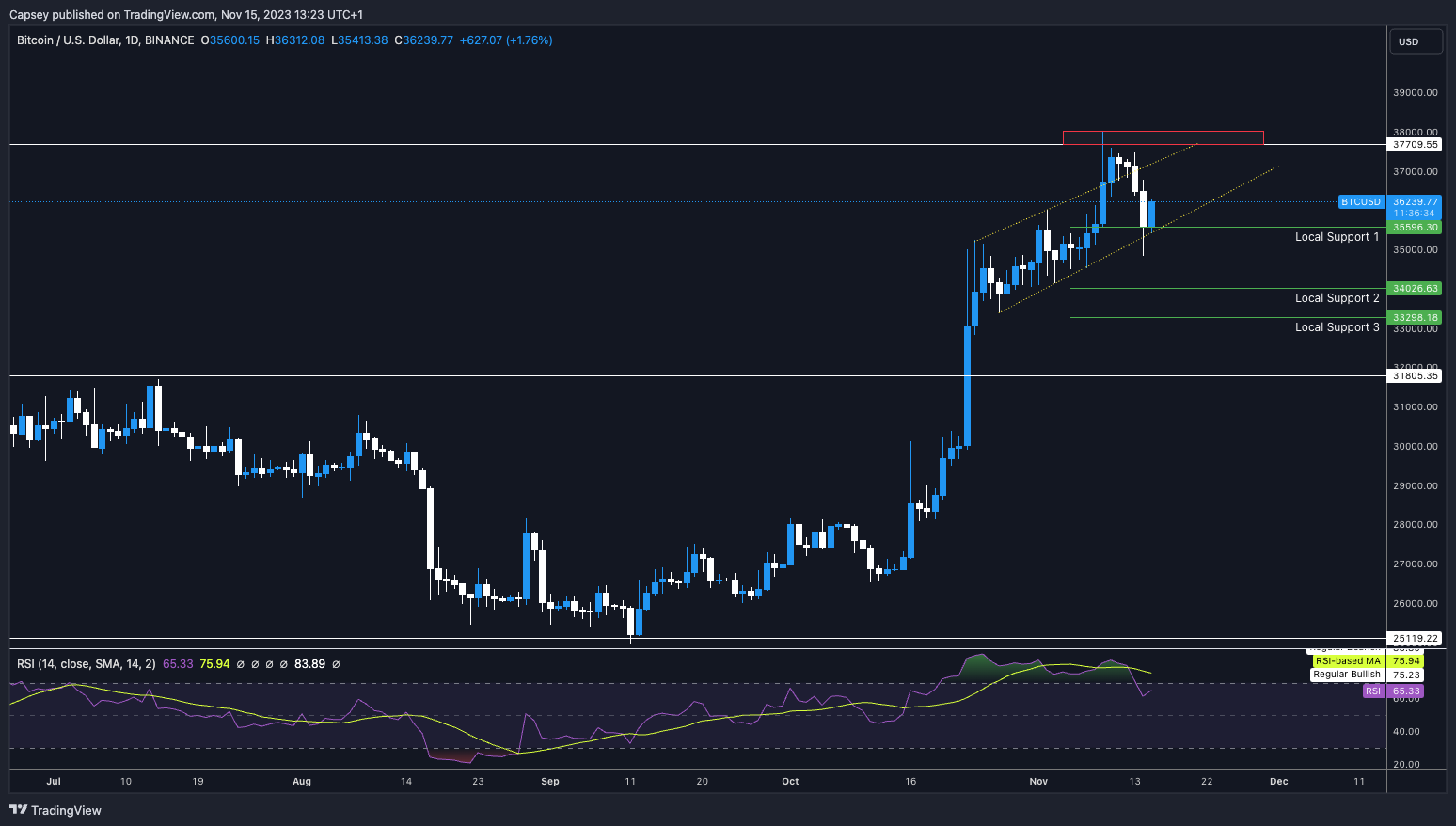

As expected, yesterday brought us that leverage flush out that saw prices pull back. Despite prices flushing out into the $35,000 level, price was able to move higher, reclaim the local support of $35,600, and close above that level. The upside resistance remains at $38,000.When looking at the RSI, the 3D and the weekly timeframes remain overbought, suggesting there could be a further pullback. However, we have also seen, in the past, that the major timeframes can stay overbought for long periods, particularly in bull markets. Nonetheless, the daily timeframe has pulled back and reset somewhat, now at 65.

All the above is positive and suggests price can have another move higher and potentially test $38,000.

Let’s assess the technicals first to see if they support this.

BTC 1D

Market mechanics

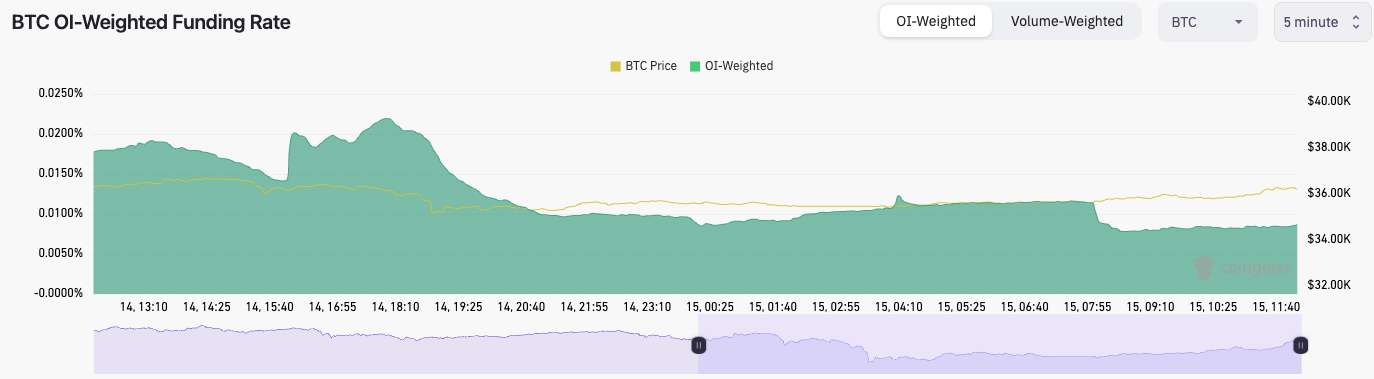

This is exactly what we were looking for when looking at the mechanics. The funding rate has come down meaningfully and now sits at 0.0087%. There’s still a long bias, but longs and shorts are now more balanced.

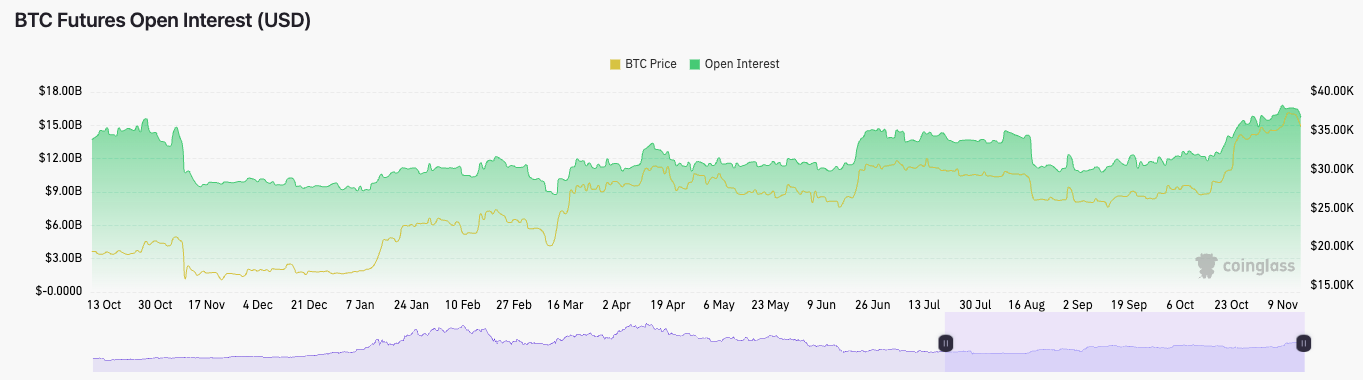

The open interest dropped from $16.5B yesterday to $15.7B today. This is a small decrease, likely due to some longs having been flushed out on yesterday’s move lower.

If we then look at the long/short ratio, it’s 0.932 over the past 24 hours. This suggests that more participants have piled into shorts in the past 24 hours. This is another factor that has brought the funding rate down.

SOL had a similar setup yesterday, and we’ve seen that drive 15% or so higher since. So, it's possible that the mechanics here are actually favourable towards longs, and we could see prices push higher for BTC here, potentially retesting the early $37,000s.

Cryptonary’s take

The technicals and the mechanics suggest BTC could move higher here and potentially retest the $37,000s and even try for another retest of the $38,000 horizontal resistance.In terms of DCA’ing, we will continue to wait to see how price reacts here, if it can retest $38,000, and then how price reacts if it gets to that level before we consider taking further action.