BTC stuck between $35k and $38k - Which way will it break out?

Bitcoin stands at a precipice, knocking at the door of the $38,000 resistance level. After multiple rejections from this level recently, both bulls and bears hold their breath to see whether support will finally break and which way BTC's volatile price will go next.

TLDR

- BTC stuck between $35K and $38K support and resistance.

- Technicals show Bitcoin keeps rejecting from the $38K level.

- Market mechanics are now healthier - longs and shorts are more balanced.

- The overall direction is difficult to predict until a clear break-up or down.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

- The Dollar Index continues its decline, now down 2.2% over the past six trading days. A declining Dollar is supportive of risk assets. However, the DXY is approaching oversold levels; therefore, a relief rally may be on the near-term horizon.

- Yesterday’s U.S. 20Y bond auction was positive. There was strong demand from investors, which saw the yield at 4.78%, below the when-issued yield of 4.79%. Additionally, primary dealers (who buy up the remaining supply) only had to buy 9.5% of the supply, far less than prior auctions.

- Later today, we have the release of the FOMC Minutes. The market doesn’t expect much from this. However, financial conditions have loosened significantly since this meeting, so if there is talk about policy needing to be tighter, the markets may react negatively if financial conditions ease. We see this as unlikely and expect the FOMC Minutes today to be a non-event.

BTC 12hr

Technical analysis

After another retest of the $37,700 to $38,000 zone yesterday and rejecting, can $BTC finally break the resistance level and move higher?- Bitcoin tested the $37,700 to $38,000 range yesterday and today and hasn’t been able to close in or above the zone.

- Bitcoin maintains its local uptrend, which should support higher prices until that trend is broken.

- Price remains in the range between $35,600 to $38,000.

- The RSI on the 12hr and 1D timeframes are both well out of overbought territory, having reset substantially. This gives Bitcoin the room to potentially go higher in the short term as it is no longer exhausted to the upside on the smaller timeframes.

- The 3D and weekly timeframes remain in overbought territory, with the 3D timeframe putting a bearish divergence on yesterday’s candle closure. Usually, it is not positive for higher prices. This makes us more wary of whether Bitcoin can gain enough momentum to break the $38,000 horizontal resistance.

Market mechanics

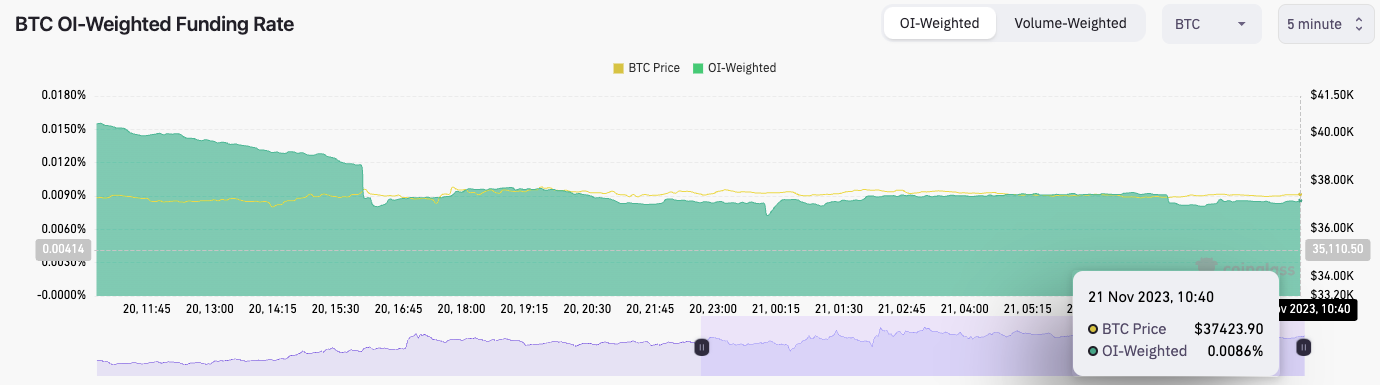

The mechanics are relatively positive here:- The OI-weighted funding rate is still positive but has reset substantially to now 0.0086%. This indicates that longs and shorts are now in a more even balance, with a slight bias to Long.

- The long/short Ratio is at 0.9712, indicating that over the past 24 hours, more participants have shorted rather than longed.

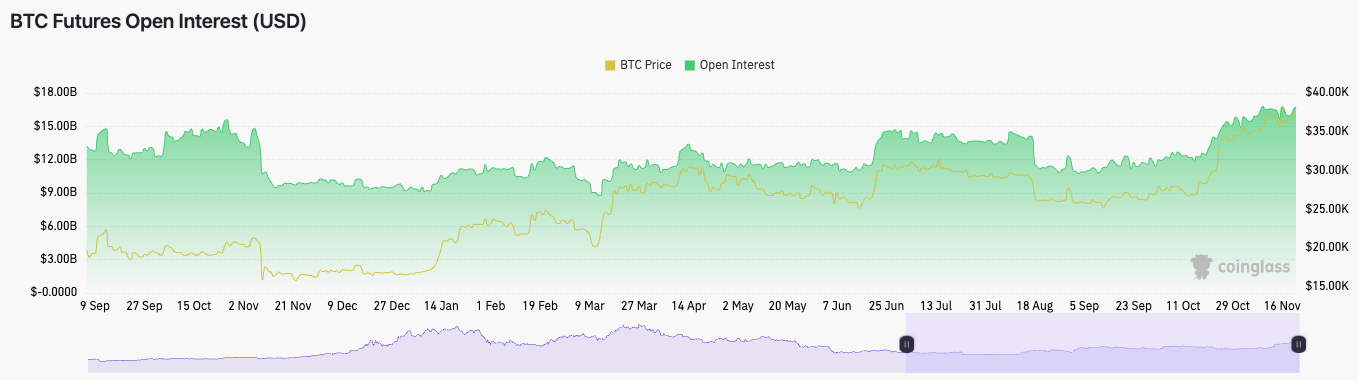

- The open interest still remains high.

Cryptonary’s take

The technicals for Bitcoin suggest that price is knocking on the door of potentially breaking above $38,000. However, we have had several rejections on the smaller timeframes from the resistance zone.The mechanics are now presenting a far healthier setup compared to prior weeks. Despite Open interest still being high, we’re seeing longs and shorts be in closer balance, meaning neither side is the crowded trade.

It’s likely that if price moves meaningfully in one direction, then the move may spiral quickly in that chosen direction. This may wipe out a significant portion of the open interest upon this move. We expect a volatile move if the range breaks ($35,600 or $38,000).

Bitcoin is difficult to call here. If we had to choose, we’d suggest that there may be a lower break than a higher break of $38,000. But again, this is very difficult to call, so we will wait for a break of the support ($35,600) or resistance ($38,000).

For now, the risk/reward of a short-term trade isn’t good. We, therefore, remain sat on the sides and will look to DCA into Bitcoin if there is a move to $34,000. If there is a move to sub $33,300, we’ll become aggressive DCA buyers down to $31,000.