However, before you make any decisions, there are indications suggesting caution in the immediate future. This is even as the probabilities of both a drop and a surge are equally imminent.

TLDR

- Bitcoin is in a bullish pennant pattern and could soon reach $37,700.

- RSI is overbought, but a pullback might happen from a higher price point.

- High funding rates suggest a bias towards going long on BTC.

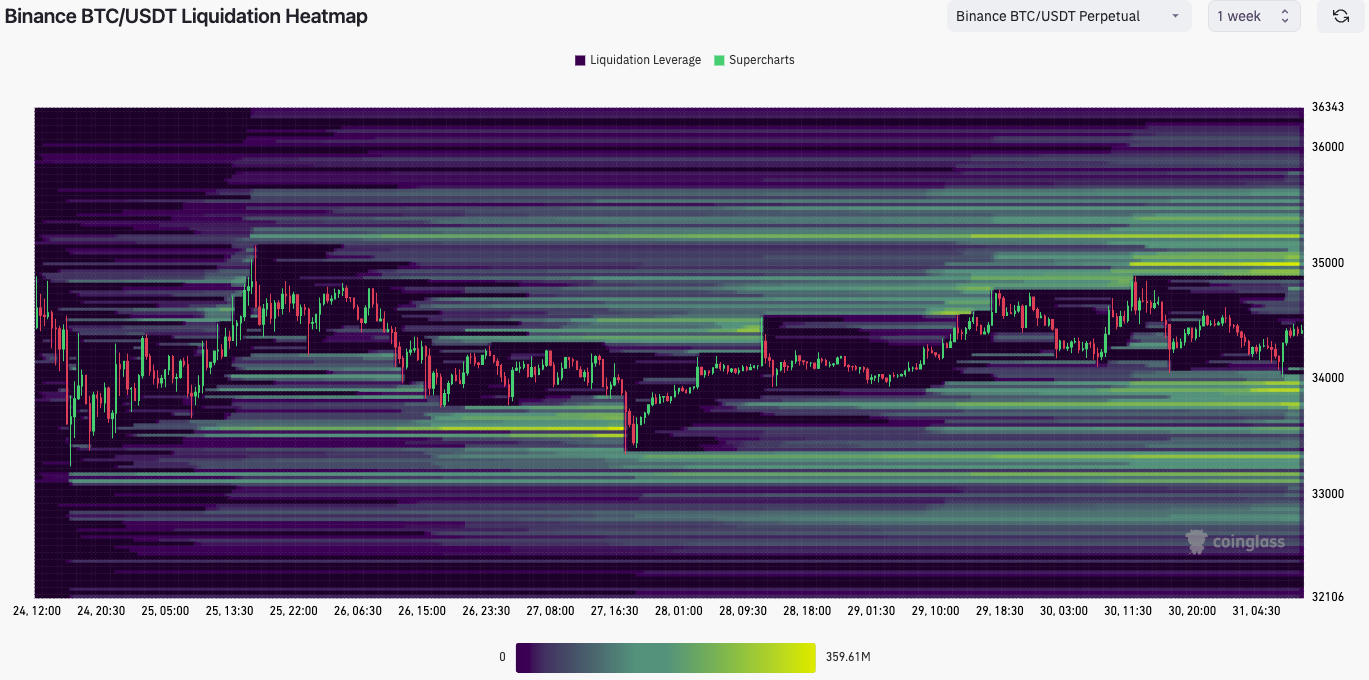

- Liquidation levels indicate the potential for quick price movements.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

BTC continues in the bullish pennant pattern with a bias to break to the upside. However, BTC remains fighting at the $34,500 horizontal resistance level. We try to keep things relatively simple here from a technical analysis point of view. The consolidation at this price level is strong, and we feel that price will break to the upside in the near term and test the $37,700 area.RSI and funding rates

The RSI remains overbought but is coming down very slightly, but there is no change here.We still believe a pullback will happen, but we feel it’ll come later, from a higher price point, say from $37,700 potentially.

The funding rate remains very positive, and open interest is now relatively high - it's at its highest in well over a year. This suggests there is a clear bias to be long BTC here, and this potentially aids the idea that a leverage flush out is due, but again, something that may come later rather than imminently.

What we also note is the liquidation levels. We can see now that there are a lot of levels that could drive squeezes in price, simply because of how stacked the liquidation levels are.

Note the brighter the green/yellow, the larger the amount of USD that would be liquidated if price reached those levels. We believe that if price does move higher or lower into one of these liquidation areas, it will drive through that range relatively quickly as offside positions are liquidated.

BTC liquidation heatmap

BTC 12hr

Cryptonary’s take

We feel the next move for BTC is a break to the upside to test the $37,700 level. However, we note that leverage is higher than usual, and there are large liquidation levels on both sides of the range. Therefore, if price does break down or breaks out, we feel offside positions will be quickly liquidated, and price will make a large move.Again, we feel that BTC goes higher here to test that $37,700 level.

Action

- We are not taking action here and waiting to see what BTC does.

- We believe that the move will be higher and that if we do reach $37,700, that may be a local top. However, we did initially feel that $35,000 would be the local top, but because price has consolidated as well as it has, we have altered our opinion to adjust for another move higher for BTC.